Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Understanding the Credit Application Form: Your Comprehensive Guide

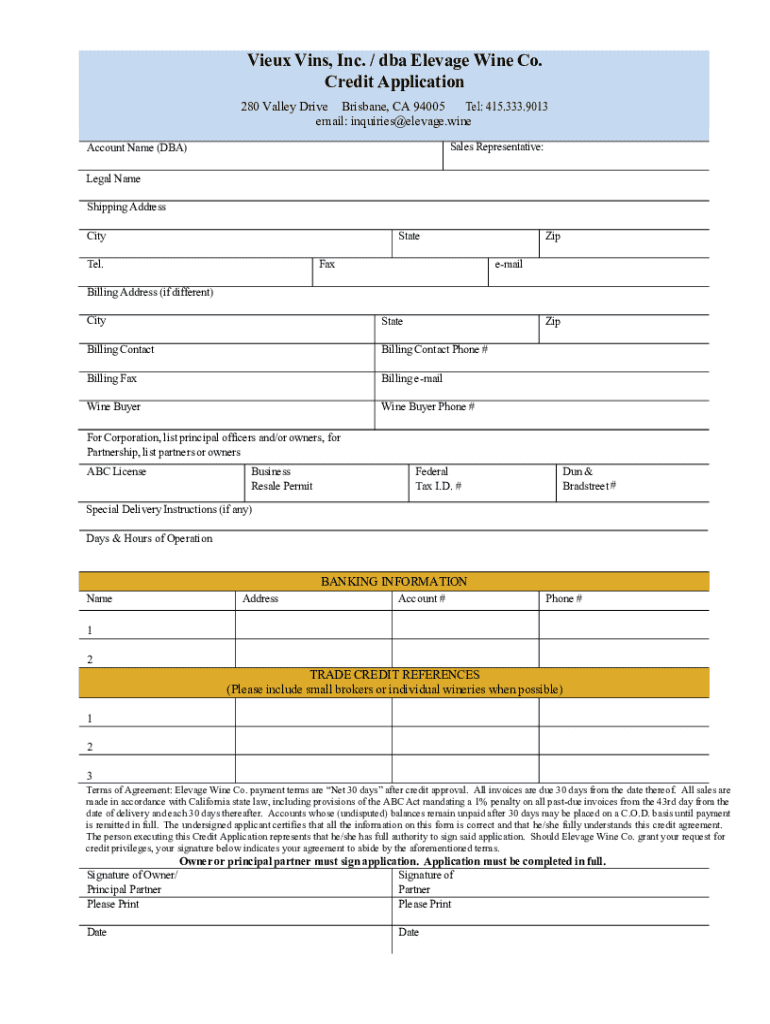

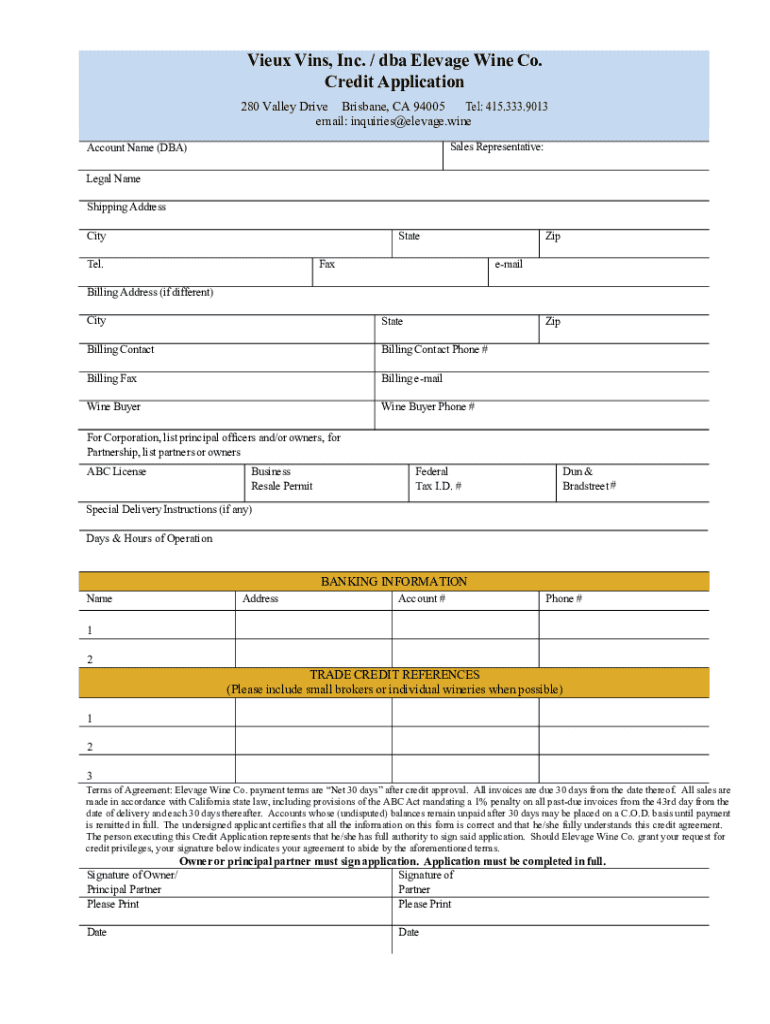

Understanding the credit application form

A credit application form is a critical document used by financial institutions to assess a borrower’s creditworthiness. This form serves as the first step for individuals and businesses aiming to secure loans, credit lines, or credit cards. The information collected through this form plays a pivotal role in determining whether an applicant will be approved or denied. It provides lenders with essential insights into the financial health and history of the applicant, allowing them to make informed lending decisions.

The significance of this form extends beyond simple data collection; it is a powerful tool that mitigates risk for lenders. By thoroughly examining potential borrowers through their credit application forms, lenders can ensure they are extending credit to qualified applicants with a higher likelihood of repayment.

Who uses a credit application form?

Virtually anyone seeking financial assistance may need to fill out a credit application form. On an individual level, people looking for personal loans or credit cards submit these forms to access funding for various needs, from buying a car to paying for home improvements. They provide insights into personal finances, helping lenders gauge the borrowing risk.

Small businesses also frequently rely on credit application forms to apply for credit lines or loans. These forms outline the company’s financial health, including existing debts and revenue, allowing lenders to evaluate the risk associated with lending to a business. Meanwhile, financial institutions, including banks and credit unions, utilize these forms as a fundamental part of their risk assessment structures, ensuring that they lend responsibly.

Key components of a credit application form

Filling out a credit application form accurately is imperative for successful approval. Several key components make up this form, each designed to elicit specific information from the applicant. In the personal information section, applicants must provide their name, address, date of birth, and social security number. This information confirms the identity of the applicant and sets the context for further assessment.

Next comes the employment details section, where applicants outline their current employer, job title, duration of employment, and income data. This information provides lenders with insights into the applicant's job stability and earning capacity. The financial information section requires disclosures of existing debts, assets, net worth, and monthly expenses, painting a complete picture of the applicant's financial situation. Finally, the form concludes with a consent section; the applicant must sign to authorize the lender to assess their creditworthiness fully.

Step-by-step guide to filling out a credit application form

Before diving into filling out a credit application form, preparation is key. Gather all necessary documents, including proof of income, recent bank statements, and existing loan documents. This organized approach ensures that you provide accurate information, which is crucial for the successful processing of your application.

Once prepared, meticulously fill out each section of the application. Begin with personal details, where accuracy is paramount. Ensure names are spelled correctly and addresses are up-to-date. Next, for employment details, provide truthful information about your job duration and income, as discrepancies can lead to delays or denial. When disclosing financial information, be open about debts and assets—honesty is vital for lenders' trust.

Common pitfalls to avoid include inaccuracies in your financial data, missing required documentation, and misunderstanding any terms in the application. Double-checking your work and asking for clarification on tricky sections can prevent future complications.

Editing and customizing your credit application form on pdfFiller

Once you have your credit application form filled out, using pdfFiller can enhance your experience significantly. With pdfFiller's powerful tools, you can easily edit fields, add notes, and customize sections to reflect your unique situation. For instance, you may need to clarify or expound on certain aspects of your financial information or provide context around specific debts.

Additionally, pdfFiller allows you to save and store your credit application securely in the cloud, ensuring that your information is always accessible. This feature is particularly valuable as it protects your data while also allowing you to retrieve and review your application at any point in time. If you have co-applicants or a financial advisor, pdfFiller facilitates easy sharing, making collaborative efforts straightforward.

Electronic signing and submission of your credit application form

Submitting your credit application form electronically can expedite the process significantly. pdfFiller simplifies this with its eSignature capabilities. To eSign your document, simply follow a straightforward step-by-step guide provided within the platform, which often involves clicking on designated signing fields and confirming your signature via your device.

After signing, there are multiple submission methods. You can submit your application online directly through the lender’s platform or email it, depending on the lender's requirements. Another option is to print out your form and submit it by mail. Regardless of your chosen method, ensure you keep a copy of your submission for tracking purposes. Following up is pivotal; monitoring the application status can help you stay informed about any additional requirements or updates from the lender.

What happens after submission?

Once you submit your credit application form, expect a processing time that typically spans several business days. However, this timeline can fluctuate based on various factors, including the lender's workload, the complexity of your application, and your credit history. It's prudent to ask the lender about typical processing times at the point of application.

The possible outcomes of your application include approval, denial, or requests for further information. If approved, you'll receive terms and conditions, which you should review carefully prior to acceptance. In the case of denial, understanding the reasons behind it is vital. This feedback can guide you on necessary improvements, such as enhancing your credit score if you consider reapplying in the future.

Addressing common concerns and questions regarding credit applications

Concerns about fraudulent applications are valid in today's financial landscape. If you suspect fraud related to your credit application, monitoring for signs such as unusual credit inquiries is prudent. Should you notice anything amiss, report the situation immediately to the relevant authorities and your credit bureau. They can provide guidance on protecting your financial identity.

In business contexts, if you find yourself unable to fund a client or pursue a credit option, there are alternative strategies. Explore various funding options, such as alternative financing or working with non-traditional lenders, to help your client find the support they need. It’s essential to keep communications open with clients, maintaining transparency regarding available options.

Sample credit application form template

To assist you in your application process, pdfFiller offers a downloadable, editable sample credit application form template. This template provides a foundational structure that you can modify to suit your personal or business requisites. Utilizing this resource can save time and make completion less daunting.

When using the sample template, ensure that you make relevant adaptations that reflect your specific financial situation. For example, include details relevant to your existing debts, assets, and income. This tailored approach ensures that lenders receive a complete and accurate representation of your financial standing, bolstering your application.

The value of using pdfFiller for your credit application process

Utilizing pdfFiller for your credit application process amplifies efficiency and effectiveness. This comprehensive document management platform not only allows you to edit and sign PDFs but also offers tools for document storage and collaboration. As a cloud-based solution, pdfFiller facilitates multi-user capabilities, meaning teams can work together on credit applications seamlessly.

Additionally, with pdfFiller's cloud-based access, you can retrieve and edit your credit applications from any device, at any location. This level of flexibility ensures that you stay organized, maintain records, and adapt applications as needed, regardless of where you find yourself during the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit application?

How do I make edits in credit application without leaving Chrome?

How do I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.