Get the free Mortgage Foreclosure Mediation Referral Order

Get, Create, Make and Sign mortgage foreclosure mediation referral

Editing mortgage foreclosure mediation referral online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage foreclosure mediation referral

How to fill out mortgage foreclosure mediation referral

Who needs mortgage foreclosure mediation referral?

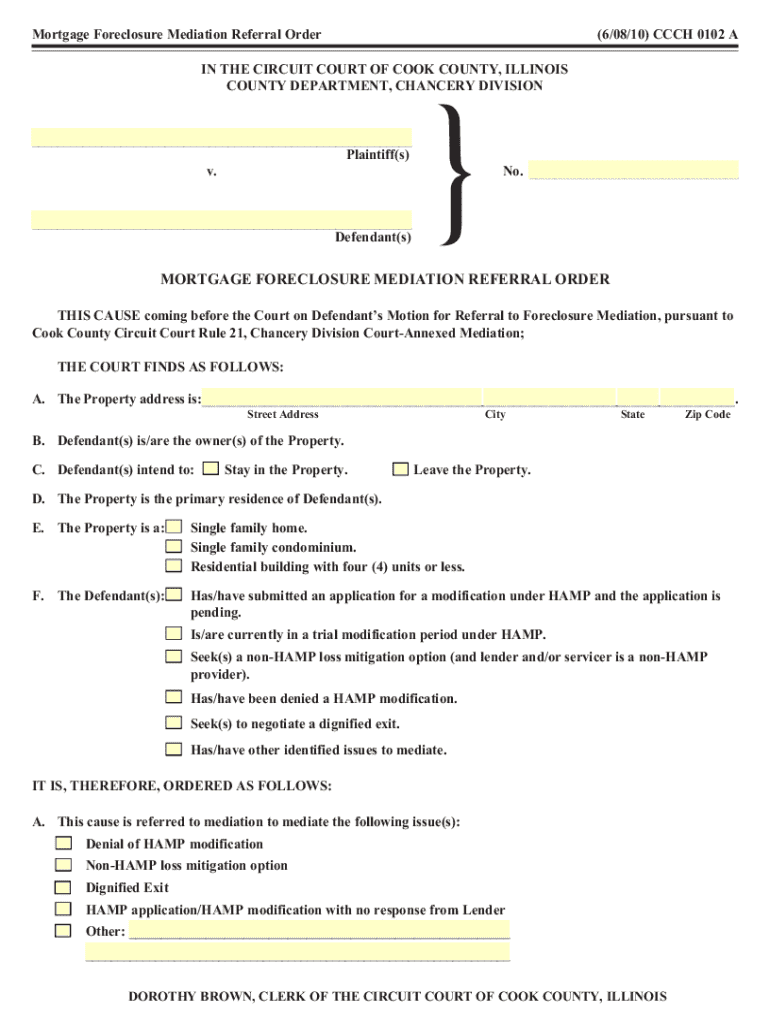

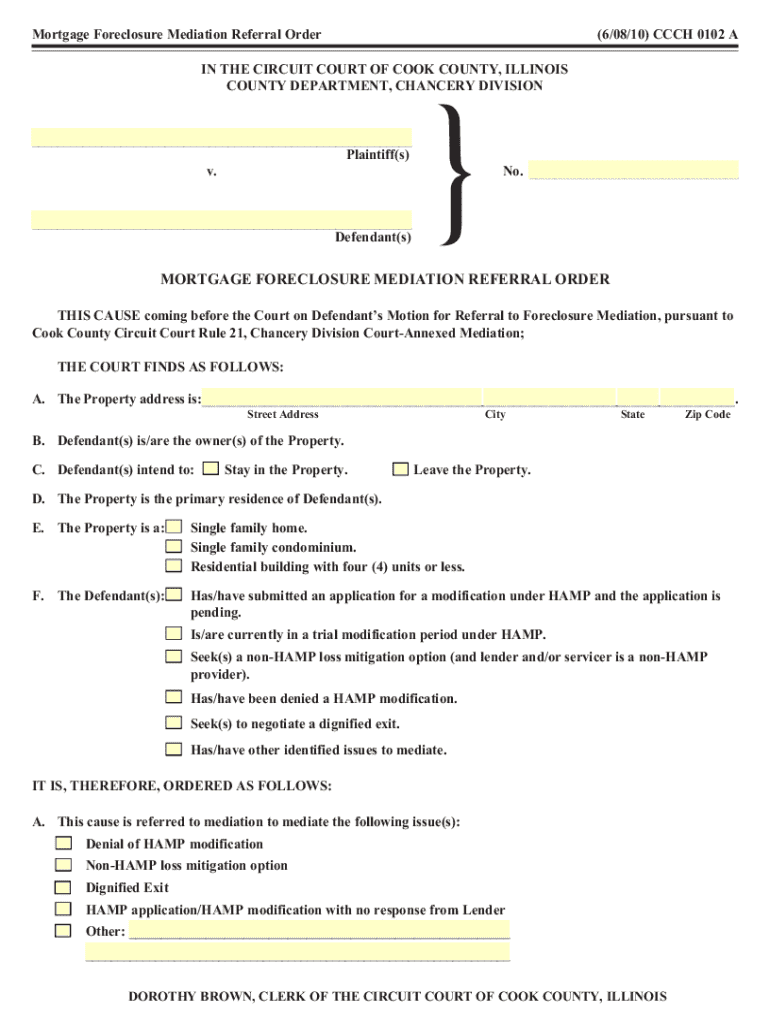

Understanding the Mortgage Foreclosure Mediation Referral Form: A Comprehensive Guide

Understanding mortgage foreclosure mediation

Mortgage foreclosure mediation is a structured alternative dispute resolution process designed to help homeowners facing foreclosure and their lenders to reach a mutually acceptable solution. Mediation typically involves a trained third-party mediator who facilitates discussions between the parties, aiming for a settlement that can often prevent foreclosure and allow the homeowner to retain their property.

The primary purpose of mediation is to create an informal environment where both sides can explore their options with the aid of the mediator. Homeowners benefit significantly from mediation as it offers them a chance to negotiate more favorable loan terms or payment plans, which might not be available in a traditional foreclosure process.

Overview of the mortgage foreclosure mediation referral form

The mortgage foreclosure mediation referral form is a critical document that initiates the mediation process. It provides the necessary information about the homeowner, their mortgage situation, and the specific issues that need to be addressed during mediation. This form ensures that all relevant details are documented, facilitating a focused discussion during the mediation sessions.

Completing the mortgage foreclosure mediation referral form is essential for homeowners needing to access mediation services. By accurately filling out this form, homeowners can effectively communicate their financial situation and any unique circumstances that might require special consideration.

Eligibility for using the mortgage foreclosure mediation referral form

To qualify for the mortgage foreclosure mediation process, homeowners must meet certain qualifications. Primarily, the home must be the homeowner's primary residence. This ensures that the mediation focuses on individuals who genuinely need assistance in retaining their houses during financial hardships.

In addition to primary residency, homeowners should demonstrate financial hardship criteria, which may include significant loss of income, medical expenses, or other unforeseen circumstances affecting their ability to pay the mortgage.

Lender participation is equally important in mediation. Lenders are required to engage in the process and should comply with established protocols to facilitate open communication during mediation. They also have specific responsibilities that obligate them to consider reasonable solutions put forward by the homeowner.

Step-by-step guide to completing the form

Filling out the mortgage foreclosure mediation referral form can seem daunting, but breaking it down into manageable steps simplifies the process. The first step is gathering necessary information, such as personal details of the homeowner, mortgage account specifics, and financial information.

Once you have all the necessary information, proceed to fill out the form. Each section requires specific details that are vital for the mediation process. Begin with personal information, including the full name, address, and contact details of the homeowner. Next, provide mortgage details, such as the account number, balance, and status. Subsequently, disclose your financial situation, including income and expenses, and finally specify your mediation requests.

Common pitfalls to avoid when completing the form include providing inaccurate information or overlooking sections. Ensure that all details are current and correct to prevent delays in the mediation process.

Editing and signing the mortgage foreclosure mediation referral form

Utilizing integrated editing tools, such as those offered by pdfFiller, simplifies the completion and signing of the mortgage foreclosure mediation referral form. With pdfFiller's editing tools, users can make simple annotations, format text, and adjust the layout as needed to ensure clarity and professionalism in their submission.

Once the form is complete, electronic signing (eSigning) becomes a straightforward next step. By using pdfFiller's eSignature features, homeowners can sign the document securely without the need for physical printing and mailing. The platform often offers secure signature verification processes ensuring the authenticity of signatures and integrity of the document.

Submitting the referral form for mediation

After completing the mortgage foreclosure mediation referral form, knowing where to submit is vital. Submissions can typically be made to mediation program offices located in your area. Some regions also allow online submission options for added convenience, catering to today’s technology-driven environment.

Being aware of important submission deadlines is crucial to ensure timely access to mediation. Always check the specific timelines provided by your local mediation program to avoid missing out on mediation opportunities. Strategies for timely submission may include setting reminders and ensuring all required documents accompany the referral form.

What to expect after submitting the form

After submitting the mortgage foreclosure mediation referral form, homeowners should anticipate a structured timeline for the mediation process. In most cases, the initial contact with a mediator occurs shortly after submission. This step is pivotal, as it lays the groundwork for scheduling mediation sessions and establishing communication lines.

Preparing for the mediation session involves organizing relevant documentation that supports your case. Bring financial statements, correspondence with your lender, and any other pertinent records. Preparation ensures that you can present your situation effectively, fostering a productive mediation environment.

Frequently asked questions (FAQ)

Common concerns about the mediation process often revolve around the effectiveness and potential costs involved. A prevalent question is, 'What if the mediation doesn't work?' While mediation aims to reach an agreement, there is no guarantee. However, it often provides homeowners and lenders an opportunity to explore creative solutions outside the traditional foreclosure route.

Another frequent inquiry deals with potential costs. Many local mediation programs are designed to be cost-effective, although it's crucial to check for any associated fees. Clarity on these costs can help homeowners budget and prepare adequately.

Leveraging pdfFiller for document management

Using pdfFiller for completing the mortgage foreclosure mediation referral form offers numerous advantages. One significant benefit is the ability to access documents from any location, enabling flexibility and efficiency. This access to cloud-based document management is particularly useful for individuals managing their paperwork while juggling various responsibilities.

Collaboration features empower teams by allowing multiple users to work on the document simultaneously, enhancing productivity. Furthermore, pdfFiller provides additional tools like document storage and version tracking, allowing users to manage their documents seamlessly throughout their mediation journey.

Final tips for a successful mediation experience

Effective communication stands out as a crucial element throughout the mediation process. Keeping an open line with your mediator and lender can foster a more accommodating environment where all parties feel heard. This communication contributes significantly to fostering understanding, which is foundational for reaching agreements.

Seeking legal advice when necessary is also advised. A knowledgeable attorney can guide individual circumstances and help protect the homeowner's rights. Coaching from a legal professional can be a game-changer in navigating complex negotiations.

Staying informed about your rights and options throughout the process equips homeowners with the knowledge needed to make empowered decisions. Being proactive and aware allows homeowners to navigate the intricacies of mortgage foreclosure mediation better.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mortgage foreclosure mediation referral directly from Gmail?

How can I modify mortgage foreclosure mediation referral without leaving Google Drive?

How do I complete mortgage foreclosure mediation referral on an iOS device?

What is mortgage foreclosure mediation referral?

Who is required to file mortgage foreclosure mediation referral?

How to fill out mortgage foreclosure mediation referral?

What is the purpose of mortgage foreclosure mediation referral?

What information must be reported on mortgage foreclosure mediation referral?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.