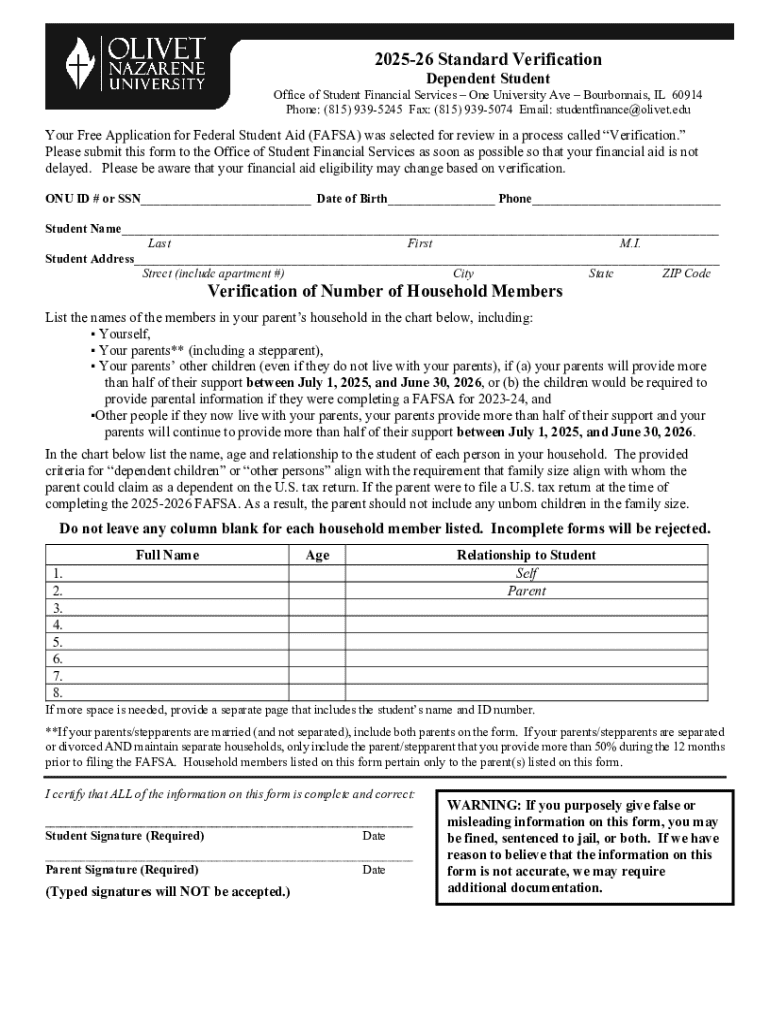

Get the free 2025-26 Standard Verification Dependent Student

Get, Create, Make and Sign 2025-26 standard verification dependent

How to edit 2025-26 standard verification dependent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-26 standard verification dependent

How to fill out 2025-26 standard verification dependent

Who needs 2025-26 standard verification dependent?

Navigating the 2025-26 Standard Verification Dependent Form: A Comprehensive Guide

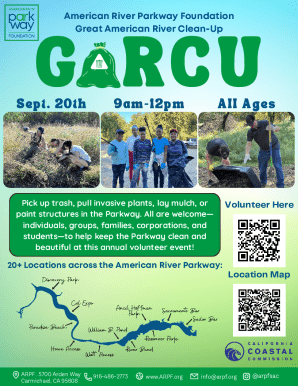

Overview of the 2025-26 standard verification dependent form

The 2025-26 Standard Verification Dependent Form plays a crucial role in the financial aid process, specifically designed to confirm the accuracy of the information provided in the Free Application for Federal Student Aid (FAFSA). Verification is an essential step that ensures students receive the financial support they qualify for based on accurate data. This process helps educational institutions and the Department of Education maintain the integrity of federal financial aid programs.

Completing the Standard Verification Dependent Form correctly is vital. Errors or omissions can lead to delays in financial aid processing, which may affect a student's ability to pay for college expenses on time. Moreover, addressing the form promptly increases the likelihood of receiving the necessary support for tuition, books, and living expenses.

Who needs to complete the standard verification dependent form?

Dependent students applying for federal student aid are typically those who must complete the 2025-26 Standard Verification Dependent Form. Those flagged for verification often fall into specific categories, such as discrepancies in FAFSA data, missing signature requirements, or incomplete responses regarding parental information. If any of these instances occur, the financial aid office will notify students regarding the need to submit verification documents.

It's essential for students to understand that failing to complete the verification process can significantly impact their eligibility for financial aid. If the necessary documents aren't submitted promptly, students may see delays in the disbursement of their aid packages, potentially affecting their ability to enroll in classes.

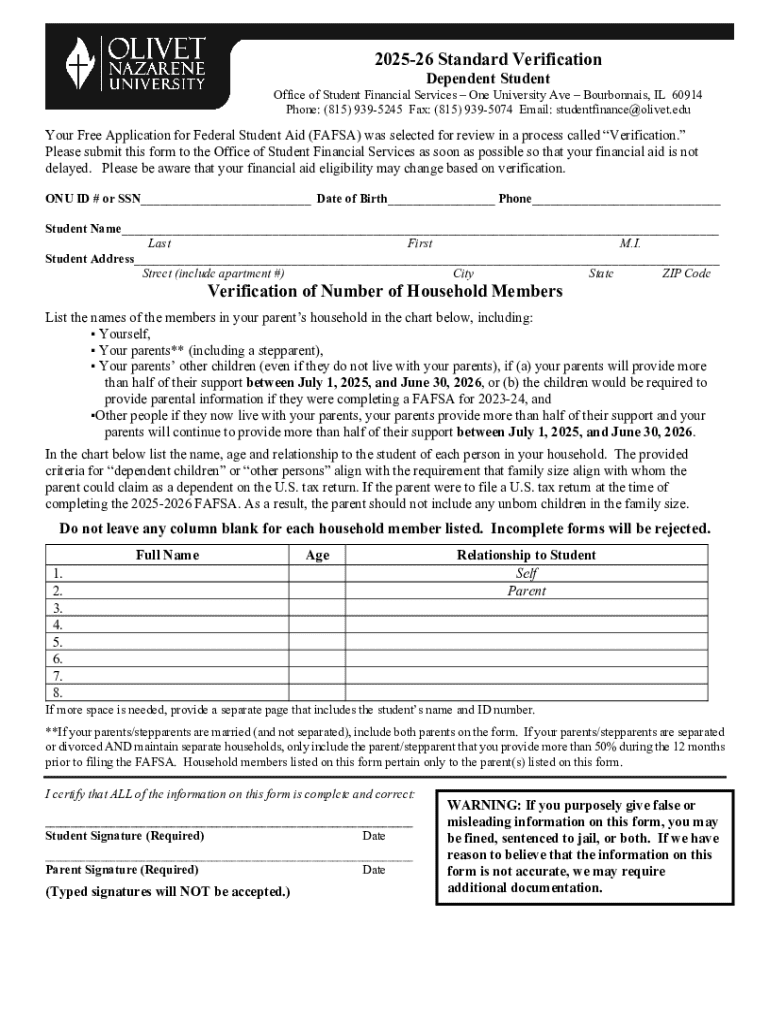

Key components of the form

The 2025-26 Standard Verification Dependent Form consists of several essential sections, each requiring specific information. Understanding these components is crucial for successfully completing the form and avoiding delays in processing.

Providing accurate and complete information in each of these sections is crucial as it ultimately influences the financial aid award amount the student may receive. Failure to do so could raise flags and result in additional verification steps.

Acceptable documentation for verification

When completing the 2025-26 Standard Verification Dependent Form, students are required to submit various documents verifying their financial information. The type of documentation needed will correspond with the information reported on the form.

As students prepare to submit these documents, they should be aware of how these submissions can be facilitated. Utilizing platforms like pdfFiller allows for easy electronic submission, ensuring that all documents are effectively uploaded, signed, and submitted without hassle. All relevant documents must bear proper signatures and attestations where required.

Common verification issues and solutions

The verification process, while straightforward, can present several common challenges that students may encounter along the way. Understanding potential pitfalls is key to navigating the verification successfully.

For students facing such issues, the best course of action is to contact their school's financial aid office. They can provide guidance on how to correct errors and where to submit additional documentation. Staying proactive and responsive is key to resolving any verification complications.

Understanding special cases in verification

Certain scenarios may complicate the verification process, requiring students to take specific actions or provide additional documentation. This often happens in unique situations, such as when a student is confined or incarcerated or when dependency overrides are needed.

Navigating these complex cases may require additional support. Leaning on trusted advisors, financial aid officers, or legal counsel can provide clarity and direction amid a complicated verification process.

Updating your information

Occasionally, students may find it necessary to make updates to their 2025-26 Standard Verification Dependent Form after submission. Changes in income, family structure, or employment status can occur after filing.

Timely updates play a critical role in the recalculation of financial aid awards. Students must remain vigilant and proactive, ensuring that they communicate changes promptly to the financial aid office.

Consequences of failing to submit required documentation

Not submitting the necessary verification documents can lead to severe penalties. The most immediate consequence is a potential delay or suspension of financial aid, which can hinder a student’s ability to continue funding their education.

Remaining organized and aware of deadlines for submission is essential to prevent setbacks that could affect academic progress.

Timeline for verification completion

The verification process can vary significantly in length, depending on several factors. Understanding this timeline is crucial for students who need to plan ahead for their academic and financial needs.

Being aware of these nuances can help students minimize delays. Maintaining open communication with financial aid advisors can also provide valuable insight into current processing times.

Tools and resources for successful completion

Utilizing tools like pdfFiller increases efficiency in completing the 2025-26 Standard Verification Dependent Form. With features designed for seamless document handling, students can edit, eSign, and collaborate on forms easily.

For those looking for additional assistance, links to helpful tutorials or video guides on using pdfFiller effectively can provide a great advantage in mastering the 2025-26 Standard Verification Dependent Form completion.

Frequently asked questions (FAQs)

Many students have common concerns as they embark on the verification process. Understanding these frequently asked questions can help ease apprehension and clarify the path forward.

Answering these inquiries can help alleviate stress during the verification process, creating a smoother experience.

Final tips for completing the 2025-26 standard verification dependent form

A successful verification experience requires attention to detail and proactive engagement. Best practices begin with double-checking your entries before submission. Careful verification of figures, names, and dates helps prevent errors that could lead to delays.

Ultimately, leveraging platforms like pdfFiller can streamline this process, allowing for a smooth and efficient verification journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025-26 standard verification dependent for eSignature?

Can I create an electronic signature for the 2025-26 standard verification dependent in Chrome?

Can I edit 2025-26 standard verification dependent on an Android device?

What is 26 standard verification dependent?

Who is required to file 26 standard verification dependent?

How to fill out 26 standard verification dependent?

What is the purpose of 26 standard verification dependent?

What information must be reported on 26 standard verification dependent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.