Get the free Direct Deposit Application

Get, Create, Make and Sign direct deposit application

How to edit direct deposit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit application

How to fill out direct deposit application

Who needs direct deposit application?

Your Comprehensive Guide to the Direct Deposit Application Form

Understanding direct deposit

Direct deposit is an electronic payment method that allows funds to be deposited directly into a bank account without the need for physical checks. This system has transformed how people receive payments, whether it's salary from an employer or government benefits. By eliminating the need for paper checks, direct deposit streamlines the payment process.

One of the key benefits of using direct deposit is the speed of transactions. Funds are often available in the recipient's account on the same day they are deposited, rather than waiting for a check to clear. Additionally, this method offers enhanced financial management, enabling better tracking of income and outflows.

Common uses of direct deposit include payroll disbursements from employers, government benefits, tax refunds, and even reimbursements. As more organizations adopt electronic payment methods, understanding the direct deposit application form becomes essential.

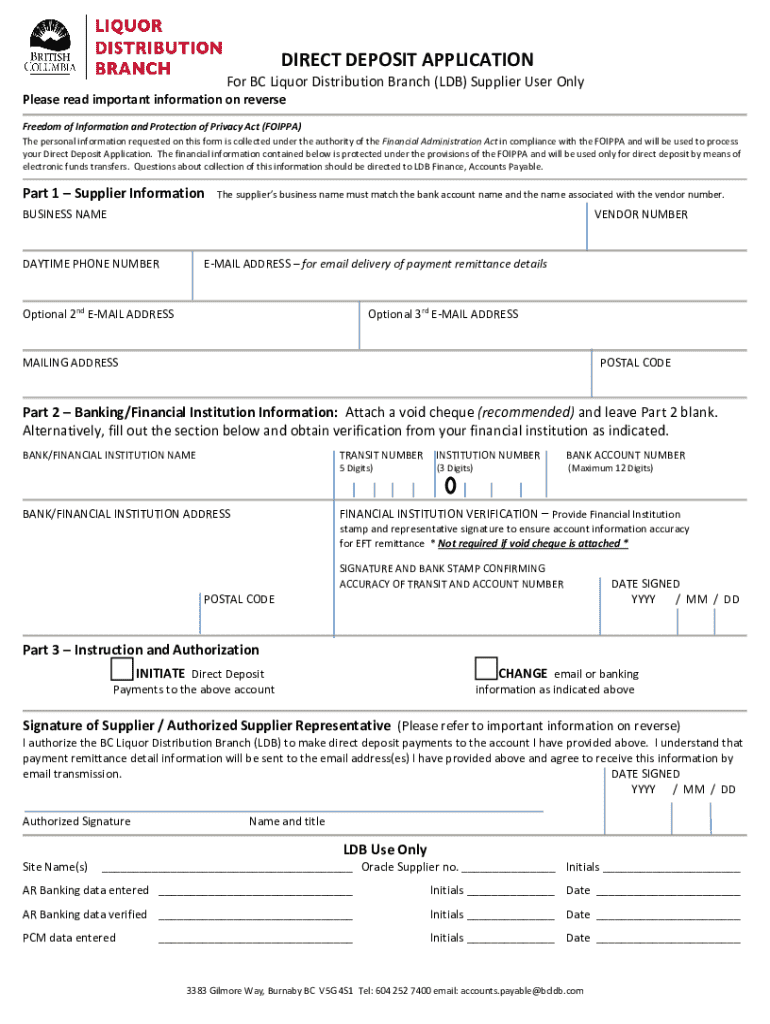

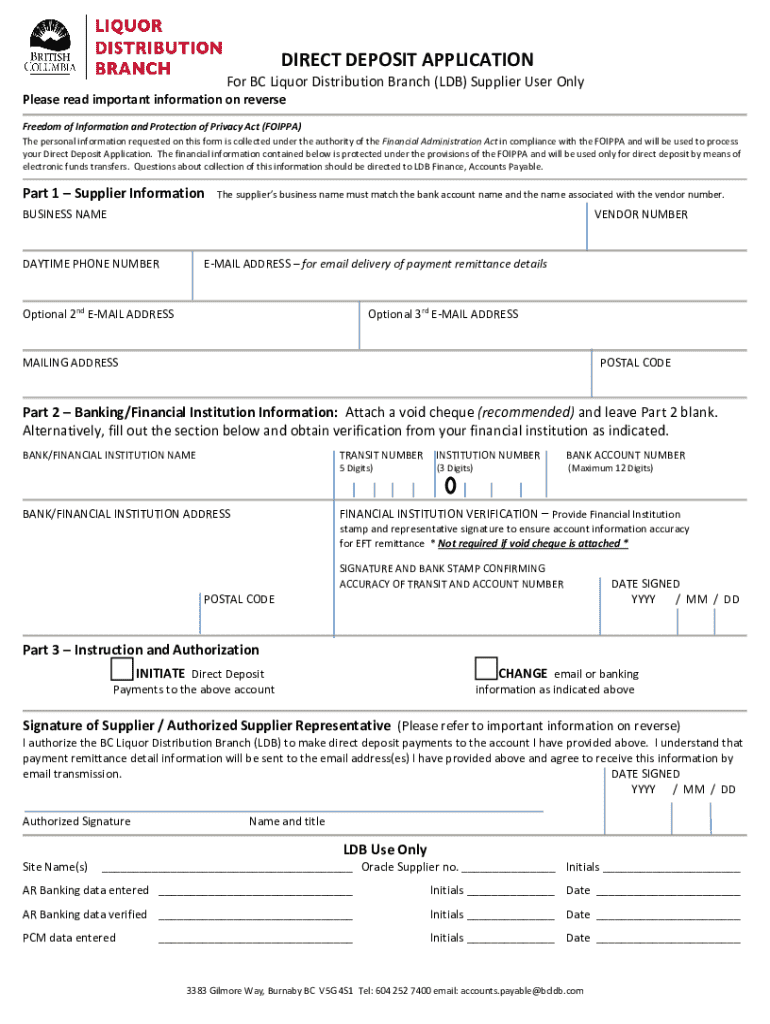

The importance of the direct deposit application form

The direct deposit application form serves as the blueprint for setting up direct deposits. Its easy-to-use structure allows individuals to submit essential information necessary for their banking institution and employer to process their requests. Without this form, accessing direct deposit options would be challenging.

Key features of the application include specific fields for personal and banking information, clear instructions, and an authorization clause. Ensuring accuracy when filling out this form is paramount to prevent payment delays or complications.

Providing accurate information ensures compliance with banking regulations and security measures. Missing or incorrect details can lead to frustration, missed payments, and potential security risks.

Where to obtain your direct deposit application form

Obtaining a direct deposit application form is straightforward. One of the best ways to get started is by downloading the form from pdfFiller, as it provides a resourceful platform for document management.

To access the form on the pdfFiller website, follow this step-by-step guide:

In addition to pdfFiller, many bank websites readily offer these forms, and your employer’s Human Resources (HR) department should have copies available as well.

Step-by-step instructions for filling out the direct deposit application form

Filling out the direct deposit application form involves several vital sections that require attention. The first section typically requests personal information. Ensure you include your full name, current address, and contact information to avoid any processing issues.

In the second section, you will be asked to provide your banking information. Here, it's essential to select the right account type—whether checking or savings—that you want your deposits directed to. Locating your account and routing numbers can typically be done through your online banking portal or by contacting your bank directly.

Finally, the authorization clause usually appears at the end of the form. This section requires your signature and date, agreeing to the terms and conditions laid out in the form. Understanding these terms ensures you know what you're authorizing regarding deposit frequency and amounts.

Editing and customizing your direct deposit application form

pdfFiller's platform offers robust tools for editing the direct deposit application form. Users can easily add or modify details, ensuring their form reflects the most accurate information. Utilizing these editing functions not only simplifies the process but also enhances overall satisfaction with your document management experience.

To customize the form effectively, consider these tips:

Once you have completed editing the form, it is crucial to proofread and utilize the proofreading tools available on pdfFiller. Ensuring every detail is accurate before submission can't be overstated.

Signing your direct deposit application form

The next step after filling out the direct deposit application form is signing it. With the advent of technology, eSigning has become a standard practice and offers several benefits such as speed and convenience. Signing through pdfFiller allows you to finalize your document securely and efficiently.

To add your electronic signature, follow these steps:

Once you have added your signature and date, review the document to confirm everything is in order before submitting it.

Submitting the direct deposit application form

With your direct deposit application form completed and signed, the next step is submission. This form often needs to be submitted to human resources or your payroll department, depending on your employer's policies. It's advisable to confirm the preferred submission method with your HR department.

After submission, ensure that you receive confirmation that your form has been processed. This could be an acknowledgment email or a receipt, which confirms your request for direct deposit is underway.

Managing your direct deposit information

Once you have set up direct deposit, it’s crucial to manage your information effectively. Tracking your payments can help you anticipate when deposits will arrive. Setting up alerts through your bank or payroll system ensures you're notified as soon as funds are available in your account.

Sometimes, you might need to change your direct deposit information, whether due to switching banks or accounts. Understanding when and how to update your banking details is critical to ensuring continuous payment without interruptions. Always reach out to your employer or bank's customer service for specific instructions on making these changes.

Troubleshooting common issues with direct deposit

Even with a properly filled-out direct deposit application form, issues may arise. Common problems include delays in payments or having incorrect information. When facing such delays, the first step is to check your bank statement or online banking account for any incoming deposits.

If you find discrepancies, immediately contact your bank or payroll department for assistance. They can provide information on processing delays and help correct any mistakes with your information. Always keep a record of your communication for reference.

Important considerations and best practices

Securing your banking information is critical. Always ensure that your forms are submitted through secure channels, avoiding public Wi-Fi networks or unsecured sites. Reviewing your direct deposit statements regularly can help you spot any unauthorized transactions early.

Lastly, understanding your rights as a direct deposit recipient can empower you to advocate for yourself in case of problems. Familiarize yourself with your responsibilities as well, especially in keeping your information up to date and accurate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find direct deposit application?

How do I make changes in direct deposit application?

How do I edit direct deposit application on an iOS device?

What is direct deposit application?

Who is required to file direct deposit application?

How to fill out direct deposit application?

What is the purpose of direct deposit application?

What information must be reported on direct deposit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.