Get the free Credit Card Authority Form

Get, Create, Make and Sign credit card authority form

Editing credit card authority form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authority form

How to fill out credit card authority form

Who needs credit card authority form?

Comprehensive Guide to Credit Card Authority Form

Understanding the credit card authority form

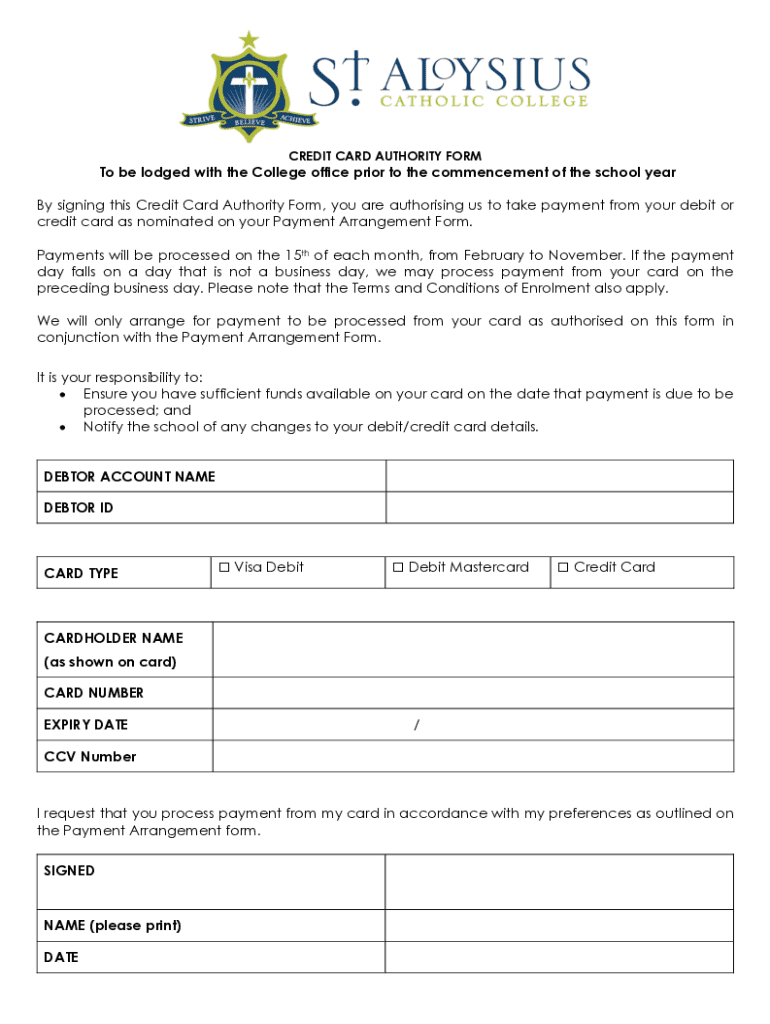

A credit card authority form, also known as a credit card authorization form, is a crucial document used primarily to authorize transactions made on a customer's credit card. Its primary purpose is to obtain the cardholder's permission, allowing businesses to charge an agreed amount to their account. This form serves as a protective measure for both merchants and consumers, ensuring that payments can be processed smoothly and securely.

Common use cases include subscription services, where companies charge recurring fees, and large transactions, where the risk of chargebacks might be more pronounced. By having customers fill out this form, businesses can minimize risks associated with fraud and payment disputes.

Importance of using a credit card authority form

Using a credit card authority form is vital for preventing chargeback abuse, a common issue that can arise when customers dispute transactions. A chargeback occurs when a consumer contacts their bank to reverse a charge, which not only affects the merchant's revenue but can also pose legal ramifications. With a signed authorization form in hand, businesses can protect themselves, upholding their right to the payment while deterring fraudulent claims.

Moreover, implementing a credit card authority form enhances transaction security. This form has built-in fraud protection measures, ensuring that businesses can accurately verify cardholder identity through signature authenticity. This not only provides a legal advantage by affirming the agreement between the merchant and the customer but also fosters trust, as consumers are reassured of the legitimacy and security of their transactions.

When to use a credit card authority form

There are specific situations where a credit card authority form is particularly beneficial for sellers. Subscription services often require ongoing transactions, making it essential to have documented consent for monthly or yearly charges. Similarly, for one-time purchases that exceed a certain amount, it's prudent to collect authorization to safeguard against potential disputes.

Remote transactions, such as those conducted online or over the phone, also necessitate the use of this form due to the lack of in-person verification. Various industries, including e-commerce and services like real estate, benefit significantly from implementing a credit card authority form, ensuring that they can capture necessary authorization while minimizing risk.

Creating and filling out your credit card authority form

Creating a credit card authority form involves several key steps. First, gather all necessary information, including the client's contact details, billing information, and specific transaction details such as amounts and dates. Ensuring you have the right documentation collected beforehand will streamline the process and ensure accuracy.

Choosing the right form template is another vital step. Opt for templates that are clear, accessible, and customizable to fit your business's needs. When filling out the form, ensure that all information is accurately entered to avoid any potential disputes. After completing the form, a thorough review is crucial. Double-check names, card numbers, and transaction amounts, and ensure that all parties involved provide their consent by signing.

Best practices for managing credit card authority forms

Once you have created and filled out a credit card authority form, the next step is to ensure that it is stored securely. Utilizing digital storage solutions can streamline record-keeping and access. Many businesses prefer to store these documents electronically, but physical copies must be kept in a safe and secure place, given their sensitive nature. It is advisable to keep records for a reasonable time, typically around five years, in compliance with local laws and regulations.

Moreover, maintaining compliance with regulations, such as PCI Compliance, is paramount. This sets the standard for secure handling of cardholder data, protecting both customers and businesses from potential breaches. Additionally, being aware of legal requirements for data privacy helps businesses navigate the complexities of consumer protection, ultimately benefiting customer trust and business credibility.

Frequently asked questions (FAQ)

It’s common for individuals to have questions regarding the credit card authority form. One frequently asked question is whether there's a legal obligation to use one. While not legally mandated, using the form is highly recommended for safeguarding against chargebacks and fraud.

Another common query is what happens if the form is not utilized. Without it, businesses may face increased risks; not having documented consent can make it harder to resolve disputes about unauthorized charges. Some individuals wonder why the credit card authority form might not always include a space for the CVV code. This omission often reduces the complexity of the form; however, it’s important for businesses to ensure they have sufficient cardholder verification through other means. Lastly, businesses should be prepared to handle disputes by following proper protocol and retaining documentation that supports their case.

Downloadable resources

If you're looking to get started with a credit card authority form, downloadable templates can be a great resource. Many platforms, including pdfFiller, offer free templates that you can customize to fit your specific needs. Using tools like pdfFiller can facilitate a more streamlined process, allowing you to edit, eSign, and collaborate on these forms effortlessly. With these templates, you can ensure compliance with industry standards and improve the quality of customer service.

Conclusion and next steps

Maximizing the use of pdfFiller for document management can significantly enhance your organization’s ability to handle credit card authority forms efficiently. Its seamless integration with other platforms helps streamline workflows, while facilitating remote collaborations among teams. By leveraging these capabilities, you can ensure that your payment processes are secure and compliant.

Feedback from users is invaluable for continuous improvement. Encourage team members and customers to share their experiences, allowing the optimization of form templates to ensure they meet user needs effectively. Collecting insights can lead to better design and functionality, ultimately benefiting everyone involved.

Related topics for further exploration

Exploring related topics can provide deeper insights into best practices surrounding financial transactions and customer data protection. Understanding the importance of customer data protection is crucial in today's digital landscape. Additionally, learning how to conduct safe online transactions plays a pivotal role in building consumer trust. Other related topics may include understanding various payment methods to weigh their pros and cons, and examining the role of digital signatures in modern business transactions. Broadening your knowledge in these areas can significantly enhance your overall strategy in handling credit card authority forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authority form directly from Gmail?

How can I edit credit card authority form on a smartphone?

How do I fill out the credit card authority form form on my smartphone?

What is credit card authority form?

Who is required to file credit card authority form?

How to fill out credit card authority form?

What is the purpose of credit card authority form?

What information must be reported on credit card authority form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.