Get the free Conditional Full Disclosure on Asset for Sale

Get, Create, Make and Sign conditional full disclosure on

Editing conditional full disclosure on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out conditional full disclosure on

How to fill out conditional full disclosure on

Who needs conditional full disclosure on?

Understanding Conditional Full Disclosure on Forms: A Comprehensive Guide

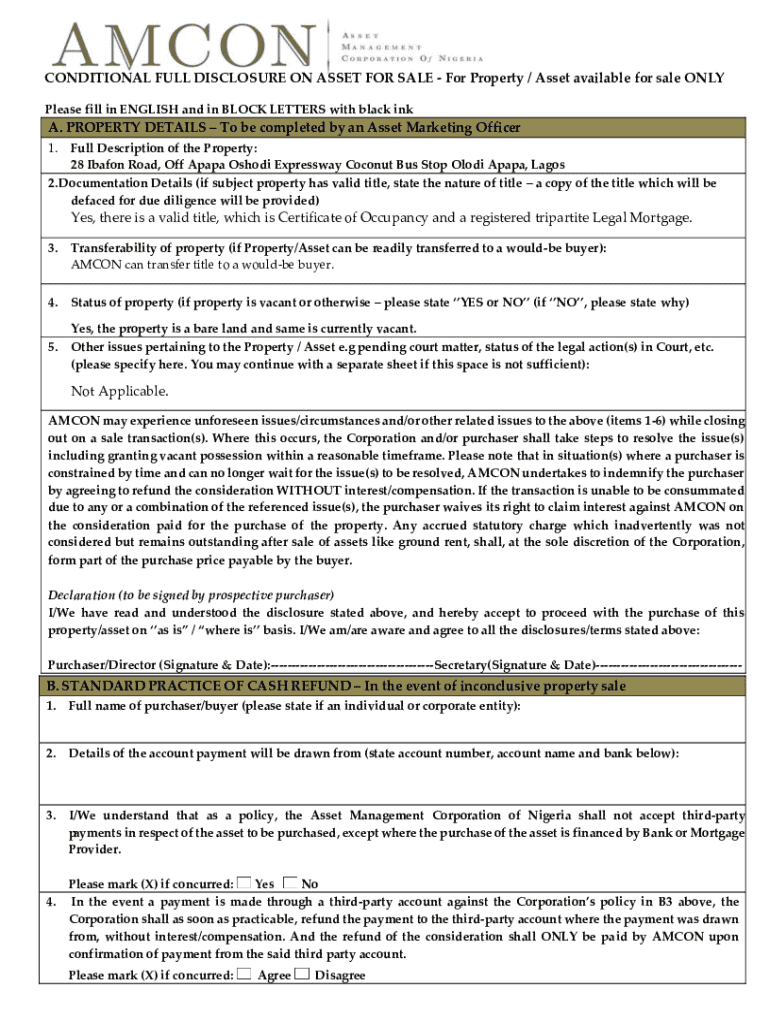

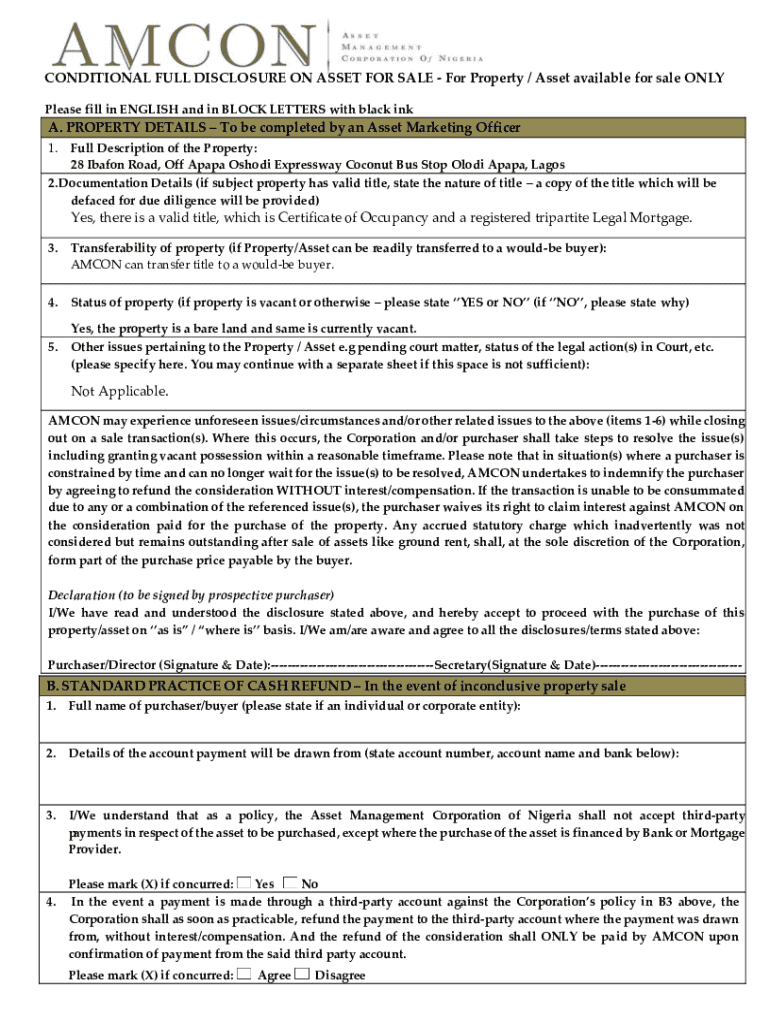

Understanding conditional full disclosure

Conditional full disclosure refers to the obligation to provide specific information when requested, contingent upon particular circumstances or conditions. This practice is crucial in maintaining transparency, particularly in fields such as finance, law, and insurance. Unlike absolute full disclosure, which mandates the release of all pertinent data, conditional disclosure allows individuals to selectively offer information only relevant to the condition at hand.

The importance of conditional disclosure is multi-faceted. In legal settings, adhering to these norms is essential to upholding justice, protecting rights, and ensuring compliance with statutory obligations. For businesses, it promotes trust and builds relationships by demonstrating a commitment to transparency. Understanding the differences between full disclosure and conditional disclosure can prevent misunderstandings and legal complications, ultimately making interactions smoother.

When is conditional full disclosure required?

Several scenarios necessitate conditional full disclosure, particularly in legal, financial, and insurance contexts. In legal proceedings, parties may be required to disclose evidence or documentation conditional to the case, ensuring that all relevant material is available while protecting sensitive information.

For financial transactions, lenders often require conditional disclosures before finalizing agreements. This ensures that all parties are aware of any potential hindrances or issues, paving the way for informed decision-making. Similarly, in insurance claims, conditional disclosure is essential. If a claimant fails to disclose relevant details, it could jeopardize the validity of their claim.

Factors influencing the need for conditional disclosure often relate to regulatory frameworks and the specific nature of forms involved. Regulations may mandate certain disclosures to ensure compliance with laws and ordinances, further underscoring the importance of understanding the specific requirements tied to each situation.

The role of conditional full disclosure on forms

Conditional full disclosure is particularly significant in several types of forms, including financial documents, legal paperwork, and employment applications. In financial forms like loan applications, applicants must disclose their financial history and any potential liabilities that may impact their creditworthiness. Legal documents often have specific sections where parties must outline any contingent claims or ongoing litigation that could affect the outcome.

Employers typically include disclosure requirements in job applications asking candidates to reveal any misdemeanors or relevant background information that could impact their potential employment. The primary purpose of conditional disclosure across these forms is to enhance transparency and foster trust among the parties involved. Such practices also provide a layer of protection against future legal challenges arising from nondisclosure.

The benefits of conditional disclosure include reducing legal risks, improving relationships through transparency, and enhancing the overall reliability of the data shared.

How to complete a form with conditional full disclosure

Completing a form requiring conditional full disclosure begins with identifying the appropriate form for your needs. Whether it's a financial document, legal paper, or employment application, recognizing the context is critical. Once identified, you'll need to navigate through the disclosure requirements specific to that form. Ensure you completely understand what information is required for conditional disclosure.

Next, collect all necessary information relevant to the disclosure. This often includes personal identification details, financial statements, or proof of eligibility, depending on the form. It’s essential to present this information clearly within the designated sections of the form. Here’s a breakdown of common sections to consider in different types of forms:

Formatting and presentation are crucial. Use clear headings and bullet points to improve readability. Avoid jargon unless necessary, and where possible, provide supporting documentation to substantiate your disclosures.

Conditional full disclosure best practices

Ensuring accuracy and honesty is paramount in conditional full disclosure. Any discrepancy or inaccuracy can lead to serious repercussions, including legal action. Here are some best practices to consider:

Moreover, understand the possible consequences of incomplete disclosure. Failing to disclose vital information could lead to legal liabilities or a loss of credibility, underscoring the need to be diligent and detailed in completing forms.

Common challenges in conditional full disclosure

Navigating the complex requirements of conditional full disclosure can be daunting. Many individuals misunderstand terms and conditions attached to the forms, leading to incomplete or incorrect disclosures. This could have severe consequences, ranging from delays in processing to financial penalties.

To alleviate these challenges, practical solutions exist. Interactive tools can assist users in understanding the requirements better and guide them through the filling process. Moreover, consulting professionals when in doubt can provide clarity and prevent potential pitfalls. Ensuring that users seek assistance whenever they encounter confusing terms or conditions is a proactive approach toward comprehensive compliance.

Interactive tools for creating forms with conditional disclosure

pdfFiller offers robust document creation tools designed for seamless integration of conditional full disclosure requirements. With its user-friendly interface, it simplifies the process of creating and editing forms, ensuring all necessary disclosures are included.

The platform features templates tailored specifically for different forms, making it easy for users to navigate their conditional disclosure obligations. The step-by-step editing and eSigning process provides clarity and precision at every stage of document management.

Real-world examples of conditional full disclosure on forms

Examining case studies of conditional full disclosure can offer valuable insights into its practical applications. Successful uses often illustrate how timely and transparent disclosures led to favorable outcomes in legal and financial contexts. For instance, in cases of loan applications, borrowers who provided complete and truthful disclosures experienced fewer delays and better interest rates.

On the other hand, failures due to incomplete disclosure often teach hard lessons. Users have reported significant issues arising from misleading or insufficiently detailed disclosures in legal agreements, often resulting in litigation. Testimonials from users highlight the importance of full disclosure in building trust and credibility, demonstrating that thoroughness is not just a procedural requirement, but a pathway to successful engagements.

Legal implications and compliance

A robust understanding of the legal framework surrounding conditional disclosure is vital for anyone involved in document creation. This knowledge helps ensure compliance with various laws and regulations that govern disclosure practices. Non-compliance can lead to severe legal ramifications, including penalties or a nullification of contracts.

pdfFiller plays a crucial role in ensuring compliance with legal standards. By providing tools that emphasize adherence to disclosure norms, users can navigate the complexities of legal documentation more effectively. Regularly updated templates and resources ensure that all forms align with current laws, thereby safeguarding the interests of the users.

Future of conditional full disclosure

The landscape of conditional full disclosure is continually evolving. Emerging trends reflect a shift towards enhanced transparency and accountability. Organizations are increasingly adopting innovative form designs that streamline the disclosure process, making it easier for users to comply without ambiguity.

Technology advancements significantly impact document management and disclosure practices. Greater automation and integration capabilities in tools like pdfFiller will continue to transform how conditional disclosures are managed, ensuring greater consistency and ease of use across various platforms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my conditional full disclosure on in Gmail?

How can I edit conditional full disclosure on from Google Drive?

How can I fill out conditional full disclosure on on an iOS device?

What is conditional full disclosure on?

Who is required to file conditional full disclosure on?

How to fill out conditional full disclosure on?

What is the purpose of conditional full disclosure on?

What information must be reported on conditional full disclosure on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.