Get the free Cdtfa-400-lme

Get, Create, Make and Sign cdtfa-400-lme

How to edit cdtfa-400-lme online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-400-lme

How to fill out cdtfa-400-lme

Who needs cdtfa-400-lme?

CDTFA-400-LME Form - How-to Guide Long-Read

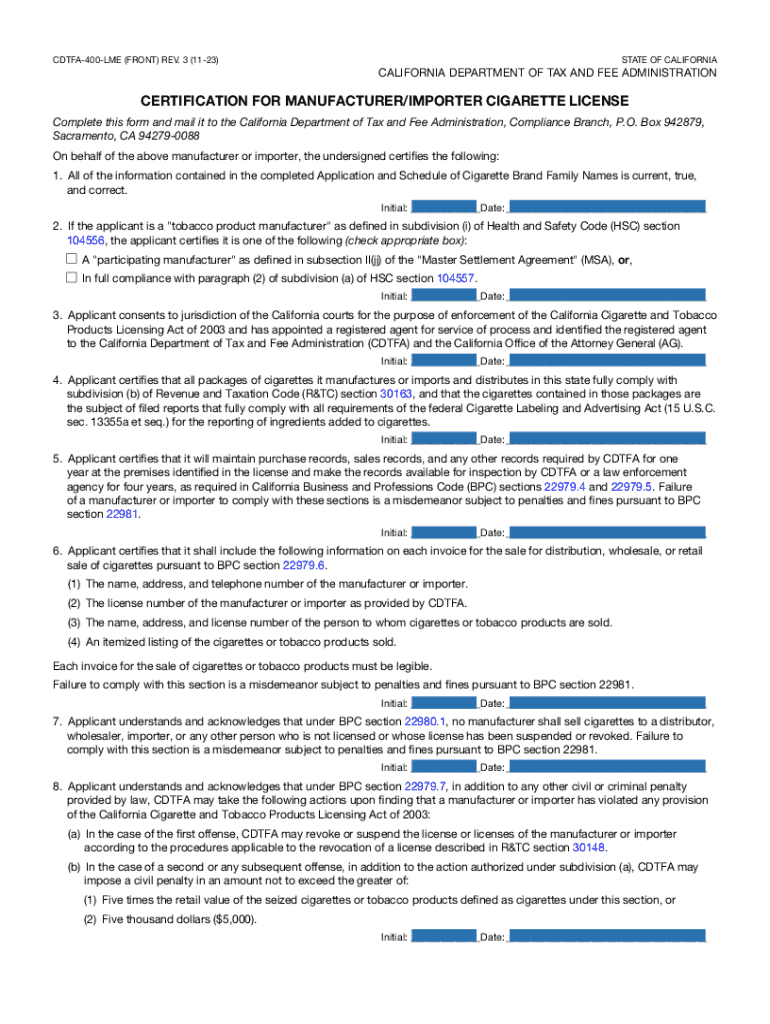

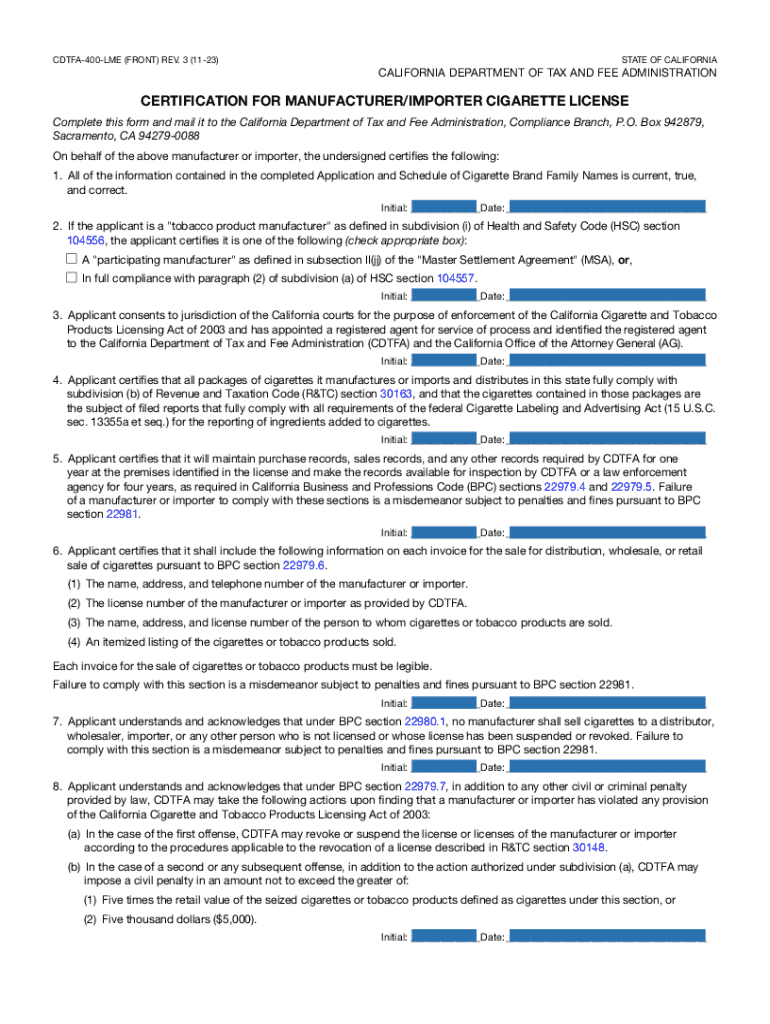

Overview of the CDTFA-400-LME Form

The CDTFA-400-LME form, officially known as the 'Claim for Refund of Sales and Use Tax', serves as a critical document for California taxpayers seeking a refund on overpaid sales tax or use tax. It is especially relevant in contexts involving tax relief related to disasters, state emergencies, and other exceptional circumstances. For many taxpayers, understanding how to properly navigate this form can mean significant financial recuperation.

For California residents and businesses alike, the CDTFA-400-LME form plays a pivotal role. Taxpayers who have inadvertently overpaid sales or use tax find this form essential for reclaiming funds. This could involve various situations, including incorrect billing, erroneous tax charges, or specific disaster-related tax relief, ensuring compliance and managing financial affairs effectively.

Applicability

The CDTFA-400-LME form is designed for a broad audience within California, including individuals and businesses alike. Generally, if you have paid more sales tax than required or are eligible for disaster relief, you should consider filing this form. However, it’s essential to determine if exceptions apply to your case, such as certain non-profit organizations or governmental entities that may follow different regulations.

To better clarify eligibility, consider the following categories: individuals who purchased goods within the state, businesses engaged in tax-exempt sales, and organizations claiming disaster relief. Each group operates under various criteria, so reviewing specific requirements is crucial.

Key features of the CDTFA-400-LME Form

The CDTFA-400-LME form is structured to provide a clear path for taxpayers to obtain refunds. Its sections are designed to capture essential details regarding taxable sales, exempt sales, and necessary declarations. Understanding the form's structure is vital for ensuring a smooth completion process.

A breakdown of each section reveals distinct purposes: Personal Information, Taxable Sales Information, Exempt Sales and Deductions, and Signatures and Declarations. Each plays a crucial role in outlining the taxpayer's details and substantiating their claim for a refund.

Common errors include misreporting sales amounts or forgetting to sign the form. To avoid such mistakes, it’s advisable to double-check figures, ensure all required sections are complete, and utilize tools like pdfFiller for enhanced accuracy.

Step-by-step instructions for completing the CDTFA-400-LME Form

Before you start filling out the CDTFA-400-LME form, gathering necessary documents is crucial. This includes sales records, tax invoices, and any relevant disaster declarations. Remember that deadlines vary based on the nature of your claim, so plan accordingly to avoid late submissions.

Now let’s go through the form section-by-section to ensure clarity and accuracy during completion.

Double-check all entries for accuracy before submission. Small discrepancies can lead to processing delays, which you want to avoid.

Using pdfFiller to fill out and manage the CDTFA-400-LME Form

pdfFiller offers an accessible platform to manage the CDTFA-400-LME form seamlessly. Begin by navigating to pdfFiller's website and finding the form using easy search functionalities or through predefined templates specific to California tax forms.

Once located, editing tools become available at your disposal. You can modify any section of the form, correct errors, or add required data before finalizing the document.

This digital platform not only simplifies the filling process but also enhances your overall document management experience, making it easier to track submissions and revisions.

Frequently asked questions (FAQs)

Many taxpayers find themselves with questions surrounding the CDTFA-400-LME form. Common queries involve the implications of errors and what steps to take once the form has been submitted.

Related forms and documents

Taxpayers dealing with the CDTFA-400-LME form should also be aware of other related forms that can provide additional relief or impact tax returns, such as the CDTFA-400-LTE form. Understanding the distinctions between these forms help in ensuring all tax affairs are in order.

Ensure you're downloading forms from official sources to avoid discrepancies and always refer back to the CDTFA for the latest versions and updates.

Tools and resources available on pdfFiller

pdfFiller stands out as an interactive tool for users seeking effective document management solutions. With various features catering to both individuals and teams, this platform makes filling out forms like the CDTFA-400-LME not only efficient but also intuitive.

Team functionalities allow users to collaborate in real-time, manage permissions, and share crucial documents effortlessly—even during taxing deadlines. This offers an organized approach to handling multiple forms and compliance documents without chaos.

User experiences and testimonials

Real-life experiences from users highlight the transformative effect pdfFiller has had on their document management processes. Many users report an increase in efficiency and confidence when completing the CDTFA-400-LME form, thanks to the platform's intuitive design and cutting-edge features.

Testimonials often underscore how pdfFiller has streamlined workflows, resulting in time savings and enhanced accuracy. Such positive experiences showcase the essential nature of adaptable document solutions in today's dynamic tax environment.

Additional support from pdfFiller

For users seeking assistance with the CDTFA-400-LME form, pdfFiller offers robust customer support options. Their help center is equipped with resources, including FAQs and contact information for direct inquiries.

Additionally, pdfFiller emphasizes continuous learning opportunities through the Learning Center. There, users can access webinars, tutorials, and guides designed to empower them with the knowledge needed for effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cdtfa-400-lme to be eSigned by others?

How do I make changes in cdtfa-400-lme?

Can I create an eSignature for the cdtfa-400-lme in Gmail?

What is cdtfa-400-lme?

Who is required to file cdtfa-400-lme?

How to fill out cdtfa-400-lme?

What is the purpose of cdtfa-400-lme?

What information must be reported on cdtfa-400-lme?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.