Get the free Michigan Married Filing Separately and Divorced or Separated Claimants Schedule, For...

Get, Create, Make and Sign michigan married filing separately

How to edit michigan married filing separately online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan married filing separately

How to fill out michigan married filing separately

Who needs michigan married filing separately?

A Comprehensive Guide to Michigan Married Filing Separately Form

Understanding the Michigan married filing separately option

Married filing separately is a tax status that allows married couples to file their own tax returns rather than filing jointly. In Michigan, this option can be advantageous for certain couples, particularly those with specific financial situations or differing incomes.

Choosing to file separately can benefit couples in various circumstances. These include instances of significant medical expenses that exceed a certain percentage of adjusted gross income (AGI), or when one spouse has considerable miscellaneous deductions. Additionally, when one partner's income is substantially lower, filing separately can sometimes lead to a better overall tax situation.

However, there are misconceptions about the married filing separately status. Some believe it automatically leads to a higher tax burden, but this isn’t always the case. Depending on the couple's specific financial details, the outcome may vary.

Who should file using the married filing separately form?

Eligibility for filing as married filing separately involves criteria for married couples. This includes filing without the consent of the other spouse or when one spouse is simply not willing to sign the tax return. There are also exceptions applicable to individuals who are concerned about joint liability for taxes.

Filing separately may provide advantages, such as protecting one spouse from the other's tax debts. However, it comes with drawbacks like higher tax rates and the loss of certain credits. For example, many educational credits and deductions are not available to those who file using this status.

Key differences: married filing separately vs. jointly

The primary differences between married filing separately and jointly hinge on tax benefits. Filing jointly typically provides lower overall tax rates due to wider income brackets. Conversely, filing separately generally results in higher tax rates and a limited range of deductions.

State-specific deductions can also impact the decision significantly. In Michigan, some deductions available to joint filers may not apply to those filing separately, such as certain underitemized credits. Further, collaborative financial strategies across income sources come into play when both spouses file jointly.

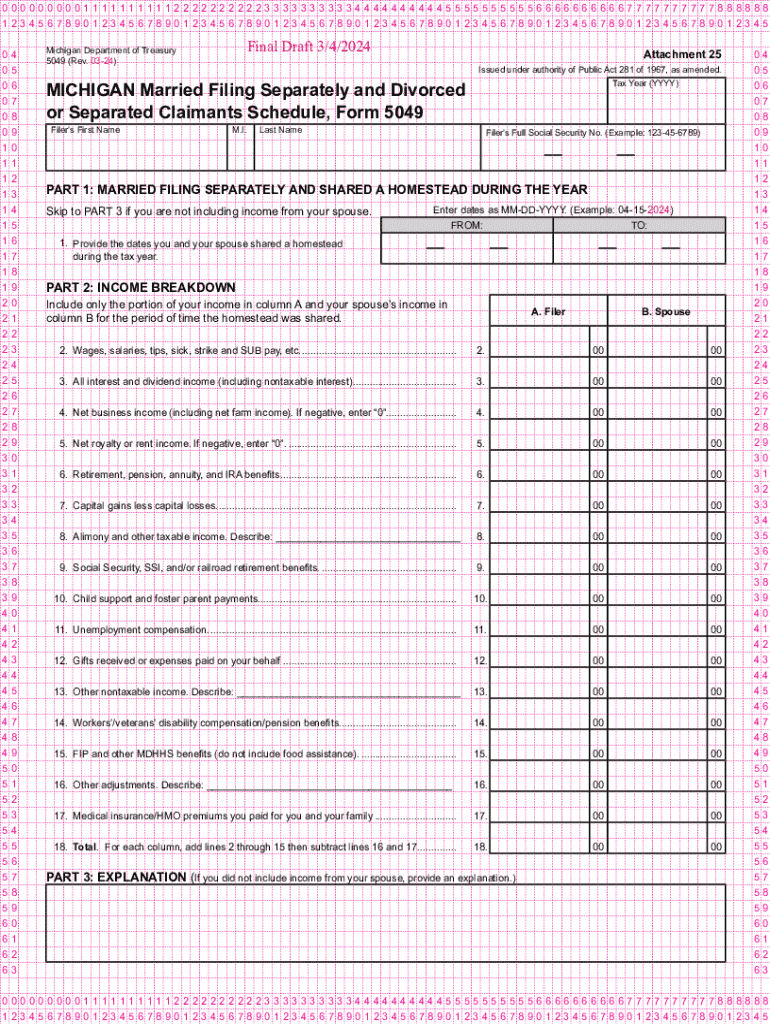

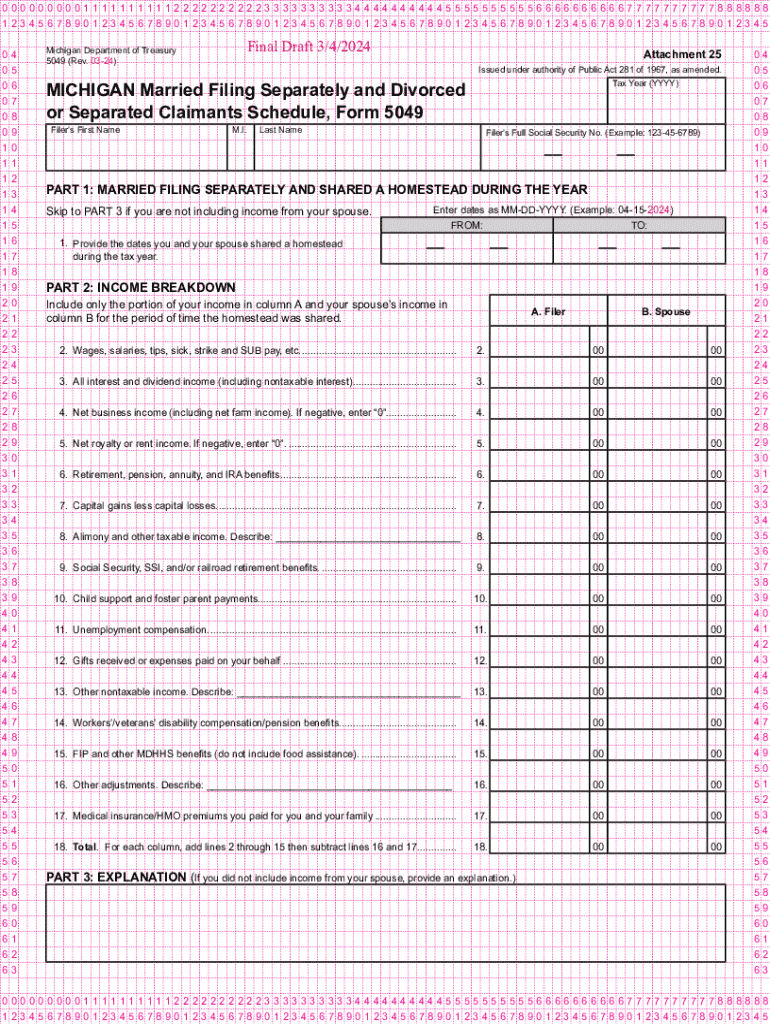

Detailed breakdown of the Michigan married filing separately form

The Michigan married filing separately form is officially labeled as Form MI-1040. It allows taxpayers to report their income and calculate their tax obligation efficiently. This form is vital for separating spouses who want to file with distinct financial identifiers.

Access to the form is available on the Michigan Department of Treasury's official website, including downloadable PDFs to facilitate easy access. Each section of the form prompts for essential information including personal details like names, addresses, and closely monitoring all sources of income.

Completing the form correctly demands attention to detail during every stage to reduce errors that would require amending. Common pitfalls include incorrect income reporting or failure to accurately claim necessary deductions.

Submission process for the Michigan married filing separately form

Once your Michigan married filing separately form is completed, knowing where to submit your return is crucial. Michigan allows for online filing through several platforms, including capabilities provided by pdfFiller, ensuring easy submission.

For those opting for a traditional approach, mailing the completed form to the appropriate Michigan Department of Treasury address is necessary. The filing deadline generally aligns with federal dates but be sure to check the Michigan-specific deadlines for accuracy.

Managing your form: Saving, editing, and signing

Utilizing pdfFiller offers advanced document management functionalities for the Michigan married filing separately form. Users can sign and edit their documents directly within the platform, a significant advantage when frequent collaboration with tax professionals is necessary.

Filing updates and revisions are another essential aspect of maintaining accuracy within forms. To amend previously submitted forms, the corresponding state guidelines for corrections must be followed, ensuring all changes are clearly documented.

Interactive tools and resources

For those filing the Michigan married filing separately form, leveraging interactive tools such as tax calculators can significantly aid in understanding potential tax obligations. These tools streamline complex calculations into clear outputs, providing valuable insights tailored to individual circumstances.

Additionally, a FAQs section addresses common queries that arise around this filing status. Often, individuals find clarity in shared experiences and inquiries that align with their own situations.

Navigating tax credit opportunities

When opting for the married filing separately status, it's crucial to be aware of various tax credits that are restricted for separate filers. Many valuable tax benefits, such as the Child and Dependent Care Credit or education credits, become less accessible for couples filing separately.

Careful consideration should also be given to the potential impacts on other credits and deductions. For instance, having limited access to deductions could significantly affect overall tax liabilities and necessitates strategic planning.

Special considerations for Michigan residents

For Michigan residents, understanding state-specific tax rules is necessary when filing the married filing separately form. Recent legislative changes may also impact tax rates and deductions, making it essential to stay current with evolving regulations.

Additionally, nuances specific to cities like Grand Rapids may affect taxes owed due to local rates and regulations. Being informed of these aspects allows for proper filing and minimizes unexpected liabilities.

Key takeaways for successful filing

As a checklist for a successful submission of the Michigan married filing separately form, begin by gathering essential documents: income statements, prior year's tax returns, and applicable deductions.

Being proactive about key deadlines enhances accuracy in submissions, ensuring compliance with all filing requirements.

Final remarks

Long-term tax planning is vital in determining the best filing status over the years. Annually reassessing your financial situation can shed light on the most advantageous route regarding tax strategy.

No matter the choice between married filing jointly or separately, understanding the implications can empower informed decisions that benefit future financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the michigan married filing separately electronically in Chrome?

How can I edit michigan married filing separately on a smartphone?

How can I fill out michigan married filing separately on an iOS device?

What is michigan married filing separately?

Who is required to file michigan married filing separately?

How to fill out michigan married filing separately?

What is the purpose of michigan married filing separately?

What information must be reported on michigan married filing separately?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.