Get the free Merchant Service Agreement

Get, Create, Make and Sign merchant service agreement

Editing merchant service agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merchant service agreement

How to fill out merchant service agreement

Who needs merchant service agreement?

Understanding the Merchant Service Agreement Form: A Comprehensive Guide

Overview of merchant service agreement

A Merchant Service Agreement (MSA) is a legally binding document that outlines the terms and conditions under which payment processing services are provided to businesses. The primary purpose of an MSA is to define the responsibilities of both the merchant (the business seeking payment services) and the payment processor (the bank or institution providing these services). Understanding the particulars of your Merchant Service Agreement is crucial for ensuring compliance, minimizing operational risks, and maximizing the efficiency of your payment systems.

Equipping yourself with knowledge about the MSA enables businesses to navigate the complexities of payment processing while protecting their interests. Furthermore, key parties involved in the agreement typically include the merchant, the acquiring bank (which facilitates payment processing), and the payment gateway service provider—which often integrates with the business’s system to securely process transactions.

Key components of a merchant service agreement

Every Merchant Service Agreement should include several essential components that detail the expectations and responsibilities of each party. Understanding these components is vital for effective management and successful business operations.

Understanding merchant fees and revenue shares

Fees associated with merchant services can vary significantly based on the payment processor and the nature of the business. Understanding these fees is critical to maintaining your business's financial health.

Revenue share models can also define how profits from transaction fees are split, with details that vary based on the agreement specifics between the merchant and the service provider.

Legal considerations in the merchant service agreement

Legal stipulations are integral to protecting both the merchant and the service provider. It is crucial to know the legal landscape that governs your agreement.

Navigating merchant obligations and rights

An effective Merchant Service Agreement delineates the obligations and rights of the parties involved, which is essential for a harmonious relationship between the merchant and payment processor.

Managing disputes and resolution techniques

Disputes may arise during the execution of a Merchant Service Agreement. Having a structured dispute resolution process is essential for addressing these conflicts efficiently.

Modifications and termination of the agreement

As businesses evolve, adjustments to the Merchant Service Agreement may be necessary. Understanding how to modify or terminate the agreement is fundamental.

Special provisions

Certain provisions in the Merchant Service Agreement can have significant implications for the parties involved. Understanding these special provisions is necessary for effective risk management.

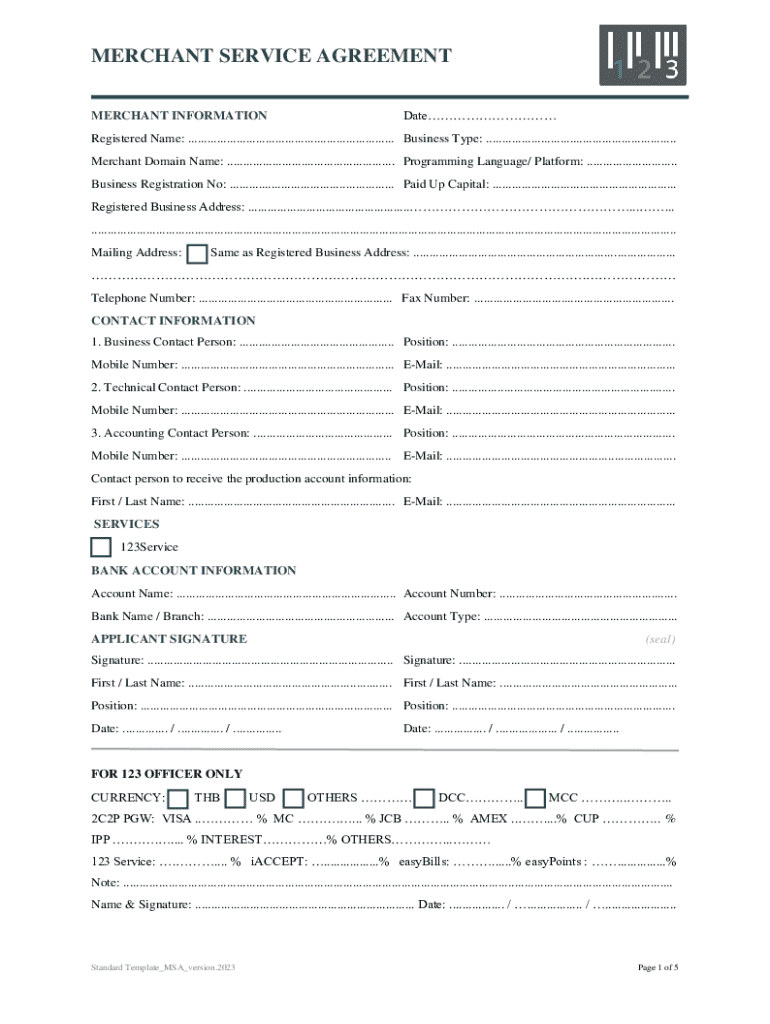

Guidelines for completing your merchant service agreement form

Filling out the Merchant Service Agreement Form accurately is vital for establishing a clear understanding between parties. Below are practical steps to ensure completeness and accuracy.

Conclusion: empowering your business through a comprehensive merchant service agreement

The importance of understanding and effectively managing your Merchant Service Agreement cannot be overstated. A well-structured agreement not only protects your rights but also establishes trust between you and your payment processor. Emphasizing the unique features of pdfFiller, this platform empowers you to seamlessly edit PDFs, eSign, and collaborate on your documentation needs. By utilizing these tools, you can enhance your operational efficiency and navigate the complexities of payment processing with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute merchant service agreement online?

How do I make edits in merchant service agreement without leaving Chrome?

How do I fill out the merchant service agreement form on my smartphone?

What is merchant service agreement?

Who is required to file merchant service agreement?

How to fill out merchant service agreement?

What is the purpose of merchant service agreement?

What information must be reported on merchant service agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.