Get the free Customer Credit Application

Get, Create, Make and Sign customer credit application

How to edit customer credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer credit application

How to fill out customer credit application

Who needs customer credit application?

Comprehensive Guide to Customer Credit Application Form

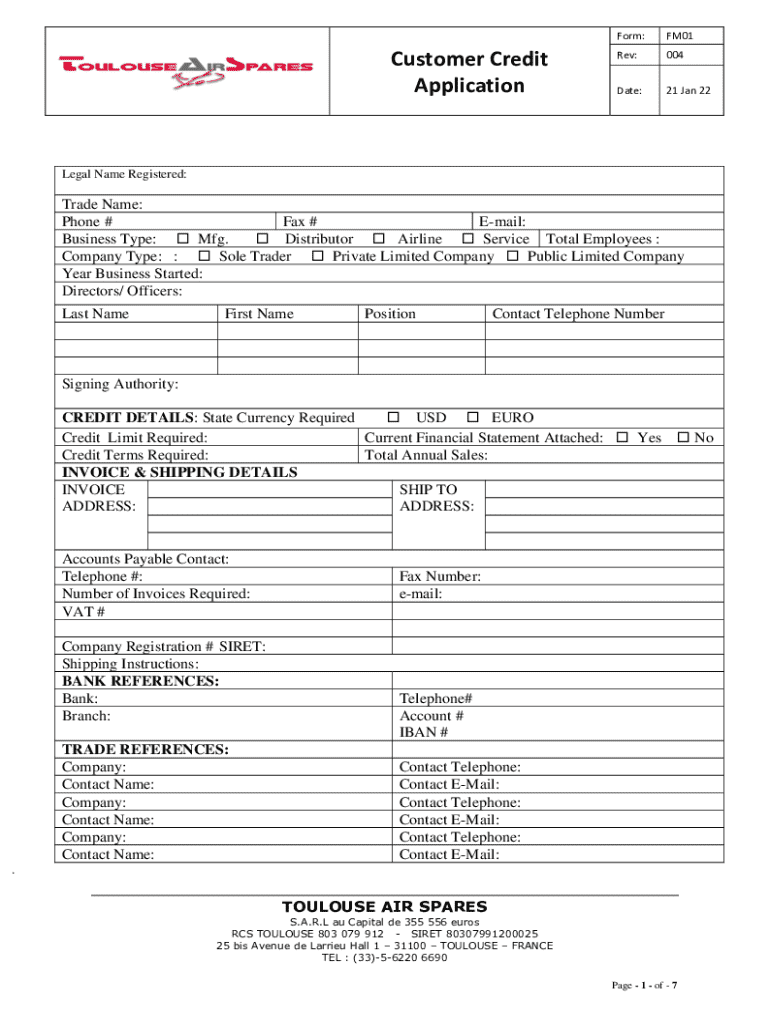

Understanding the customer credit application form

The customer credit application form is a crucial document used by businesses to assess the creditworthiness of potential clients. It serves as a formal request for credit facilities, providing lenders with insight into an applicant's financial stability and repayment capability.

Understanding the purpose of this form is vital; it not only initiates the application process but also allows companies to mitigate risks associated with lending. Without this document, businesses may face increased chances of bad debts and financial losses.

How to access the customer credit application form

Accessing the customer credit application form is straightforward, especially through platforms like pdfFiller. Users can navigate to the pdfFiller platform by visiting their official website and using the search functionality to quickly locate the template needed.

The pdfFiller library is extensive, allowing users to find the customer credit application form among various templates. For those preferring alternative sources, forms may also be available through financial institutions or industry-specific organizations that offer downloadable resources through their websites.

Detailed instructions for filling out the form

Filling out the customer credit application form accurately is crucial for a successful credit assessment. Here’s a step-by-step guide to complete each section effectively.

Start with the Personal Information Section by ensuring all details are correct. Errors here can delay processing or result in rejections. Follow with the Financial Information Section where precision is imperative; include all relevant financial details to present a clear picture.

Next, fill out the Employment History Section to demonstrate job stability. This section can significantly enhance your credibility as a borrower. Finally, review Authorizations carefully; understand that by signing, you consent to credit checks and other verification processes.

Common mistakes to avoid include leaving sections blank, providing inaccurate information, or failing to sign the document. By ensuring every detail is accurate, you improve your chances of approval of the customer credit application form while adhering to any applicable laws and regulations.

Editing the customer credit application form

Once you have filled the customer credit application form, it is often necessary to make edits. The pdfFiller platform offers a range of powerful editing tools to facilitate this process.

You can easily change any text or fields, add interactive signature fields for eSigning, and even incorporate additional documents or attachments relevant to your credit application. This flexibility not only saves time but enhances the quality and professionalism of your submission.

Collaboration is also seamless on pdfFiller; you can share the form with colleagues for feedback or use the real-time editing features to work collectively. Version control ensures that you can track changes and revert on previous iterations if needed, making the editing process smooth and efficient.

Signing the customer credit application form

Signing the customer credit application form is a critical step that ensures your intent to proceed with the credit request. pdfFiller simplifies this process with various eSigning options. You can create your digital signature directly within the platform or invite others to sign, making it easy for all parties involved.

Understanding the legal validity of eSignatures is also essential. In most jurisdictions, eSignatures hold the same legal standing as traditional handwritten signatures, contributing to the credibility of your application. To protect your signed document, follow best practices such as using secure access codes and ensuring the document is stored safely or encrypted.

Managing and submitting the customer credit application form

After completing and signing your customer credit application form, managing and submitting it appropriately is vital. pdfFiller provides several options for saving and storing your completed forms conveniently.

You can save your document directly on the platform, ensuring easy access later or use the built-in emailing function to send the form to lenders or relevant parties. Alternatively, users can download a copy for manual submission, which can be particularly useful if a particular lender requires hard copies.

Monitoring responses after submission is equally important. By following up promptly, you can address any questions or provide additional information if needed, ultimately aiding in the approval process of your customer credit application form.

Troubleshooting common issues

While using the customer credit application form, you may encounter various challenges. Knowing how to address common issues can alleviate stress and ensure a smoother experience. For instance, if you notice errors on the form after submitting, it’s advisable to contact customer support through pdfFiller immediately.

The customer support team is well-equipped to assist you with any technical difficulties or questions you may have. Additionally, familiarizing yourself with frequently asked questions related to the customer credit application form can enhance your understanding of the process.

Real-life applications and case studies

Understanding the real-world effectiveness of the customer credit application form can enhance its perceived value. Success stories show how individuals and teams have minimized turnaround time for loan applications and improved approval rates consistently through meticulous preparation and presentation.

For example, a small business owner used pdfFiller to streamline their credit applications, receiving funding four times faster than with previous methods. By diligently filling out the necessary sections and collaborating with their accountant through pdfFiller, they showcased their financial responsibility effectively, leading to a successful outcome.

Additional features of pdfFiller relevant to your needs

Beyond just creating and submitting the customer credit application form, pdfFiller provides numerous additional features that optimize document management. Integrating the form with other tools, such as CRM systems and accounting software, can streamline your workflow and enhance productivity.

Security is paramount when handling sensitive information, and pdfFiller offers robust protocols to protect your data, including encryption and secure access controls. Consider exploring the various subscription plans available, as pdfFiller caters to both individuals and teams, ensuring that you find the right solution for your document management needs.

Appendix

For those new to the customer credit application form or seeking further clarity, an appendix can be beneficial. This section may include a sample customer credit application form, highlighting effective completion methods, as well as terms of service and privacy policy information that outlines user rights and responsibilities.

Additionally, providing alternative resources for understanding credit applications and lending criteria can enhance knowledge and overall readiness when applying for credit. Being well-informed is the key to navigating financing successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send customer credit application for eSignature?

How do I execute customer credit application online?

Can I create an eSignature for the customer credit application in Gmail?

What is customer credit application?

Who is required to file customer credit application?

How to fill out customer credit application?

What is the purpose of customer credit application?

What information must be reported on customer credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.