Get the free California Form 570

Get, Create, Make and Sign california form 570

How to edit california form 570 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california form 570

How to fill out california form 570

Who needs california form 570?

California Form 570: A Complete How-to Guide

Understanding California Form 570

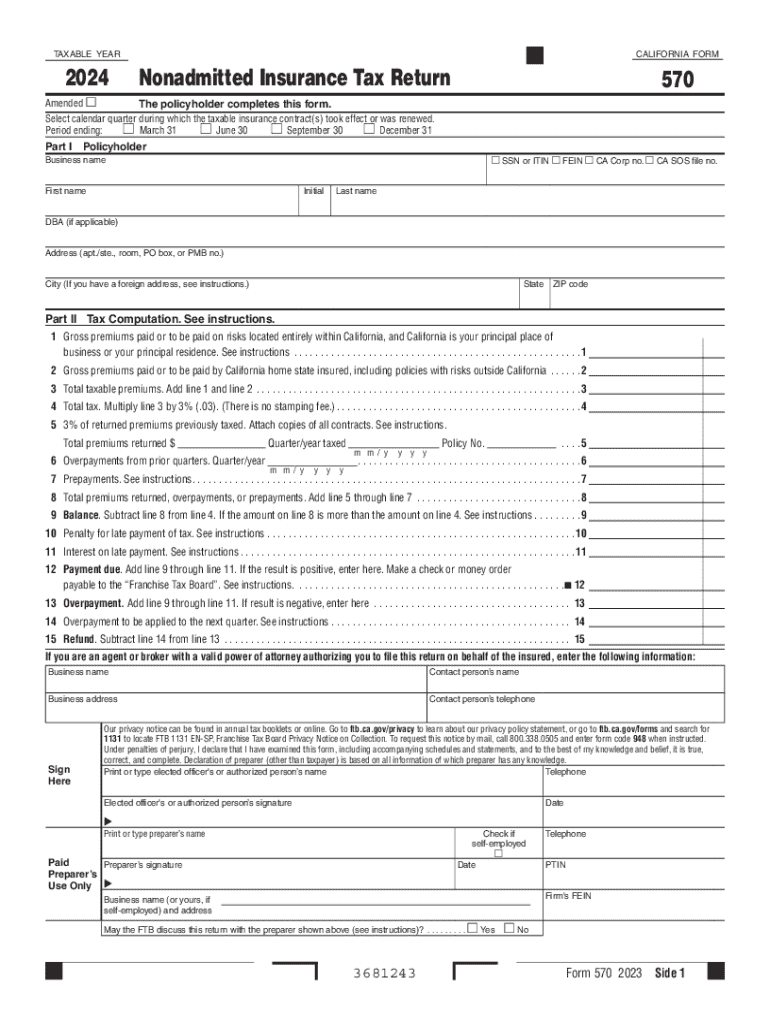

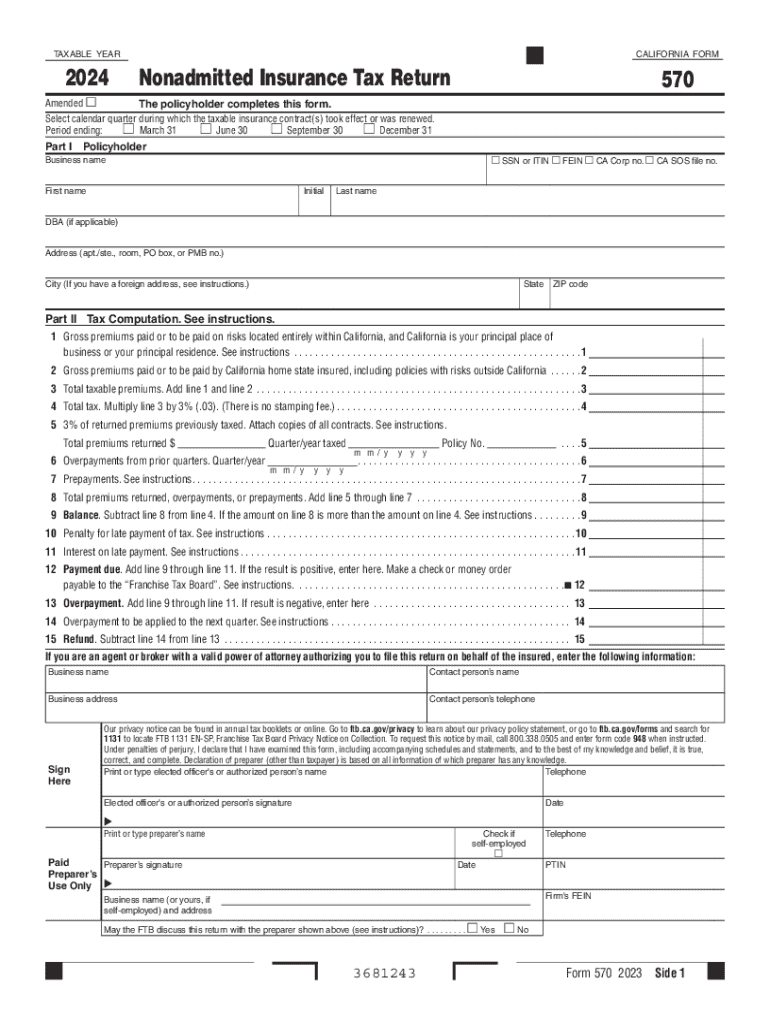

California Form 570 is essential for individuals and businesses that engage in the nonadmitted insurance sector. This form primarily serves to calculate and report the Nonadmitted Insurance Tax (NIT) owed to the state. Originally introduced to ensure compliance within this specific tax regulation, Form 570 has undergone several updates to adapt to changing circumstances in both taxation and insurance industries.

The importance of Form 570 cannot be understated. It plays a crucial role in California's revenue collection methodology and significantly impacts both taxpayers and insurance providers. Understanding the nuances of this form is essential for any entity participating in the nonadmitted insurance market.

Who needs to file Form 570?

Eligibility for filing Form 570 encompasses a range of individuals and businesses that are subject to the Nonadmitted Insurance Tax. This includes businesses that seek coverage from insurers not licensed in California, individuals who purchase nonadmitted insurance, and insurance agents handling such transactions. The complexity of the California insurance landscape necessitates that these taxpayers keep accurate records and file their returns timely.

However, not every taxpayer is required to file. Exemptions are provided for certain categories, such as government entities and specific types of nonadmitted insurance contracts. By understanding who qualifies for these exemptions, taxpayers can save time and ensure compliance with state regulations.

Key components of Form 570

Form 570 is divided into three main parts: Part I contains policyholder information, Part II focuses on tax computation, and Part III lists the insurance contracts utilized. Each segment is crafted to collect specific information crucial for tax assessment, helping to streamline the reporting process.

Key terms associated with Form 570 are vital for accurate filing. For instance, ‘nonadmitted insurance’ refers to coverage provided by insurers not licensed in the state where the coverage is being issued. The understanding of premiums, tax rates, and assessment timelines also forms the backbone of this documentation process.

Detailed instructions for filling out Form 570

Filing Form 570 requires meticulous attention to detail. Here’s a step-by-step guide:

Filing Form 570

Understanding when and how to file Form 570 can prevent unnecessary penalties. The filing deadline usually aligns with the state income tax deadline, typically falling on April 15th. Late submissions can incur significant fines, making timely filing critical for compliance.

Form 570 can be submitted online through the California Department of Tax and Fee Administration (CDTFA) portal or mailed directly to the provided address. It’s important to keep track of submitted forms to avoid potential complications. Common errors include missing data or incorrect tax calculations, which can lead to repercussions during the review process.

Managing your Form 570 submission

After filing, managing your Form 570 submission effectively is essential. You can track the status of your filed form through the CDTFA’s online services, providing peace of mind and allowing for timely follow-ups.

If you need to amend your filing, specific procedures exist to ensure accuracy. Completing an amended return involves specifying changes and submitting it through the appropriate channels. Moreover, if you require assistance from a third party, a designated third-party representative can be appointed using the provided forms, allowing for delegated responsibilities without affecting your liability.

Online tools and resources for filling Form 570

Utilizing online tools, like pdfFiller, allows for a streamlined process when handling Form 570. Interactive document editing features enable users to fill out and electronically sign the form efficiently, ensuring that submissions can be made swiftly without compromising accuracy.

Collaboration features available through pdfFiller encourage teamwork, permitting multiple users to work on documents in real time. This becomes particularly beneficial for insurance teams needing to coordinate on submissions and related tasks. Additionally, the document management capabilities ensure that completed forms are stored securely, providing easy access and peace of mind.

Frequently asked questions (FAQs)

As with any tax document, confusion can arise surrounding Form 570. Common queries include determining eligibility, understanding tax rates, and clarifying submission guidelines. Addressing these FAQs can equip filers with the knowledge needed to navigate potential pitfalls.

Expert tips suggest maintaining organized records throughout the year, double-checking entries for accuracy, and seeking professional advice when uncertainties arise. This proactive approach can significantly ease the filing process and reduce the risk of unnecessary complications.

Support and assistance

In case you require additional help with California Form 570, several resources are available. The CDTFA provides official contact numbers and internet resources where guidance can be obtained. This facility offers internet assistance and prompt telephone support to address specific inquiries.

Furthermore, employing professional tax services or consulting licensed tax professionals can ensure compliance and address more complex issues efficiently, providing necessary expertise and insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my california form 570 in Gmail?

How can I edit california form 570 from Google Drive?

How do I fill out california form 570 on an Android device?

What is california form 570?

Who is required to file california form 570?

How to fill out california form 570?

What is the purpose of california form 570?

What information must be reported on california form 570?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.