Get the free Cash/self Employment Business Ledger

Get, Create, Make and Sign cashself employment business ledger

How to edit cashself employment business ledger online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cashself employment business ledger

How to fill out cashself employment business ledger

Who needs cashself employment business ledger?

Cash Self Employment Business Ledger Form: Comprehensive Guide

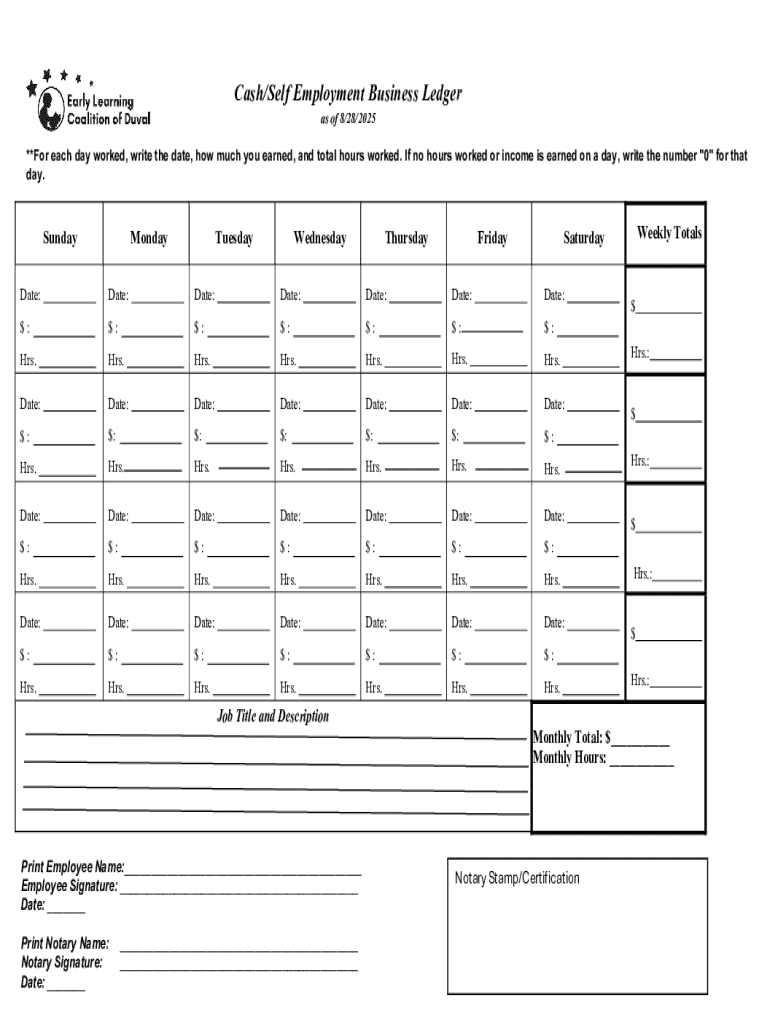

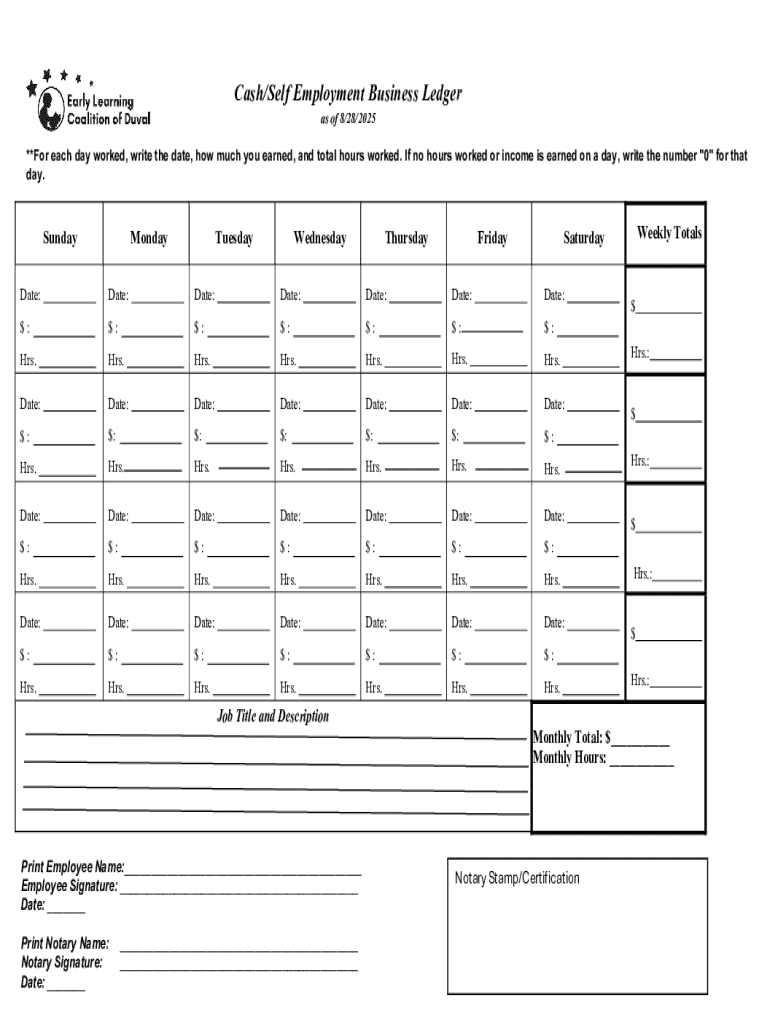

Understanding the cash self employment business ledger

A cash self-employment business ledger serves as an essential tool for freelancers and self-employed individuals to document their financial transactions. This ledger captures income, expenses, and helps maintain a clear picture of one's business financial health. By consistently recording transactions, self-employed individuals can chart their profitability, prepare accurate tax returns, and make informed business decisions. An effective ledger not only minimizes the risk of errors but also enhances accountability, making it a vital component of managing a self-employed business.

Why you need a cash self employment business ledger

Maintaining a cash self-employment business ledger is crucial for any self-employed individual who wishes to keep a finger on the pulse of their financial health. By carefully tracking income and expenses, you can instantly identify periods of higher profitability or unforeseen losses. This constant oversight helps you make informed decisions about pricing, reducing costs, or even reinvesting into your business. Additionally, maintaining a proper ledger is not just best practice for financial management; it is also a legal requirement. When tax season arrives, having everything documented simplifies the filing process and reduces the risk of audits.

Core components of a cash self employment ledger

To create a comprehensive cash self-employment business ledger, there are key elements that you must include. First and foremost are the income sources; it’s essential to delineate different revenue streams, whether from freelance writing, consulting, or other services you provide. Equally important is categorizing your expenses into fixed and variable types. Fixed expenses, such as rent or software subscriptions, remain constant, while variable expenses can fluctuate, such as project materials or overtime labor. Additionally, understanding the distinction between personal and business-related expenses is vital, as mixing these can lead to inaccuracies in financial reporting.

Getting started with your cash self employment business ledger

Starting your cash self-employment business ledger requires thoughtful consideration of format and layout. You can choose between a traditional paper ledger or a digital one. Digital ledgers offer flexibility, allowing you to use various tools like spreadsheets or dedicated financial software. For setting up your ledger, create columns for essential details like Date, Description, Income, Expense, and Balance. Each entry should be clear and concise to ensure easy tracking and accountability. A well-structured layout promotes easier data entry and retrieval, allowing you to focus on insights rather than logistics.

Filling out your cash self employment business ledger

Maintaining diligence in updating your cash self-employment business ledger is crucial for accurate financial tracking. Establish a routine - daily or weekly updates can prevent a backlog of entries that can lead to errors. Accuracy is key, so when entering data, always double-check your entries against source documents such as receipts or invoices. Another best practice is to maintain an organized system for storing and categorizing such documentation; this will come in handy during tax preparation or audits. Keeping your ledger clean and updated will empower you to react quickly to financial trends in your business.

Leveraging technology to manage your ledger

With the advancement of technology, managing your cash self-employment business ledger has never been easier. Platforms like pdfFiller provide interactive tools that simplify the management of your ledger. Users can create, fill out, edit, and secure documents in the cloud, making it easier to access their financial data from anywhere. With features like eSigning and document sharing, pdfFiller offers a comprehensive solution that enhances collaboration with accountants or business partners. Additionally, using templates can accelerate the process of ledger creation, ensuring your records remain consistent and professional.

Common mistakes to avoid in your cash self employment business ledger

While managing your cash self-employment business ledger, certain pitfalls are common. One frequent mistake is overlooking smaller income or expense entries, which can accumulate over time and distort your financial picture. Additionally, mixing personal and business finances can complicate tax reporting and lead to missed deductions. Inconsistent record-keeping practices can also result in gaps in your data, making it challenging to provide accurate information when needed. To mitigate these issues, commit to a disciplined approach to entering data and maintain a clear separation between your personal and professional expenditures.

Expert tips for maximizing your cash self employment ledger

To get the most out of your cash self-employment business ledger, consider adopting strategies used by financial professionals. An organized ledger can serve not only as a historical record but also as a predictive tool for future business decisions. Use your data to gain insights into spending patterns and identify areas where cost optimization is possible. Integration with accounting software will further streamline data entry and analysis, allowing for easier tax preparation and financial forecasting. Remember, a well-maintained ledger is a tool for both compliance and strategic growth.

Examples and templates for your cash self employment business ledger

Several templates are readily available for download to help jumpstart your cash self-employment business ledger. From basic to advanced options, these templates can be customized according to your specific business needs. Reviewing real-world examples can further inspire you; many successful self-employed individuals attribute their financial clarity and growth to consistent ledger management. Utilizing accessible templates will allow you to maintain that level of professionalism without starting from scratch, ensuring accuracy in your financial tracking.

Frequently asked questions about cash self employment business ledgers

Even with the guidance above, doubts may arise when managing your cash self-employment business ledger. Commonly asked questions include how to handle cash transactions, especially if receipts are lost, and when it might be time to hire a professional. Cash transactions should always be recorded immediately, even if documentation is not available; estimates can be noted but should be corroborated later. If you find yourself overwhelmed or unsure about entries, seeking professional assistance can provide peace of mind and accuracy in your financial reporting.

Final thoughts on effective ledger management

Investing time in your cash self-employment business ledger yields long-term benefits that are invaluable for your financial health. By proactively managing your ledger, you position yourself for successful audits, strategic tax planning, and ultimately, sustained growth in your business. Remember, efficient ledger management not only aids in compliance but nurtures a healthier financial future while unlocking insights for expansion. Continue to engage with and refine your practices to maximize the advantages your ledger brings to your self-employment journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cashself employment business ledger from Google Drive?

How do I edit cashself employment business ledger online?

How do I complete cashself employment business ledger on an Android device?

What is cashself employment business ledger?

Who is required to file cashself employment business ledger?

How to fill out cashself employment business ledger?

What is the purpose of cashself employment business ledger?

What information must be reported on cashself employment business ledger?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.