Get the free Chattel Mortgage

Get, Create, Make and Sign chattel mortgage

Editing chattel mortgage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chattel mortgage

How to fill out chattel mortgage

Who needs chattel mortgage?

Chattel Mortgage Form: Comprehensive How-to Guide

Understanding chattel mortgages

A chattel mortgage is a loan arrangement that uses movable personal property as collateral, enabling borrowers to acquire financing while retaining possession of the asset. This financial instrument contrasts with traditional mortgages, where real estate serves as collateral, limiting access to ownership during the loan term.

In simple terms, a chattel mortgage allows individuals or businesses to purchase vehicles, machinery, or equipment without transferring ownership until the debt is fully paid. Unlike conventional mortgages, borrowers can still use the asset while repaying the loan, making it a practical financing option for many.

Key features and benefits

One of the primary benefits of a chattel mortgage is the distinction between ownership and possession. The lender retains ownership interest through the mortgage, while the borrower maintains possession and use of the asset. This arrangement can be particularly advantageous for businesses needing operational equipment, allowing them to generate revenue before the loan is fully paid off.

Additionally, chattel mortgages often come with lower interest rates compared to unsecured loans, making them a cost-effective financing solution. Borrowers can also benefit from tax deductions, as the interest paid on the mortgage might be tax-deductible, depending on local laws or regulations.

Common uses of chattel mortgages

Chattel mortgages are widely used in various sectors for financing movable assets. Common applications include purchasing vehicles for transportation services, acquiring machinery and equipment for construction industries, or securing office furniture for startups. Businesses that rely on heavy equipment or specific vehicles often consider chattel mortgages as a strategic financing option.

Industries that typically utilize chattel mortgages span agriculture, transportation, and manufacturing. For example, a farmer may use a chattel mortgage to finance new tractors, allowing them to enhance productivity while managing cash flow.

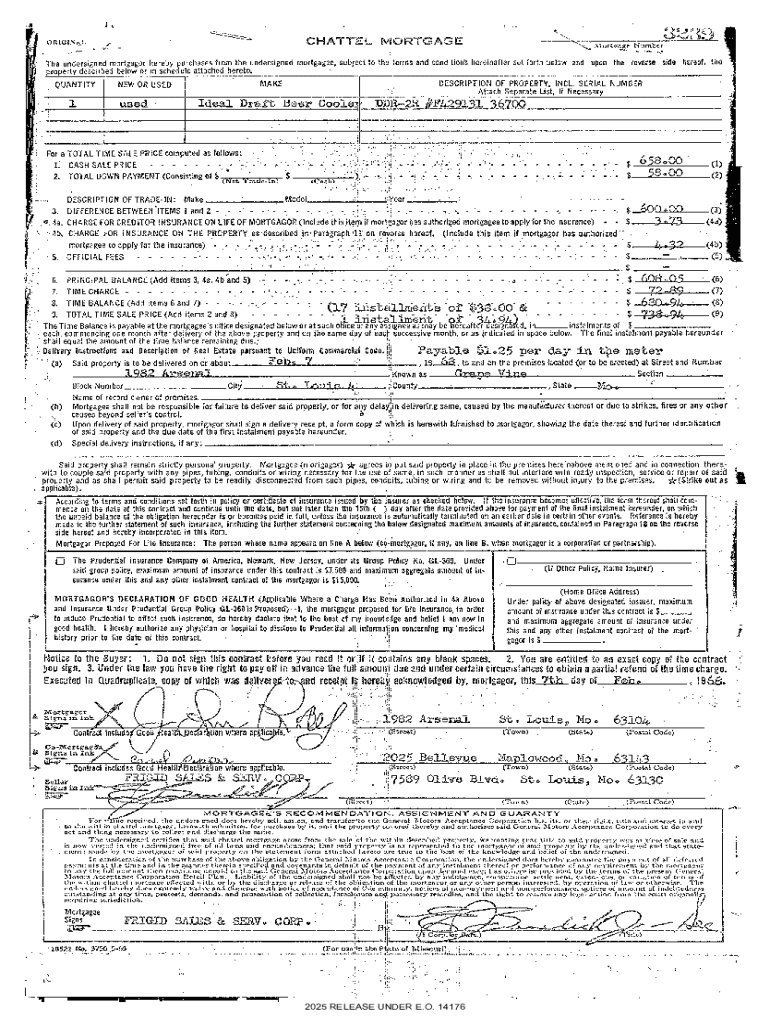

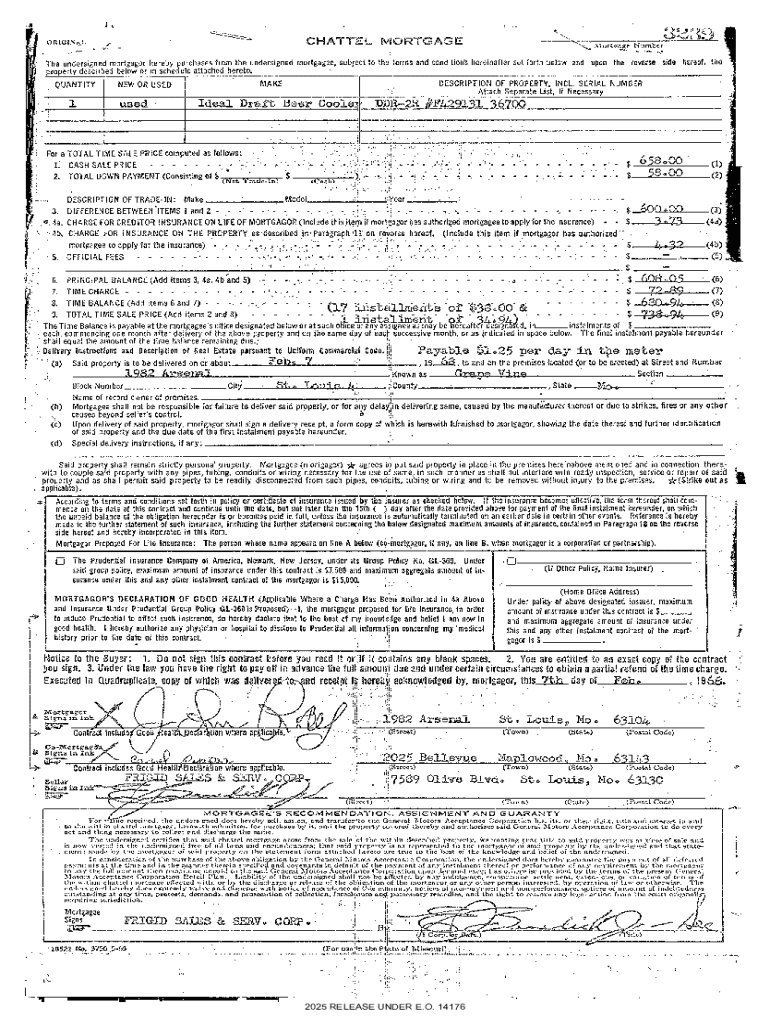

Essential components of a chattel mortgage form

The chattel mortgage form is a crucial document in the mortgage process, serving as a legally binding agreement between lenders and borrowers. It plays an essential role in securing the terms of the loan and formalizing the collateral arrangement. The accuracy of the information provided in this form is paramount, as it affects the validity of the mortgage.

Essential components typically included in a chattel mortgage form start with the details of both parties involved—the borrower and the lender. This section outlines names, addresses, and contact information, ensuring clear identification. Furthermore, the form should contain a detailed description of the chattel property being financed, including specific identifiers such as serial numbers or model descriptions.

Mandatory information required

In addition, optional clauses may be included for enhanced clarity and legal protection. These can address insurance requirements for the chattel property, outlining responsibilities for obtaining coverage. Moreover, any rights and obligations of the parties involved may also be detailed within the form, providing additional insights into the responsibilities each party holds under the mortgage agreement.

Step-by-step guide to filling out a chattel mortgage form

Filling out a chattel mortgage form can be simple if you follow a structured process. First, it's essential to gather necessary documentation. This includes identification documents, proof of ownership or value of the chattel, and any financial statements that might support the loan application.

Once your documentation is in order, you can start completing the form. Accurately fill in borrower and lender information, ensuring that all names and addresses are clear and correct. Next, provide a detailed description of the chattel, specifying all identifiable features and relevant information required to distinguish the asset.

Common errors to avoid

Before finalizing the form, it’s vital to review everything for accuracy. Double-check entries, ensuring that no critical information is omitted. When finished, securely share the completed form with the lender to avoid delays in processing your mortgage application.

Editing and customizing your chattel mortgage form

Once you’ve filled out the chattel mortgage form, editing and customizing the document can help address any last-minute changes or additional clauses you might want to include. Tools like pdfFiller allow users to easily make adjustments to PDF documents without needing technical skills.

Using pdfFiller’s features, you can quickly replace text, adjust formats, and ensure that your document meets all necessary standards. Additionally, incorporating digital signatures within the chattel mortgage form is straightforward, providing a secure method for all involved parties to eSign the agreement while maintaining legal validity.

Incorporating digital signatures

The legal aspects of digital signatures are well-established, making them a dependable choice for signing mortgage agreements, including chattel mortgages. When you use a platform like pdfFiller, integrating eSignatures into your forms helps streamline the process, further simplifying the completion and submission of your chattel mortgage form.

Submitting and managing your chattel mortgage form

After completing and customizing your chattel mortgage form, the next step is submission. You can choose between traditional methods, such as mailing hard copies or submitting in person, or opting for electronic submission methods. Electronic submissions tend to be faster and allow tracking features that traditional methods might lack.

For documents submitted electronically, it’s crucial to ensure that they are stored securely. Utilizing pdfFiller’s capabilities to organize documentation digitally can help you keep all your mortgage application materials in one place, enhancing monitoring and management of your mortgage status.

Keeping track of your form

Collaborating with teams on chattel mortgage forms

If you’re part of a team handling chattel mortgages, leveraging collaboration features can significantly improve workflow efficiency. pdfFiller allows users to share documents seamlessly with team members, enabling everyone involved to have access and review essential documents.

Employing commenting and track changes functionality can enhance communication and ensure that input from various team members is integrated effectively. Establishing clear roles and responsibilities for document editing can streamline the submission process and prevent miscommunication throughout the mortgage process.

Best practices for team collaboration

Frequently asked questions (FAQs) about chattel mortgages

Understanding common misconceptions about chattel mortgages is essential for making informed financial decisions. Many individuals mistakenly believe that chattel mortgages are only available for businesses, but they are also accessible to individuals purchasing movable assets such as cars or boats.

Eligibility criteria can vary, but generally, lenders will assess the borrower’s creditworthiness and ability to repay the loan. For those encountering issues with their chattel mortgage, timely communication with the lender is crucial to explore potential solutions or refinancing options, ensuring that the asset remains secure.

Case studies: Success stories of using chattel mortgages

Real-world examples can shed light on the practical applications and benefits of chattel mortgages. Individual borrowers have successfully financed vehicles for personal use, finding it a flexible means to maintain liquidity while ensuring they have transportation available.

On a larger scale, businesses have utilized chattel mortgages for purchasing high-value machinery crucial for their operations. In one case, a construction company acquired state-of-the-art excavators, doubling its productivity within months. These success stories illustrate how effective chattel mortgages can be in both personal and business finance.

Lessons learned from different situations often highlight the importance of diligent preparation and communication with lenders. Several case studies emphasize the value of having accurate information ready when applying for financing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in chattel mortgage?

How do I edit chattel mortgage on an iOS device?

How do I complete chattel mortgage on an Android device?

What is chattel mortgage?

Who is required to file chattel mortgage?

How to fill out chattel mortgage?

What is the purpose of chattel mortgage?

What information must be reported on chattel mortgage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.