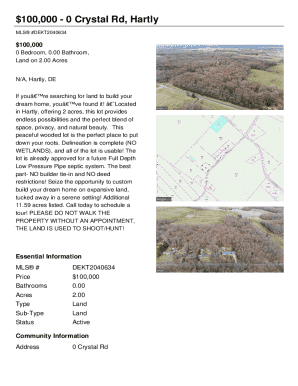

Get the free Demande De RÈglement – Assurance Voyage

Get, Create, Make and Sign demande de rglement assurance

How to edit demande de rglement assurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out demande de rglement assurance

How to fill out demande de rglement assurance

Who needs demande de rglement assurance?

Demande de Règlement Assurance Form: Your Comprehensive Guide

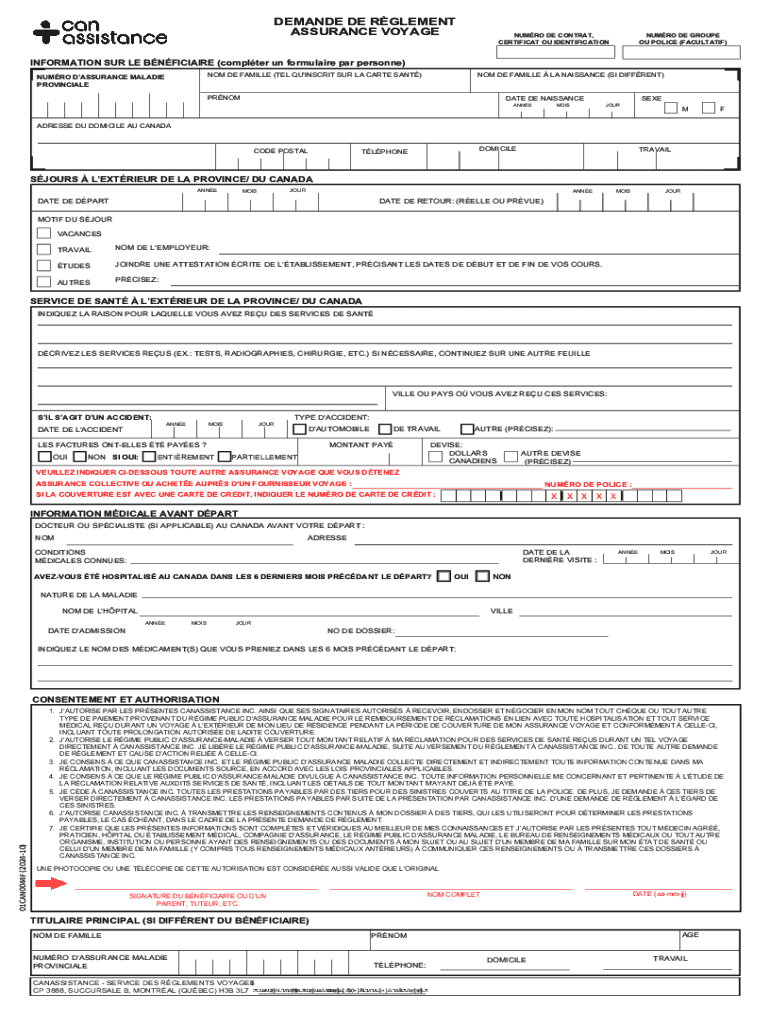

Understanding the Demande de Règlement Assurance Form

The Demande de Règlement Assurance Form is a crucial document that individuals use to formally request compensation from their insurance provider. This form serves a dual purpose: it initiates a claim process and provides the insurance company with pertinent information needed to assess and settle the claim. By understanding this form's significance, policyholders can navigate the claims process more efficiently.

Managing insurance claims effectively can make a significant difference in your financial recovery following unexpected events. Whether it's an accident, health issue, or property damage, knowing how to fill out and submit this form correctly is paramount.

Preparing to fill out the Demande de Règlement Assurance Form

Before diving into the form, gathering all necessary information is essential. Ensure that you have the following personal details ready: your full name, contact information, and any identification numbers related to your policy. Typically, insurance policies come with a unique number. Have this information on hand as it directly links your claim to your specific account.

Additionally, it's crucial to document specifics about the incident that led to your claim. This includes the dates of the event, locations where it occurred, and a detailed description of what transpired. Accurate details will facilitate a smoother assessment process by your insurance provider.

You will also need specific documents for submission. This may include proof of loss documentation, medical reports or hospital receipts, and any other relevant forms the insurer may require.

Step-by-step guide to completing the Demande de Règlement Assurance Form

Completing the Demande de Règlement Assurance Form might seem daunting at first, but breaking it down into manageable steps can help simplify the process. Here's a detailed walkthrough:

By following these steps carefully, you'll ensure that your application is submitted with clarity, increasing your chances of a successful claim.

Submitting the Demande de Règlement Assurance Form

Once you have completed the form and gathered all necessary documents, the next step is submission. Depending on your insurance provider, you often have multiple options for submitting your claim. Online submission is increasingly popular, allowing for faster processing times, while traditional paper submissions are still available.

Regardless of the method you choose, be aware of any deadlines for submitting your claim. Insurance companies typically have strict timelines that must be adhered to for the claim to be valid. After submission, it's wise to track your submission to ensure it has been received and is being processed.

After submission: What to expect

After you have submitted your Demande de Règlement Assurance Form, the processing of your claim will begin. This timeline can vary significantly based on the type of claim and the insurance company involved. Generally, simpler claims, like those for minor accidents, may be processed within weeks, while more complex claims can take several months.

It is essential to follow up on the status of your claim periodically. Keep a detailed record of any interactions you have with your insurance provider, including dates and times of calls or emails, as this can be helpful if any issues arise.

Troubleshooting common issues

If your claim is denied, it can be frustrating, but it's essential to understand that this is not necessarily the end of your claim's journey. You have the right to appeal the decision. Each insurance company usually has a clearly defined appeals process, and knowing these steps can help you navigate the situation effectively.

If you find yourself needing assistance, contacting your provider can often clear up confusion and lead to solutions.

Tips for a smooth claims experience

Staying organized throughout the claims process can significantly improve your experience. Keeping meticulous records of all documents, correspondences, and receipts related to your claim will offer peace of mind and bolster your case should any issues arise.

Utilizing digital tools, like pdfFiller, streamlines document handling. With features that enhance document management, users can fill out, edit, and sign their forms electronically. This not only speeds up the submission process but also integrates collaboration tools that allow multiple parties to contribute to the claim if necessary.

Frequently asked questions (FAQs)

Understanding the finer points of the Demande de Règlement Assurance Form may lead to some common questions, including what happens if you miss the submission deadline or if you can modify the form after submission. Typically, failing to meet the deadline may result in your claim being rejected, stressing the importance of timely submission. Modifying a form after its submission is also typically not permitted, which highlights the need for careful review before sending it off.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send demande de rglement assurance for eSignature?

How do I make changes in demande de rglement assurance?

How do I fill out demande de rglement assurance using my mobile device?

What is demande de rglement assurance?

Who is required to file demande de rglement assurance?

How to fill out demande de rglement assurance?

What is the purpose of demande de rglement assurance?

What information must be reported on demande de rglement assurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.