Get the free Michigan Net Operating Loss Mi-1045

Show details

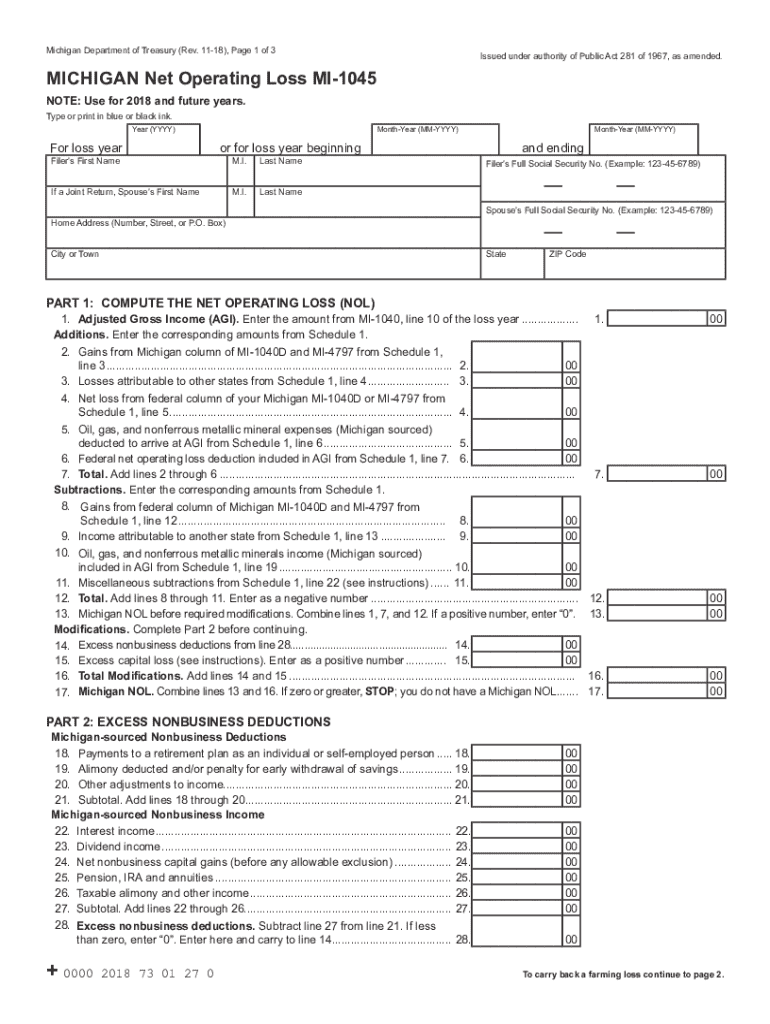

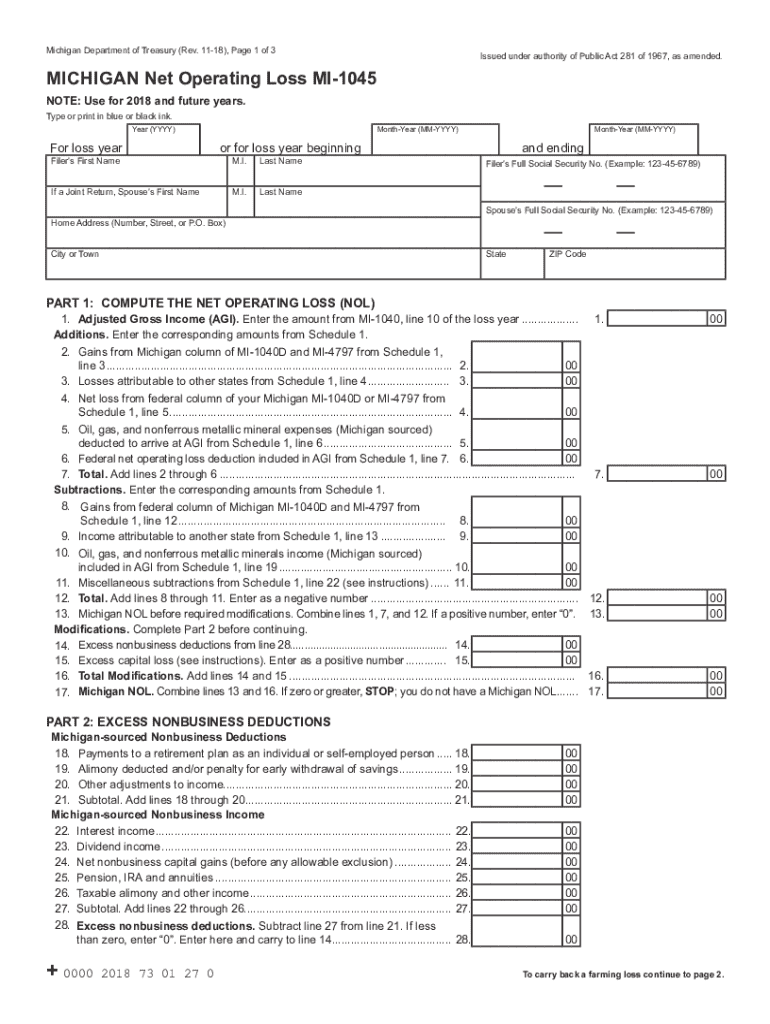

This form is used to compute the Michigan Net Operating Loss (NOL) for taxpayers who have incurred business losses and wish to claim deductions for those losses, including special provisions for farming

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan net operating loss

Edit your michigan net operating loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan net operating loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan net operating loss online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit michigan net operating loss. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan net operating loss

How to fill out michigan net operating loss

01

Gather necessary financial documents and records for the year in which the loss occurred.

02

Calculate the total Michigan taxable income for the year.

03

Identify the net operating loss (NOL) for the year by subtracting allowable deductions from total income.

04

Complete the Michigan Corporate Income Tax (CIT) form or Michigan Individual Income Tax form (if applicable) as required.

05

Fill out Schedule NOL to report the net operating loss.

06

Calculate the NOL carryforward, if applicable, which can be used to offset future income for up to 20 years.

07

Submit the completed forms and retain a copy for your records.

Who needs michigan net operating loss?

01

Businesses that operate in Michigan and incur a net operating loss in a tax year.

02

Companies looking to offset future taxable income with past losses to reduce tax liability.

03

Taxpayers who want to ensure they are maximizing their tax benefits related to losses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify michigan net operating loss without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your michigan net operating loss into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute michigan net operating loss online?

With pdfFiller, you may easily complete and sign michigan net operating loss online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my michigan net operating loss in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your michigan net operating loss right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is michigan net operating loss?

Michigan net operating loss (NOL) refers to the amount by which a business's allowable deductions exceed its gross income during a tax year, resulting in a negative income that can be carried forward or backward to offset taxable income in other years.

Who is required to file michigan net operating loss?

Corporations and certain businesses that incur a net operating loss in Michigan are required to file for a Michigan net operating loss, which can also include pass-through entities like partnerships and S corporations that can pass NOLs to their owners.

How to fill out michigan net operating loss?

To fill out a Michigan net operating loss, taxpayers must complete the appropriate forms, typically including Michigan Corporate Income Tax forms, and provide details about income, allowable deductions, and the calculation of the NOL for the specific tax year.

What is the purpose of michigan net operating loss?

The purpose of the Michigan net operating loss provision is to allow businesses to reduce taxable income in profitable years by offsetting it with losses from previous years, thereby providing tax relief and encouraging business resilience.

What information must be reported on michigan net operating loss?

Information that must be reported on Michigan net operating loss includes the taxable income, total deductions, calculation of the NOL, the year it was incurred, carry-forward or carry-back details, and any applicable adjustments as per state tax regulations.

Fill out your michigan net operating loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Net Operating Loss is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.