Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Overview of credit card authorization forms

A credit card authorization form is a crucial document that enables businesses to securely charge a customer’s credit card for goods and services. This form serves as a legally binding agreement between the cardholder and the business, ensuring that payments are processed according to the terms specified within the document.

For businesses, the importance of credit card authorization forms lies in their ability to protect against payment disputes and fraud. By obtaining customer consent for charges, companies can significantly reduce the risk of chargebacks. For customers, these forms provide transparency about payment obligations and help them manage their finances effectively.

Understanding credit card authorization forms

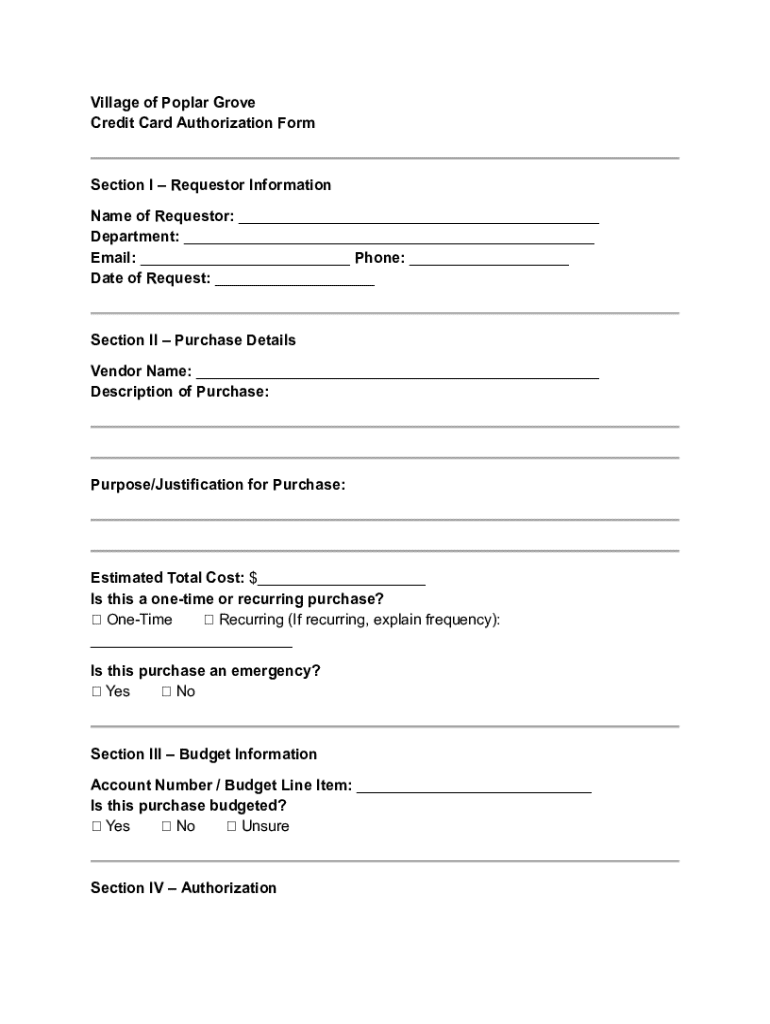

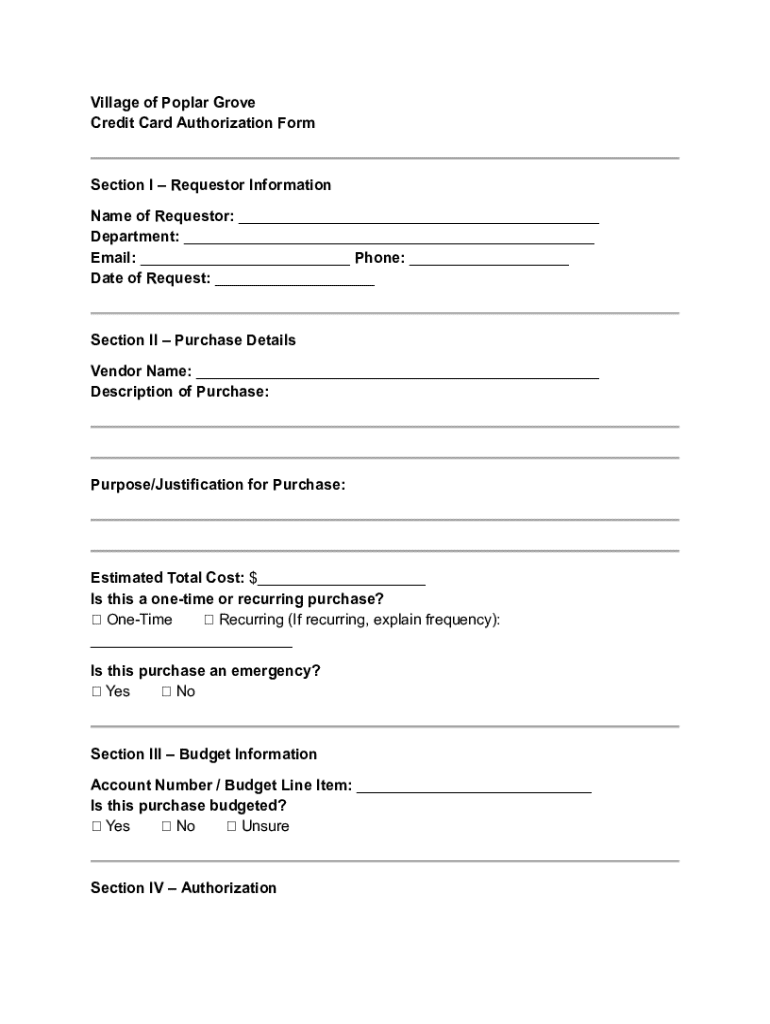

A comprehensive credit card authorization form includes several key components that ensure clarity and security in transactions. Understanding these components is vital for both businesses and customers involved in the payment process.

There are different types of credit card authorization forms: one-time payment authorization forms, which are used for single transactions, and recurring payment authorization forms that facilitate ongoing payments, such as for subscription services. Each type serves distinct purposes depending on the nature of the business transaction.

When to use a credit card authorization form

Credit card authorization forms should be utilized in various scenarios to enhance security and minimize financial risk. For instance, subscription services frequently rely on these forms to authorize regular payments while ensuring customers are well-informed of their ongoing charges.

In e-commerce, especially for businesses that deal with card-not-present transactions, authorization forms serve as essential safeguards. Retail establishments and businesses providing services in person also benefit from authorization forms, as they establish a written record of consent from customers prior to running charges.

Utilizing a credit card authorization form can greatly benefit sellers by minimizing chargebacks, which often result in financial loss, and by protecting against fraudulent transactions. By securing prior consent, businesses can confidently process payments while maintaining customer trust.

Creating an effective credit card authorization form

An effective credit card authorization form must be clear and comprehensive. Essential elements must be included to protect both the business and customer interests. A well-structured form outlines the terms of payment, provides clear instructions, and ensures data protection compliance.

Best practices for formatting include adopting a user-friendly design, which makes it easy for customers to fill out the required fields. Use straightforward language and provide explicit instructions, allowing users to complete the form with minimal confusion. A clean layout with adequate spacing enhances readability and accessibility.

How to fill out a credit card authorization form

Filling out a credit card authorization form correctly is vital for validating the transaction. Here’s a step-by-step guide to ensure accuracy in the completion process.

Common mistakes to avoid include incorrect card details, neglecting to sign the form, and failing to provide all required information. These oversights can lead to transaction failures or disputes, so careful attention is paramount.

E-signing options for credit card authorization forms

Electronic signatures (e-signatures) have transformed the way credit card authorization forms are utilized. Businesses can offer customers the flexibility to sign their authorization forms digitally, which streamlines the payment process.

The benefits of using e-signatures for transactions are manifold. They reduce paperwork, save time, and enhance efficiency. Using a secure e-signing platform, like pdfFiller, ensures that documents are managed safely, recorded properly, and remain compliant with legal standards.

pdfFiller facilitates secure e-signing by providing a comprehensive platform where users can create, edit, and sign documents effortlessly. This not only enhances user experience but also improves the security of sensitive financial transactions.

Legal considerations surrounding credit card authorization forms

Legal considerations are paramount when dealing with credit card authorization forms. It is essential to ensure informed consent from the cardholder, as this forms the basis of any authorization transaction. Compliance with fraud prevention laws and consumer protection regulations protects both parties involved.

Businesses bear legal obligations regarding data storage and privacy as they collect sensitive customer information. Familiarity with laws such as PCI Compliance ensures that companies are equipped to safeguard cardholder data and maintain trust within their customer base.

FAQs about credit card authorization forms

Addressing customer inquiries about credit card authorization forms helps clarify many uncertainties surrounding payments and authorizations. Below are common questions and their answers.

Downloadable templates

pdfFiller provides access to various downloadable templates for credit card authorization forms that can be customized to fit specific business needs. These templates cater to one-time payments, recurring transactions, and more complex scenarios.

When customizing templates, it’s important to ensure that all relevant fields are filled out clearly and comply with legal requirements. By tailoring these documents, businesses can enhance their user experience while offering transparency and security.

Further insights and resources

If you encounter issues with chargebacks, it's vital to have a clear understanding of your business’s rights and obligations regarding payment disputes. Effective documentation practices also support minimizing future disputes.

Furthermore, choosing the best payment processing solutions is critical for enhancing revenue streams and protecting customer interests. pdfFiller can enhance your document management processes, ensuring compliance and efficiency in payment transactions.

Related topics for further reading

Diving deeper into secure payment processing methods is essential for business success. Understanding card-not-present transactions and their associated risks can equip businesses to better manage potential fraud. Additionally, implement recurring billing methods effectively to ensure consistent revenue generation.

Stay informed on best practices in financial management and payment processing by exploring related topics that are fundamental to running a secure and compliant business.

Keep engaging with our content

Engage with us to stay updated on the latest document management trends and solutions available through pdfFiller. Exploring our features can significantly enhance your business workflow and provide valuable insights that drive operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

Can I sign the credit card authorization form electronically in Chrome?

Can I create an eSignature for the credit card authorization form in Gmail?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.