Get the free Cash Receipt Form

Get, Create, Make and Sign cash receipt form

Editing cash receipt form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash receipt form

How to fill out cash receipt form

Who needs cash receipt form?

Understanding the Cash Receipt Form: Your Comprehensive Guide

Understanding the cash receipt form

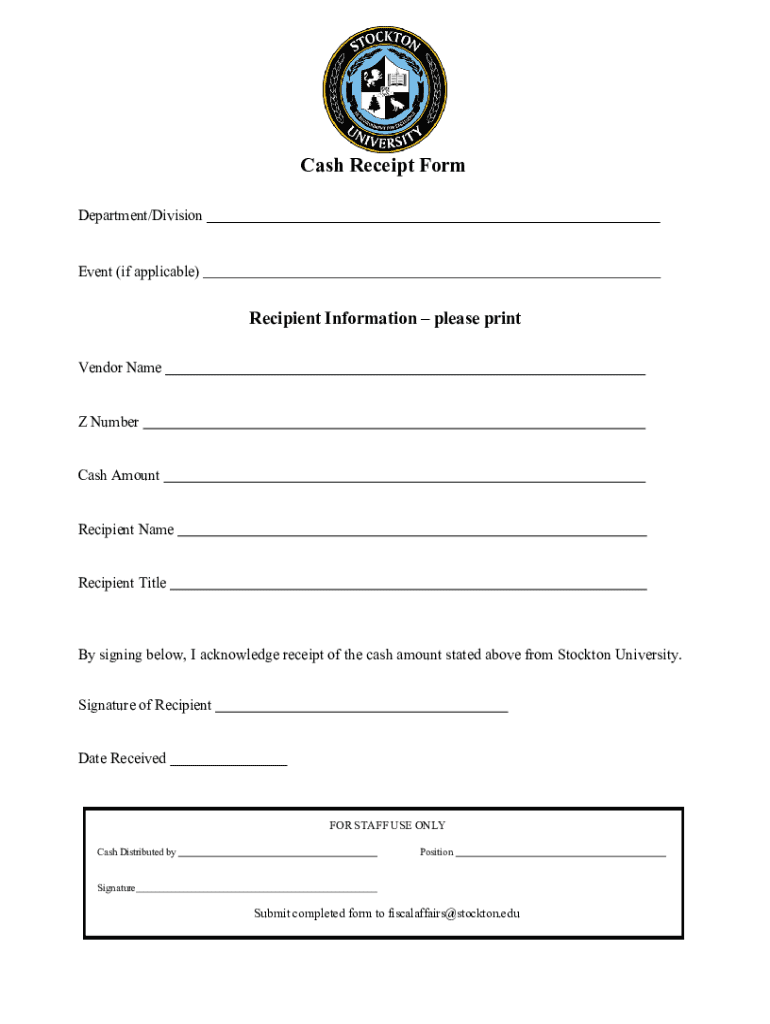

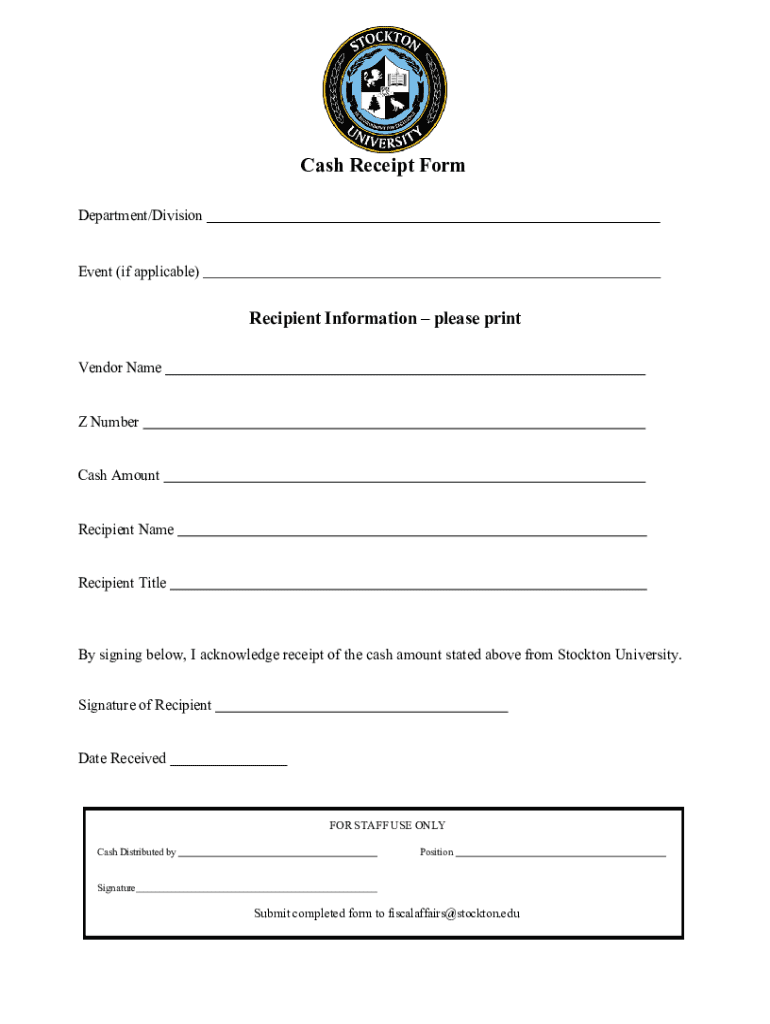

A cash receipt form serves as a crucial document in the realm of financial transactions, designed specifically to document the receipt of cash payments. Its primary function is to provide an official acknowledgment that a payment has been received, effectively acting as a proof of transaction between the payer and the payee. Whether in a retail store, service center, or any business environment where cash exchanges hands, the cash receipt form plays an indispensable role in maintaining transparent financial records.

The importance of cash receipts cannot be overstated. They not only help in tracking income and cash flow but they also provide essential documentation during financial audits. From a compliance standpoint, having a well-maintained cash receipt offers protection for both parties involved, ensuring clarity and accountability in financial dealings.

When to use the cash receipt form

Cash receipt forms are essential in several situations. The most common scenario is when cash payments are made, particularly in retail and service sectors. Whenever a customer completes a transaction involving cash, the issuance of a cash receipt form becomes necessary. Moreover, cash receipts are also important when documenting inter-departmental cash transfers, such as a campus department transferring funds to another or when accounting for petty cash.

Another critical aspect to consider involves regulatory and compliance considerations. Maintaining a paper trail through cash receipts is vital for financial audits. They serve not only as proof of transaction but also help in fulfilling legal obligations. The lack of proper documentation can lead to discrepancies and potential legal issues, making it imperative to issue cash receipts for all cash transactions.

How to fill out the cash receipt form

Filling out a cash receipt form efficiently ensures that all necessary information is accurately documented. The first step involves gathering essential information, such as the payer's details, the payment amount, date of the transaction, and the purpose of the payment. These details are imperative to maintain a clear record that will be beneficial in the future.

Each section of the form must be completed carefully, ensuring that no significant details are overlooked. After filling out the form, take the time for a thorough double-check for accuracy. Errors, even minor ones, can lead to confusion or potential disagreements in the future.

Editing and customizing your cash receipt form

pdfFiller provides users with a seamless experience when it comes to managing their cash receipt forms. The platform allows you to access customizable cash receipt templates that can be tailored to fit unique business needs. Using pdfFiller, you can navigate to the document templates section to find an ideal cash receipt form and begin editing it according to your specifications.

pdfFiller's collaborative features enable teams to work together when customizing forms. You can effortlessly share the cash receipt form with team members for their input, allowing for real-time comments and suggestions. This collaborative capability not only enhances the quality of the document but also fosters teamwork and collective responsibility.

Signing and validating the cash receipt form

Signatures on cash receipts are not just formality; they are critical for validating the transaction. A signature serves as proof of transaction, establishing that both the payer and the payee have agreed to the terms of the exchange. In many business contexts, a signed cash receipt may serve as an official record for accounting and auditing purposes.

With pdfFiller, users have the option to electronically sign their cash receipt form. This eSignature feature simplifies the validation process while ensuring compliance with legal eSignature laws. Businesses can confidently send and receive signed documents digitally, alleviating the need for physical signatures and enhancing the efficiency of transaction processing.

Managing your cash receipt forms

Efficiently organizing and storing cash receipts is crucial for any business. Best practices for digital record-keeping include utilizing cloud storage solutions, like pdfFiller, to ensure easy access to all financial documentation. By organizing these records effectively, you can quickly retrieve any cash receipts needed for audits or customer inquiries.

Additionally, incorporating tracking codes and references on your cash receipt forms allows for easier monitoring of payments and transactions. This practice can connect with your accounting software for total integration, providing a holistic view of your financial status and effortlessly managing cash flow.

Frequently asked questions (FAQs)

Many people have common queries regarding cash receipt forms. One prevalent question is, 'What happens if I make a mistake on the form?' The best course of action is to void the incorrect receipt and issue a new one to ensure accuracy. Another question pertains to the retention period for cash receipts. It's typically advisable to keep them for at least seven years, depending on local regulations. Lastly, some individuals wonder if a cash receipt form can be used for non-cash transactions. The answer is no; it's specifically designed for cash exchanges.

Best practices for issuing cash receipts

To ensure consistency and professionalism in your cash transaction processes, establishing standardized forms for cash receipts is essential. This also includes using a uniform format that helps in maintaining clarity. By having a standardized cash receipt form, businesses can ensure that all critical information is captured, minimizing the risk of omission which could lead to disputes later.

Moreover, clear and professional cash receipts help enhance customer trust and satisfaction. Customers expect transparency in their transactions, and providing them with a well-organized cash receipt reflects positively on your business's image. Ensuring that every cash receipt is detailed and comprehensible not only boosts customer confidence but also fosters long-term relationships.

Feedback and support options

For those seeking assistance with their cash receipt forms, pdfFiller offers various support channels. Users can contact customer service via chat, email, or phone for inquiries and issues related to document management. Additionally, pdfFiller encourages community feedback, allowing users to submit suggestions for form improvements. Engaging on user forums provides tips and best practices, enhancing the overall experience with the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the cash receipt form in Gmail?

How do I edit cash receipt form straight from my smartphone?

How can I fill out cash receipt form on an iOS device?

What is cash receipt form?

Who is required to file cash receipt form?

How to fill out cash receipt form?

What is the purpose of cash receipt form?

What information must be reported on cash receipt form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.