Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms: A Comprehensive Guide

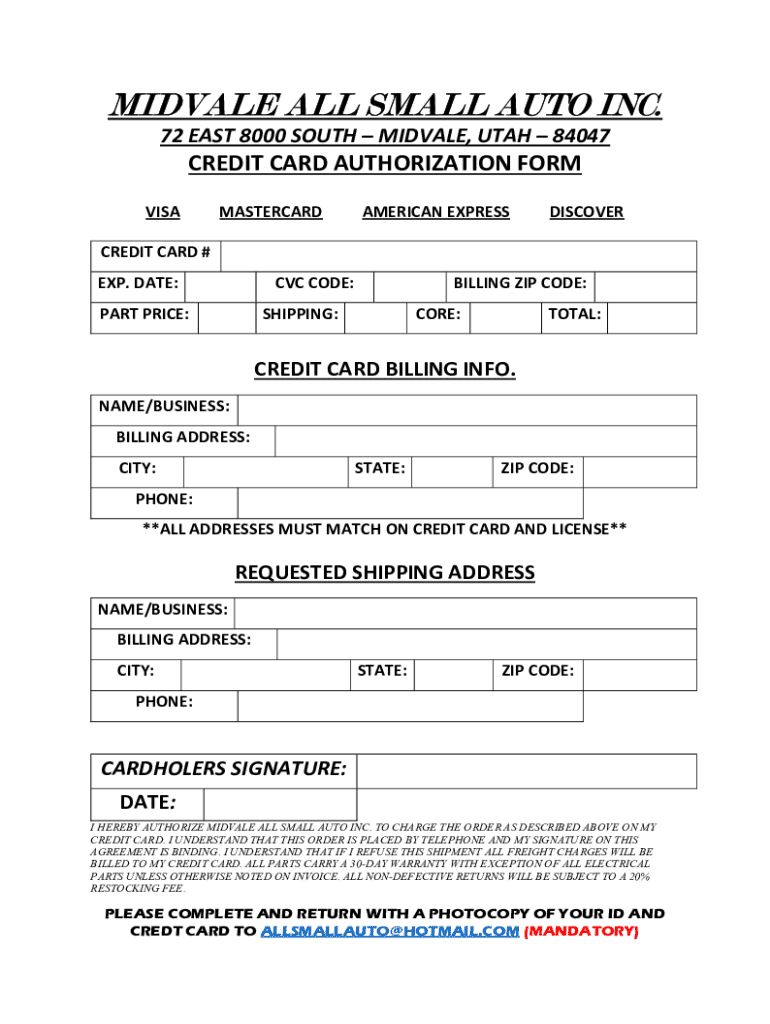

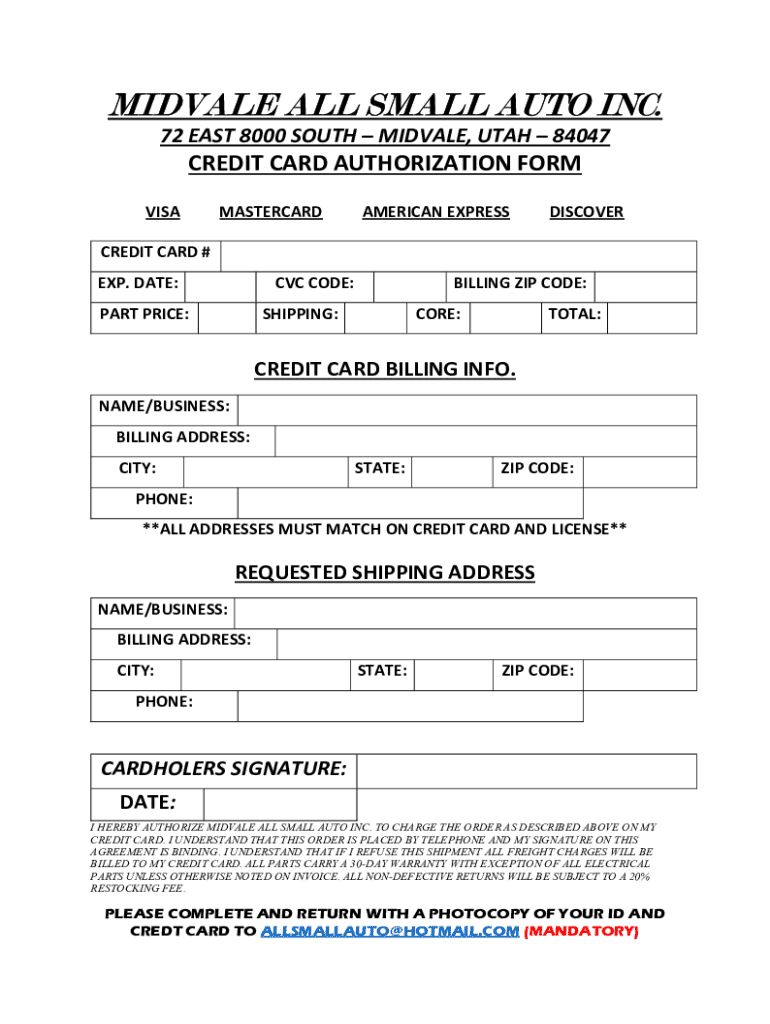

Understanding the credit card authorization form

A credit card authorization form is a document that allows a merchant to charge a customer's credit card for goods or services provided. Functioning as a security measure, this form not only verifies the cardholder's consent but also protects businesses from potential chargebacks. It provides necessary authorization details and helps create a secure transaction environment.

Using a credit card authorization form is particularly vital in industries where the cardholder may not be physically present. For instance, businesses such as restaurants, subscription services, or e-commerce platforms often rely on these forms to ensure that payment is secure and legitimate. By implementing this form, companies can protect themselves and maintain trust with their customers.

Key components of the form

A comprehensive credit card authorization form typically contains key elements that help establish a legal basis for processing payments. First and foremost, it includes cardholder information such as the cardholder's name, billing address, and contact information. This allows businesses to verify that the individual seeking to make a purchase is indeed the rightful owner of the credit card.

Another core component of this form relates to merchant information. This includes the merchant's company name, contact details, and any specific references to the transaction at hand. Lastly, the payment details section specifies the amount to be charged and the purpose of the transaction, ensuring clarity and accountability. Together, these components form a robust framework for secure transactions.

Benefits of utilizing a credit card authorization form

Utilizing a credit card authorization form offers significant advantages to both consumers and businesses. A primary benefit is chargeback prevention. Businesses can protect themselves from disputes by having written proof of the customer’s agreement to the transaction. This is essential, particularly in industries prone to chargeback claims.

Moreover, a properly filled out authorization form simplifies the transaction process. It ensures that all necessary details are documented upfront, allowing for swifter payment processing. For customers, this means a more efficient experience and fewer chances for delays. Enhanced security is another benefit; by implementing these forms, businesses can build customer trust, knowing that they have mechanisms in place to combat potential fraud.

When to use a credit card authorization form

Credit card authorization forms should be used in specific scenarios. Businesses that operate remotely, such as online retailers or subscription services, must frequently obtain written authorization from customers before processing payments. Hotels and restaurants may also utilize them for reservations and services, thereby reducing the potential for disputes regarding service fees.

Best practices suggest ensuring that authorization forms are completed correctly before processing payments. This includes verifying cardholder information and transaction amounts, as any errors could lead to disputes or fraud. Merchants should also consider implementing a secure platform for storing these forms, ensuring that sensitive customer data is protected.

How to fill out a credit card authorization form

Filling out a credit card authorization form requires careful attention and a step-by-step approach. Begin by gathering all necessary information, including the cardholder’s name, card number, expiration date, and billing address. Accurate data entry is critical, as any mistakes can lead to delays or disputes down the line.

Next, proceed to fill out the cardholder information section, followed by specifying the amount to be charged and the purpose of the transaction. Be thorough in providing payment details and ensure that the signature section is at the bottom, as this is where the cardholder will authorize the transaction. Double-checking can help avoid common mistakes such as incorrect amounts or missing signatures.

Legal considerations

Understanding the legal dimensions surrounding credit card authorization forms is imperative. While businesses may not be legally obligated to use these forms, they serve as a protective measure for both parties. They minimize the risk of chargebacks by providing documented consent for payment, which can be crucial in disputes.

Compliance with PCI DSS standards is another fundamental aspect of handling credit card transactions securely. This ensures that businesses are following best practices in safeguarding customer payment information. Additionally, retaining signed authorization forms comes with its guidelines; businesses must ensure the forms are stored securely and for an appropriate duration, in alignment with their internal policies and legal requirements.

Download templates for convenience

For those seeking convenience, downloadable credit card authorization form templates are available, simplifying the process of document creation. Various types of templates can be found, tailored to different business needs, enabling quick adaptation across sectors like restaurants or services.

Using templates saves valuable time and effort, as they lay out all the essential fields required for capturing cardholder and merchant details. Moreover, individuals and businesses can easily customize these templates to meet their unique transaction needs. Each template can be modified using tools in platforms such as pdfFiller, making it easier than ever to generate authenticated documents.

Frequently asked questions (FAQ)

Common questions arise regarding the use of credit card authorization forms. If you encounter an error on the form, it’s essential to contact the cardholder to resolve the issue swiftly and avoid complications. Additionally, businesses should ascertain how long they intend to keep authorization forms. Retaining them for a reasonable duration, typically ranging from 2 to 5 years, is advisable but should also comply with any applicable legal requirements.

Digital signing has become a standard practice, allowing for seamless processing of authorization forms. This evolution should encourage industries to adopt ways to capture digital signatures for improved efficiency. If your template does not include a CVV space, customizing the template to add a field can enhance security by enabling merchants to verify that the card is present and the cardholder legitimate.

Optimize your document management with pdfFiller

Embracing a cloud-based platform like pdfFiller provides immense advantages in document management. These benefits include seamless collaboration among team members, which is especially useful for businesses with remote staff and multiple contributors to the document creation process. pdfFiller not only allows for efficient editing and sharing but also integrates eSignature capabilities making it easier to collect approvals on credit card authorization forms.

Utilizing pdfFiller means businesses can streamline their document creation processes, ensuring that essential information is quickly captured and processed. This centralized approach helps mitigate risks associated with managing physical forms while enhancing the overall efficiency of your operations. As organizations increasingly shift towards digital solutions, incorporating tools like pdfFiller is key to maintaining competitive advantages.

Related resources and tools

Further exploring related articles can contribute to a broader understanding of effective transaction management within different industries. Resources addressing secure payment processing and business planning can greatly aid businesses in maintaining smooth operations. By connecting with additional tools that provide resources for payment solutions, companies can equip themselves with the knowledge needed to navigate today’s financial landscapes effectively.

Utilizing the right tools allows businesses to access comprehensive information, crucial for decision-making processes. These resources will empower companies to adopt best practices that safeguard transactions while enhancing customer experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card authorization form online?

How can I edit credit card authorization form on a smartphone?

How do I complete credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.