Get the free Covered California for Small Business Change Request Form for Employers

Get, Create, Make and Sign covered california for small

Editing covered california for small online

Uncompromising security for your PDF editing and eSignature needs

How to fill out covered california for small

How to fill out covered california for small

Who needs covered california for small?

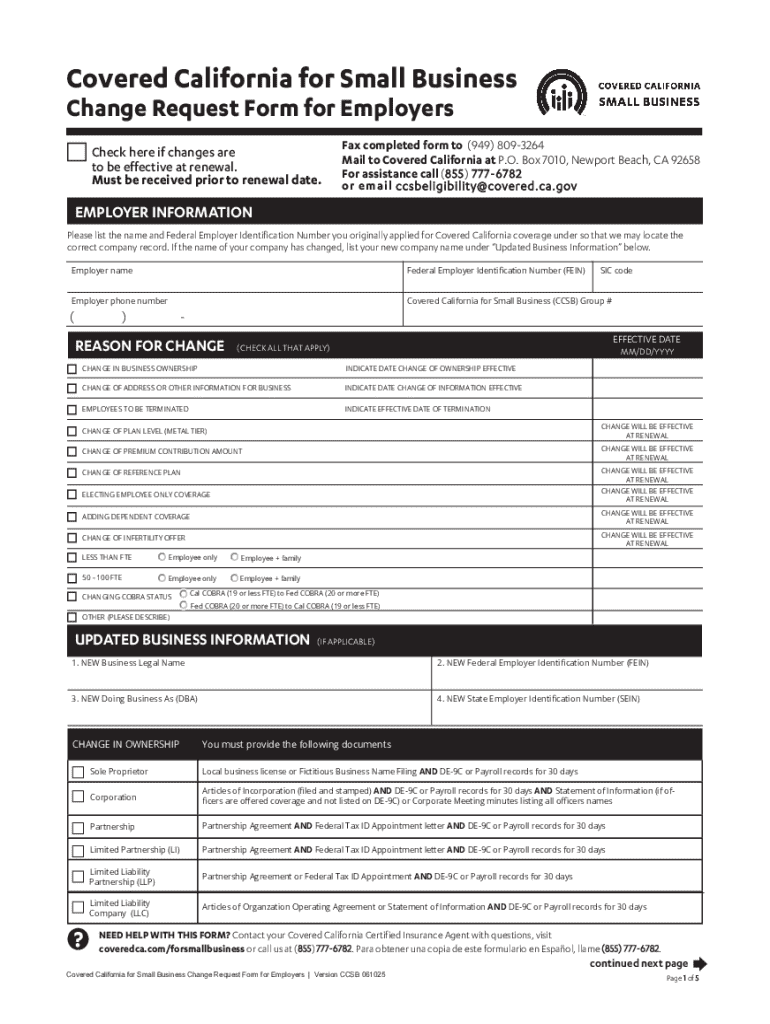

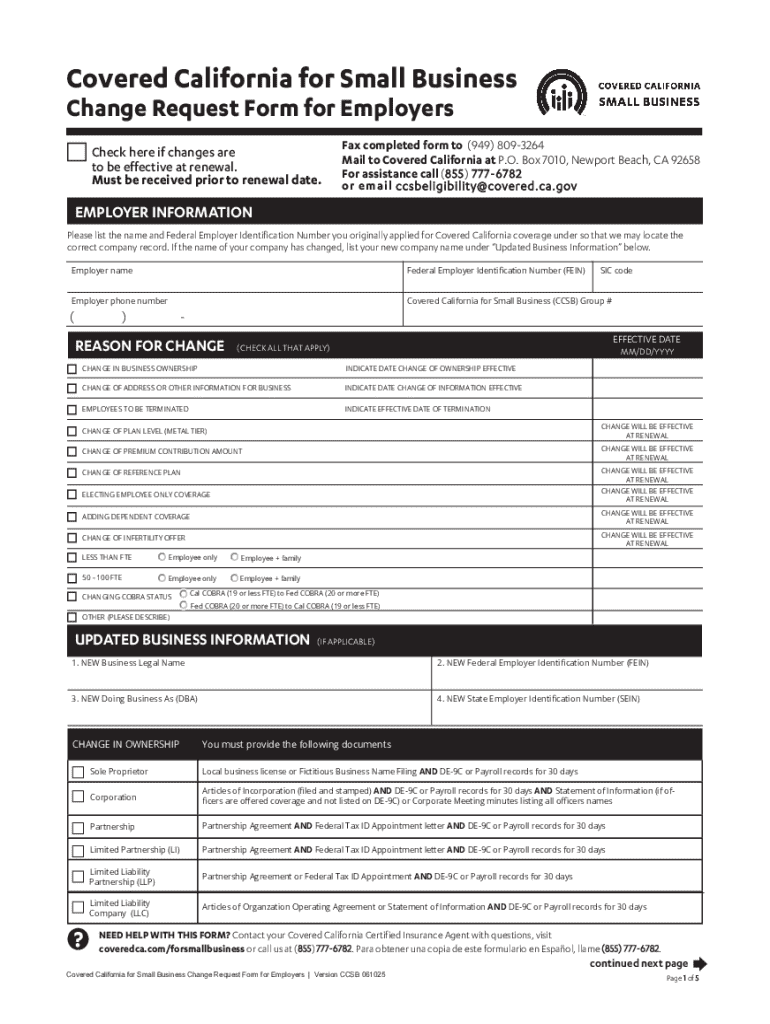

Covered California for Small Form: A Comprehensive Guide for Small Businesses

Understanding Covered California for small businesses

Covered California is the health insurance marketplace established to provide Californians with access to affordable health care. It plays a crucial role for small businesses by facilitating the purchase of health plans that meet federal standards. Unlike traditional health insurance options that can be complex and challenging to navigate, Covered California offers streamlined processes, making it easier for entrepreneurs to secure coverage for their employees. With its focused design for the small group market, it enhances the ability of small businesses to offer competitive benefits.

Importance of health coverage for small business employees

Providing health insurance is not just a legal obligation for some businesses; it also reflects the value an employer places on the well-being of their employees. Studies indicate that businesses offering health insurance are more likely to retain their talent. In fact, nearly 70% of employees consider health benefits a critical factor in their job satisfaction. By investing in employee health coverage, businesses can significantly boost morale and reduce turnover, which ultimately translates into a more stable workforce.

Qualifying for tax credits and benefits

Small businesses can navigate the complexities of tax credits offered through Covered California by understanding their eligibility criteria. Generally, small businesses with fewer than 25 full-time equivalent employees (FTEs) earning an average salary of less than $51,000 may qualify for significant tax credits. The federal government can subsidize up to 50% of premiums paid by small businesses on behalf of their employees. These incentives can greatly alleviate the financial burden on employers while enabling them to provide necessary health coverage.

Key changes and updates

Staying informed about updates to Covered California is vital for small businesses. Recent changes to policies and eligibility criteria can affect the level of health coverage available, and keeping abreast of these changes ensures businesses comply with the law. Additionally, legislative updates can introduce new incentives or modify existing tax credits, thus directly impacting the overall affordability of health insurance for small businesses.

Cost-sharing reductions explained

Cost-sharing reductions (CSRs) are vital in helping lower out-of-pocket costs for employees enrolled in specific health plans through Covered California. Understanding how CSRs function allows small business owners to provide better financial support to their employees when it comes to deductibles, copayments, and coinsurance. This is particularly important for lower-income employees who may qualify for enhanced CSRs based on their income levels. The application process for CSRs is integrated into the coverage application and typically involves submitting income documentation.

Coverage levels and options

Covered California offers a range of coverage levels to meet the diverse needs of small businesses and their employees. The plans include Bronze, Silver, Gold, and Platinum tiers, each designed to strike a balance between premium payments and out-of-pocket costs. Bronze plans generally have lower monthly premiums but higher costs when care is needed, while Platinum plans offer the opposite: higher premiums with lower out-of-pocket expenses. This structure allows employers to select plans that resonate best with their employees' needs, making health insurance more accessible.

Essential health benefits

Covered California plans include a comprehensive list of essential health benefits that cover a wide range of services necessary for maintaining health. These benefits include hospitalization, prescription drugs, preventive services, maternity and newborn care, mental health services, and more. By offering a plan that includes these essential benefits, businesses not only comply with regulations but also promote the overall well-being of their employees, fostering a healthier, more productive workplace.

Dental and vision coverage options

In addition to standard health coverage, small businesses can offer dental and vision benefits through Covered California. Dental coverage can vary from basic preventive services to more comprehensive care options, enabling employees to access necessary dental health services without exorbitant out-of-pocket costs. Vision care options also enhance the overall coverage provided and reflect a strong commitment to employee health. In today’s competitive employment landscape, having these additional benefits can be a strong draw for potential employees.

Navigating health care resources for small businesses

Covered California provides numerous resources that support small businesses through the health care process. These resources include access to calculators for determining premiums and subsidies, informative guides for understanding health coverage, and direct customer service lines for obtaining assistance. You can find essential documents and forms on their website, allowing you to take full advantage of the available options. By utilizing these resources, business owners can simplify the often-complex journey of providing health insurance.

Group submissions: A step-by-step guide

Submitting group enrollment paperwork may seem daunting, but a clear step-by-step approach simplifies the process. First, gather necessary documents including employee information and tax records. Next, complete the enrollment forms, ensuring all sections are filled accurately. After that, double-check for any required signatures before submitting the paperwork to Covered California. This organized approach reduces the chances of errors, ensuring a smoother enrollment experience.

How to enroll your small business in a health plan

Enrolling in a Covered California health plan involves several crucial steps. Start by determining your business’s eligibility and available plans during the specific enrollment period. Following this, you can explore different health plan options based on your budget and employee needs. Ensure all applications are submitted by the stated deadlines to avoid unnecessary penalties or gaps in coverage. Post-enrollment, you’ll have ongoing responsibilities such as timely premium payments and notifying Covered California of any changes in employee status.

Managing and maintaining your health coverage

Once your small business is enrolled in a Covered California health plan, effective management is essential. This includes monitoring policy renewals, understanding your coverage limits, and assisting employees with claims or questions. Make sure to review your health plan each year to adjust as needed based on employee changes or business growth. Utilizing resources available through Covered California can also provide support, enabling you to navigate the complexities of maintaining health coverage efficiently.

Benefits of using pdfFiller for document management

pdfFiller offers a powerful solution that simplifies managing documents related to Covered California. With its cloud-based platform, users can easily edit, fill out, and sign health coverage forms online. This streamlines the document creation process, allowing small business owners to focus more on their operations and less on paperwork. Moreover, important health coverage documents can be organized in one place, enhancing productivity and promoting transparency.

Success stories: Real-life examples of small businesses

Real-life examples illustrate the positive impacts of implementing health coverage through Covered California. Small businesses that adopted comprehensive health plans report higher employee satisfaction and productivity. For instance, a tech startup took advantage of Covered California's tax credits, enabling them to offer quality health coverage without overwhelming financial strain. Business owners have reported improved employee morale, retention rates, and productivity since enrolling in these plans, proving the value of health coverage in fostering a thriving workplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit covered california for small online?

How do I fill out covered california for small using my mobile device?

How do I edit covered california for small on an iOS device?

What is covered california for small?

Who is required to file covered california for small?

How to fill out covered california for small?

What is the purpose of covered california for small?

What information must be reported on covered california for small?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.