Get the free Crs Entity Self-certification Form

Get, Create, Make and Sign crs entity self-certification form

Editing crs entity self-certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs entity self-certification form

How to fill out crs entity self-certification form

Who needs crs entity self-certification form?

CRS Entity Self-Certification Form: A Comprehensive Guide

Understanding the CRS Entity Self-Certification Form

The CRS (Common Reporting Standard) is a pivotal framework established by the OECD (Organisation for Economic Co-operation and Development) designed to combat tax evasion globally. It requires participating jurisdictions to obtain information from their financial institutions and automatically exchange that information with other jurisdictions on an annual basis. This initiative significantly enhances transparency in the financial sector and aids governments in their efforts to tax foreign assets.

The CRS Entity Self-Certification Form plays a vital role in this framework. It allows entities to provide their financial institutions information about their tax residence and status. By properly completing this form, entities affirm their commitment to compliance with international tax obligations, which is essential for financial institutions to accurately report account holders' information to the tax authorities.

Who needs to fill out the CRS Entity Self-Certification Form?

Organizations and entities that hold accounts with financial institutions must complete the CRS Entity Self-Certification Form. This includes a wide range of entities such as corporations, partnerships, and trusts. In general, any entity that is not treated as an individual for tax purposes is required to submit this form. The different categories include:

Exemptions do exist. Certain governmental entities, international organizations, and specific types of non-profit organizations may not be required to file the CRS Entity Self-Certification Form. Additionally, accounts with minimal balances often fall under different exemption categories.

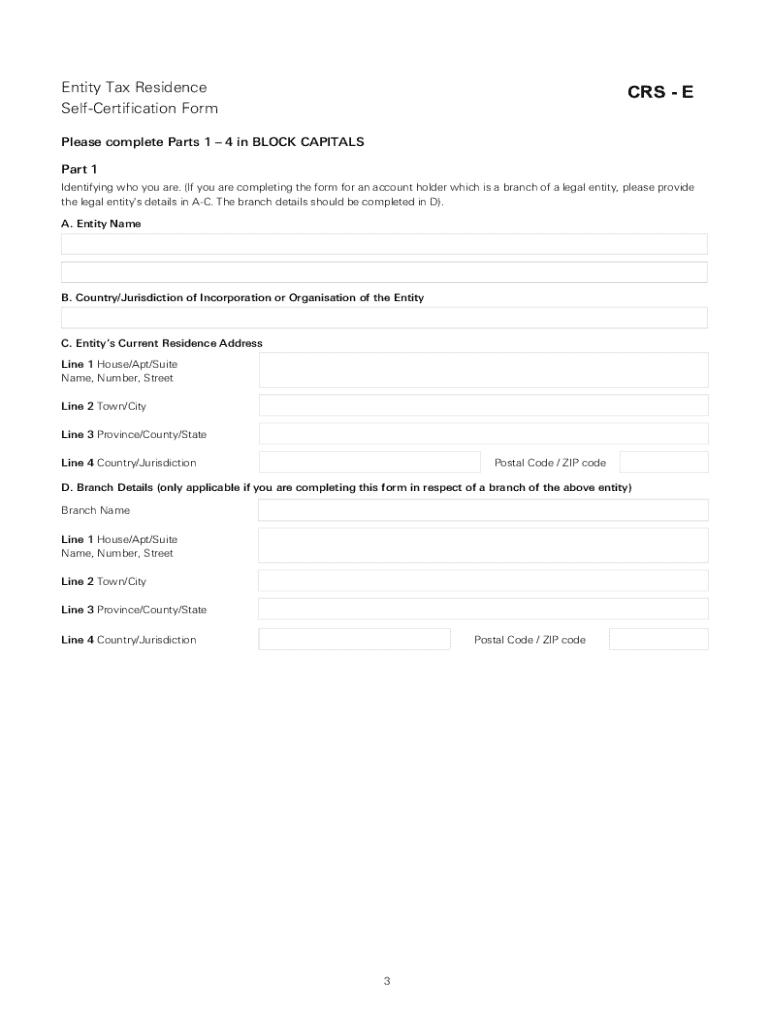

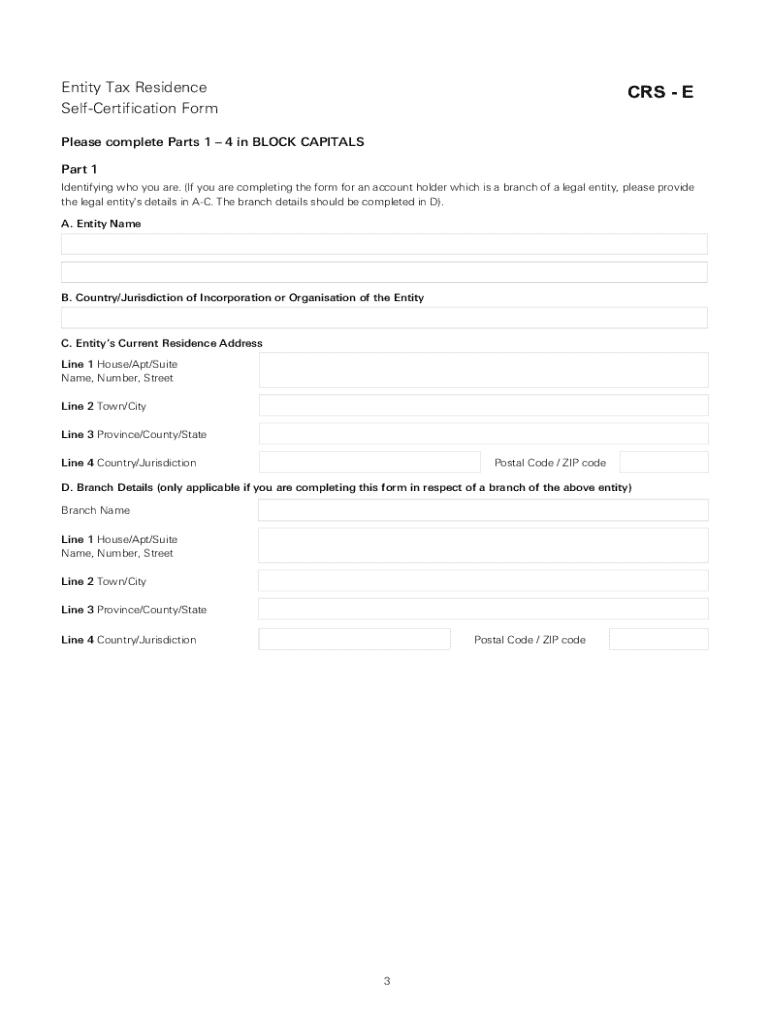

Step-by-step guide to completing the CRS Entity Self-Certification Form

Completing the CRS Entity Self-Certification Form can seem complex, but with careful preparation, it can be straightforward. Start by gathering the necessary documents and information, which may include:

When filling out the form, follow these steps:

Common mistakes when filling out the form

Filling out the CRS Entity Self-Certification Form is crucial for compliance, and mistakes can lead to significant issues. Some common errors include providing incorrect identification details or misclassifying the entity's status as active or passive. It's essential to pay close attention to these critical aspects. Consider the following tips to improve accuracy:

Managing your CRS Entity Self-Certification Form with pdfFiller

pdfFiller provides a robust, cloud-based platform that enhances the process of managing the CRS Entity Self-Certification Form. Users can access their forms from anywhere, which significantly increases convenience, particularly for teams operating in various locations. The platform’s interactive editing features make it easier to fill out forms quickly and accurately.

When utilizing pdfFiller, you can also benefit from features like:

Frequently asked questions (FAQs)

After submitting the CRS Entity Self-Certification Form, you may have several questions regarding the next steps. The processing timeline can vary based on the financial institution's internal procedures, and entities should be prepared for potential audits if discrepancies arise. It is crucial to maintain accurate records to support the information provided.

If you need to update your certification information, you typically must submit a new form reflecting the changes. This can include updates to tax residency status, ownership, or any other critical elements that may have changed since the last certification.

For those using pdfFiller, customer support is readily available for assistance with the form and any technical questions you may have.

Additional considerations related to CRS compliance

Remaining informed about regulatory changes related to the CRS is essential for ensuring compliance. As tax laws evolve, it’s crucial for entities to stay updated on their obligations to avoid penalties or fines. Non-compliance can lead to serious repercussions, including hefty financial penalties and loss of trust from clients or regulatory bodies.

Therefore, maintaining organized and accurate record-keeping practices, alongside regular reviews of compliance requirements, is crucial for all entities subject to CRS regulations. Investing time in understanding the landscape of tax compliance can save entities significant issues in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the crs entity self-certification form in Chrome?

How do I complete crs entity self-certification form on an iOS device?

How do I fill out crs entity self-certification form on an Android device?

What is crs entity self-certification form?

Who is required to file crs entity self-certification form?

How to fill out crs entity self-certification form?

What is the purpose of crs entity self-certification form?

What information must be reported on crs entity self-certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.