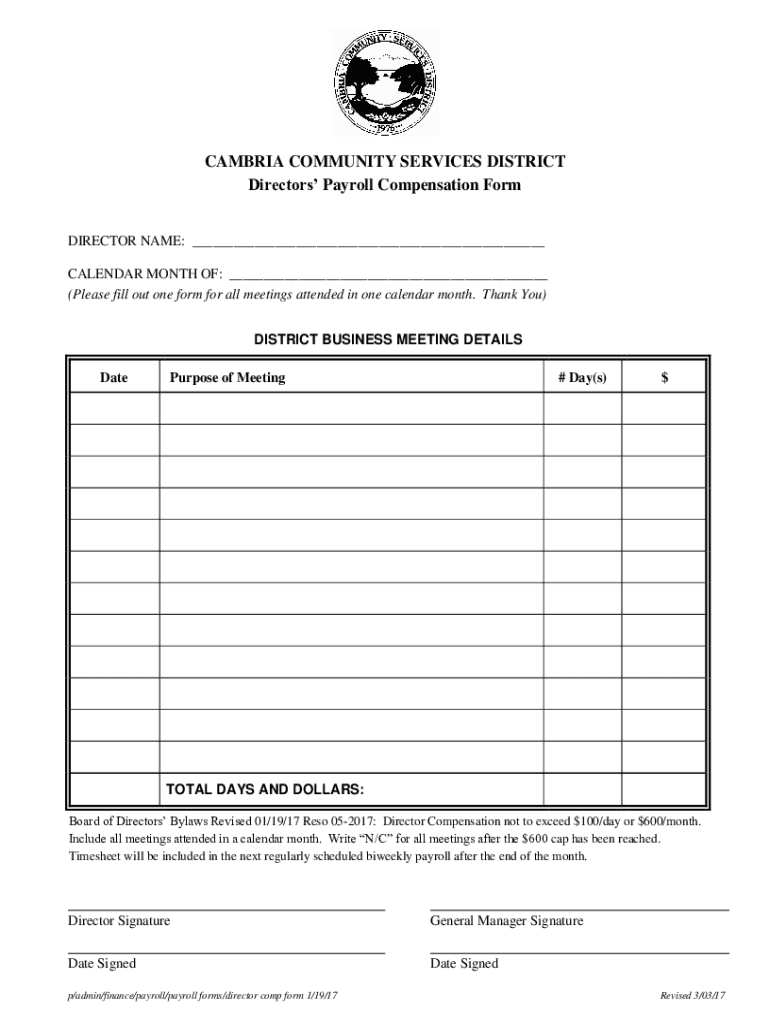

Get the free Directors’ Payroll Compensation Form

Get, Create, Make and Sign directors payroll compensation form

How to edit directors payroll compensation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out directors payroll compensation form

How to fill out directors payroll compensation form

Who needs directors payroll compensation form?

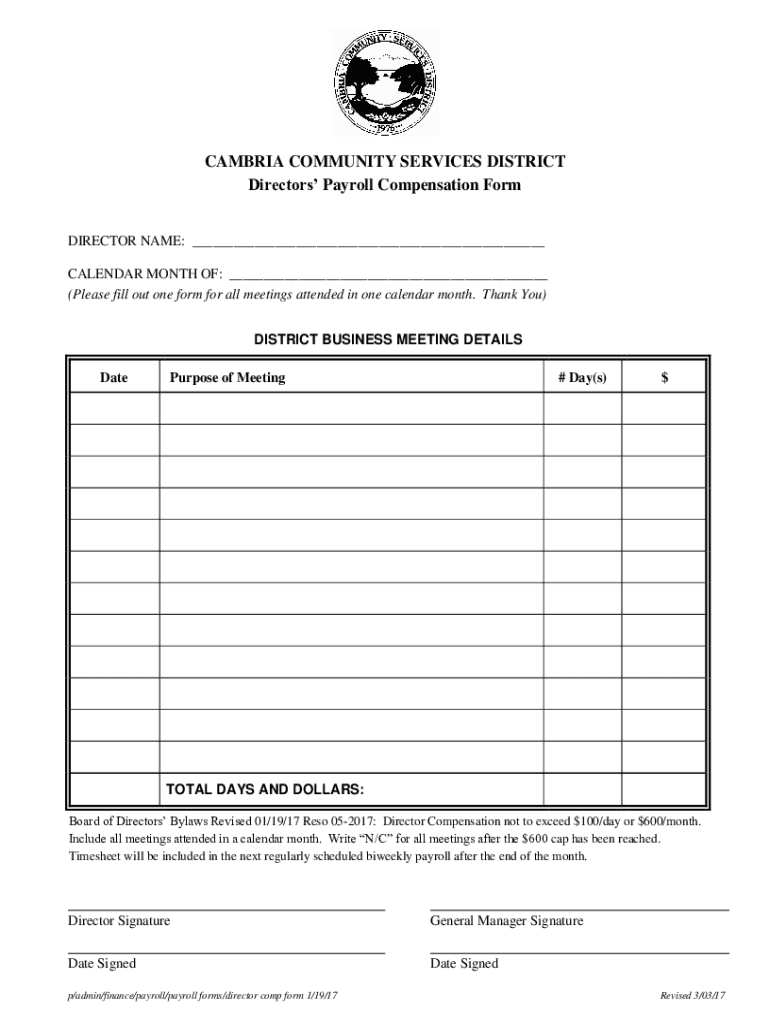

Comprehensive Guide to Directors Payroll Compensation Form

Understanding directors payroll compensation

Directors payroll compensation refers to the financial rewards that are allocated to individuals serving on a company’s board of directors. This compensation may take various forms, including salaries, bonuses, stock options, and other benefits. Ensuring accurate and fair compensation is crucial not only for fostering good governance but also for enhancing boardroom performance and retaining talented directors.

The management of compensation for directors must align with the company's overall compensation policies, which are typically influenced by market trends, company performance, and peer relationships within the industry. Proper management of these compensations forms the backbone of a well-functioning governance structure, ensuring that directors' contributions are recognized and rewarded.

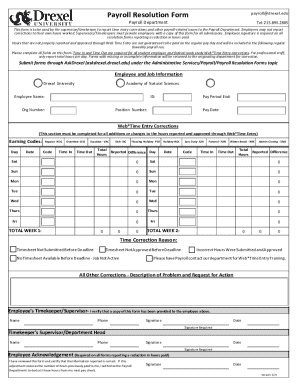

Key components of the directors payroll compensation form

A directors payroll compensation form is an essential document that encompasses several key pieces of information. First and foremost, it requires the basic details of the director, including their full name, qualifications, and the role they play in the company. Additionally, company specifics like the name, address, and identification numbers are crucial for maintaining accurate records.

Another vital aspect of this form is a detailed breakdown of the compensation structure. This includes specifying fixed salaries, bonuses, equity grants, and any other financial incentives. Moreover, understanding how payroll is integrated into the company's financial system is vital for compliance with tax regulations and for ensuring that all payments are processed efficiently.

How to fill out the directors payroll compensation form

Filling out the directors payroll compensation form correctly is critical to avoid future complications. Start by gathering all necessary documentation, which may include identification, previous compensation data, and current market analysis on benchmark compensation rates.

Next, you’ll want to fill in the personal and company information, detailing both the director’s role and the nature of the relationship with the company. Specify compensation amounts, making sure to break them down into cash compensation and any stock options or other forms of compensatory benefits.

After that, input relevant tax information to ensure that everything complies with local and federal regulations. Finally, review the entire document for accuracy and coherence before signing the form. Taking the time to double-check will help avoid common mistakes such as misreported figures or missing signatures.

Managing and editing your directors payroll compensation form

In the digital age, managing your directors payroll compensation form can be significantly streamlined with tools like pdfFiller. As needs change, you may need to modify the information on the form. This can be easily achieved by adding or modifying details directly within the pdfFiller platform, ensuring the document is always up-to-date.

Furthermore, pdfFiller provides excellent collaboration options, allowing team members to review and approve the form efficiently. You can assign roles to different team members for enhanced oversight, and utilize comment features for constructive feedback geared at refining the form further before finalization.

eSigning the directors payroll compensation form

Digital signatures have become an integral part of document management, especially for important forms like the directors payroll compensation form. The benefits of eSigning include not only the speed and convenience it provides but also enhanced security and tracking features.

To eSign your completed form, first select your preferred signing method, which can range from a typed signature to a draw-your-own option. After selecting your method, add the signatures to the PDF as needed. Once all parties have signed, finalize the document to ensure it is locked and secure for future reference.

Tracking and managing completed forms

Once the directors payroll compensation form is filled out and eSigned, tracking its status and managing the document is crucial for compliance and record-keeping. With pdfFiller, you can easily search for and retrieve completed forms without hassle. This capability is particularly helpful for audits or regulatory checks.

Moreover, archiving forms is simple with the built-in organizational tools. It’s important to keep a well-structured archive for compliance purposes, ensuring that all forms can be quickly found in the future. This process not only enhances efficiency but helps maintain good standing with regulatory bodies.

Legal considerations and implications

Managing directors payroll compensation is not just a matter of filling out forms; it carries significant legal implications. Understanding tax liabilities related to director compensation is crucial to avoid penalties or audits. This includes being aware of the different tax treatments based on the type of compensation provided.

Additionally, it’s essential to ensure compliance with both federal and state labor laws. Discrepancies in these can lead to legal issues or financial penalties for the organization. Conducting regular audits of your compensation practices is an effective way to maintain compliance and ensure that the company's policies align with current legislation.

Trends and best practices in director compensation

The landscape of director compensation is ever-evolving due to various market conditions and governance standards. Currently, many organizations are leaning towards equity-based compensation as a way to align directors' interests more closely with the company's long-term success. As a best practice, transparency in compensation practices has become paramount, helping foster trust in governance.

Moreover, organizations are increasingly adopting compensation structures that embrace diversity and equity. Best practices include benchmarking against industry standards and regularly reassessing compensation policies to ensure they are competitive and fair. This approach not only ensures compliance but also enhances the organization's reputation in the governance community.

Frequently asked questions (FAQs)

It's common to encounter questions regarding directors payroll compensation forms, particularly for those new to the process. If you accidentally make a mistake on the form, the proper procedure is typically to find the section that requires correction and follow company policies to amend it before resubmitting.

Adjusting compensation after submission may require a formal review and re-approval of the directors payroll compensation form to ensure compliance with both governance norms and legal requirements. As for average compensation rates, these can vary widely by industry and company size, making it essential to conduct thorough market research to understand competitive practices.

Additional tools and resources on pdfFiller

For those seeking to enhance their understanding and management of directors payroll compensation forms, pdfFiller offers a variety of resources. Users can easily access related documentation templates that streamline the form-filling process and ensure compliance with best practices.

Furthermore, pdfFiller’s educational materials, available in various formats including eLearning, provide insights into governance fundamentals and virtual director professionalism. These resources empower users to navigate the complexities of compensation and enhance their overall proficiency in document management and governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit directors payroll compensation form in Chrome?

Can I create an eSignature for the directors payroll compensation form in Gmail?

How do I edit directors payroll compensation form on an Android device?

What is directors payroll compensation form?

Who is required to file directors payroll compensation form?

How to fill out directors payroll compensation form?

What is the purpose of directors payroll compensation form?

What information must be reported on directors payroll compensation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.