Get the free Credit Card Application Form

Get, Create, Make and Sign credit card application form

Editing credit card application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card application form

How to fill out credit card application form

Who needs credit card application form?

Comprehensive Guide to the Credit Card Application Form

Understanding credit card applications

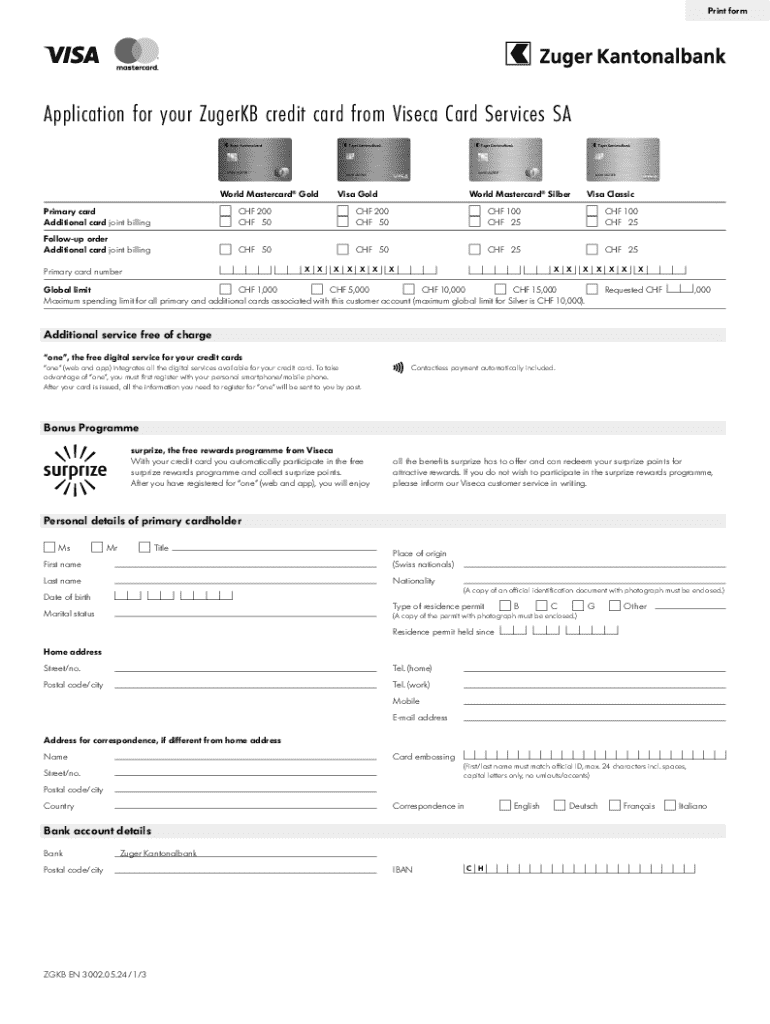

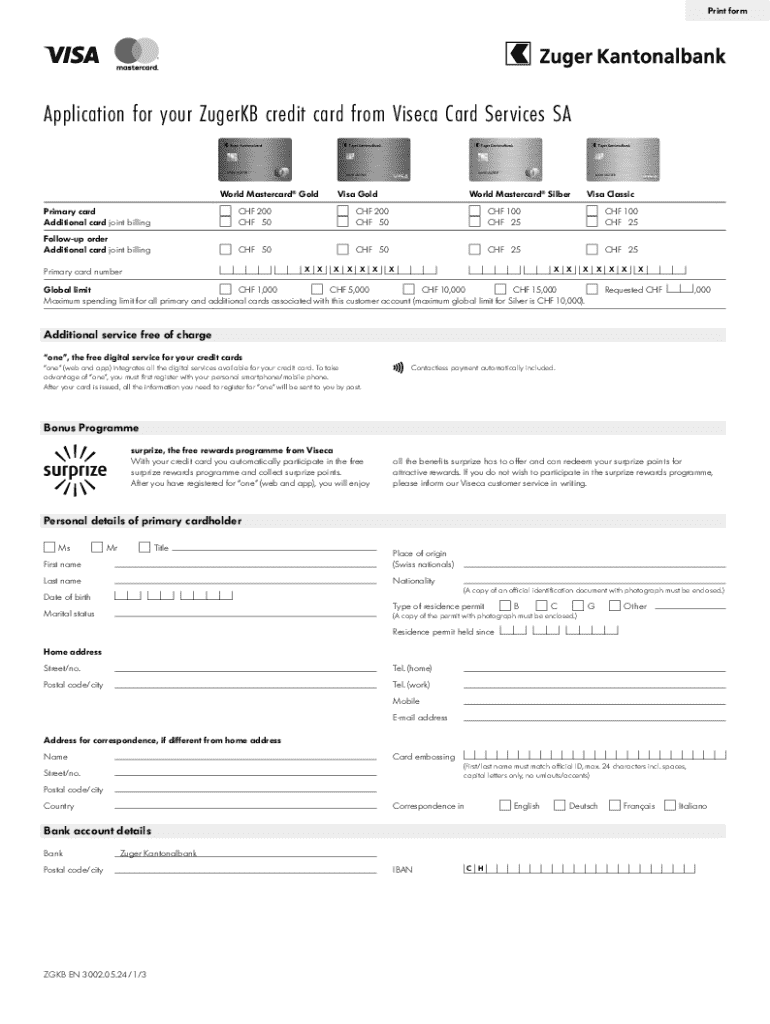

A credit card application form is a document that consumers fill out to request credit from a financial institution. This form collects essential information such as personal details, financial status, and employment information, which helps the issuer assess the applicant's creditworthiness. Understanding the components of this form is crucial for a successful application.

The need for a credit card often stems from several key benefits, including convenience, the ability to build credit history, and access to rewards programs. Many people apply for credit cards to manage their finances better, enjoy travel perks, and protect purchases through fraud prevention measures.

Types of credit card applications

Applications for credit cards can be categorized primarily into online and paper formats. Online applications are often more popular today due to their convenience and quicker processing times, allowing you to apply from anywhere, any time.

When considering types of credit cards, applicants may explore various options:

Preparing to fill out your credit card application

Before diving into the credit card application form, it’s imperative to gather essential documents and information. This preparation can streamline the process and reduce errors. Commonly required items include personal identification, such as a Social Security Number (SSN) or government-issued ID, along with detailed financial information about your income and current employment.

Another crucial step is reviewing your credit history. Understanding where you stand can help identify potential issues that might arise during the application process. Obtain your credit report from reliable agencies, check your credit score, and ensure that it accurately reflects your creditworthiness.

Step-by-step guide to filling out the credit card application form

Accessing the application via pdfFiller simplifies the process of applying for a credit card. Here’s a step-by-step guide to ensure you don’t miss any critical details:

Common mistakes to avoid when applying

Navigating the credit card application process can be daunting, especially when applicants make avoidable mistakes. Some common pitfalls include submitting incomplete or inaccurate information, which can lead to application delays or denials. Always take time to ensure that your information is correct and complete.

Additionally, failing to check for hidden fees or terms can lead to unpleasant surprises once the credit card is issued. Understanding the annual percentage rate (APR), fees, and terms of use is essential before committing. Ignoring credit score considerations can also be detrimental; it’s best to apply when your score is favorable.

Post-application process

After submitting your credit card application, confirmation usually follows promptly. This confirmation can take various forms, such as a confirmation email or an automated response. Understanding your application status is crucial; you may receive immediate approval, further inquiry, or denial.

Timeframes for approval and denial can vary by issuer, ranging from minutes to several days. Be sure to check your email or online account for updates. Being patient and proactive will help keep you informed during this waiting period.

Dealing with possible application issues

In the unfortunate event that your application is rejected, it’s crucial to understand the reasons behind this decision. Reach out to the credit card issuer for clarity on denial factors. This knowledge can help you address potential issues before reapplying.

Common issues may include a low credit score, high debt-to-income ratio, or errors in your application. Fixing these problems might require time and strategic financial planning. When reapplying, consider waiting at least six months, during which you can improve your credit score and rectify any inaccuracies.

Utilizing pdfFiller for easy document management

pdfFiller offers a seamless editing experience for credit card application forms. Editing PDF forms is simple and straightforward, allowing you to fill in required information or make changes based on your preferences quickly.

Using the eSign feature streamlines the approval process, letting you sign documents electronically without printing. Collaboration with team members is facilitated through sharing options, making it easy to work together on applications, especially for business-related credit cards.

Interactive tools and resources

pdfFiller also features a credit card application calculator, a handy tool that helps you evaluate the potential costs associated with different credit card offers. By simply inputting potential balances and interest rates, you can estimate how much credit you may require.

For common application questions, an FAQ section addresses various queries. Engaging in a survey about your application experience can also help improve processes. Such tools enhance your interaction with the credit card application process, making it user-friendly.

Engaging with the pdfFiller community

User testimonials can provide real-life insights into how pdfFiller enhances the application process. Many users have shared success stories on how utilizing pdfFiller has facilitated their credit card applications, saving them time and ensuring accuracy.

The pdfFiller community encourages suggestions for improving the application experience. Engaging directly with us can lead to ongoing support and help address any challenges faced while filling out forms.

Should you consider alternative solutions?

It's vital to explore other financial products beyond traditional credit cards. Options such as personal loans, debit cards, or even alternative credit products can provide beneficial features without the downsides of credit card debt. Engaging in thorough comparisons allows you to assess which credit card offers suit your needs best.

When comparing credit card offers, consider aspects such as rewards structure, interest rates, and any annual fees. This careful examination ensures that you are equipped with the information needed to make the best decision for your financial situation.

Was this guide helpful?

Your feedback is valuable! We encourage you to share your thoughts on this guide, including what aspects were helpful or any additional topics you wish to navigate. Learning more about financial management can significantly aid in future credit decisions.

pdfFiller remains committed to providing resources that enable better document management and financial understanding. Exploring our platform ensures you’re never lost in the journey of credit card applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card application form without leaving Google Drive?

How can I get credit card application form?

How do I make changes in credit card application form?

What is credit card application form?

Who is required to file credit card application form?

How to fill out credit card application form?

What is the purpose of credit card application form?

What information must be reported on credit card application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.