Get the free Controlling Persons Self-certification Form

Get, Create, Make and Sign controlling persons self-certification form

How to edit controlling persons self-certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out controlling persons self-certification form

How to fill out controlling persons self-certification form

Who needs controlling persons self-certification form?

Controlling Persons Self-Certification Form - How-to Guide

Understanding the controlling persons self-certification form

The controlling persons self-certification form is an essential document that plays a crucial role in tax compliance for individuals and entities involved in international financial activities. It serves as a declaration of tax residency, helping governments streamline information sharing and prevent tax evasion. By accurately completing this form, individuals and entities confirm their compliance with tax law requirements, ensuring that they are not inadvertently falling into non-compliance traps that could lead to severe penalties.

In today's interconnected financial landscape, tax authorities around the world are increasingly emphasizing the need for transparency and information sharing. The controlling persons self-certification form provides a standardized approach to gather information about individuals who exercise ultimate control over legal entities or arrangements. Filling out this form accurately is not just a regulatory necessity; it’s also a safeguard against potential legal issues.

Who needs to fill out the form?

Generally, individuals who are considered controlling persons of an entity, such as shareholders, partners, or individuals with significant managerial control, are required to complete this form. It is typically necessary for a variety of legal entities, including corporations, partnerships, and trusts, when they open bank accounts or engage in other financial activities that necessitate disclosures about their ownership and control structures.

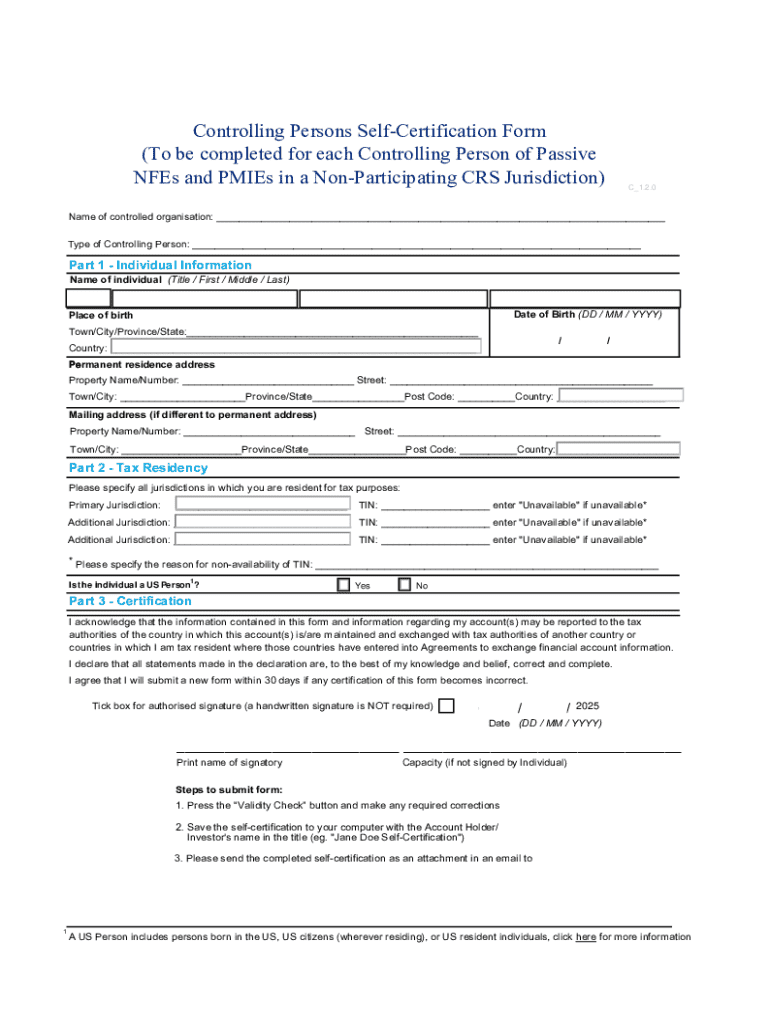

Key components of the form

Understanding the key components of the controlling persons self-certification form is vital to ensure that all required information is accurately provided. The form is generally divided into several sections aimed at capturing essential personal and tax-related information. The personal information section requests basic details necessary for identity verification, while the tax residency information section pertains to the jurisdictions in which the individual holds tax obligations.

Another critical component involves detailing the controlling persons, which refers to individuals who have significant influence or control over the entity's operations or assets. This aspect is especially important for entities with complex structures.

Personal information section

Included in the personal information section are specifics such as the person's full name, address, date of birth, and tax identification number (TIN). These details help tax authorities ascertain the identity of the individual and confirm their tax residency status.

Tax residency information

Tax residency information requires the individual to declare their tax residency status. This often includes identifying all jurisdictions where they are liable to pay taxes. For individuals managing assets or operations in multiple countries, this part is crucial to avoid cross-border tax issues and non-compliance.

Controlling persons details

Identifying controlling persons involves stating who qualifies as such, based on ownership percentages or control rights. Establishing clear control is vital for adherence to legal standards, particularly to reduce risks associated with money laundering and tax evasion.

Step-by-step instructions for completing the form

Completing the controlling persons self-certification form requires methodical attention to detail. Begin by gathering all necessary documentation to support the information you are about to provide. Important documents include proof of identity (such as a passport or ID card), tax residency certificates, and if applicable, documents confirming ownership or control of entities.

Next, as you fill out the form, ensure you accurately enter personal information, which typically includes your full name, date of birth, address, and TIN. Double-check these details, as errors can lead to delays or complications in processing your form. Moving on to tax residency, clearly state all applicable jurisdictions where you are a tax resident. Failures here could increase your risk of audits or penalties later.

After completing those sections, proceed to the controlling persons information. Carefully identify each controlling person accurately, confirming that all essential details align with other provided documents.

Common mistakes to avoid

Using pdfFiller to streamline the process

pdfFiller offers a user-friendly platform that significantly simplifies the process of completing the controlling persons self-certification form. With pdfFiller, users can easily access a variety of editing tools that allow them to customize the document before finalizing it. This means you can tailor the form to suit your specific needs while ensuring that you remain compliant with all regulations.

Editing the form

Editing the form through pdfFiller is straightforward. You can fill out each section of the self-certification form interactively, allowing you to make adjustments as needed without the hassle of printing and rewriting. The platform also provides options for inserting additional information wherever necessary, enhancing clarity and completion.

eSigning the document

Once the form is filled out, eSigning it is just as simple. pdfFiller’s e-signature functionality allows you to add your digital signature securely, ensuring that your document is legally valid. The platform guides you through the signing process, making it convenient and reliable.

Collaborating with others

Collaborating is essential in getting the controlling persons self-certification form filled out correctly, especially for entities with multiple controlling persons. pdfFiller allows you to share the document with others, making it easy for them to review, comment, and input their information directly. This collaborative capability ensures accuracy and fosters communication among all parties involved.

Saving and managing your documents

After the form is completed and signed, pdfFiller provides options for secure cloud-based storage. You can save your document directly within the platform, making it readily accessible whenever needed. This streamlined document management system encourages organizational efficiency, making it easier to retrieve forms and track their statuses later.

Submitting the form

Submission of the controlling persons self-certification form can depend on the requirements of your financial institution or relevant tax authority. Typically, you have several methods for submitting the form. Online submissions may be allowed through your bank or institution’s secure portals, while traditional methods may include mailing the completed form directly.

Regardless of the method chosen, it’s essential to ensure that your form is completed accurately and all relevant documentation is attached before submission. After you submit, it’s wise to follow up to ensure that it has been received and processed correctly. This could involve checking the status through your financial institution’s portal or contacting their customer service.

Follow-up procedures

After submitting your controlling persons self-certification form, you should keep an eye on its processing status. Generally, processing times can vary by institution, but it's prudent to expect confirmation within a few weeks. If you haven’t received feedback or confirmation, reach out directly to the relevant institution to clarify any outstanding issues or confirm receipt of your submission.

Frequently asked questions (FAQs)

What happens if make a mistake?

If you realize that a mistake has been made after submitting the controlling persons self-certification form, it’s vital to act quickly. Most institutions allow you to correct errors by submitting a revised form or a written request detailing the changes needed. Ensure you keep documentation of any communications regarding these corrections.

How long does processing take?

Processing times can differ based on the receiving institution and the complexity of the submitted information. Generally, you might expect a confirmation within two to four weeks. However, variations can occur, so be sure to check directly with the institution for specific timeframes.

What if my details change?

If your details change after submitting the self-certification form, such as a change in tax residency or a change in controlling persons, it's crucial to inform the relevant institution promptly. Request guidance on how to update your information, as failure to do so may lead to regulatory complications.

Real-life examples and case studies

Example scenarios

Consider an individual named Sam, who controls a family business operating across multiple countries. Sam completed the controlling persons self-certification form, accurately reflecting his tax residency in both his home country and the foreign jurisdiction. By providing all necessary details, he avoided compliance issues and ensured that the business met necessary regulatory standards. Another situation could involve a holding company that operates in different territories, where the need for precise identification of multiple controlling persons becomes critical to maintain transparency and uphold tax regulations.

Testimonials from users

Many individuals and teams using pdfFiller have shared their positive experiences with completing the controlling persons self-certification form. Users appreciate the platform for its straightforward interface and collaborative features. One user noted how easy it was to gather input from other controlling persons and submit the form without hassle. Overall, feedback indicates that pdfFiller significantly simplifies the complexities often associated with regulatory documentation.

Troubleshooting common issues

Technical challenges with the form

While pdfFiller is designed to minimize technical issues, some users may encounter challenges during the completion process. Common issues can include problems with uploading documents or saving changes. If you face any difficulties, pdfFiller's support resources offer guidance and troubleshooting tips, ensuring you can address any issues quickly.

Understanding regulatory questions

Regulatory questions can often arise when completing the controlling persons self-certification form. If you need clarification on specific aspects, reaching out to your financial institution or a tax professional is advisable. They can help ensure you understand the requirements and that your submission meets all necessary regulations.

Conclusion and next steps

Best practices for keeping document records

To maintain compliance and ensure future accessibility, adopting best practices for document management is vital. After submitting the controlling persons self-certification form, store a copy of the completed document in a secure, organized location. Utilize pdfFiller’s cloud storage capabilities to ensure that your documentation is both safe and retrievable when needed.

Additionally, monitor future tax residency changes or adjustments to controlling entities, taking timely action to update your documentation as necessary. This proactive approach will not only help maintain compliance but also alleviate potential future complications.

Inviting further questions or support

If you have questions or require assistance, don't hesitate to seek support from pdfFiller's comprehensive help resources or directly contact customer support. Access to assistance ensures that you can navigate the complexities surrounding the controlling persons self-certification form effectively, allowing you to focus on your primary financial and strategic objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit controlling persons self-certification form straight from my smartphone?

How do I fill out controlling persons self-certification form using my mobile device?

How do I fill out controlling persons self-certification form on an Android device?

What is controlling persons self-certification form?

Who is required to file controlling persons self-certification form?

How to fill out controlling persons self-certification form?

What is the purpose of controlling persons self-certification form?

What information must be reported on controlling persons self-certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.