Get the free Property Tax Rebate Application Form

Get, Create, Make and Sign property tax rebate application

Editing property tax rebate application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax rebate application

How to fill out property tax rebate application

Who needs property tax rebate application?

Property Tax Rebate Application Form: A How-to Guide

Understanding property tax rebates

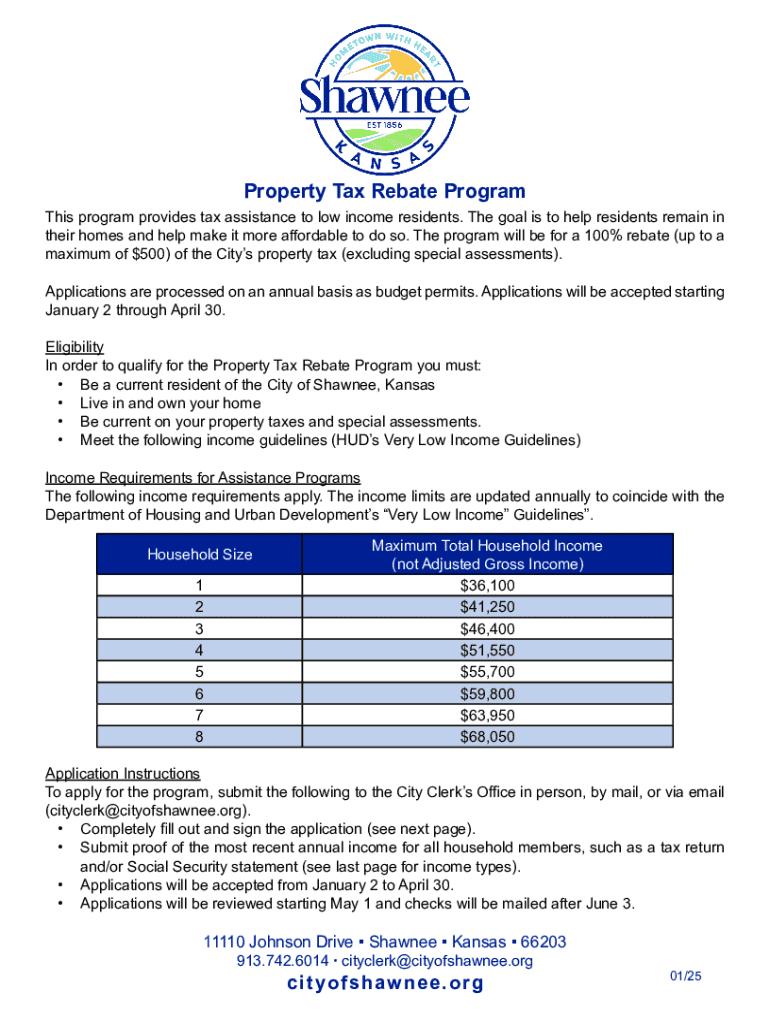

A property tax rebate is a financial benefit provided to eligible homeowners and sometimes renters to alleviate the burden of property taxes. Rebates can significantly reduce the annual tax liability, making housing more affordable. The primary purpose is to support individuals and families by returning a portion of their tax payment back to them.

For many, property tax rebates represent a crucial opportunity for financial relief. They are particularly important for lower-income families or seniors on fixed incomes who may struggle to meet high tax obligations. These rebates not only provide immediate resources to help cover essential expenses but also contribute to greater financial stability over the long term.

Eligibility criteria for property tax rebates

Eligibility for property tax rebates typically hinges on factors such as age, income, and residency status. Homeowners must usually be at least a certain age, such as 65 years for senior citizen rebates, and meet specific income thresholds. Furthermore, they must demonstrate that they reside in the property for which they are claiming the rebate.

For renters, eligibility conditions generally include income limits and proof of rental payments. Low-income renters may qualify for separate incentive programs. In addition, there are various types of property tax rebates available, including senior citizen rebates and low-income programs tailored to assist vulnerable populations.

Preparing to apply for the property tax rebate

Before filling out the property tax rebate application form, it is crucial to prepare by gathering all necessary documentation. This typically includes proof of income, such as tax returns or recent pay stubs, and documentation demonstrating property ownership or rental agreements. Additionally, you will need to provide identification, which may involve your Social Security Number or Individual Taxpayer Identification Number (ITIN).

Understanding the application timeline is also essential. Generally, states have specific windows during which applications can be submitted. Keeping track of these dates ensures you won't miss the opportunity to apply for the rebate.

Step-by-step guide to completing the property tax rebate application form

Accessing the property tax rebate application form is the first step in the process. Most states provide this paperwork online, and resources like pdfFiller offer easy access to forms you can download and print. It's key to use the right form specific to your state or local jurisdiction.

Once you have the form, begin by filling out your personal information, including your name, address, and contact details. Ensure all entries are correct, as inaccuracies can delay processing.

Next, report your income accurately. Depending on your situation, you may need to list different types of income such as wages, pensions, or benefits. Low-income applicants should follow specific instructions that detail how to represent their financial situation clearly.

Afterward, provide information about your property. Include details like the type of property and its assessed value. Finally, make sure to sign and submit your application accurately. With tools like pdfFiller, you can use e-signature options and submit your documents either online or via mail.

After you submit your application

Once you've submitted your property tax rebate application, tracking its status is essential. Most state agencies allow you to check your application progress online — be sure to note any reference number you receive upon submission. Understanding the expected timeline for processing will help manage your expectations.

After processing, if you are approved for the rebate, funds will typically be issued either via direct deposit or a mailed check. Familiarize yourself with the payment schedule so that you know when to expect your rebate.

Frequently asked questions (FAQs)

If you find yourself without a Social Security Number or ITIN, you may still be able to apply for certain rebates. Some states have alternative identification methods available. For those needing assistance filling out the application, local non-profit organizations often offer help for free. It's crucial to know your application deadlines, which vary but are typically set for annual submissions before a specific date each year.

To ensure correctness in your application, consider reviewing it with a family member or advisor who has experience. If your application happens to be denied, you can usually appeal the decision or request further information on why you did not qualify.

Resources and tools for managing your application

Utilizing tools like pdfFiller can greatly enhance your experience with document management. This platform allows you to create, edit, and co-sign documents efficiently, facilitating collaboration for team submissions. Using online forms ensures that you have access to the latest application templates and instructions.

In addition, several avenues offer support for applicants. Local government offices typically have resources and guides for property tax rebates. They may also provide online help desks that can answer specific questions you might have while filling out the property tax rebate application form.

Related information and legislation

Understanding current laws governing property tax rebates can help clarify what programs are available in your state. Each state may have distinct eligibility criteria, benefits, and application procedures, which can change due to legislation. Staying informed about these regulations ensures you can take full advantage of available rebates.

State-specific programs also vary widely. Some states offer significant tax relief for seniors, while others focus on low-income families. Being aware of these specific programs will assist you in knowing which rebates apply to your situation.

Advanced tips for maximizing your rebate

To maximize your property tax rebate, consider filing for multiple rebate programs if eligible. Understanding the different types of rebates available can increase your overall benefits. Ensure you carefully read the eligibility criteria for each program to avoid missing out.

Moreover, keeping thorough records from year to year can streamline future applications. Save all documentation related to your income, property, and any correspondence regarding tax rebates. Well-maintained records facilitate not only future applications but also provide valuable insights into your finances.

Invitation for feedback

Your experience matters. If you found this guide on the property tax rebate application form helpful, we would love to hear your feedback. Sharing your thoughts will not only assist us in improving future guides but also help other readers seeking the same information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get property tax rebate application?

How do I execute property tax rebate application online?

Can I create an electronic signature for signing my property tax rebate application in Gmail?

What is property tax rebate application?

Who is required to file property tax rebate application?

How to fill out property tax rebate application?

What is the purpose of property tax rebate application?

What information must be reported on property tax rebate application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.