Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-To Guide

Understanding credit card authorization forms

A credit card authorization form is a critical document utilized during financial transactions to obtain permission from the cardholder to charge their credit card. This form acts as a safeguard, ensuring that both the business and the customer are protected against fraudulent activity and unauthorized charges. It confirms that the cardholder agrees to the specified transaction, thus minimizing potential disputes and chargebacks.

Utilizing a credit card authorization form is vital for any business handling credit card payments. It helps prevent chargeback abuse, where customers dispute legitimate transactions, leading to financial losses for businesses. Additionally, this form protects both parties by clearly documenting the agreement, which can be essential when negotiating any transaction-related disputes.

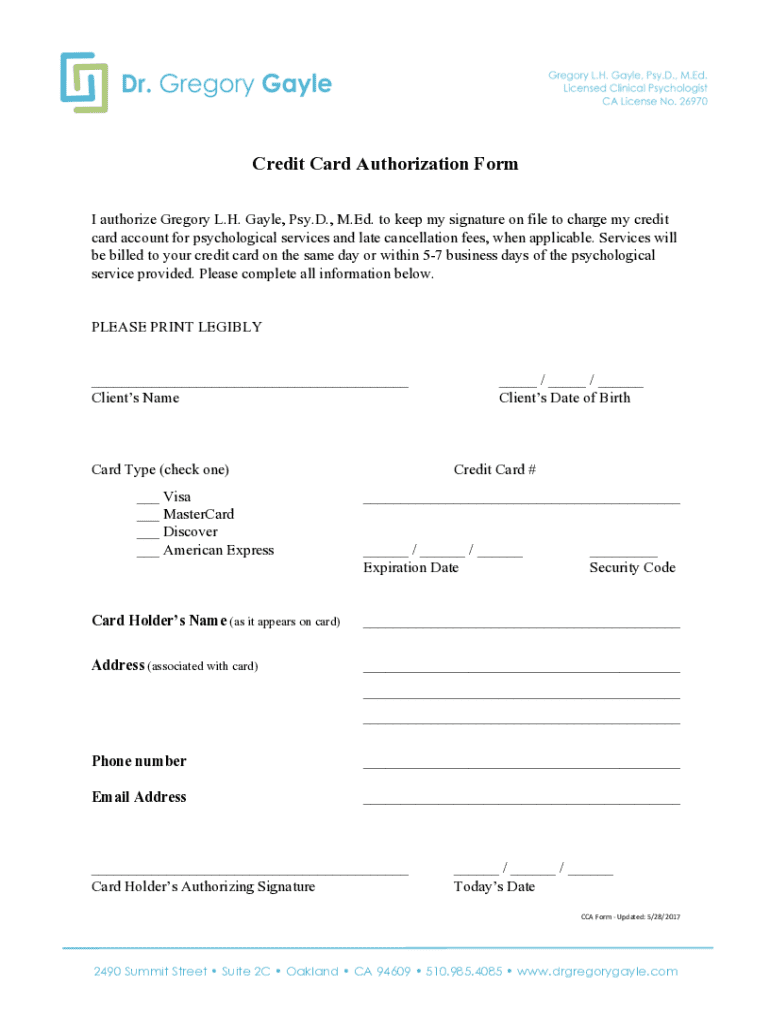

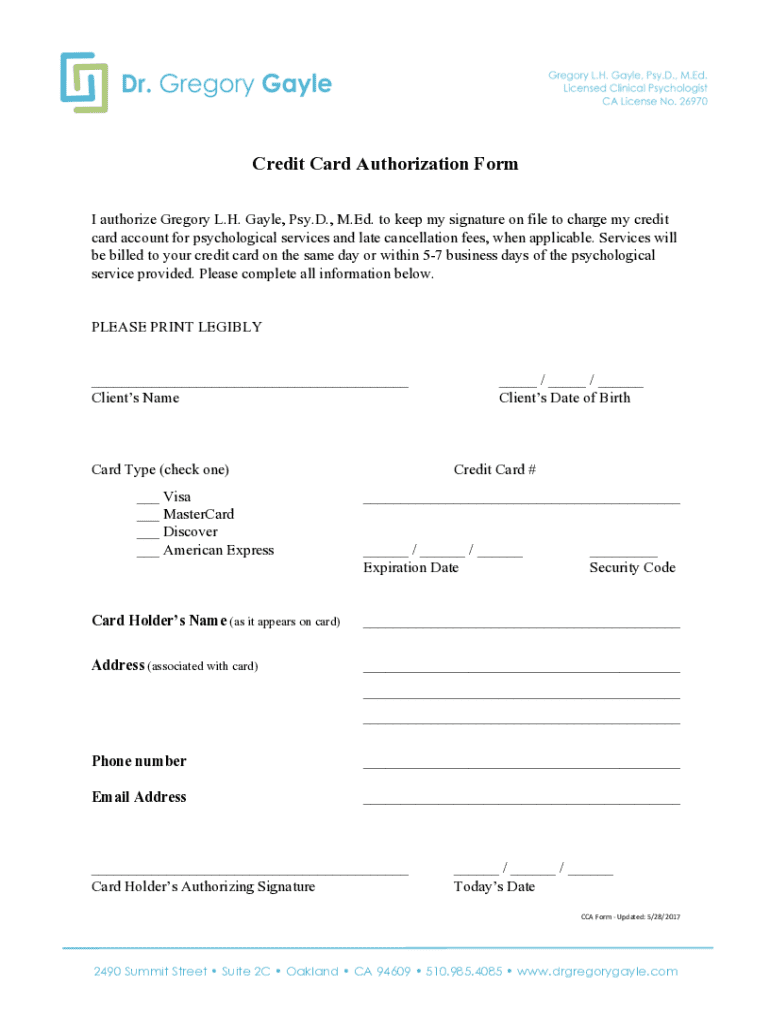

Components of a credit card authorization form

A well-structured credit card authorization form contains several essential elements to effectively capture the necessary information for processing payments. First and foremost, it includes cardholder information such as name, address, and contact details, ensuring the transaction can be properly associated with the individual making the payment.

The form also encompasses payment details, which include the card number, expiration date, and any specific instructions relevant to the transaction. Additionally, a designated area for the cardholder's signature and the date of authorization serves to legitimize the agreement between both parties. While some key components are mandatory, others can be optional, such as requiring the CVV (Card Verification Value) for added security or detailing terms and conditions that apply to the transaction.

Another important term in this context is ‘Card on File,’ which refers to the practice of storing a customer’s credit card details securely for future transactions without requiring the customer to re-enter their information.

When and how to use a credit card authorization form

Credit card authorization forms are vital in several scenarios. For online transactions, these forms help validate the transaction and protect businesses from potential fraud, ensuring that the cardholder fully consents to the charges. In retail settings, these forms are often utilized for larger purchases or special orders, ensuring the business has explicit authorization before charging the card. Service-oriented businesses, such as hotels or salons, frequently require authorization forms for ensuring payment for services rendered.

To complete a credit card authorization form, follow this step-by-step guide: First, collect necessary information from the cardholder, including their name, address, and credit card details. Populate the form accurately, ensuring all required fields are filled in. Lastly, ensure compliance with applicable payment processing regulations, such as privacy standards and data protection laws. Best practices also include providing secure channels for form submission and thoroughly recording and securing each completed form in line with your business policies.

Legal obligations and implications

The use of credit card authorization forms may be legally required depending on the jurisdiction and the nature of the transaction. Different countries and states have established specific regulations regarding customer authorization, particularly concerning security and privacy provisions. Businesses should familiarize themselves with their local laws to ensure compliance and avoid potential legal ramifications.

When it comes to storing and managing signed forms, businesses are generally advised to keep them for a recommended period, which can vary. Secure storage is crucial, whether retaining physical copies in a locked location or opting for digital storage options that provide encryption and secure access. Digital storage solutions often simplify record-keeping and allow for easy retrieval when needed.

Downloadable templates and tools

To facilitate the creation of credit card authorization forms, many businesses leverage templates available in document management platforms such as pdfFiller. These platforms provide ready-to-use templates that ensure all essential components are included, making customization efficient and simple. Users can significantly benefit from features allowing for easy editing, collaborative entry, and the capability to electronically sign forms, ensuring a streamlined workflow.

These interactive tools not only assist with document management but also integrate electronic signing capabilities, which can expedite the transaction process. Using a reliable document management system empowers businesses to maintain a secure, organized way of handling authorization forms, thereby minimizing errors and saving time.

Frequently asked questions (FAQ)

One common question is whether credit card authorization forms actually prevent chargeback abuse. While they are not a foolproof method, they provide documentation that can support the merchant's case during disputes. If an authorization is declined, the best course of action is to communicate clearly with the customer to understand any issues and possibly explore different payment methods.

Handling disputes related to authorization can be challenging; having a well-documented authorization form is crucial. If disagreements arise, businesses should refer to the terms outlined in the form to help resolve conflicts promptly. Additionally, some forms may not include CVV fields due to varying business needs or the security measures in place with their payment processors.

As for compliance, businesses are encouraged to retain signed forms for several years, typically between three to seven, depending on their location and industry standards. Efficient record retention can help safeguard against potential legal claims and customer disputes.

Related topics of interest

Understanding how to set up recurring payments securely is essential for businesses relying on subscriptions or ongoing services. Payment gateways are another crucial element; knowing how they work will inform strategies for streamlining transactions. Equally, customer data security is paramount, particularly in today’s landscape where data breaches are increasingly common, highlighting the importance of customer authorization in Card-Not-Present (CNP) transactions.

Community engagement

Engaging with our community is vital for sharing experiences related to credit card authorization forms. By subscribing to our newsletter, users can stay informed on the latest insights and updates, enhancing their knowledge about transaction security practices and document management.

We encourage readers to share their experiences and tips related to credit card authorization forms. Whether you have insights on best practices or challenges you've faced, your input can foster a rich community discussion that benefits everyone involved in payment processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

Can I sign the credit card authorization form electronically in Chrome?

How can I edit credit card authorization form on a smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.