Get the free Fr Y-6

Get, Create, Make and Sign fr y-6

Editing fr y-6 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fr y-6

How to fill out fr y-6

Who needs fr y-6?

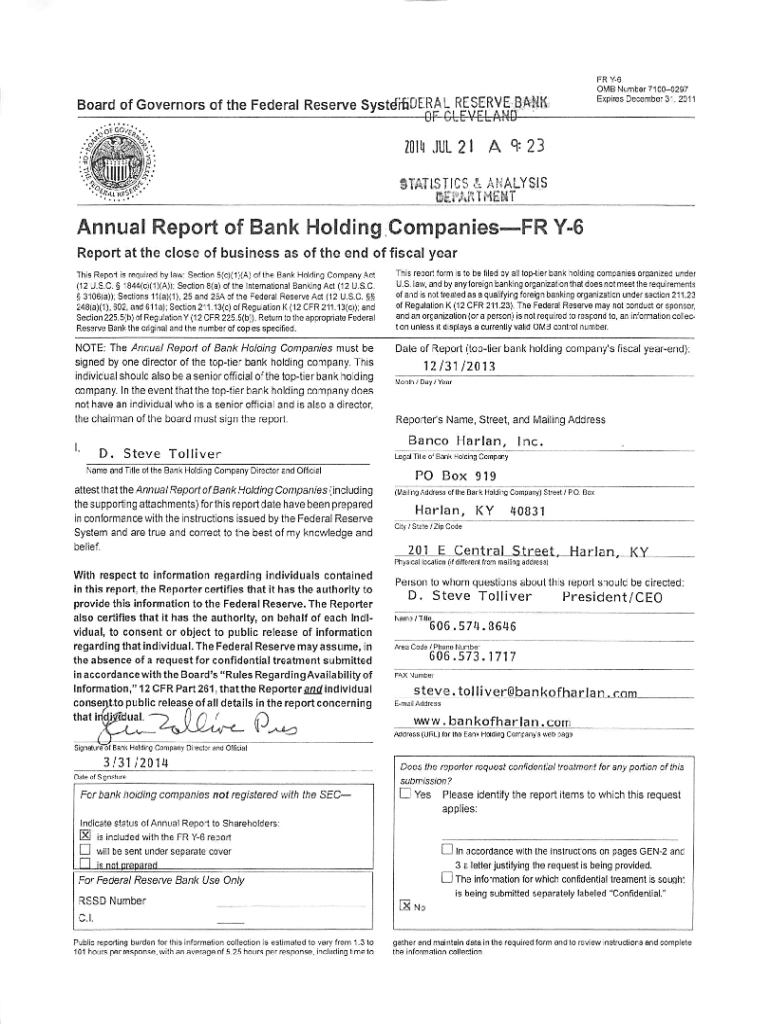

FR Y-6 Form: A Comprehensive How-to Guide

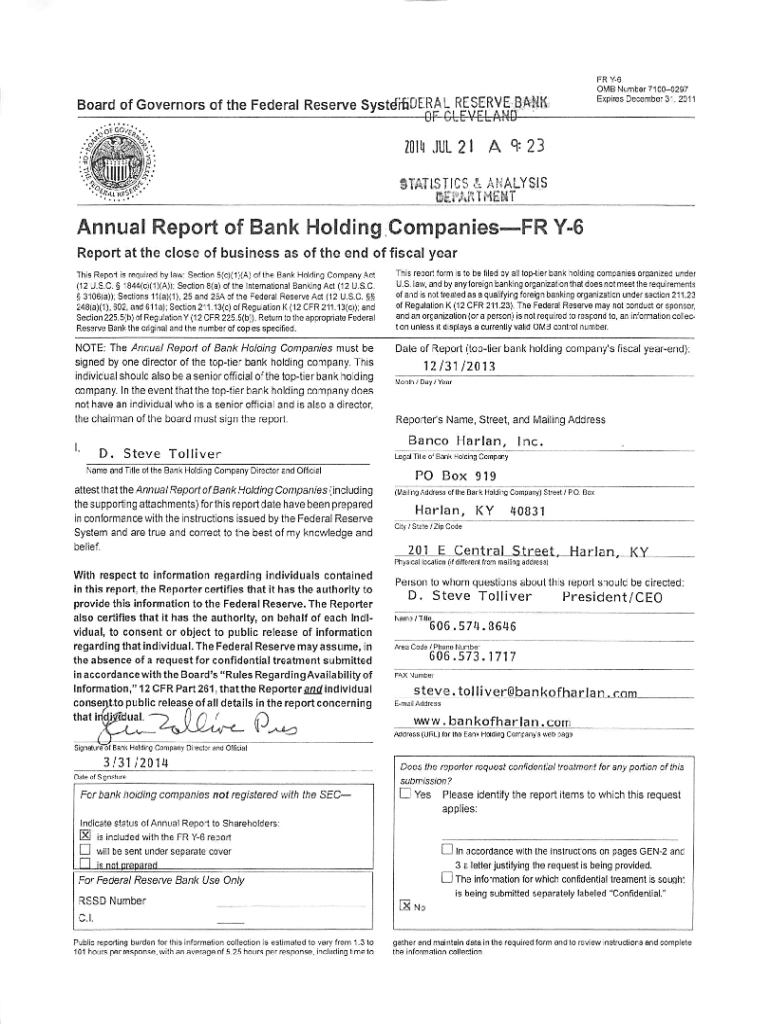

Understanding the FR Y-6 Form

The FR Y-6 Form is a critical document required by the United States government for certain banking organizations. It serves as a tool for the Federal Reserve to collect valuable information about a bank's structure, ownership, and financial status. This reporting form is more than a mere bureaucratic requirement; it plays a pivotal role in enhancing regulatory compliance and ensuring the transparency of financial institutions.

The importance of the FR Y-6 Form cannot be overstated. It provides regulators with essential data that informs policy decisions and financial oversight. By accurately completing this form, banking organizations contribute to a healthier financial ecosystem, enhancing accountability and potentially averting crises.

Navigating the FR Y-6 Form Structure

Understanding the structure of the FR Y-6 Form is essential for successful completion. The form typically consists of several key components divided into distinct sections, each focusing on specific areas of data collection. These sections require detailed and accurate information from banking institutions.

Common terminology used within the form can often be confusing. Familiarity with this language helps in deciphering what is needed and avoids common pitfalls that can lead to mistakes. Knowing terms like 'ownership structure,' 'financial statements,' and 'institutional information' is critical for any organization tasked with filling out the FR Y-6.

Step-by-step instructions for completing the FR Y-6 Form

Before filling out the FR Y-6 Form, organizations must prepare by gathering necessary documentation. It's important to ensure all relevant financial statements, ownership data, and compliance records are ready and accurate. This preparation helps in adhering to the reporting deadlines specified by the government.

Each section of the form has specific information that must be filled in. For instance, Section 1 focuses on Institutional Information, requiring you to provide basic data about the banking organization, including its name, location, and charter information.

In Section 2, you'll detail the Ownership Structure, indicating the percentage of ownership held by individuals or other entities. This section is crucial for identifying any potential conflicts of interest or regulatory concerns. Section 3 requires data from the organization's financial statements, including balance sheets that provide insights into its financial health.

Once the form is completed, it's vital to review it thoroughly. A checklist can be beneficial in this stage. You'll want to ensure every section is filled out accurately, common mistakes such as transposed numbers or missing signatures are avoided, and that all required documentation is attached.

Tools and resources for managing the FR Y-6 Form

Several interactive tools can help streamline the process of completing the FR Y-6 Form. For example, platforms like pdfFiller offer features that enable easy navigation through the form's sections, guiding users step-by-step through the required information. Integration with financial data management systems can also help eliminate duplication of effort by automatically updating relevant fields.

Additionally, eSigning capabilities facilitate a quicker turnaround for document approval, allowing for prompt submission once the form is completed. Utilizing electronic submission processes can also speed up the filing, ensuring compliance with deadlines and reducing paperwork.

FAQs about the FR Y-6 Form

Many questions arise surrounding the FR Y-6 Form, especially regarding its submission timeline. Generally, the form needs to be submitted annually, with specific reporting periods defined by the institution's fiscal year. It's essential to stay informed about any adjustments to these deadlines.

Additionally, understanding the penalties for late submission is crucial. Regulatory bodies may impose fines or other sanctions on institutions that fail to file on time, underscoring the importance of diligence in this process.

For organizations facing issues while filling out the FR Y-6, technical support is available. Utilizing resources offered by platforms like pdfFiller provides access to information and customer service options that can assist with overcoming obstacles in the completion process.

Best practices for filing the FR Y-6 Form

Maintaining accurate records is crucial in ensuring the smooth completion of the FR Y-6 Form. Organizations should implement rigorous documentation management systems to keep track of ownership changes, financial statements, and compliance reports. Consistently updated records allow for easier access to information when filling out the form.

Staying updated with regulatory changes is equally important. Institutions must actively monitor developments pertaining to reporting requirements and ensure that they are incorporating any new guidelines into their filing practices.

Collaborating effectively with team members can streamline the filing process. Utilizing platforms such as pdfFiller facilitates collaborative features that enhance teamwork, allowing for multiple contributors to work on different sections of the form concurrently.

The importance of the FR Y-6 Form in financial oversight

The FR Y-6 Form is vital for regulatory compliance. By providing essential information about ownership structures and financial standings, the form plays a significant role in risk assessment for regulatory agencies. It aids in identifying potentially problematic institutions, ensuring that interventions can take place before crises arise.

Accurate reporting has long-term benefits for banking organizations as well. It enhances credibility with regulators and investors, positioning institutions favorably in the eyes of stakeholders. When banks maintain accurate and timely filings, they not only comply with requirements, but they also build trust that can lead to better business opportunities.

Additional features of pdfFiller for document management

Beyond managing the FR Y-6 Form, pdfFiller offers a comprehensive suite of document solutions. Users can handle a variety of document types beyond just reports, enabling a broader scope of reporting and compliance needs. This versatility makes pdfFiller a valuable tool in any organization’s document management arsenal.

The platform also provides cloud-based accessibility, allowing teams to access their documents from anywhere. This capability is crucial in instances where team members are working remotely or need to collaborate across different locations. Furthermore, pdfFiller's tools optimize collaboration and workflow by enabling simultaneous contributions on multiple documents.

Staying informed on FR Y-6 developments

Remaining updated on FR Y-6 developments is essential for banking organizations. Regularly tracking regulatory updates helps institutions adapt to changes in reporting requirements or compliance guidelines. This vigilance promotes diligence in financial reporting and ensures preparedness for any shifts in regulations.

Engaging with the community can also be beneficial. Many organizations and forums are available where users can share insights and ask questions about the FR Y-6 Form. Engaging in these spaces provides additional support and can lead to valuable networking opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fr y-6 for eSignature?

Where do I find fr y-6?

How do I edit fr y-6 in Chrome?

What is fr y-6?

Who is required to file fr y-6?

How to fill out fr y-6?

What is the purpose of fr y-6?

What information must be reported on fr y-6?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.