Get the free Self-assessment Form

Get, Create, Make and Sign self-assessment form

Editing self-assessment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out self-assessment form

How to fill out self-assessment form

Who needs self-assessment form?

Self-Assessment Form: Your Comprehensive How-to Guide

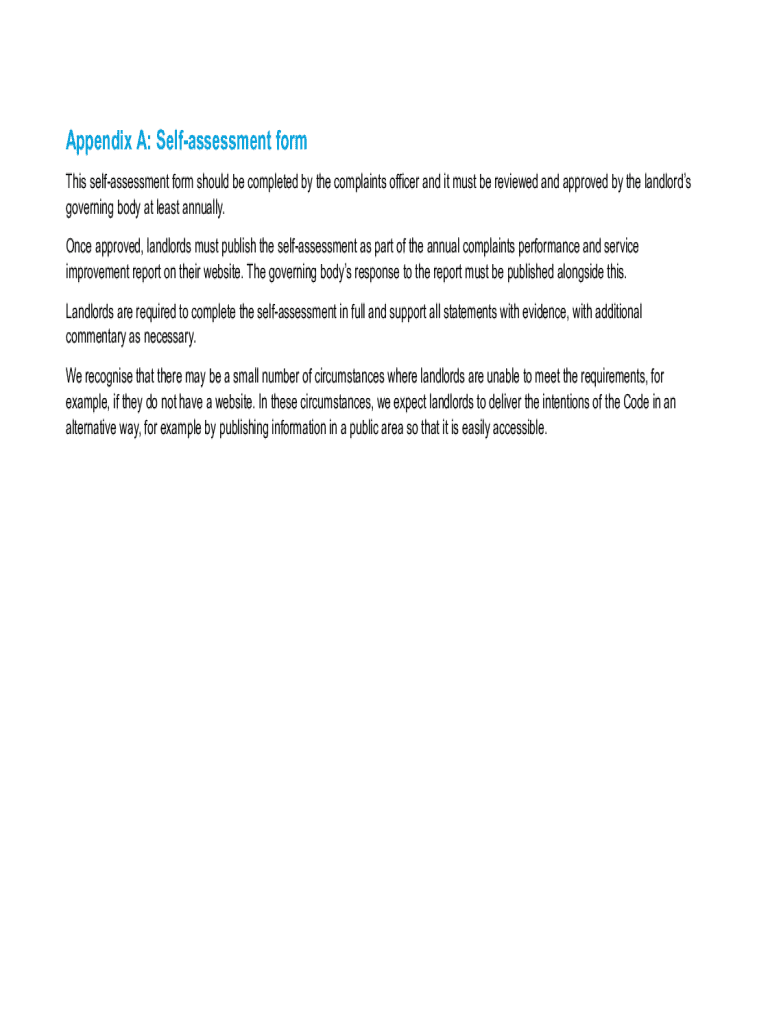

Understanding the self-assessment form

A self-assessment form is a tax return document that allows individuals to report their income and capital gains, as well as claim tax reliefs and deductions. Primarily used in the UK, this form plays a crucial role in calculating your tax liability, particularly for those who are self-employed, have multiple income sources, or earn money that isn’t taxed at source. By providing this information, you ensure compliance with tax regulations and help HM Revenue and Customs (HMRC) assess your tax bill accurately.

The self-assessment form is not only for self-employed individuals but also includes those receiving rental income, dividends, or other forms of taxable income. Understanding its components is essential as it contains various sections, including income details, expenses, and other allowances that can significantly impact your overall tax situation.

Do need to complete a self-assessment form?

Whether you need to complete a self-assessment form depends on several criteria. If you are self-employed or received taxable income over a specific threshold, you are obliged to file this return. Typically, if your total annual income exceeds £1,000 from sources other than your salary, you must file a self-assessment tax return. Additionally, other scenarios such as earning rental income, dividends, or capital gains can trigger this requirement.

There are also exemptions to consider. For example, if your income falls below the taxable threshold or if all your income is taxed at source (like PAYE system), you may not need to complete a self-assessment form. It's important to note that failing to file when required can result in penalties from HMRC, including late fees and interest on unpaid tax.

Preparing to fill out your self-assessment form

Preparation is key to accurately completing your self-assessment form. Start by gathering essential personal information, including your National Insurance number, unique taxpayer reference (UTR), and details of your address. In addition, you need comprehensive financial documents such as payslips, bank statements, and records of income from dividends and interest. It is also crucial to collect any evidence related to business expenses and allowable deductions, as they can significantly affect taxable income.

Moreover, maintain detailed records of any non-standard income, expenses, or claims you wish to include, such as charitable donations or pension contributions. This organized approach not only streamlines the completion process but also reduces the risk of errors, ensuring that your self-assessment tax return is filed correctly and on time.

Step-by-step guide on completing the self-assessment form

Completing the self-assessment form requires careful consideration and diligence. Start with the main tax return section, known as SA100. This form consists of various sections that require detail concerning your total income, tax-free allowances, and the tax you owe. Fill in personal details first to establish identification, followed by your income categorization, including wages, dividends, and other sources. Pay careful attention to the specifics, as misreporting can lead to issues with indexing and potential penalties.

Common pitfalls include not reporting all sources of income, failing to include all allowable expenses, or missing certain deadlines. Double-check that you have completed everything accurately before submission. After that, go on to fill out any supplementary pages for reporting additional income types, investments, or non-standard income such as rental property earnings. Each supplementary page serves a distinct purpose, so it’s crucial to choose the correct pages to ensure your return is complete.

Considerations for self-employed individuals

Self-employed individuals must adhere to unique guidelines when filling out the self-assessment form, particularly concerning income and expenses. It’s essential to report all business income accurately and provide supporting documentation such as invoices, receipts, and statements. Moreover, many self-employed individuals can claim allowable deductions that significantly reduce their taxable income. These can include expenses for business premises, equipment, travel, and even professional development courses, which can contribute to tax relief.

Understanding how to navigate these allowable deductions is paramount, as HMRC has guidelines on what qualifies. Being educated about the tax reliefs and credits available may help maximize your tax efficiency. For instance, expenses like maintenance and repairs to your workspace, materials used for your trade, and other necessary operational costs can usually be deducted.

Seeking professional help: When and why it’s necessary

While many people can navigate their self-assessment form independently, certain circumstances warrant the use of an accountant. If your tax situation is complex, such as owning multiple properties, investment portfolios, or foreign income, hiring a professional might be prudent. Accountants provide expert guidance to ensure compliance with all tax laws, make legitimate claims for deductions, and possibly reduce your tax bill.

When selecting an accountant, consider the cost and potential return on investment. Costs typically vary based on the complexity of your tax affairs and the services rendered. It is advisable to ask potential accountants relevant questions about their experience with self-assessment forms, their fee structures, and how they stay updated with tax regulations to ensure you receive informed and effective guidance.

Frequently asked questions (FAQs)

As you embark on the self-assessment journey, you may encounter common queries. First, how to file a tax return electronically? Most individuals choose to use online services provided by HMRC or platforms like pdfFiller, which streamline the filing process. The electronic filing system often offers immediate confirmation and helps reduce errors.

Another common question pertains to the processing time for a tax return. Typically, once submitted electronically, processing can be completed in roughly a few hours to several days, while paper submissions may take longer. Lastly, individuals often inquire about common mistakes to watch for during submission. Key errors include incorrect personal details, failing to report all sources of income, and missing deadlines. Utilizing organized records and the right tools can mitigate these risks effectively.

Additional tips for managing your self-assessment form

To ensure successful management of your self-assessment form, employing best practices for record-keeping is fundamental. Create a systematic approach by organizing your financial documents throughout the year rather than waiting until tax time. Maintaining digital and physical copies of receipts helps bolster your claims and supports transparent financial reporting.

Leverage technology for simplified processes—tools and software, including pdfFiller, offer intuitive interfaces to edit, sign, and manage tax forms efficiently. This can save you time and reduce the likelihood of errors. Additionally, storing your completed forms as PDFs aids in preserving the formatting, making it easier to retrieve and reference in the future.

Exploring related tax topics

In addition to completing your self-assessment form, it is beneficial to explore various related tax topics. Understanding concepts such as income from pensions, annuities, and state benefits is essential to accurately report your total income. Furthermore, knowing how other income types, like UK dividends or rental income, interact with your tax obligations can provide deeper insights into your liability.

Additionally, becoming conversant with tax relief measures related to charitable donations, student loans, and high-income child benefit charges can lead to substantial savings. Each of these topics plays a role in shaping your overall tax strategy, providing clarity on how to structure your finances with the available reliefs.

Filing your self-assessment: A step-by-step checklist

Successfully filing your self-assessment form involves a systematic approach to ensure completeness and accuracy. Begin by confirming that all sections of the form are complete, reviewing each for any missing information. Double-check your figures to verify the accuracy of the amounts reported, as even minor discrepancies can lead to complications with HMRC.

Once you have confirmed everything is in order, understand the submission options available to you—either electronically through HMRC's portal or via traditional mail. Familiarize yourself with the deadlines, as these can affect potential penalties for late filing. Adhering to this checklist will promote smooth navigation through your self-assessment process.

Helpful resources and tools for tax management

To enhance your experience with creating and managing your self-assessment form, consider leveraging interactive tools offered by platforms like pdfFiller. These resources enable users to handle documents effortlessly, providing features for e-signing and collaboration. Utilizing these tools streamlines the process and maximizes efficiency as you complete your self-assessment tax return.

PdfFiller also facilitates the seamless editing and managing of your forms. With easy access to templates and a user-friendly interface, creating well-structured documents becomes more straightforward. Embrace technology to transform how you handle your self-assessment and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send self-assessment form to be eSigned by others?

Can I create an electronic signature for signing my self-assessment form in Gmail?

How do I complete self-assessment form on an Android device?

What is self-assessment form?

Who is required to file self-assessment form?

How to fill out self-assessment form?

What is the purpose of self-assessment form?

What information must be reported on self-assessment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.