Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

Editing crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

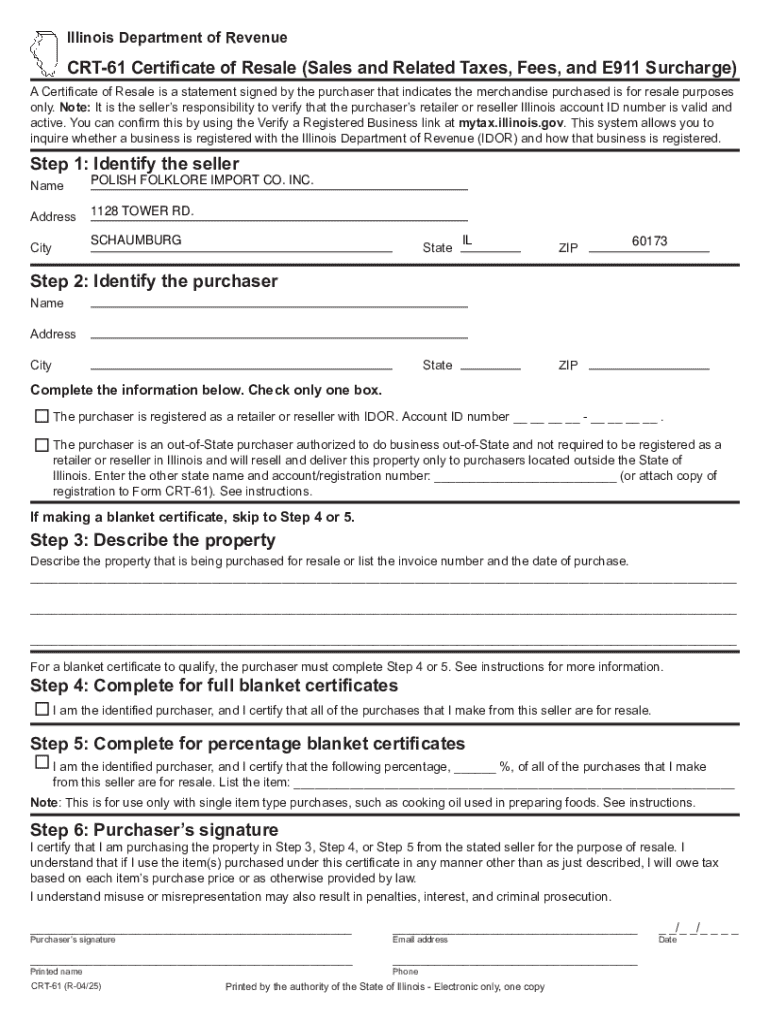

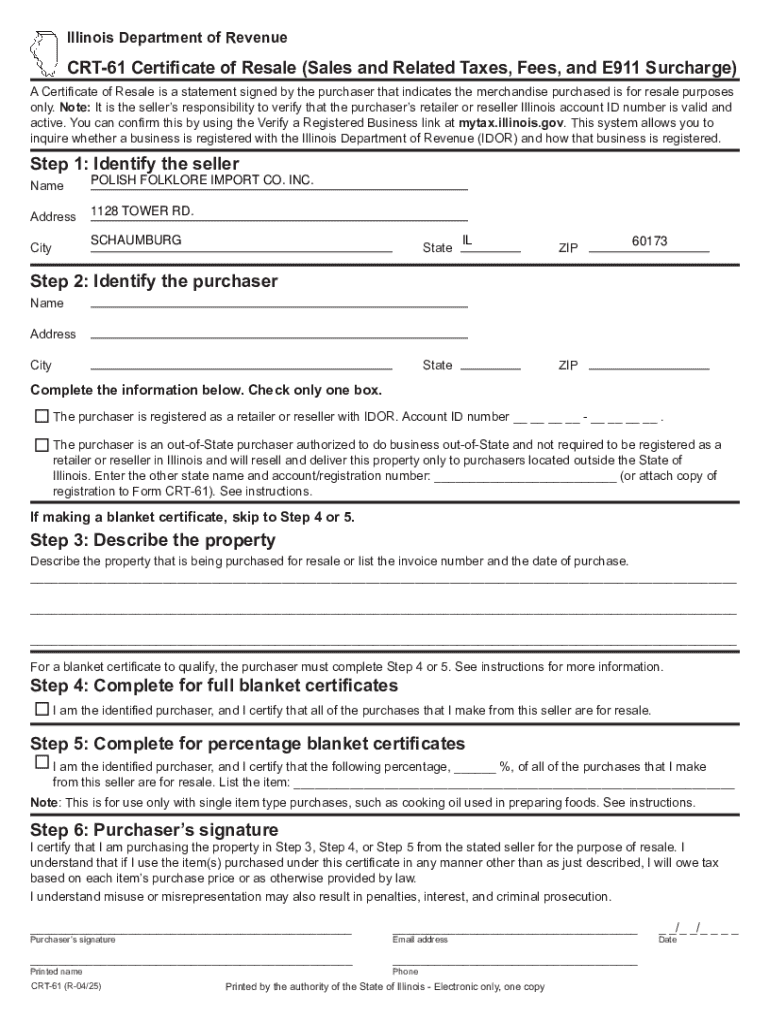

CRT-61 Certificate of Resale Form: A Comprehensive Guide

Understanding the CRT-61 Certificate of Resale Form

The CRT-61 Certificate of Resale Form is a crucial document for businesses involved in the sale of goods. This form allows a buyer to purchase items without paying sales tax, as they intend to resell those items rather than use them for personal consumption. The certificate essentially shifts the tax responsibility from the buyer to the end consumer. Importantly, the CRT-61 ensures that legitimate resale transactions are tax-exempt, thus enabling cash flow efficiency and compliance with state tax regulations.

The purpose of the CRT-61 is multifaceted; it provides proof for both buyers and sellers about the nature of the transaction, establishing that the buyer is indeed purchasing items for resale. This helps prevent tax evasion while facilitating smoother business operations. In many states, the absence of a valid CRT-61 during such transactions could lead to tax obligations for sellers and potential penalties for non-compliance.

Who needs a CRT-61 Certificate of Resale Form?

A variety of businesses and individuals benefit from utilizing the CRT-61 certificate of resale form. Retailers, wholesalers, and distributors typically require this form to legally purchase goods without incurring sales tax. Additionally, manufacturers who buy raw materials with the sole purpose of producing items for resale need this certificate to maintain compliance with tax laws.

Common scenarios for the CRT-61’s use can be found in industries such as apparel, electronics, and construction materials. For example, a clothing retailer purchasing large inventories from wholesalers would need a CRT-61 to avoid unnecessary tax burdens, thus ensuring they can pass on competitive pricing to consumers. Understanding who requires this form can significantly benefit businesses aiming to streamline their purchasing processes.

Key features of the CRT-61 Certificate of Resale Form

The CRT-61 form contains essential elements that ensure all parties in a transaction are adequately informed and compliant with tax regulations. At its core, the CRT-61 typically includes details such as the seller’s and buyer’s names, addresses, and sales tax ID numbers. It may also require a description of the type of property, goods, or services being purchased tax-exempt.

Furthermore, it is critical to distinguish the CRT-61 certificate from sales tax permits. A sales tax permit is an authorization issued by the state to collect sales tax. In contrast, the CRT-61 is specifically a declaration of intent to resell. Businesses must understand these distinctions to navigate compliance effectively and prevent any potential legal issues relating to tax responsibilities.

Obtaining the CRT-61 Certificate of Resale Form

Acquiring the CRT-61 Certificate of Resale Form can be straightforward if you follow the necessary steps. Typically, businesses seeking to obtain this form should visit their state’s Department of Revenue website, where they can download the form or request a physical copy. In some cases, specific platforms like pdfFiller offer templates that can simplify this process.

Before filling out the form, ensure you have the required documentation at hand. This includes business ownership proof and, if applicable, resale licenses or tax ID numbers. Once the documentation is complete, you can fill out the CRT-61 efficiently, which sets the stage for correct usage in transactions. Properly acquiring this form ensures businesses stay compliant with state tax regulations.

Filling out the CRT-61 Certificate of Resale Form

Filling out the CRT-61 Certificate of Resale Form requires attention to detail. Each section is designed to capture specific information necessary for tax compliance. Start by entering the buyer's information, including the name and address. Next, accurately detail the seller's information along with their tax ID number. It’s vital to describe the property or products being purchased as this validates the transaction.

A common mistake involves leaving out critical details or incorrectly filling out sections, which can render the form void. Therefore, double-check the entries and ensure all required fields are complete. Utilizing digital tools like pdfFiller can help here, as they often prompt users about missing information and allow for easy corrections before submission.

Using the CRT-61 Certificate of Resale Form effectively

When utilizing the CRT-61 in transactions, it’s important to establish when and how this form should be presented. Typically, buyers provide the CRT-61 certificate to sellers at the time of purchase, ensuring that the transaction is recorded without the addition of sales tax. Sellers, in turn, are responsible for keeping the form on file as proof that tax was not collected due to resale intentions.

Maintaining accurate information on the CRT-61 is key to compliance. Should any changes occur regarding the business or ownership, it’s advisable to update the form promptly to avoid audits or discrepancies. Being diligent in managing this certificate allows both parties to ensure that they are compliant with tax obligations, safeguarding against potential financial penalties.

Accepting a CRT-61 Certificate of Resale Form

Sellers must be knowledgeable about accepting CRT-61 certificates to protect themselves against inadvertent tax liabilities. Accepting a CRT-61 means having confidence in its legitimacy; sellers should verify the buyer’s tax identification and evaluate the form for completeness before consenting to a tax-exempt sale. Furthermore, maintaining a record of all received CRT-61 forms enables sellers to demonstrate compliance should they undergo any audits.

The legal implications of accepting a CRT-61 certificate are significant. Should a seller accept an invalid form, they could become liable for uncollected sales tax. Therefore, establishing a clear process for evaluating CRT-61 forms, including maintaining thorough documentation, is critical for businesses aiming to mitigate risks associated with resale transactions.

Managing your CRT-61 Certificate of Resale Form

Effective management of CRT-61 Certificates of Resale involves organized storage as well as compliance with renewal regulations. Whether physically storing the forms or using digital solutions like pdfFiller, maintaining a thorough filing system is crucial. Digital storage options often allow for easier retrieval, sharing, and security, ensuring businesses have quick access to documents when needed.

When it comes to updating or renewing CRT-61 forms, regular reviews of business details are necessary. If there are any changes in business structure or ownership, it’s imperative to fill out a new form. Setting reminders for renewals can also help businesses stay ahead of compliance requirements and retain their status as legitimate resellers.

Important considerations

To avoid audits and compliance issues, businesses must be diligent in understanding their obligations related to the CRT-61 Certificate of Resale Form. One critical aspect is keeping track of the expiration dates and renewal conditions for the forms. Not only is it important to maintain accurate and updated records, but businesses must also recognize that failing to request valid CRT-61 forms from buyers could lead to unintentional tax liabilities.

Utilizing assistance can additionally fortify compliance efforts. Resources such as state government websites provide a wealth of information on tax regulations, and platforms like pdfFiller offer user-friendly tools that help users navigate document management seamlessly, enhancing overall compliance with state requirements.

Interactive tools for better management

In the age of digital documentation, using tools like pdfFiller allows users to fill out and sign the CRT-61 Certificate of Resale Form easily. pdfFiller’s platform enables businesses to interactively edit the form, ensuring that every bit of information is accurate and submitted in compliance with local laws. The features simplify form completion, provide templates, and enhance overall document management efficiency.

Furthermore, collaboration features within pdfFiller allow teams to work together on completing and managing the CRT-61, making it easier to handle multiple forms across various transactions. Shared access enables real-time edits, tracking document versions, and even automated reminders for renewals, thus improving team productivity while ensuring compliance.

Conclusion

Mastering the CRT-61 Certificate of Resale Form is paramount for businesses aiming to operate smoothly while abiding by tax laws. Its importance goes beyond mere compliance; when used effectively, it can enhance cash flow and simplify operations. Businesses that leverage tools like pdfFiller not only streamline their document management, but also ensure accurate, cloud-based solutions make their processes far more efficient. Maintaining a reliable system around the CRT-61 certificate will ultimately contribute to a business's success in the competitive market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit crt-61 certificate of resale in Chrome?

How can I fill out crt-61 certificate of resale on an iOS device?

Can I edit crt-61 certificate of resale on an Android device?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.