Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding the Form 10-Q: A Comprehensive How-To Guide

Understanding Form 10-Q

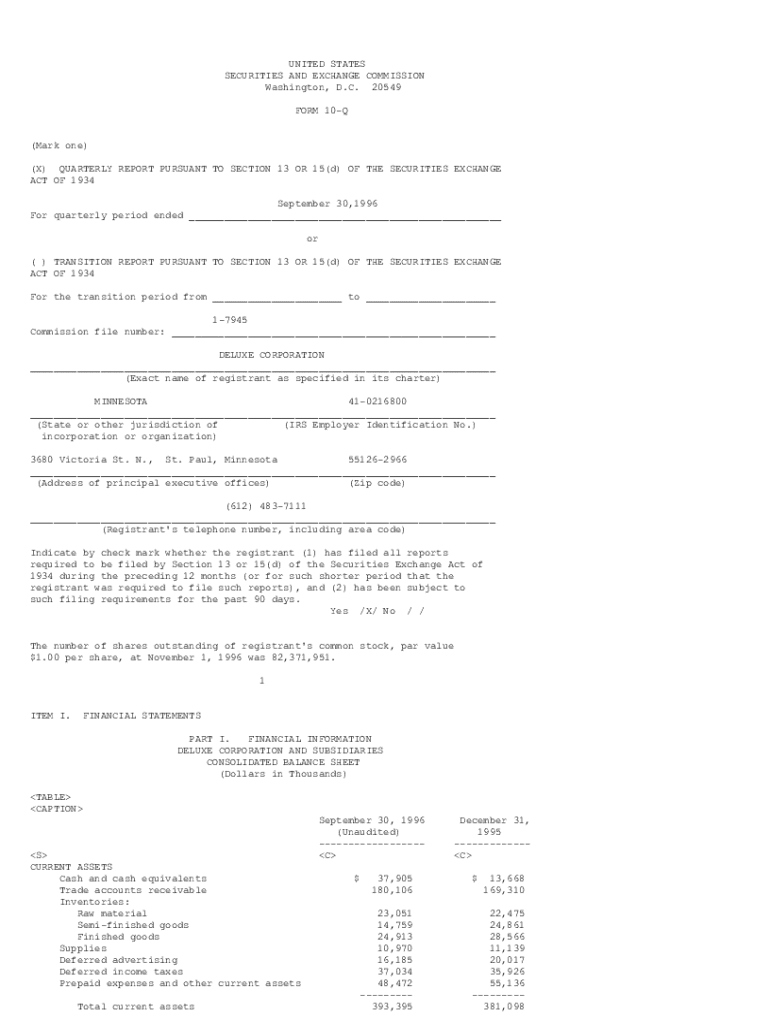

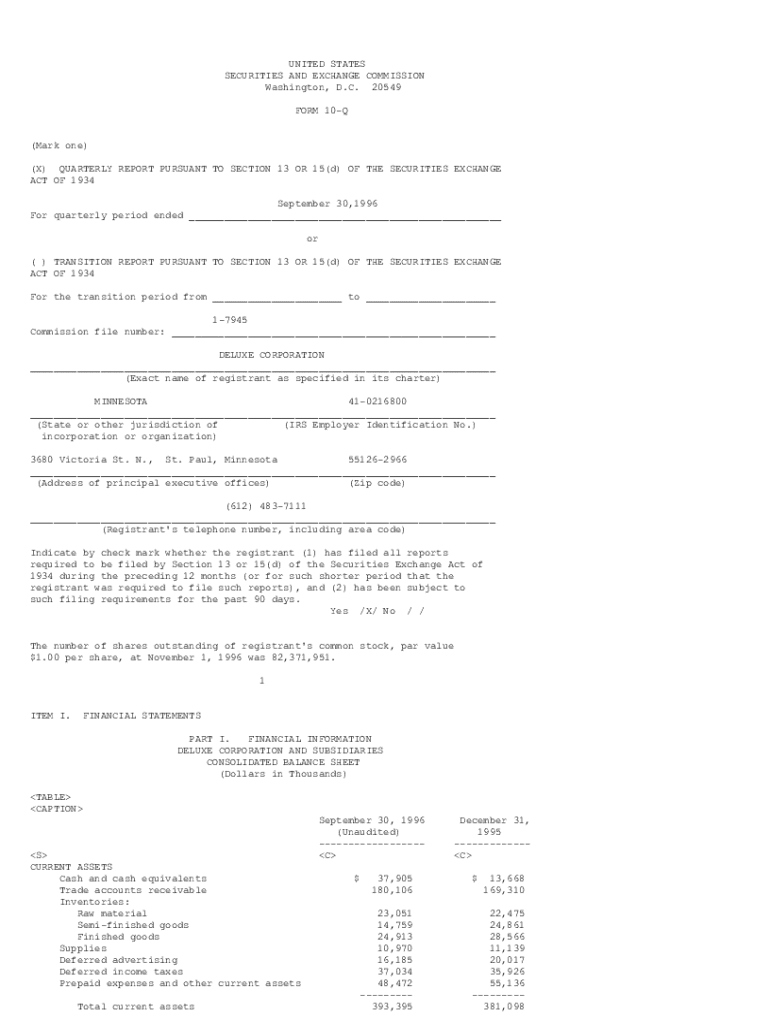

Form 10-Q is a crucial document required by the Securities and Exchange Commission (SEC) for publicly traded companies in the United States. This quarterly report provides a comprehensive overview of a company’s financial performance, including detailed financial statements and management analyses. The primary purpose of Form 10-Q is to keep investors and stakeholders informed about the company's ongoing financial health and operational results. Unlike the annual Form 10-K, which encompasses a full year of data, the 10-Q focuses on quarterly results.

The importance of the Form 10-Q in financial reporting cannot be overstated. It not only serves as a regulatory compliance tool but also plays a role in promoting transparency and accountability in corporate finances. By requiring companies to disclose their financial performance quarterly, the SEC ensures that investors have access to timely information that can influence their investment decisions. Unlike other SEC filings, such as Form 8-K, which reports on special events or significant corporate changes, the 10-Q provides a routine update on financial status and reflects ongoing business operations.

Breakdown of the components of Form 10-Q

Delving into the specifics of Form 10-Q reveals its structured components designed to present comprehensive information. The report includes complete financial statements such as the balance sheet, income statement, and cash flow statement, which are essential for evaluating the company’s financial performance. Together, these statements give a snapshot of the company's assets, liabilities, revenues, and cash flow positions, enabling investors to make informed decisions.

Moreover, Form 10-Q features Management’s Discussion and Analysis (MD&A), allowing management to contextualize the financial results. This section often contains qualitative assessments regarding operational successes, challenges faced during the quarter, and strategic decisions taken. Additionally, the disclosure of market risk highlights both quantitative and qualitative factors that may affect the company's future performance, increasing transparency about risk exposures.

Detailed itemization of required contents

Each Form 10-Q must strictly adhere to the SEC requirements, including specific items that must be disclosed. The items are well-defined to ensure uniformity across companies, making it easier for stakeholders to compare financial performances. Item 1 requires financial statements, which summarize the company's current financial health. Item 2 focuses on Management’s Discussion and Analysis, providing qualitative assessments of performance.

Following this, Item 3 necessitates quantitative and qualitative market risk disclosures, while Item 4 emphasizes the need for information about controls and procedures in place to ensure accuracy. Finally, Item 5 includes any other pertinent information that may be relevant to investors, ensuring a comprehensive overview of the company's current operations and risks.

Filing Form 10-Q

Filing a Form 10-Q requires meticulous preparation and adherence to specific guidelines. Companies begin by gathering financial data from their accounting systems, ensuring accuracy across all figures. Next, they complete each section of the form, carefully following SEC guidelines to avoid penalties. Attention to detail is paramount, as any errors or omissions may lead to compliance issues or investor mistrust.

Once the form is completed, a thorough review is mandatory to ensure compliance with existing regulatory standards. Companies can utilize internal teams or engage external auditors for an additional layer of scrutiny before submission. Finally, companies must file the completed form with the SEC through the EDGAR database, ensuring that all necessary documents are in order and ready for public access.

Understanding filing deadlines and requirements

Timeliness is crucial when it comes to filing Form 10-Q. Public companies are required to file their quarterly reports within 40 days after the close of each fiscal quarter. This schedule not only helps keep investors informed but also aligns with fair financial reporting practices. Companies must be acutely aware of these deadlines as missing them can result in severe consequences, including reputational damage and legal penalties.

The penalties for late filings can range from fines to increased scrutiny from regulators. Additionally, delays in submitting Form 10-Q can damage a company’s credibility in the eyes of investors, potentially leading to decreased stock prices and a loss of investor confidence. Keeping an organized filing schedule and utilizing effective document management tools can help mitigate these risks.

How to find and access Form 10-Qs

Investors and other stakeholders can conveniently access Form 10-Q filings through online databases and resources. One of the most comprehensive sources is the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) database. This platform allows users to search for specific companies or documents quickly and retrieve the latest filings, ensuring that they have the most up-to-date information available.

To retrieve Form 10-Q from EDGAR, users can follow these steps: begin by navigating to the SEC’s EDGAR database website, use the search function to input the name of the company or its Central Index Key (CIK), and select the desired form from the list of filings. Moreover, utilizing platforms like pdfFiller can enhance document management by streamlining the process of accessing documents and facilitating smooth collaboration across teams.

Key highlights and insights from recent Form 10-Q filings

Recent filings of Form 10-Q across various sectors have unveiled important trends in financial reporting. For instance, companies are increasingly focusing on sustainability and corporate social responsibility in their discussions, indicating a shift towards transparency in non-financial performance metrics. Many firms have also developed innovative reporting strategies, utilizing visuals and concise summaries to enhance the readability of financial data.

Notable changes in financial results from previous quarters can also be observed, particularly in sectors affected by global events such as supply chain disruptions due to the pandemic. Case studies from effective reporting strategies show that companies which leverage their Form 10-Q reporting to address emerging risks have seen improved investor confidence and stock price resilience. By analyzing these filings, stakeholders can gain insights into a company’s operational adjustments and future outlook.

Best practices for managing and reviewing Form 10-Q

Effective management and review of Form 10-Q filings are essential for maintaining compliance and ensuring accuracy. One recommended practice is to utilize tools like pdfFiller for editing and collaboration, allowing teams to work simultaneously on documents and track changes effectively. This interactive platform enables users to manage and sign documents seamlessly, accelerating the turnaround time for filing.

Additionally, implementing internal checklists can help teams cover all critical aspects necessary for compliance and accuracy. These checklists can include sections to verify financial data, completeness of disclosures, and alignment with SEC regulations. Regular team meetings to discuss progress, share insights, and troubleshoot issues can also foster a collaborative environment that ensures timely and compliant submissions.

Frequently asked questions about Form 10-Q

As companies navigate the complexities of filing Form 10-Q, several common questions frequently arise among preparers. One question often posed revolves around specific filing items, such as the details required in Item 2 (Management’s Discussion and Analysis). Preparing teams also inquire about common challenges faced during the preparation and submission process, including data collection and timeline management. Seeking guidance from platforms like pdfFiller can provide additional resources and support, easing the preparation of such essential documents.

Addressing these inquiries efficiently not only ensures compliance but also aids companies in maintaining transparency with their stakeholders. Resources available through pdfFiller can demystify the requirements and streamline the entire process, making it more manageable and less daunting for those involved in the reporting.

Leveraging pdfFiller for your document needs

pdfFiller stands out as an invaluable resource for simplifying the complexity of Form 10-Q preparation and filing. Offering robust features like seamless editing, signing workflows, and document tracking, this cloud-based platform empowers teams to collaborate effectively. By utilizing pdfFiller, users can enhance their document management capabilities, ensuring nothing falls through the cracks during the filing process.

The platform’s real-time collaboration tools enable different stakeholders to work on documents concurrently, reducing bottlenecks and improving efficiency. Additionally, pdfFiller’s tracking features ensure all amendments are recorded, streamlining the review process and maintaining compliance standards effortlessly. For teams seeking a more efficient way to manage their Form 10-Q, pdfFiller is an ideal solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out form 10-q using my mobile device?

How do I edit form 10-q on an iOS device?

How do I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.