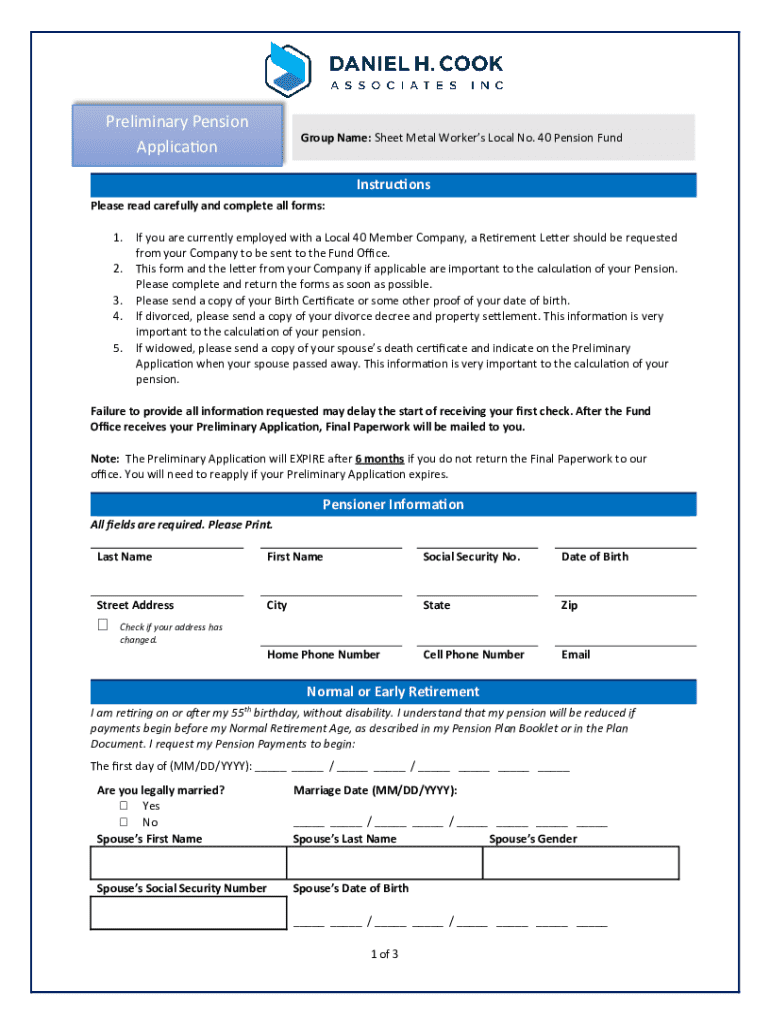

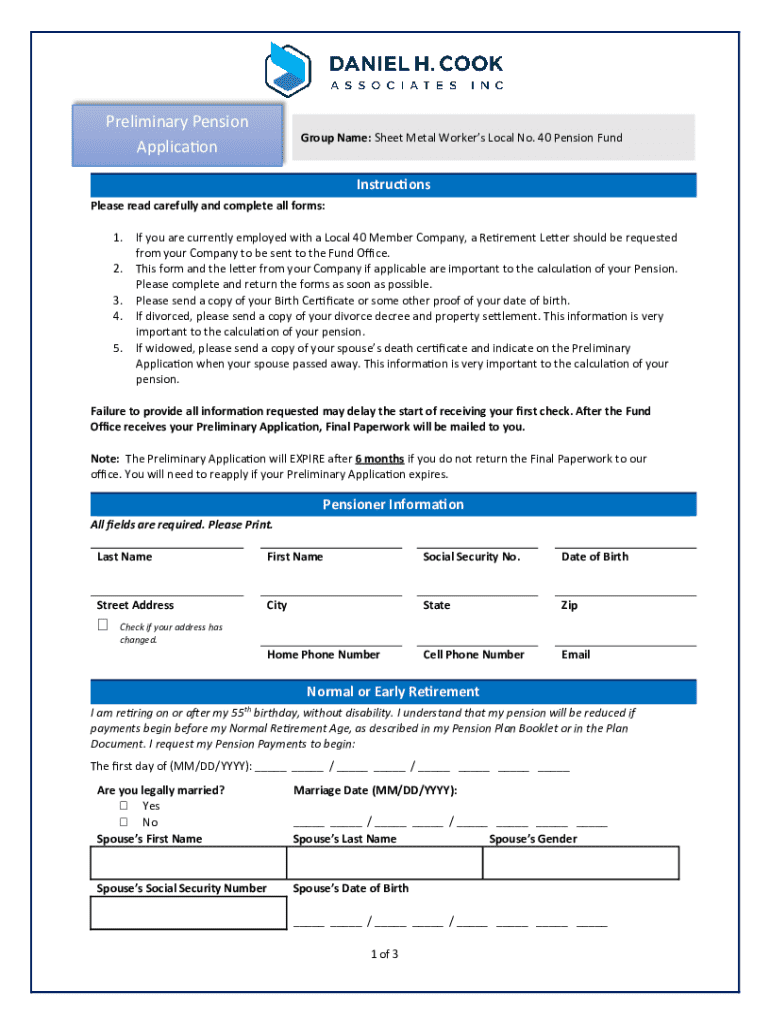

Get the free Preliminary Pension Application

Get, Create, Make and Sign preliminary pension application

Editing preliminary pension application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out preliminary pension application

How to fill out preliminary pension application

Who needs preliminary pension application?

Your Essential Guide to the Preliminary Pension Application Form

Understanding the preliminary pension application form

The preliminary pension application form serves as the first step in your journey toward securing your pension benefits. This vital document provides a foundational overview of your eligibility and enables pension administrators to gather initial information necessary for processing your application.

The primary purpose of this form is to streamline the initial assessment of your pension entitlements. It allows you to declare your basic details, employment history, and pertinent information regarding your pension scheme. Unlike more detailed pension forms that request comprehensive information, the preliminary application focuses on essential aspects that facilitate efficient processing.

It is important to note the key differences between a preliminary application and other related forms, such as the detailed pension application. The preliminary form is less detailed but lays the groundwork for a more extensive application process. This form doesn’t finalize benefits but initiates the discussion with your pension provider.

When to use the preliminary pension application form

Determining when to use the preliminary pension application form involves understanding the eligibility criteria. Generally, you should submit this form if you are approaching retirement age or experiencing a life event that may trigger pension benefits, such as job loss or a change in employment.

Early submission is critical for several reasons. First, it allows pension administrators ample time to assess your eligibility and clarify any potential issues. Additionally, if you are nearing retirement, submitting the preliminary form expedites your overall application, ultimately affecting the timing of your pension payments.

Key sections of the preliminary pension application form

Personal information

The personal information section typically requires your name, address, date of birth, and contact details. Accurate information is paramount as any discrepancies can lead to delays in processing your application or potential issues later.

Employment history

This section of the form necessitates detailed records of your employment history, including dates of employment, job titles, and the names of employers. Compiling this information can be straightforward if you maintain updated records. Gather old pay stubs, tax records, or other documentation that ensures clarity regarding your career.

Pension scheme details

In this segment, provide information regarding your current pension scheme, including the type of plan you are enrolled in, such as defined benefit or defined contribution plans. Understanding your pension scheme is crucial, as this will inform the subsequent steps in your pension application process.

Step-by-step guide to completing the preliminary pension application form

Gathering required documentation

Before filling out the preliminary pension application form, make sure to gather all necessary documentation. Commonly required documents include proof of identity and residency, employment letters, and anything that verifies your pension scheme.

It's crucial to organize these documents systematically. You might consider using a folder or a digital tool that allows you to track these files easily. Having all your documents ready saves time and reduces stress during the application process.

Completing the form

When filling out the preliminary pension application form, pay attention to each field's instructions carefully. It’s essential to ensure you provide honest and accurate information to prevent any complications down the line. Some common pitfalls include misplacing dates or omitting critical information.

Reviewing your completed form

Once you have filled out the form, take time to review your answers. Create a checklist to double-check all entries, ensuring you haven't missed anything. Clarity and legibility are vital; poorly written entries could lead to misunderstandings.

Editing and signing your preliminary pension application form

Utilizing pdfFiller tools can drastically improve your document editing process. Whether you need to make changes or finalize your entries, pdfFiller provides an intuitive platform to edit your document seamlessly. You also have the benefit of e-signing options to authenticate your form electronically.

Moreover, collaboration features enable team review, making it easier if you require input from others before final submission. This feature enhances the quality of your application by allowing insights from multiple perspectives.

Submitting your preliminary pension application form

There are various options available for submitting your completed preliminary pension application form, such as online submission, mailing a printed copy, or even submitting in person, depending on your pension provider's protocols. Online submission tends to be the quickest and most efficient method.

To ensure timely submission, consider the deadlines set by your pension provider. Tracking your submission status is equally crucial, allowing you to confirm that your application has been received and is under review.

Managing your pension applications with pdfFiller

pdfFiller empowers users to manage their pension applications effortlessly. The platform offers a range of features, including tools for document management, unlimited storage, and easy access to past applications and documents. This cloud-based solution allows you to handle your paperwork from anywhere.

The secure storage capabilities ensure that your sensitive documents remain protected and easily retrievable whenever needed. You can track changes to your forms, ensuring every version of your application is accounted for.

Troubleshooting common issues

While filling out the preliminary pension application form may seem straightforward, challenges can arise. Common issues include form layout errors, incorrect information entries, and submission issues. If you encounter these problems, it’s crucial to consult your pension provider’s guidelines for clarity.

For more complicated errors or issues that persist, do not hesitate to seek help or support. Often, pension advisors can provide the necessary guidance, ensuring your application process is as smooth as possible.

Additional tools and resources

Useful links

Explore further with links to related pension forms available on the pdfFiller website. You can find additional guidance and articles on pension management tailored to your specific needs, enriching your understanding of the pension landscape.

External resources for in-depth knowledge

Consider accessing pension advisory services that offer personalized insights into navigating the complexities of pension plans. Resources focusing on the legal considerations related to pensions can also empower you with knowledge for future decisions.

FAQs about the preliminary pension application form

First-time applicants often have questions regarding the preliminary pension application form. Common inquiries revolve around what constitutes 'eligible income' and how to accurately represent employment history.

Seeking clarifications about the various sections of the form can also prevent misunderstandings that could delay your application. Don’t hesitate to reach out to support channels for answers tailored to your individual situation.

Staying informed and updated

Keeping up with pension policy changes is crucial. Since pension systems can experience legislative shifts, resources like the pdfFiller blog offer ongoing information about the latest developments and best practices in managing pension plans.

By subscribing to updates from trusted pension management sources, you can ensure you are well-informed and able to make timely decisions regarding your pension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send preliminary pension application for eSignature?

How do I make edits in preliminary pension application without leaving Chrome?

Can I sign the preliminary pension application electronically in Chrome?

What is preliminary pension application?

Who is required to file preliminary pension application?

How to fill out preliminary pension application?

What is the purpose of preliminary pension application?

What information must be reported on preliminary pension application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.