Get the free Credit Card Charge Authorization Form

Get, Create, Make and Sign credit card charge authorization

How to edit credit card charge authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card charge authorization

How to fill out credit card charge authorization

Who needs credit card charge authorization?

Understanding the Credit Card Charge Authorization Form

Understanding the Credit Card Charge Authorization Form

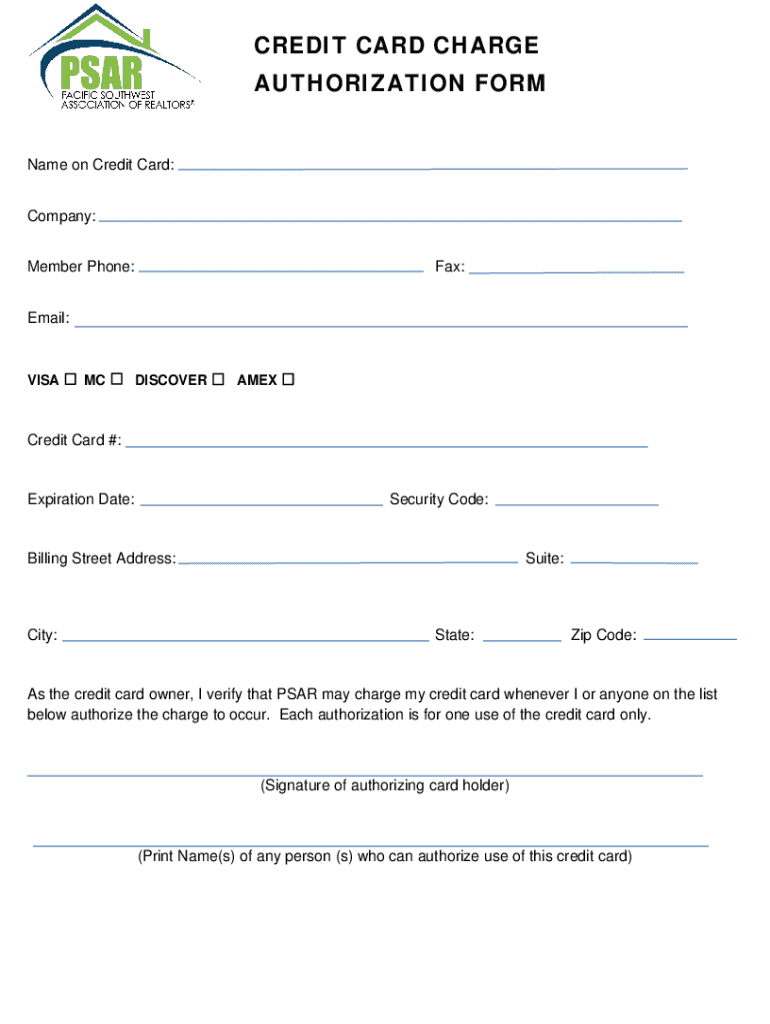

A credit card charge authorization form is a written document that gives merchants permission to charge a specified amount to a customer's credit card. This form serves as a safeguard for both the merchant and the cardholder by documenting their agreement in financial transactions. The form is essential in minimizing the risk of chargebacks, which can cost businesses time and money.

In various industries, from retail to service-based businesses, the credit card charge authorization form plays a pivotal role. It protects against unauthorized transactions and provides a legal framework that reinforces trust between merchants and customers. By understanding this form, businesses can streamline their payment processes and enhance customer satisfaction.

Key components of a credit card charge authorization form

The efficacy and legal standing of a credit card charge authorization form hinge on its complete and accurate components. Here are the essential elements that should be included:

Compliance and legal considerations

Utilizing a credit card charge authorization form is not merely a formality; it comes with significant legal implications. Various regulations govern the use of such forms, particularly concerning consumer rights and data privacy. Adhering to these legal standards is crucial for businesses to avoid liability.

Privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the Payment Card Industry Data Security Standard (PCI DSS), mandate how businesses collect and store sensitive data. Thus, companies must ensure that all captured authorization forms are stored securely, preventing unauthorized access.

Benefits of using a credit card charge authorization form

The benefits of implementing a credit card charge authorization form extend beyond legal protection. Here’s how these forms assist businesses and enhance customer relations:

Common scenarios for utilizing a credit card charge authorization form

There are numerous situations where a credit card charge authorization form is essential. Most notably, these include:

Steps for creating a credit card charge authorization form

Creating an effective credit card charge authorization form involves a straightforward process. Here are the necessary steps for businesses looking to develop their own forms:

Interactive tools for form management

Managing credit card charge authorization forms can be overwhelming, but using tools like pdfFiller simplifies the process immensely. With pdfFiller, users can customize their forms, edit them in real time, and even sign electronically from anywhere.

Features offered by pdfFiller enhance collaboration and efficiency in managing these critical documents. Users can:

Frequently asked questions (FAQ)

Addressing some common concerns regarding credit card charge authorization forms can provide greater clarity on their use:

Best practices for implementing credit card charge authorization forms

Establishing best practices for credit card charge authorization forms can significantly enhance compliance and efficiency. Consider the following strategies:

Conclusion on the importance of credit card charge authorization forms

Understanding the significance of credit card charge authorization forms lays the foundation for secure transactions. These forms not only protect businesses from fraud and chargebacks but also cultivate trust and satisfaction in customer relations. Employing a solution like pdfFiller enhances the creation, management, and security of these critical documents, empowering businesses to focus on their core operations without the headache of transactional disputes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card charge authorization in Gmail?

Can I sign the credit card charge authorization electronically in Chrome?

Can I create an eSignature for the credit card charge authorization in Gmail?

What is credit card charge authorization?

Who is required to file credit card charge authorization?

How to fill out credit card charge authorization?

What is the purpose of credit card charge authorization?

What information must be reported on credit card charge authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.