Get the free Chartered Accountants Act, 1949

Get, Create, Make and Sign chartered accountants act 1949

Editing chartered accountants act 1949 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chartered accountants act 1949

How to fill out chartered accountants act 1949

Who needs chartered accountants act 1949?

Understanding the Chartered Accountants Act 1949 Form: A Comprehensive Guide

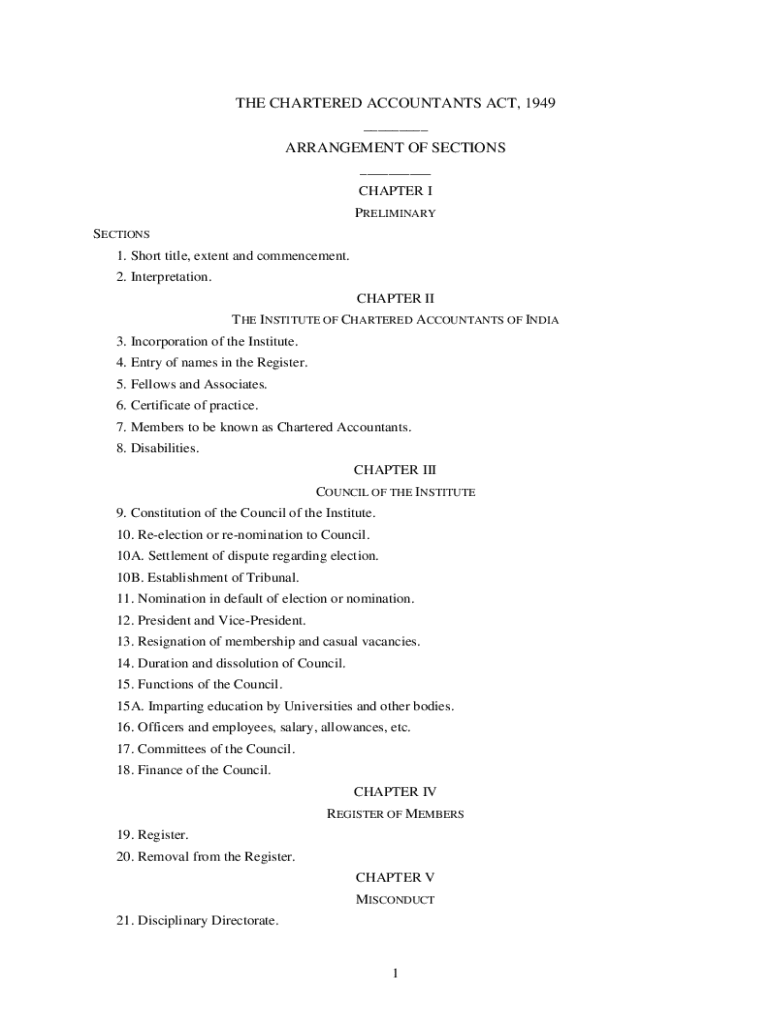

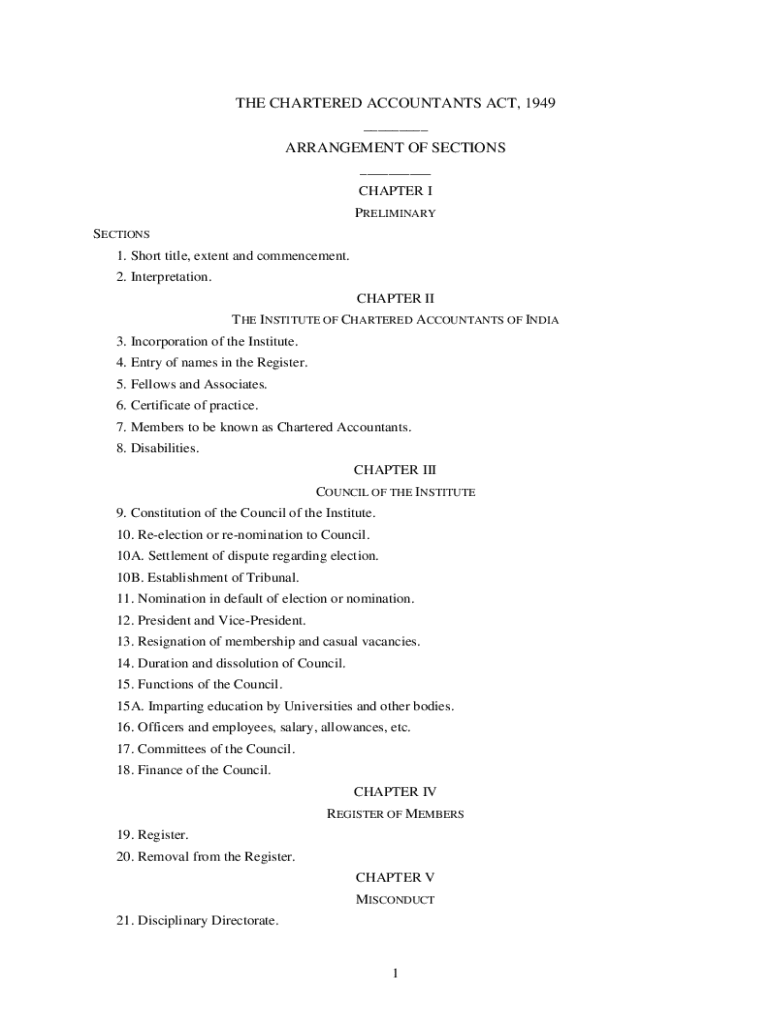

Overview of the Chartered Accountants Act, 1949

The Chartered Accountants Act, 1949, is a pivotal piece of legislation in India that regulates the profession of chartered accountancy. Established to streamline the practice of chartered accounting and ensure a regimented system of standards, the Act has significantly contributed to maintaining the integrity and professionalism of the industry. The primary purpose of this Act is to provide for the establishment of a national body for regulating the profession and for the betterment of the quality of services provided by chartered accountants.

The structure of the Act comprises several key provisions outlining the responsibilities of chartered accountants, the establishment of the Institute of Chartered Accountants of India (ICAI), the process for registration, and the disciplinary mechanisms in place. These sections work hand-in-hand to foster a professional, accountable environment where chartered accountants can operate with clarity and ethical integrity.

Importance of the Chartered Accountants Act form

Forms arising from the Chartered Accountants Act are essential for various functions within the profession. They facilitate official processes such as registration, compliance with ongoing education requirements, and submission of financial statements. By providing a structured method for communication with regulatory authorities, these forms help uphold standards and ensure that all chartered accountants comply with legal requirements.

The role of these forms extends beyond mere paperwork; they embody the values of accountability, transparency, and professionalism that the ICAI strives to promote. Each form is a key component not only in helping maintain regulatory compliance but also in fostering a culture of continuous professional development and ethical practice among chartered accountants.

Types of Chartered Accountants Act forms

The Chartered Accountants Act encompasses various forms, each tailored for specific processes relevant to chartered accountants. Understanding these forms is crucial for current and aspiring professionals in the field. The most important types include:

Step-by-step guide to filling out the Chartered Accountants Act form

Completing forms under the Chartered Accountants Act can seem daunting, but with a systematic approach, it can be a straightforward process. Here’s a step-by-step guide:

Interactive tools for form management

In this digital age, tools like pdfFiller enhance the management of forms related to the Chartered Accountants Act. With pdfFiller, users can streamline the process significantly. Here are some features of pdfFiller that can be of great help:

Common FAQs about the Chartered Accountants Act forms

Navigating through the various forms can prompt numerous questions. Here are some common queries:

Related forms and processes in the field of chartered accountancy

The landscape of forms in the accounting profession extends beyond the Chartered Accountants Act. Some related forms and processes include:

Keeping updated with modifications to the Act and form requirements

To stay effective in your role, it is essential to keep abreast of any modifications to the Chartered Accountants Act and related forms. Regular updates from the ICAI offer crucial insights and can impact your compliance obligations. Always refer to official notifications for any changes, guidelines, or new requirements that might arise.

Utilizing resources such as the ICAI newsletter, official announcements, and the ICAI’s social media channels ensures that you are informed about the latest developments in the field.

The role of pdfFiller in managing Chartered Accountants Act forms

pdfFiller stands out in providing a cloud-based platform for managing Chartered Accountants Act forms. Its user-friendly interface and capabilities significantly enhance the document process. With features like online storage, fast accessibility, and robust security protocols, users can manage their documents efficiently and safely.

Testimonials from users underscore the platform's efficiency, mentioning how it alleviates the stress of handling paperwork and bureaucratic red tape, ensuring more time for the core aspects of chartered accountancy.

Contact information for further inquiries

If you have specific regulatory questions or require clarifications regarding forms, the ICAI is the best point of contact. They can be reached through their official website, or direct email and phone services are also available for personalized assistance.

For inquiries about the pdfFiller platform, customer support is readily accessible through various channels, including live chat, email, and resource centers designed to assist users.

Frequently accessed links related to Chartered Accountants Act

Maintaining a handy list of relevant links can prove beneficial. Here are some frequently accessed resources for chartered accountants:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find chartered accountants act 1949?

How do I complete chartered accountants act 1949 online?

Can I sign the chartered accountants act 1949 electronically in Chrome?

What is chartered accountants act 1949?

Who is required to file chartered accountants act 1949?

How to fill out chartered accountants act 1949?

What is the purpose of chartered accountants act 1949?

What information must be reported on chartered accountants act 1949?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.