Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form - A Comprehensive How-to Guide

Understanding the Form 990: A Fundamental Overview

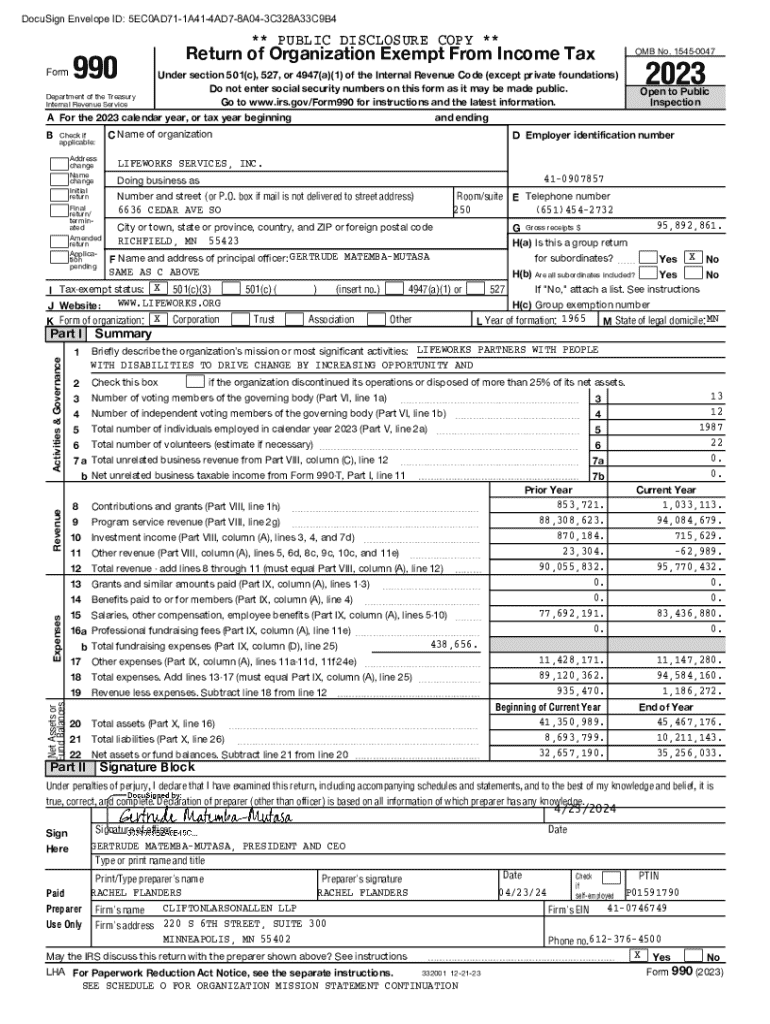

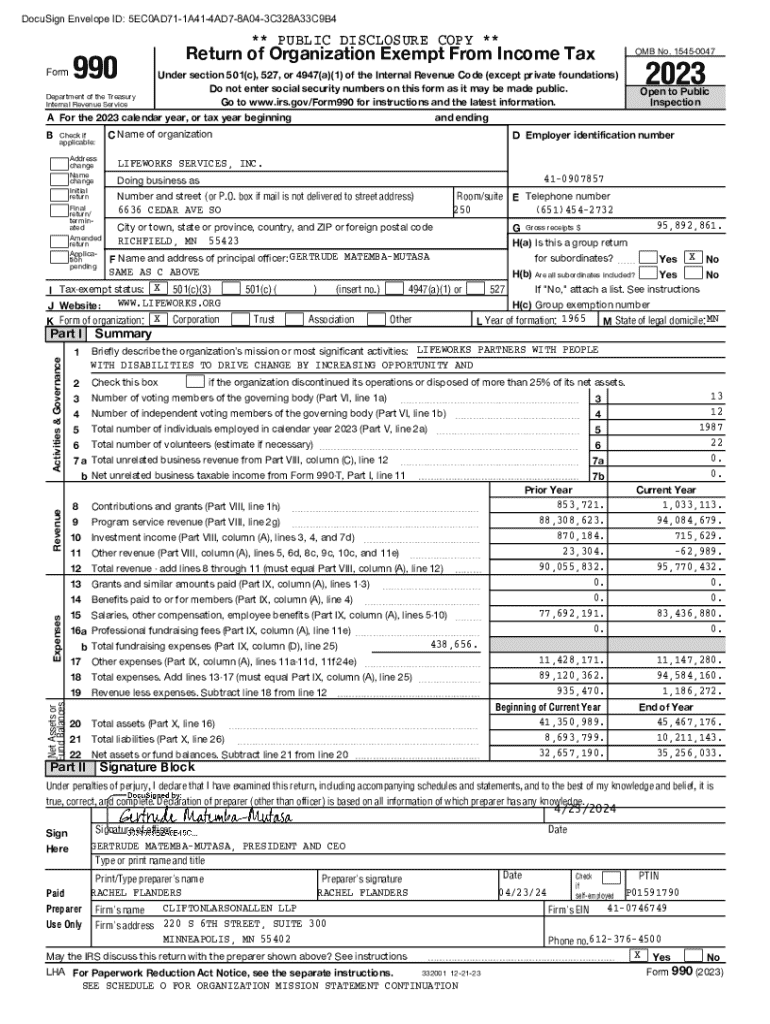

Form 990 is a crucial document that tax-exempt organizations, including nonprofits, must file annually with the IRS. Its primary purpose is to provide transparency regarding the financial status and operations of these organizations. Unlike traditional business tax filings, Form 990 caters specifically to organizations that have received tax-exempt status under Section 501(c)(3) and similar classifications. This filing is essential not just for compliance with federal laws, but also for gaining and maintaining donor trust.

Form 990 serves as a public record, offering insights into an organization’s revenue, expenditures, programs, and compliance with tax regulations. It's designed to ensure that nonprofits operate transparently and maintain their tax-exempt privileges. All this information is made available to the public, which can influence donation decisions significantly. Thus, understanding and accurately completing this form is vital for the sustainability of nonprofit organizations.

Types of Form 990

There are several versions of Form 990, each tailored to different types of organizations and their specific revenue thresholds. The principal forms are:

Selecting the correct form is imperative to ensure compliance with IRS regulations. Filing the appropriate version not only mitigates potential penalties but enhances organizational credibility.

Who must file Form 990?

Form 990 must be filed by all tax-exempt organizations, with specific criteria determining whether a full or modified form is necessary. Generally, organizations qualifying for tax-exempt status must submit Form 990 if they bring in annual revenues above the specified thresholds. However, there are notable exemptions. For example, churches and some other religious organizations may not be required to file. Additionally, organizations that are classified as private foundations typically file Form 990-PF instead.

Decoding the Form 990 Structure: Line-by-Line Breakdown

Understanding the structure of Form 990 is integral to successfully completing it. The form contains several core sections, each serving a unique purpose in detailing an organization's operations and finances.

Each part must be navigated carefully, ensuring that organizations present an accurate and comprehensive disclosure of their activities. Failing to do so can result in reputational damage and lost tax-exempt status.

Navigating the Schedules

Form 990 requires several supplementary schedules, providing crucial details about the organization’s financial activities. Some of the key schedules include:

Selecting the correct schedules is critical as they offer IRS insights into various aspects of the organization. Misreporting or omitting required schedules can lead to complications during the review process.

Step-by-Step Guide to Completing Form 990

Completing Form 990 may seem overwhelming at first glance. However, following a systematic approach can streamline the process. Begin with gathering all necessary documentation, as this forms the foundation for accurate reporting.

Once documentation is in hand, start filling out the form section by section. Input data accurately, ensuring every figure corresponds with collected documentation to avoid discrepancies during IRS evaluations.

A thorough review process minimizes the risk of rejection and fosters an environment of accountability among board members and stakeholders.

Managing and Submitting Form 990

Filing deadlines for Form 990 can differ based on an organization’s fiscal year end. Typically, nonprofits have to submit the form by the 15th day of the 5th month after the end of their fiscal year. For instance, if a nonprofit operates on a calendar year, its Form 990 would be due by May 15. However, extensions are available.

Form 990 can be filed online through the IRS’s website, or authorized providers such as pdfFiller. Online submissions ensure quicker processing and confirmation. For paper filings, organizations should ensure they are using the most recent version of the form and mail it to the correct address based on their location.

Post-Submission Process

After submitting Form 990, it enters the IRS’s review system. Ensuring that accurate information is presented prevents unnecessary audit flagging. If corrections are needed, organizations should promptly file Form 990-X, which is designated for amendments. This can rectify minor errors without resulting in substantial repercussions.

Overall, organizations should focus on maintaining transparency throughout the process, as this fosters continued trust with donors and the general public.

Interactive tools and resources

Utilizing online platforms can make the completion and management of Form 990 more efficient. pdfFiller offers a robust suite of tools that empower organizations to seamlessly edit, eSign, and collaborate on their forms within a single, cloud-based platform.

Accessing the PDF Form 990 through pdfFiller

pdfFiller provides a user-friendly interface that simplifies the editing process for Form 990. Users can access the PDF version of the form directly on the platform, making it easier to fill out the required fields. The interactive nature of pdfFiller allows for easy tracking of changes and updates.

Tools for collaboration and eSigning

Collaboration is crucial when gathering inputs from board members or financial officers. pdfFiller’s built-in eSignature functionality ensures that all signatures are collected electronically, maintaining compliance and authenticity. Engaging multiple stakeholders in the process enhances accuracy, helps verify compliance, and strengthens organizational integrity.

Furthermore, it enables real-time collaboration, allowing team members to communicate and make changes swiftly, thus ensuring that the final document reflects the organization's consensus.

Common questions and scenarios regarding Form 990

Even with comprehensive guidelines, organizations might face challenges concerning Form 990. Common queries often arise relating to missed deadlines or discovering errors after submission. Understanding the correct protocol is essential.

What to do if you miss a deadline?

If a nonprofit organization misses its Form 990 filing deadline, it can face penalties. The first course of action is to immediately file the form, even if late, as this can reduce penalties. Organizations may incur fines that increase based on how long the form remains unfiled, particularly if gross receipts exceed $1 million.

Handling issues with Form 990 data

If organizations identify errors in their submitted Form 990, they must act quickly to rectify these mistakes. Filing Form 990-X for corrections is advisable; this indicates that an amendment has been made, clarifying the errors to the IRS and ensuring compliance.

Frequency and importance of filing Form 990

Filing Form 990 is not just a requirement but a vital practice for nonprofits. It encourages annual reflection on goals and transparency while reinforcing trust with stakeholders. Regularly analyzing the form can provide insights into organizational health, impacts, and areas of improvement.

Leveraging Form 990 for transparency and trust

Form 990 plays a pivotal role in demonstrating accountability for nonprofits. By filing this document accurately, organizations present a transparent view of their operations, finance, and commitment to their missions. Transparent practices enhance public confidence, attract potential donors, and fortify the organization’s reputation.

Furthermore, nonprofits can leverage data from Form 990 not just for regulatory compliance, but also for strategic planning purposes. By analyzing reported income, expenses, and program effectiveness, organizations can align their strategic goals with their operational realities.

The role of Form 990 in building credibility

A meticulously completed Form 990 fosters credibility, showing donors that the organization manages its resources prudently and aligns with its stated mission. Potential donors often scrutinize Form 990 to assess how their contributions might be utilized, making the accuracy and transparency of this document essential.

Finding additional support for Form 990 completion

Given the complexities of Form 990, organizations may find it beneficial to seek professional assistance. Consulting with experts or utilizing services that specialize in nonprofit compliance can ensure accurate filings, lessening the burden on internal resources.

Online communities and support groups also provide avenues for sharing experiences and advice. Organizations can connect with peers to discuss challenges and strategies related to Form 990, further enriching the filing experience.

Continued learning opportunities

Continued education regarding Form 990 is beneficial not just for compliance but for fostering a culture of transparency and diligence within the organization. Webinars, online courses, and local workshops dedicated to nonprofit reporting are excellent resources to enhance knowledge and efficiency in the process.

By investing in learning opportunities, organizations empower their teams to approach Form 990 with confidence, ensuring that they not only meet regulatory requirements but also contribute positively to their reputations and community standing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990?

How can I edit form 990 on a smartphone?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.