Get the free Covered California for Small Business (ccsb) Enrollment and Change Request for Emplo...

Get, Create, Make and Sign covered california for small

Editing covered california for small online

Uncompromising security for your PDF editing and eSignature needs

How to fill out covered california for small

How to fill out covered california for small

Who needs covered california for small?

Covered California for Small Businesses: A Comprehensive Guide

Understanding Covered California for small businesses

Covered California is the state's health insurance marketplace designed to provide affordable health insurance options to residents, including small businesses. The primary purpose of this platform is to connect individuals and employers with health care plans that fit their needs while adhering to regulations under the Affordable Care Act (ACA). For small business owners, Covered California is pivotal in ensuring that they can provide their employees with competitive health benefits, which is increasingly crucial in attracting and retaining talent in a competitive market.

Small businesses often face challenges related to budgeting for employee health coverage. Covered California addresses this by allowing small employers to offer group health insurance options. These plans are specifically designed to be financially manageable for smaller firms, thus promoting workplace health and overall productivity.

Tax credit opportunities for small businesses

The tax credit available through Covered California is a significant financial incentive for small businesses. This tax credit is designed to help offset the costs of providing health coverage to employees, effectively making group insurance more affordable. Eligibility for the tax credit depends on factors such as the number of full-time equivalent (FTE) employees a business has and the average annual wages paid.

In California, small businesses with fewer than 25 employees and average annual wages of less than $56,000 may qualify for the tax credit. The credit can cover as much as 50% of the premiums paid for employee health insurance, providing a substantial savings opportunity. This financial support encourages more employers to provide health insurance, thereby promoting better overall health outcomes within the workforce.

Coverage types and essential health benefits

Covered California offers several coverage levels, including Silver, Gold, and Platinum plans, each designed to meet different health care needs and budgetary constraints. Understanding these levels is crucial for small business owners aiming to provide the best options for their employees. The Silver plans typically cover about 70% of health care costs, Gold plans around 80%, and Platinum plans approximately 90%.

Critical to any employer's decision-making process are the essential health benefits that all plans must cover. These services ensure that employees receive comprehensive care without incurring excessive out-of-pocket expenses. Essential health benefits include items such as emergency services, hospitalization, maternity and newborn care, mental health services, and preventive services.

Navigating cost-sharing reductions

Cost-sharing reductions are essential for smaller companies that are concerned about the affordability of health coverage for their employees. These reductions lower out-of-pocket costs like deductibles, copayments, and coinsurance for eligible employees, making it easier for them to access necessary health services. Eligibility for these reductions is based on household income and is designed to ensure that low- to moderate-income individuals can afford quality healthcare.

To apply for cost-sharing reductions, employers need to instruct their employees on how to fill out and submit their applications through Covered California. The application process can be straightforward if approached methodically. Business owners should encourage their employees to provide accurate income estimates and family sizes to maximize their potential savings.

Exploring dental and vision coverage options

Dental and vision coverage are essential components that many small business owners overlook when evaluating health plans. Covered California offers different dental plans that must comply with pediatric requirements, ensuring coverage for children up to the age of 19. Additionally, options for adult dental and vision care are available, providing comprehensive support for the whole family.

The choice of dental and vision plans can significantly affect the overall health and well-being of employees. Options range from basic coverage for preventative services such as check-ups and cleanings to comprehensive plans that cover advanced procedures. It's advisable for small business owners to carefully compare available plans and consider factors such as premium costs and coverage limits when selecting the right options.

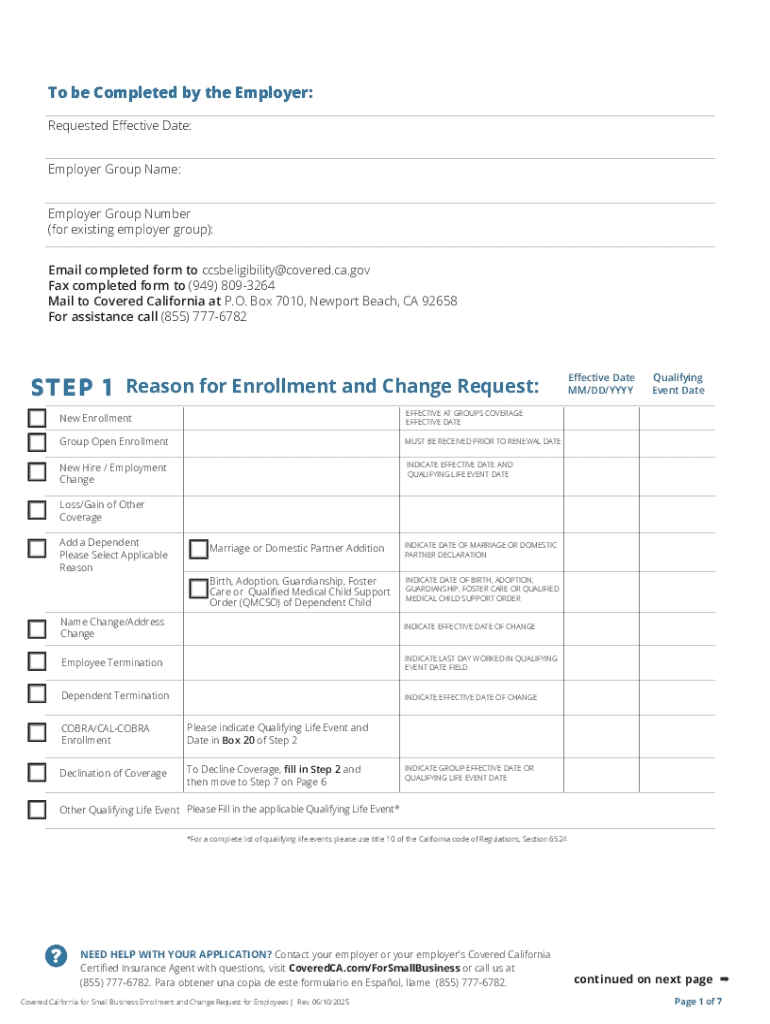

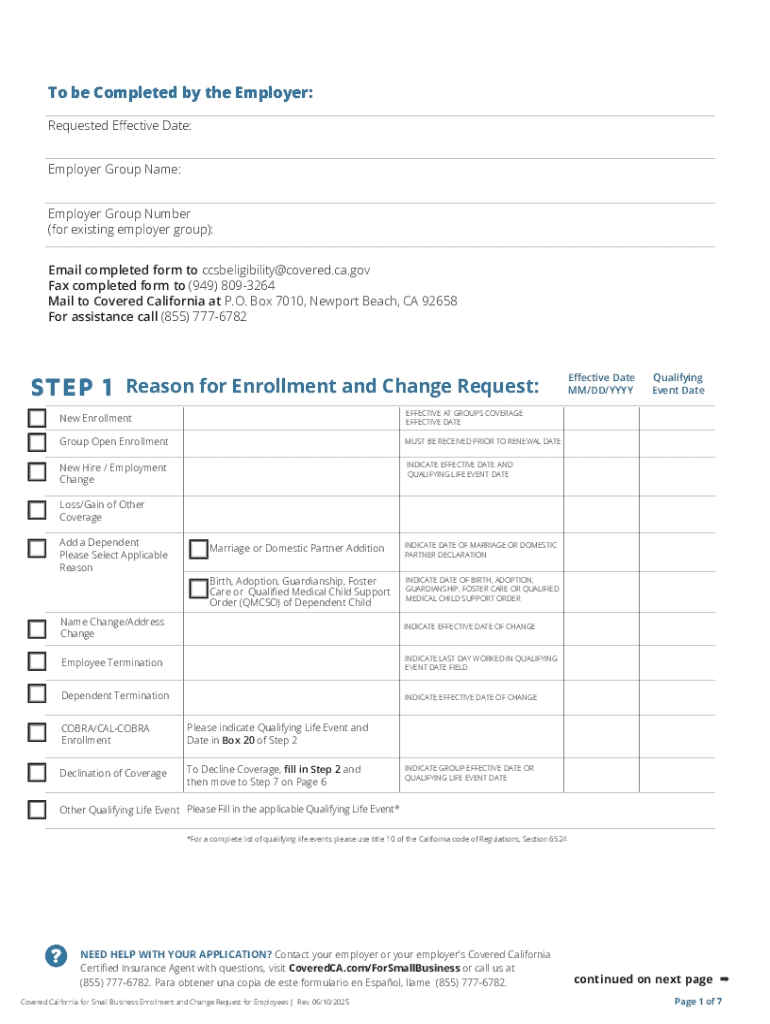

How to enroll in Covered California for small businesses

Enrolling in Covered California can be a straightforward process if small business owners approach it with the right information. The first step involves gathering necessary documents such as employee records, tax information, and details about the business's structure. Having these documents organized ahead of the enrollment period can save time and ensure accuracy throughout the process.

To begin enrollment, business owners can access Covered California’s online portal. It’s vital to verify information entered to avoid common pitfalls, such as incorrect employee counts or mismatched details that might hinder the enrollment process. Familiarizing oneself with the platform can also streamline the experience.

Resources and tools for small business owners

Covered California provides a suite of helpful tools and calculators that assist small business owners and their employees in understanding the health insurance options available to them. These interactive tools make navigating insurance plans simpler, facilitating informed decision-making about coverage choices.

In addition, small business owners can benefit from working with certified agents and brokers who are knowledgeable about Covered California’s offerings. Choosing the right assistance can ease the enrollment process and provide tailored advice that aligns with specific business needs.

Staying compliant with legal requirements

Every small business owner must understand their obligations under the ACA, which includes offering health insurance to their employees if they have 50 or more full-time equivalents. Even for those with fewer employees, staying informed about health care regulations can prevent legal pitfalls. Fostering transparency about employee benefits not only complies with the law but also builds trust within the workforce.

Proper documentation post-enrollment is crucial for compliance. Businesses must retain records of employees’ insurance coverage, premium payments, and communications regarding health benefits. This documentation not only serves as a record for potential audits but also helps clarify coverage and responsibilies to employees.

Customer support and assistance

Covered California offers various support channels for small business owners looking for assistance during the enrollment process or seeking clarification on coverage options. Business owners can reach out via the Covered California phone line, email support, and even in-person assistance at designated locations around the state.

To maximize these resources, it's vital that business owners prepare a list of questions or concerns to streamline their interactions with customer support. Common inquiries often revolve around eligibility, benefits, and the application process, which can be efficiently addressed with proper preparation.

The benefits of using pdfFiller for your documents

Managing documents related to Covered California enrollments can be made significantly easier with pdfFiller. This robust platform allows users to edit PDFs, eSign them, and collaborate with their teams from any location, enhancing productivity and ensuring full compliance with legal and administrative requirements.

The cloud-based nature of pdfFiller ensures that all your documents are accessible anywhere, allowing business owners to manage critical paperwork without the worry of losing essential files. The ease of filling out forms electronically also aids in reducing errors and streamlining communication between employees and management.

Engaging with the community

Engaging with local business communities and networks can provide small business owners with invaluable insights, updates, and best practices related to health insurance options. Collaborating with other small business entities fosters a supportive environment where owners can share experiences, address challenges, and learn from one another.

Staying informed about healthcare changes is also critical. Subscribing to relevant newsletters and attending community events can help business owners keep abreast of updates in policies and regulations, particularly as the healthcare landscape evolves towards 2025 and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send covered california for small for eSignature?

Can I sign the covered california for small electronically in Chrome?

Can I edit covered california for small on an iOS device?

What is covered california for small?

Who is required to file covered california for small?

How to fill out covered california for small?

What is the purpose of covered california for small?

What information must be reported on covered california for small?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.