Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

A Comprehensive Guide to Credit Card Authorization Forms

Understanding the credit card authorization form

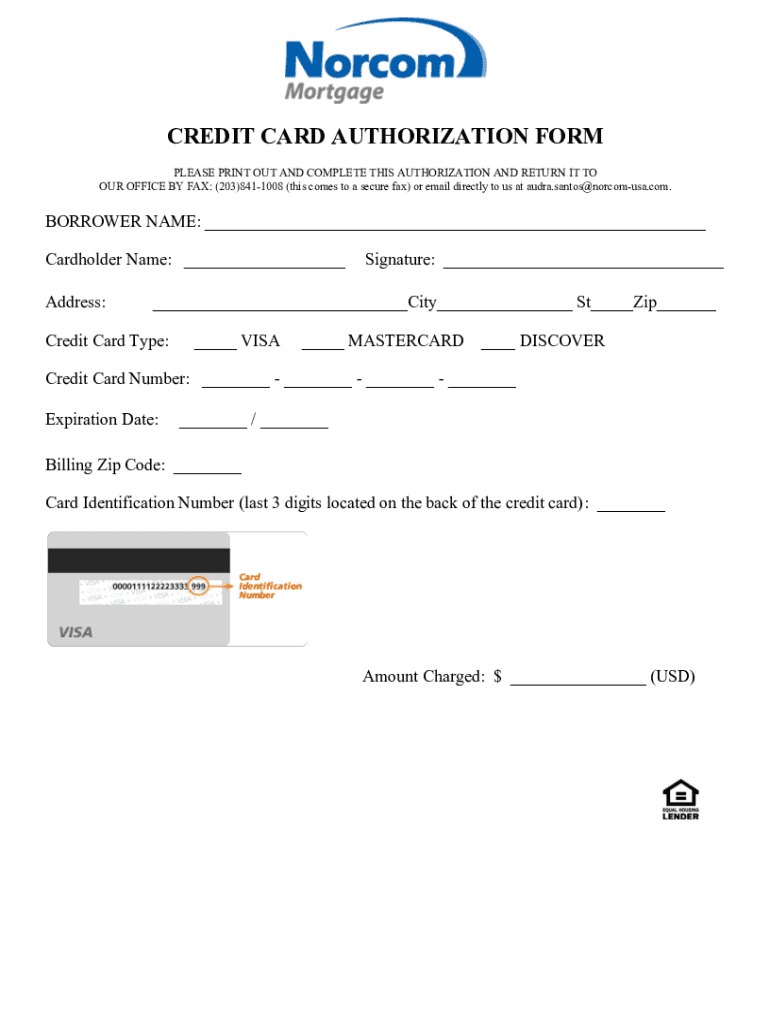

A credit card authorization form functions as a formal agreement allowing a merchant to charge a specified amount to a customer’s credit card. It explicitly details the transaction, including necessary information about the cardholder and the financial specifics of the purchase.

The primary purpose of this form is to secure permission from the cardholder before executing a transaction. Using such a form not only protects the merchant but also enhances the customer’s trust in the payment process. Many businesses leverage this tool to guard against fraudulent transactions and payment disputes.

Credit card authorization forms are particularly useful in scenarios where the transaction doesn't occur in person. For example, companies providing services remotely—like subscription services or consulting—rely heavily on these forms to ensure compliance and protect against future disputes.

Benefits of credit card authorization forms

Utilizing a credit card authorization form brings several benefits to businesses. Primarily, it acts as a safeguard against chargeback abuse which can undermine a company’s financial health. Chargebacks occur when a customer disputes a charge with their bank, asking for a refund without having initiated the return process with the merchant.

By requiring a signed credit card authorization, businesses establish clear evidence of consent for the transaction. In the event of a chargeback, the authorization form can serve as proof that the customer agreed to the transaction, significantly strengthening the merchant’s position.

Furthermore, these forms contribute to enhanced payment security. When both parties have documented consent for a transaction, it minimizes the risk of fraud. This documentation also streamlines payment processing, allowing sellers to manage transactions efficiently and effectively.

Key components of a credit card authorization form

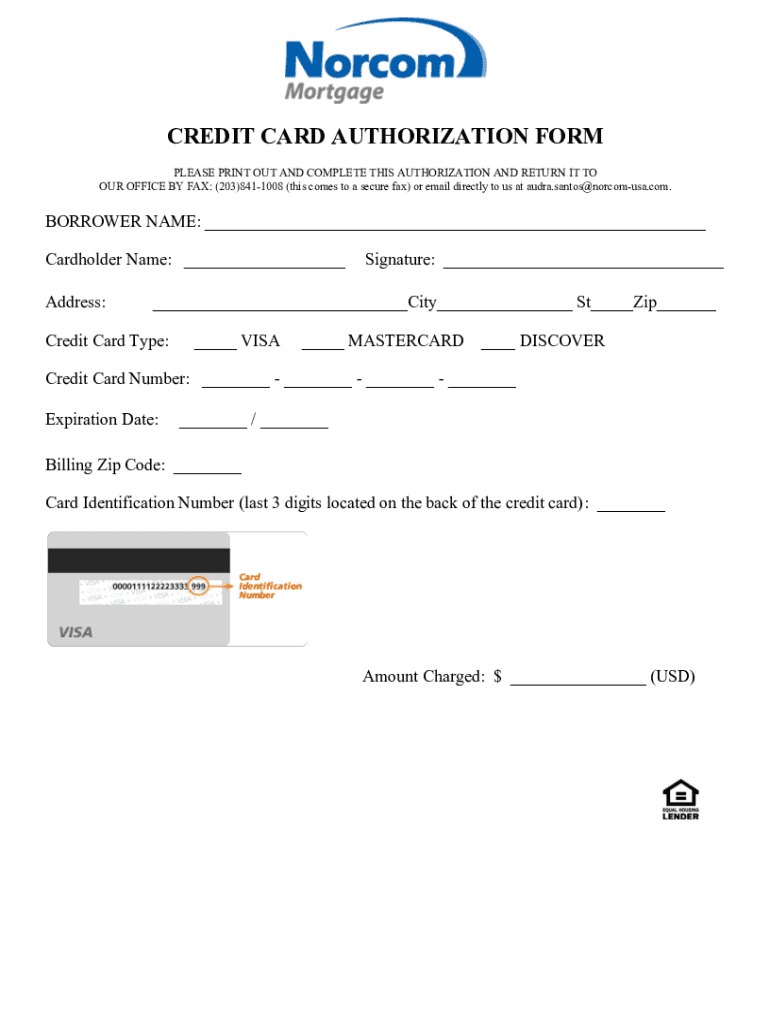

A well-designed credit card authorization form must include essential elements to ensure clarity and compliance. Start with cardholder information, which typically consists of the name, address, and card number. It's crucial to collect transaction details, including the amount, service or goods rendered, and date of the transaction. Proper merchant details should also be included, providing a point of contact for any questions or disputes.

An authorized signature line is pivotal; this indicates that the cardholder actively agrees to the transaction. In addition, including the CVV (Card Verification Value) is important during the authorization process, as it helps validate that the cardholder is the one making the transaction. The concept of maintaining a 'card on file' can also be advantageous, especially for recurring transactions, allowing for easier future payments while ensuring security.

How to create a credit card authorization form

Creating an effective credit card authorization form is a straightforward process. Start with a user-friendly template that aligns with your branding. The template should comply with relevant payment processing standards to ensure legality and security.

Once you have selected a template, fill in the required information, such as cardholder details and transaction specifics. It’s crucial to incorporate necessary security features, like SSL encryption for online forms. Lastly, review the form carefully before finalization to ensure it’s clear and comprehensive.

Managing and storing credit card authorization forms

Once you've created your credit card authorization forms, managing and storing them safely is paramount. Best practices suggest that forms should be stored securely, whether digitally or in paper form. Keep signed forms in a locked file cabinet or use encrypted digital storage for enhanced security.

Legal considerations regarding the retention of these forms vary by jurisdiction, but generally, it’s advisable to keep them on file for at least a few years—often until after any potential disputes have settled. When weighing digital versus paper storage, consider the convenience of access and potential risks associated with each method.

Common questions about credit card authorization forms

Many individuals and businesses have questions about the necessity and implications of credit card authorization forms. One common query is whether they are legally obligated to use them. While not always mandated by law, they serve as a best practice that enhances legitimacy and reduces potential risks.

Failure to use a credit card authorization form may expose a business to higher risks of chargebacks and fraud. Notably, if a cardholder revokes authorization after the transaction has been completed, the merchant may face challenges in dispute resolution. Therefore, clearly communicating the terms of the authorization form to cardholders is crucial.

Downloadable resources

To support businesses in navigating the world of credit card transactions and authorizations, pdfFiller offers a variety of resources. Users can download an easy-to-use credit card authorization form template designed to meet compliance standards while being user-friendly.

Additional templates for related payment processing documents are also available, promoting efficiency and proper documentation in business transactions.

Maximizing the use of credit card authorization forms for your business

Integrating credit card authorization forms into your payment process is essential for any business that handles card-not-present transactions. Educating your team on the proper use and compliance with these forms fosters a culture of security and transparency.

Using tools like pdfFiller can streamline your document management. With features that allow users to edit, eSign, and securely store authorization forms from anywhere, adopting such digital solutions can significantly enhance your operational workflow.

Related topics to explore

Expanding your knowledge on related topics can further equip businesses to handle payment processes competently. Understanding payment gateways and their role in transactions and recognizing the implications of card-not-present (CNP) transactions is essential in today’s remote payment landscape.

Moreover, being aware of common challenges in payment processing and strategies to overcome them can ensure smoother financial operations for your business, supporting continued growth and stability.

Sign up for more insights

Staying updated with the latest developments in document management solutions and payment processing practices is vital for businesses. Consider subscribing to our newsletter or following us on social media for ongoing insights, tips, and tools that can aid your financial operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card authorization form online?

How do I make edits in credit card authorization form without leaving Chrome?

Can I edit credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.