Get the free Minnesota Business Activity Report

Get, Create, Make and Sign minnesota business activity report

Editing minnesota business activity report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota business activity report

How to fill out minnesota business activity report

Who needs minnesota business activity report?

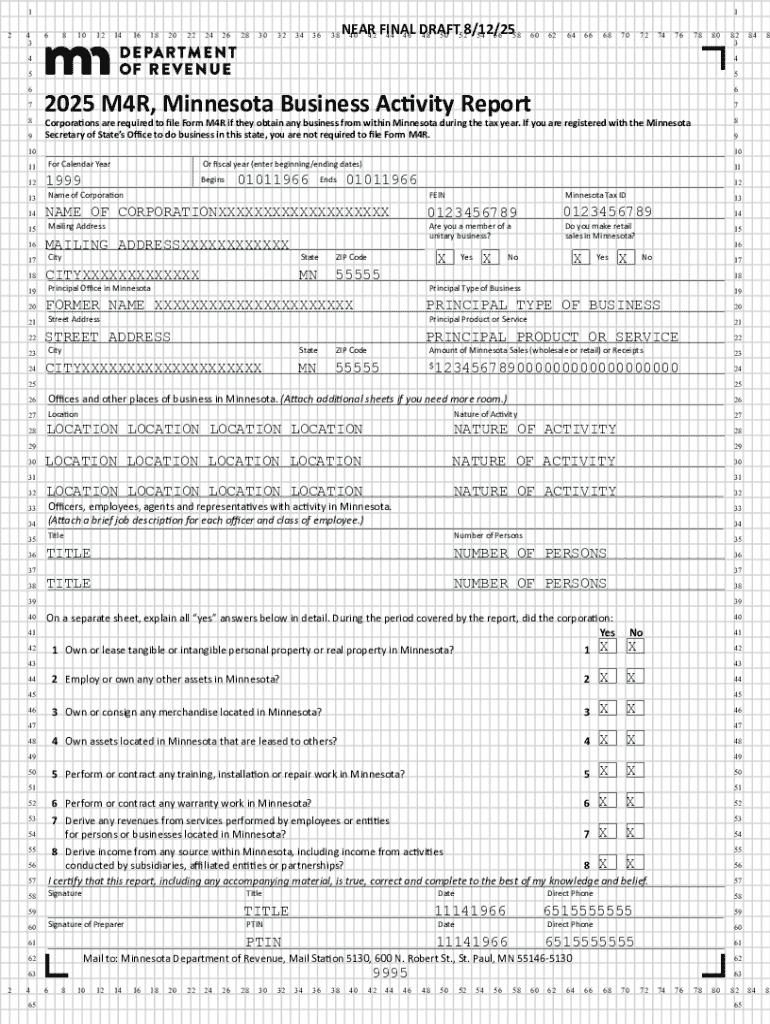

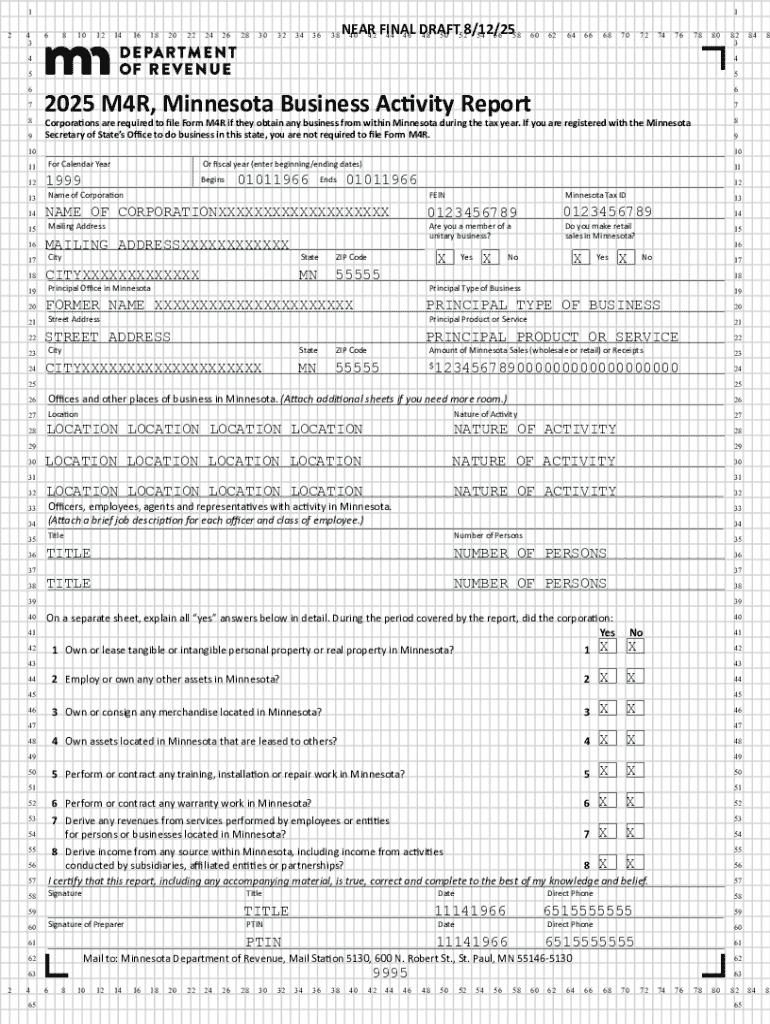

Understanding the Minnesota Business Activity Report Form

Understanding the Minnesota Business Activity Report Form

The Minnesota Business Activity Report Form is a vital document for any business operating in the state. This form not only reflects the business's financial performance but also fulfills crucial regulatory obligations set by the state government. By accurately completing and submitting this report, businesses ensure compliance with Minnesota tax laws and contribute to the state's overall economic health.

Commonly referred to as the BARS, this report is particularly significant for local businesses as it provides a detailed overview of business activities. It enables the Minnesota Department of Revenue to track economic growth, ascertain compliance with state regulations, and facilitate governmental planning.

Who needs to complete this form?

Any business entity operating within Minnesota is required to complete the Business Activity Report Form. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). If your business generates revenue, regardless of its size or sector, you must complete this form to keep your standing with state authorities.

Start-ups and small businesses, in particular, may overlook the importance of timely submission; however, all businesses are accountable to Minnesota regulations. Consistent reporting not only helps in avoiding penalties but also better prepares businesses for future forecasting and planning.

Purpose and benefits of submitting the Business Activity Report

The primary purpose of the Minnesota Business Activity Report is to ensure that businesses comply with state tax obligations. By submitting this form, businesses validate their economic contributions and ensure visibility in governmental plans. Moreover, it enhances transparency and fosters trust with stakeholders.

Filing this report also provides various benefits, such as:

Key features of the Minnesota Business Activity Report

When completing the Minnesota Business Activity Report Form, several key features stand out. These features not only guide business owners during the completion process but also ensure that the Department of Revenue receives the specific information necessary for analysis and processing.

A detailed breakdown of required information includes:

Step-by-step guide to completing the Minnesota Business Activity Report Form

Completing the Minnesota Business Activity Report can seem daunting, but breaking it down into specific steps can simplify the process significantly.

Follow these steps to ensure you complete the form accurately:

Interactive tools for submission support

To make the document management process seamless, pdfFiller offers interactive features that enhance user experience when working on the Minnesota Business Activity Report Form.

Utilizing pdfFiller for online form completion provides businesses with several advantages:

Submitting your Business Activity Report

After completing the Minnesota Business Activity Report, the next step is submitting it to the appropriate authorities. It's important to be aware of the submission methods and deadlines to ensure compliance.

Businesses can choose from multiple submission options:

Managing your Business Activity Report with pdfFiller

Once the report is submitted, managing it effectively becomes essential for future reference and compliance checks. pdfFiller provides several features aimed at enhancing document management.

Some ways to manage your submitted Business Activity Report include:

Frequently asked questions (FAQs)

As businesses prepare to file their Minnesota Business Activity Report, several common questions may arise. Here are answers to help clarify the process.

Best practices for future report submissions

To simplify the filing process in the future and ensure accuracy, it is beneficial for businesses to adopt best practices when managing their financial records and compliance. These practices can greatly enhance operational efficiencies.

Learn more about Minnesota business regulations

Business owners seeking in-depth knowledge about Minnesota's regulatory climate and compliance requirements can benefit from numerous resources.

Stay updated on business activity reporting in Minnesota

The landscape of Minnesota business regulations is ever-evolving, and staying informed is crucial for ongoing compliance. Subscribe to notifications and regularly follow insights from reliable sources to remain on top of your reporting obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my minnesota business activity report directly from Gmail?

How can I get minnesota business activity report?

How do I complete minnesota business activity report on an Android device?

What is minnesota business activity report?

Who is required to file minnesota business activity report?

How to fill out minnesota business activity report?

What is the purpose of minnesota business activity report?

What information must be reported on minnesota business activity report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.