Get the free CALFRESH REPAYMENT AGREEMENT FOR ...

Get, Create, Make and Sign calfresh repayment agreement for

Editing calfresh repayment agreement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calfresh repayment agreement for

How to fill out calfresh repayment agreement for

Who needs calfresh repayment agreement for?

CalFresh repayment agreement for form: A comprehensive guide

Understanding CalFresh repayment agreements

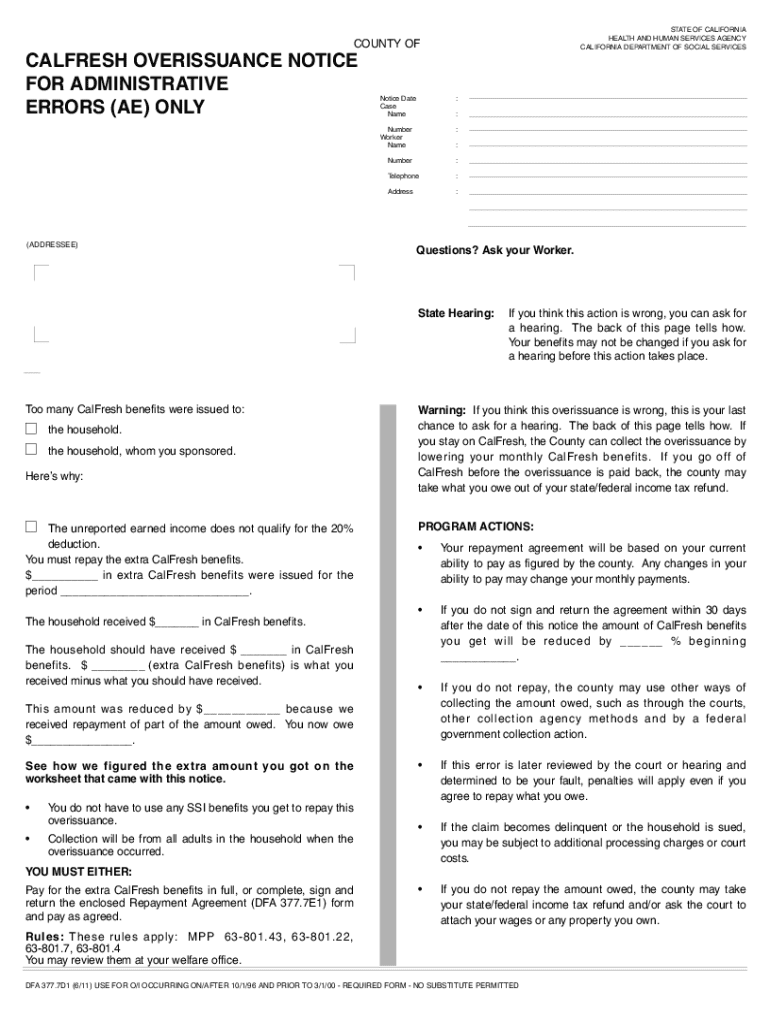

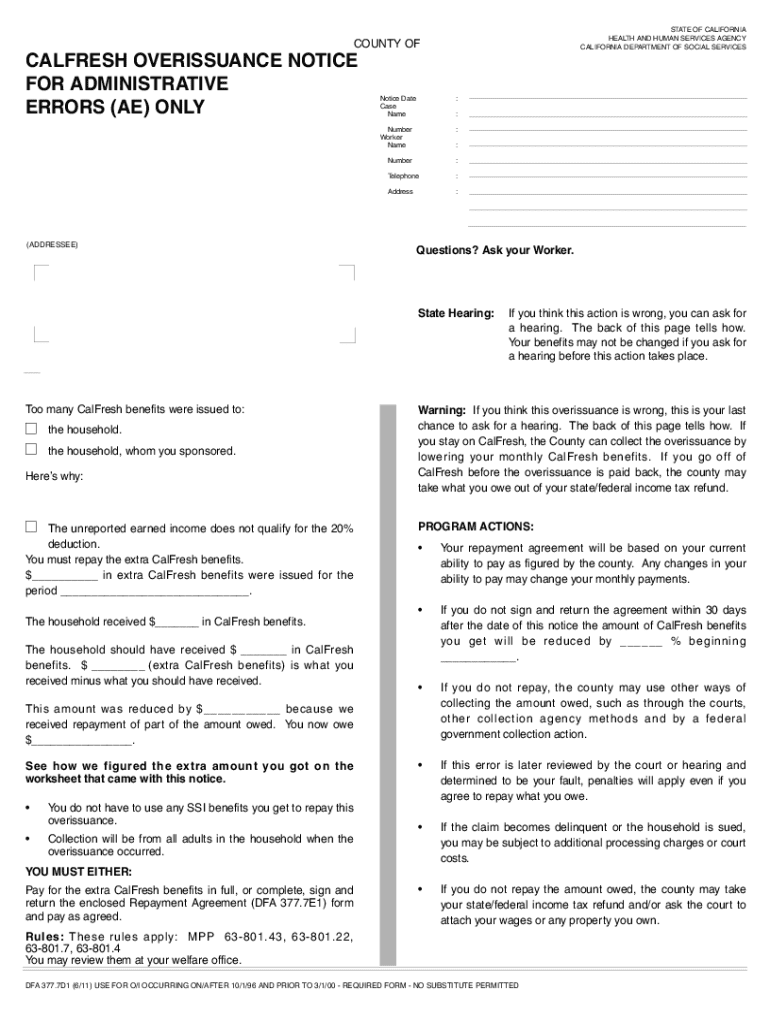

CalFresh repayment agreements are formal arrangements that allow individuals who have received overpayments in their CalFresh benefits to repay the excess funds. This mechanism is crucial to maintaining the integrity of the CalFresh program while providing individuals a manageable way to settle debts they have incurred due to various reasons. Repayment agreements typically arise when discrepancies in income reporting, entitlement miscalculations, or administrative errors lead to an overissuance of benefits.

Understanding the purpose and importance of these agreements within the CalFresh program is essential. They not only help correct financial discrepancies but also ensure that California residents can continue to receive vital support without risking future benefits by failing to address past overpayments. Common situations leading to repayment agreements often involve temporary income fluctuations, loss of employment, or even misunderstandings regarding eligibility criteria related to household income and expenses.

Overview of the CalFresh program

CalFresh is California's version of the Supplemental Nutrition Assistance Program (SNAP), designed to assist low-income households in accessing nutritious food. Eligible households receive benefits deposited onto an EBT card to purchase food items. Key facts about CalFresh include that it serves millions of Californians, providing much-needed nutrition support while stimulating local economies through food purchases.

To qualify for CalFresh, applicants must meet specific eligibility criteria. This generally includes household size, income levels, and residency status within California counties. Occasionally, individuals may encounter overpayments in their benefits, often due to factors such as application errors, missed income updates, or changes in family composition that affect eligibility—a reminder that all beneficiaries should keep their information up to date to prevent complications.

The repayment process

The CalFresh repayment process begins with an initial notification from the county office indicating an overpayment. Once notified, recipients have the option to establish a repayment agreement. The process involves several key steps: first, reviewing the notification letter carefully and ensuring that the stated overpayment figures are accurate. Then, individuals must communicate with their local county office to discuss repayment options, which may include a lump sum payment or a structured payment plan.

Adhering to key deadlines is critical in managing a repayment agreement. Typically, beneficiaries must respond to the repayment notice within a given period—often 30 days—to avoid additional penalties or the suspension of benefits. Clear communication with county offices is extremely important throughout this process; queries regarding repayment terms, personal circumstances, or questions about form completions must be addressed promptly.

Types of repayment agreements

Repayment agreements can generally fall into two categories: lump-sum payments and payment plans. A lump-sum payment involves settling the entire overpayment amount at once, which may be suitable for individuals who have the financial capacity to do so. Conversely, a payment plan allows repayable amounts to be spread over several months, making it more manageable for those who may face tighter financial constraints.

Each repayment option has its pros and cons. A lump-sum payment can resolve the debt quickly and avert future financial complications, but it may strain an individual’s current finances. On the other hand, a payment plan may ease immediate pressure but prolong financial obligation. Factors to consider when choosing a repayment method include the current household budget, anticipated changes in personal income, and any potential future claims against additional benefits.

Managing your repayment agreement

Effectively managing a repayment agreement is essential for ensuring compliance and avoiding complications. Establishing a clear payment schedule helps beneficiaries stay organized; using calendar reminders or spreadsheet tools can be helpful for this process. Additionally, budgeting tools can assist in tracking other expenses to ensure funds are available for timely repayments.

Life circumstances can change unexpectedly, and it’s important for individuals to know how to handle any sudden financial hardship. Beneficiaries experiencing temporary challenges should communicate promptly with their county office to discuss the possibility of adjusting the repayment agreement, which might include reduced payment amounts or extended timelines based on their new financial realities.

Potential consequences of non-compliance

Failing to fulfill repayment obligations can lead to serious consequences, including penalties that may affect the recipient’s current and future CalFresh benefits. Individuals who do not comply may face a reduction in their benefits or even termination of eligibility, ultimately exacerbating their financial challenges. Understanding these potential consequences underscores the importance of addressing repayment agreements proactively.

In cases where individuals disagree with the overpayment amount or terms of the repayment agreement, options are available to appeal or negotiate these terms. Advocating for oneself and seeking clarity on claims raised by county offices can lead to more favorable resolutions and prevent future financial distress.

Common questions about CalFresh repayment agreements

Many individuals have questions when faced with CalFresh repayment agreements. Common concerns include what to do if someone cannot afford to repay the amount owed. In such cases, it’s critical to communicate with the county office; they can provide guidance and options tailored to individual financial circumstances. Another frequent inquiry is whether a beneficiary can dispute the amount owed. Yes, if the recipient believes there’s an error in the amount stated, they should document their case and follow through with the appeals process.

In light of the ongoing COVID-19 pandemic, many have sought clarification on how these repayment agreements may be affected. While federal and state regulations have provided temporary relief measures, it's essential to stay informed about the latest updates from the California Department of Social Services regarding modifications to the repayment obligations during public health emergencies.

Resources for assistance

Navigating a CalFresh repayment agreement can feel overwhelming, but various resources exist to assist individuals in this process. Official CalFresh resources can be accessed through the California Department of Social Services website, where individuals can find vital information and contact details for local county support. Additionally, online tools are available to help manage repayments, including expense tracking and budgeting calculators.

Numerous community organizations also provide support and guidance, offering workshops or one-on-one consultations to help beneficiaries understand their rights, obligations, and available resources in relation to CalFresh and repayment agreements. Taking advantage of these resources can enhance one's knowledge and confidence during the repayment process.

Filling out the CalFresh repayment agreement form

Completing the CalFresh repayment agreement form accurately is crucial to avoid unnecessary delays. Individuals need to gather essential information, including identification details, specific income figures, and documentation proving household size and expenses. Carefully following instructions on the form can help ensure that all sections are filled out correctly, enhancing the likelihood of the agreement being accepted without issue.

Common pitfalls to avoid during this process include overlooking required documentation or miscalculating income and expenses. It’s advisable to double-check numbers and ensure that all supporting documents are submitted alongside the form, as any omissions can lead to setbacks in processing the repayment agreement.

Leveraging pdfFiller for document management

pdfFiller offers a powerful suite of features for managing repayment forms seamlessly. Users can easily edit PDFs directly within the platform, which simplifies the process of completing the CalFresh repayment agreement form. The eSigning capabilities allow for quick submissions, eliminating the need for printing and physically mailing documents.

Furthermore, pdfFiller’s collaboration tools enable individuals to work alongside family members or advisors on their repayment documents. Its cloud-based platform ensures that all forms are securely accessible from anywhere, making it easier to store critical documents related to repayment agreements, keeping track of your payment history, and establishing a well-organized repository for important correspondence.

Finalizing your repayment process

Once the repayment agreement is completed and submitted, it’s essential to confirm acceptance with the appropriate county office. Keeping records of all correspondence and payments related to the repayment agreement is crucial for maintaining compliance. These records serve as proof of payments made and provide reassurance in case of future discrepancies regarding the repayment amount.

Looking ahead, it’s also important for beneficiaries to monitor their CalFresh benefits regularly. Staying informed about future eligibility requirements and changes can help ensure compliance and continued access to benefits, thereby promoting food security for households across California.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit calfresh repayment agreement for from Google Drive?

Where do I find calfresh repayment agreement for?

How do I edit calfresh repayment agreement for in Chrome?

What is calfresh repayment agreement for?

Who is required to file calfresh repayment agreement for?

How to fill out calfresh repayment agreement for?

What is the purpose of calfresh repayment agreement for?

What information must be reported on calfresh repayment agreement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.