Get the free Covered California for Small Business Employee Application

Get, Create, Make and Sign covered california for small

How to edit covered california for small online

Uncompromising security for your PDF editing and eSignature needs

How to fill out covered california for small

How to fill out covered california for small

Who needs covered california for small?

Covered California for Small Businesses: A Comprehensive Guide

Understanding Covered California for Small Businesses

Covered California is the state's health insurance marketplace, designed to provide accessible health coverage options for individuals, families, and small businesses. Its primary purpose is to facilitate affordable healthcare enrollment, ensuring that all Californians can obtain necessary medical services without financial strain. Covered California for small businesses specifically focuses on providing a streamlined approach for employers to offer health insurance to their employees, making it easier for small enterprises to comply with health coverage mandates while promoting employee wellbeing.

Having health coverage is vital for small businesses, as it helps attract and retain top talent, fosters a healthier workforce, and can reduce absenteeism. Access to health insurance not only boosts employee morale but also contributes to increased productivity. Through Covered California, employers can access various plans that suit their budget and workforce needs, enhancing their organizational attractiveness in a competitive market.

Coverage options available

Covered California offers multiple coverage levels—Bronze, Silver, Gold, and Platinum—allowing small business owners to select plans that align with their financial resources and employee requirements. Understanding each tier's features can assist employers in making informed decisions about health coverage.

Eligibility requirements

To enroll in Covered California for Small Business, certain eligibility criteria must be met. Generally, small businesses with 1 to 100 employees can apply. This program is aimed at companies that wish to offer health insurance to their employees, thereby supporting both employee health and the sustainability of the business.

Employers need to have a minimum of one employee working at least 20 hours per week, which can be a combination of full-time and part-time employees. It’s important to note that businesses must maintain at least 50% of their workforce to be eligible for tax credits, thus making it essential to understand employment categorization for eligibility purposes.

Cost considerations

Understanding the costs associated with health insurance is crucial for small businesses. The premium amounts depend on various factors, including the number of employees, the demographics of the employee base, and the selected coverage level. By carefully evaluating these factors, small business owners can estimate their overall health insurance costs.

Cost-sharing reductions are also essential to examine, as they significantly affect out-of-pocket expenses. Depending on the chosen plan, employees may face different deductibles, copays, and out-of-pocket limits, which can vary widely between Bronze and Platinum plans. Evaluating total costs across coverage levels allows businesses to manage their budgets effectively.

Essential health benefits

Covered California mandates a set of essential health benefits that every plan must provide, creating a foundation of necessary services for all enrollees. Understanding these benefits is crucial for both employers and employees, as it ensures that they receive adequate coverage tailored to their healthcare needs.

Among the essential benefits included are preventive services, emergency services, hospitalization, maternity and newborn care, and mental health services. Additionally, dental and vision coverage can also be significant for small business employees, enhancing their overall health benefit package.

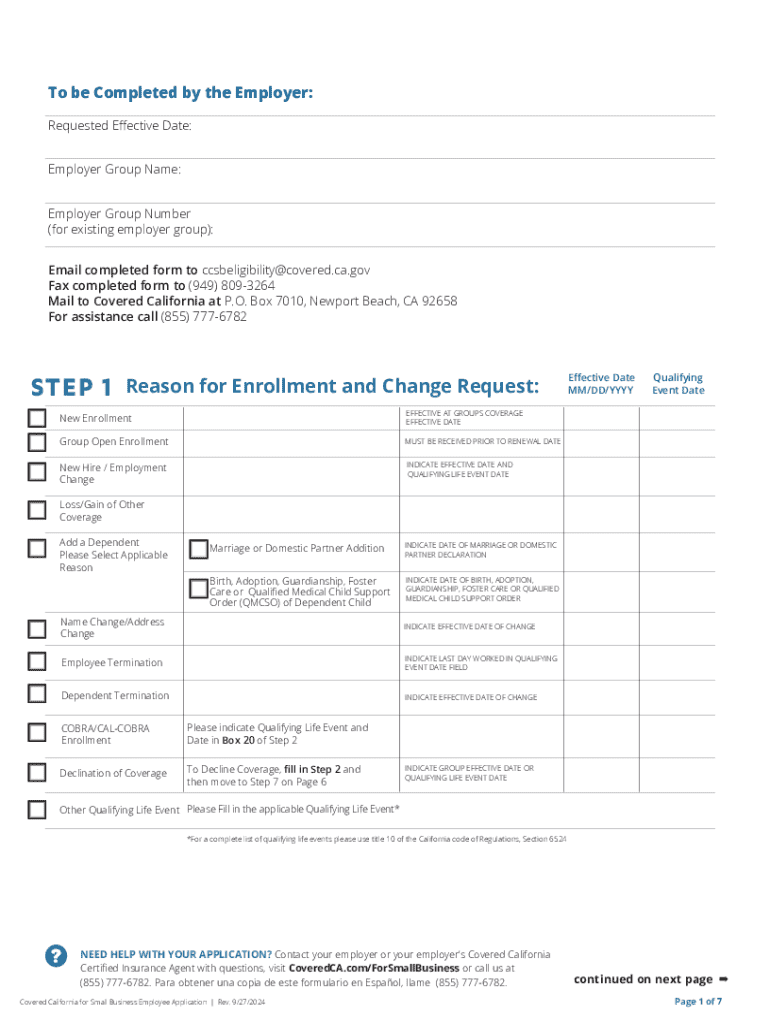

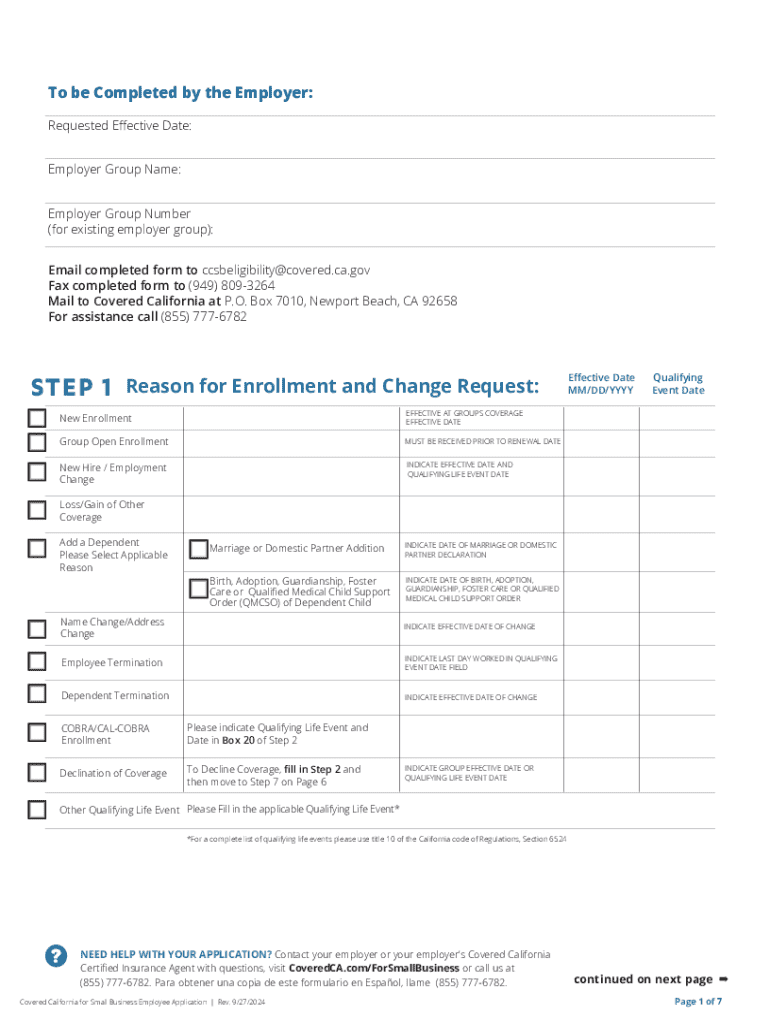

Enrollment process for Covered California

The enrollment process for Covered California for small businesses is straightforward. Preparation is key. Employers should gather relevant documentation and employee information in advance to streamline the application process. Having a clear plan regarding which coverage options to explore helps to expedite the decision-making.

The enrollment steps include visiting the Covered California website, completing the online application form, and submitting necessary documentation, such as employee details and payroll information. After submission, employers will be able to review available plans and select the most suitable coverage.

Managing your Covered California plan

Post-enrollment, managing your Covered California plan effectively is vital for optimizing your health coverage. Employers need to understand how to view and edit their plans, enabling them to adjust coverage as their business needs change. Keeping abreast of covered services and making necessary adjustments will enhance the employee experience.

Utilizing tools such as pdfFiller can significantly streamline document management tasks, allowing businesses to efficiently edit, fill out, eSign, and manage all relevant forms in a cloud-based solution. Establishing effective communication with the insurance provider is also essential for ensuring that any updates or queries are addressed promptly.

Resources for small businesses

Navigating the Covered California landscape can be complex for small businesses, but a variety of resources are available to assist. Employers should familiarize themselves with healthcare resources specific to their region to explore healthcare options effectively. This includes understanding local insurance brokers, healthcare providers, and community organizations that can provide support.

An organized approach to managing forms and documents is also crucial. Having a checklist of all required forms for enrollment and ongoing management can save considerable time and effort. Lastly, knowing where to find assistance can be a game-changer during the application process.

The advantages of using pdfFiller for Covered California forms

pdfFiller stands as an essential tool for managing Covered California forms, enhancing the experience of document management through innovative features. One key advantage is its comprehensive document creation and management capabilities. With pdfFiller, small business owners can easily fill out, edit, and eSign forms directly from their web browser, substantially reducing the hassle often associated with dealing with paperwork.

Additionally, collaboration tools within pdfFiller allow team members to work together seamlessly on document preparation, ensuring that all necessary information is captured efficiently. This cloud-based platform means that users can access their documents from anywhere, allowing greater flexibility and convenience in managing essential health coverage documentation.

The future of health coverage for small businesses

Health coverage for small businesses is evolving, with trends indicating a more significant focus on flexible and comprehensive options. The landscape is continually changing as new legislation emerges and policies are refined to enhance coverage transparency and quality. Covered California is at the forefront of these advancements, reflecting partnerships with local healthcare providers to ensure that small businesses receive effective health solutions.

By keeping informed on trends and changes, small businesses can better navigate future challenges and opportunities within the healthcare landscape. Understanding how upcoming healthcare legislation impacts employer obligations ensures businesses remain compliant while offering their employees valuable health benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete covered california for small online?

How do I make edits in covered california for small without leaving Chrome?

How do I edit covered california for small straight from my smartphone?

What is covered california for small?

Who is required to file covered california for small?

How to fill out covered california for small?

What is the purpose of covered california for small?

What information must be reported on covered california for small?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.