Get the free Controlling Person Self-certification Form

Get, Create, Make and Sign controlling person self-certification form

Editing controlling person self-certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out controlling person self-certification form

How to fill out controlling person self-certification form

Who needs controlling person self-certification form?

How-to Guide: Controlling Person Self-Certification Form

Understanding the Controlling Person Self-Certification Form

The Controlling Person Self-Certification Form is a vital document used primarily for compliance with financial regulations, particularly in the areas of tax residency and anti-money laundering. This form collects crucial information about individuals who hold control over certain accounts, ensuring that financial institutions can accurately report pertinent data to tax authorities. The form plays an essential role in mitigating risks associated with financial crimes, maintaining transparency, and adhering to international standards such as the Common Reporting Standard (CRS) and Foreign Account Tax Compliance Act (FATCA).

With the increased focus on financial compliance and the movement towards global standardization, understanding the necessity of the Controlling Person Self-Certification Form is crucial for anyone engaging with financial institutions, particularly if they have significant financial stakes or affiliations. By ensuring the information is accurately reported, entities protect themselves against potential legal repercussions or compliance breaches.

Who needs to fill out the form?

Individuals who qualify as 'controlling persons' may differ based on jurisdiction, but generally, this includes anyone who exercises control over an account or a corporation. Typical scenarios include directors of a company, partners in a partnership, and individuals who own a certain percentage of an organization. The definition is thus broad enough to encompass anyone with a significant authority or ownership role.

In practical terms, if you are a shareholder with a controlling interest in a corporation or a trustee having authority over a trust, you will likely be required to complete this form. Additionally, if you are a signatory on an account or have the power to direct the funds of a financial entity, submitting the Controlling Person Self-Certification Form is typically necessary for compliance with tax reporting obligations imposed by local and international laws.

Key components of the Controlling Person Self-Certification Form

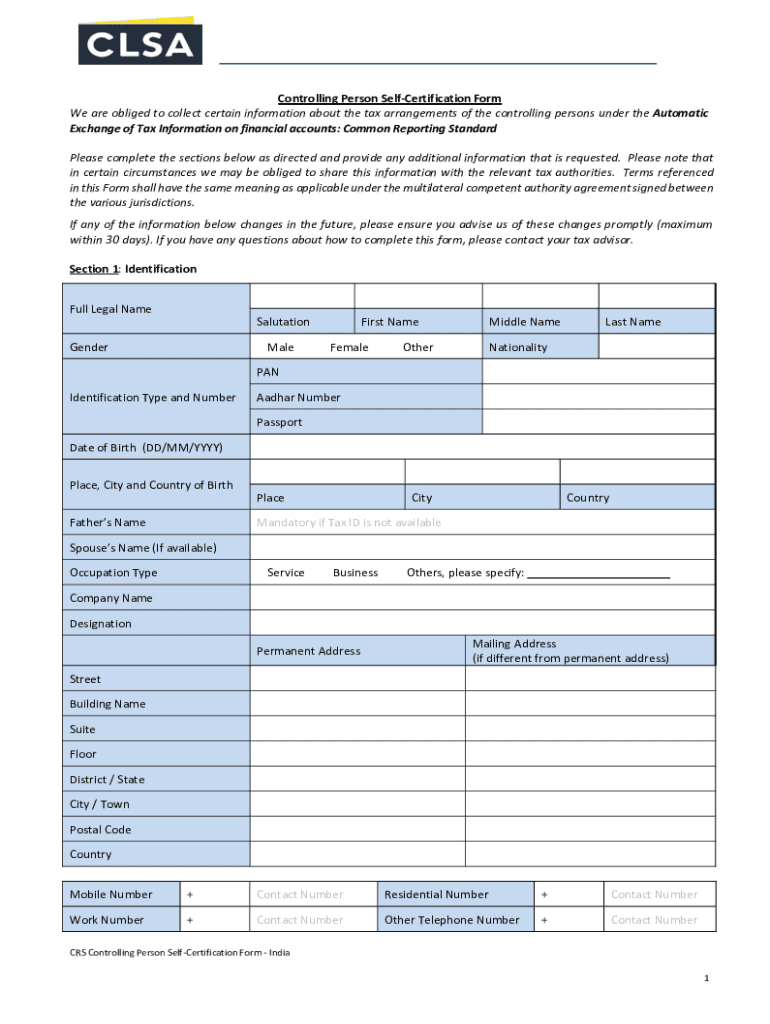

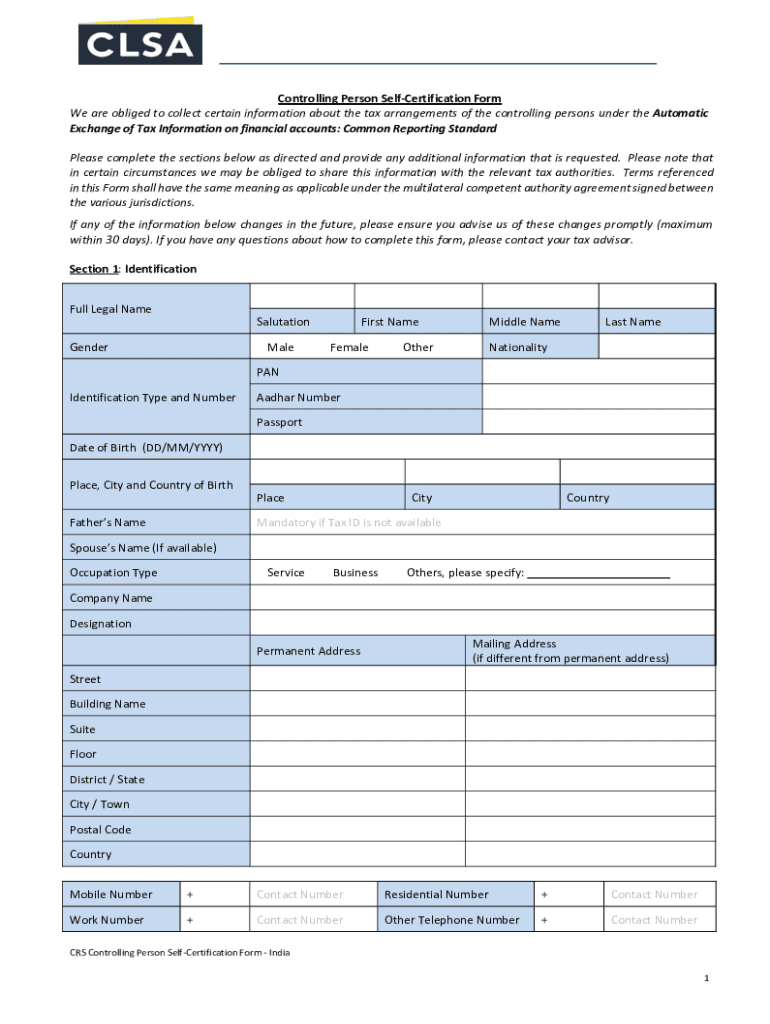

The Controlling Person Self-Certification Form comprises several essential components that need to be filled out accurately to ensure compliance. The first section primarily requests basic information. This includes your full name, date of birth, and nationality, which are crucial for identification purposes. All personal details must be accurate to avoid complications with your financial institution or regulatory authorities.

Following basic information, the form inquires about your residential address and contact information. This part is essential not only for geographical identification but also for corresponding with tax authorities when necessary. The next significant segment involves tax residency information, where you will declare your tax residency status. You must provide details such as your tax identification number (TIN) if required, which serves as a key identifier for tax reporting.

The final key section features certification statements. This segment will ask you to affirm that the information you have provided is correct and acknowledge the penalties for submitting false information. Discrepancies in this area can lead to severe financial and legal repercussions, underscoring the importance of accuracy and honesty when completing the form.

Step-by-step instructions for completing the form

To begin the completion process, you need to access the Controlling Person Self-Certification Form. This can be easily done through pdfFiller, a user-friendly platform that enables you to download the form in PDF format. Navigate to the pdfFiller website and use the search feature to locate the specific form you need. Once located, click the download button to save it in your desired format.

Next, it's time to fill out the form. Carefully follow each section and ensure that all details are accurate. pdfFiller provides editing tools that allow users to enter text seamlessly, making it easier to avoid mistakes or misentries. For example, you can use the text box feature to input personal details without issues. Don't forget to review your entries as you go along, ensuring each line matches the corresponding instructions.

In addition to filling out the form, you might need to provide supporting documentation depending on your jurisdiction or the requirements of the institution where you are submitting the form. Commonly required documents include proof of identification, resident status documents, and any legal papers that establish your ownership or control over the relevant entity or account. pdfFiller facilitates document attachment, allowing you to upload required files easily.

Reviewing and validating the form

Once you have completed the Controlling Person Self-Certification Form, it's crucial to thoroughly review it before submission. Many individuals overlook small but significant details that can lead to delays or rejections of their forms. Common mistakes include misentered tax identification numbers, incorrect addresses, and missing signature sections. Paying close attention to these areas can prevent complications during the verification process.

Using the collaborative review features of pdfFiller can significantly enhance the accuracy of your form. You can invite colleagues or legal advisors to review your filled-out document. Utilize the comments feature to discuss specific sections or clarify uncertainties, ensuring everyone is aligned before submission.

Submitting the form

After reviewing the Controlling Person Self-Certification Form, you are ready to submit it. Submission methods can vary based on your institution or local regulations. Typically, institutions will provide online submission portals as well as physical delivery options. It’s important to familiarize yourself with the preferred submission method to avoid any delays in processing your form.

When submitting online via pdfFiller, you will often receive confirmation, which may include a tracking number to check your submission status. If opting for physical delivery, keep a copy of the submission receipt and track your delivery to ensure it reaches the correct destination on time.

Managing your form after submission

Once you have submitted the Controlling Person Self-Certification Form, proper document management becomes paramount. Retaining a copy for your records is crucial, as it may serve as a reference for future interactions with financial institutions or regulatory bodies. pdfFiller offers excellent document management features that enable you to save, organize, and access your forms easily, ensuring they are easily retrievable when needed.

Furthermore, if there are changes in your circumstances or new information arises, keeping your self-certification up to date is essential. pdfFiller’s platform allows you to easily edit and resubmit your form as required. This flexibility ensures ongoing compliance and representation of your current financial situations.

Additional tips and best practices

Understanding the specific regulations around controlling persons is crucial to ensure compliance. Since laws may vary depending on jurisdiction, researching local requirements and changes is advisable before completing the Controlling Person Self-Certification Form. Keep up to date with tax regulations that may impact your obligations, as financial laws can evolve.

Utilizing the features provided by pdfFiller can enhance your experience in managing the Controlling Person Self-Certification Form. For instance, the eSigning feature allows you to sign documents digitally, expediting the process significantly. Collaborating with team members can also streamline the completion of multiple certifications, ensuring that all forms are accurate and submitted on time. By exploring these tools, you can make the document management process more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute controlling person self-certification form online?

How do I edit controlling person self-certification form online?

How do I edit controlling person self-certification form on an iOS device?

What is controlling person self-certification form?

Who is required to file controlling person self-certification form?

How to fill out controlling person self-certification form?

What is the purpose of controlling person self-certification form?

What information must be reported on controlling person self-certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.