Get the free Check & Ach Stop Payment Request Form

Get, Create, Make and Sign check ach stop payment

How to edit check ach stop payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check ach stop payment

How to fill out check ach stop payment

Who needs check ach stop payment?

Your Comprehensive Guide to Check ACH Stop Payment Form

Understanding ACH transfers and stop payments

ACH, or Automated Clearing House, is a secure network used for electronically moving money between bank accounts. It is commonly utilized for various types of transactions, including direct deposits, bill payments, and money transfers. Understanding the nuances of ACH is essential, especially when it comes to initiating a stop payment. Stop payments on ACH transactions are specific requests sent to a financial institution to halt the processing of a transaction before it clears, distinguishing them from traditional check stop payments.

Common reasons for utilizing an ACH stop payment include unauthorized transactions, duplicate payments, or in cases where fraud prevention measures must be enacted. Unlike checks, where a stop payment can be more straightforward, ACH transactions might involve complications due to their electronic nature and the various networks involved. It's crucial to grasp these differences when addressing issues that may arise with such transactions.

When to submit an ACH stop payment form

Knowing when to act on an ACH stop payment form can be the difference between financial loss and recovery. Scenarios that necessitate submitting such a form include unauthorized transactions—where a withdrawal occurs without your permission—duplicate payments, or when there's a potential fraudulent situation. Acting promptly in these cases is vital; it minimizes potential losses and stops any unauthorized funds from being processed.

Delaying the request could lead to complications, especially as ACH transactions can be processed quickly. Staying vigilant and having proactive measures in place can help in preventing these scenarios altogether.

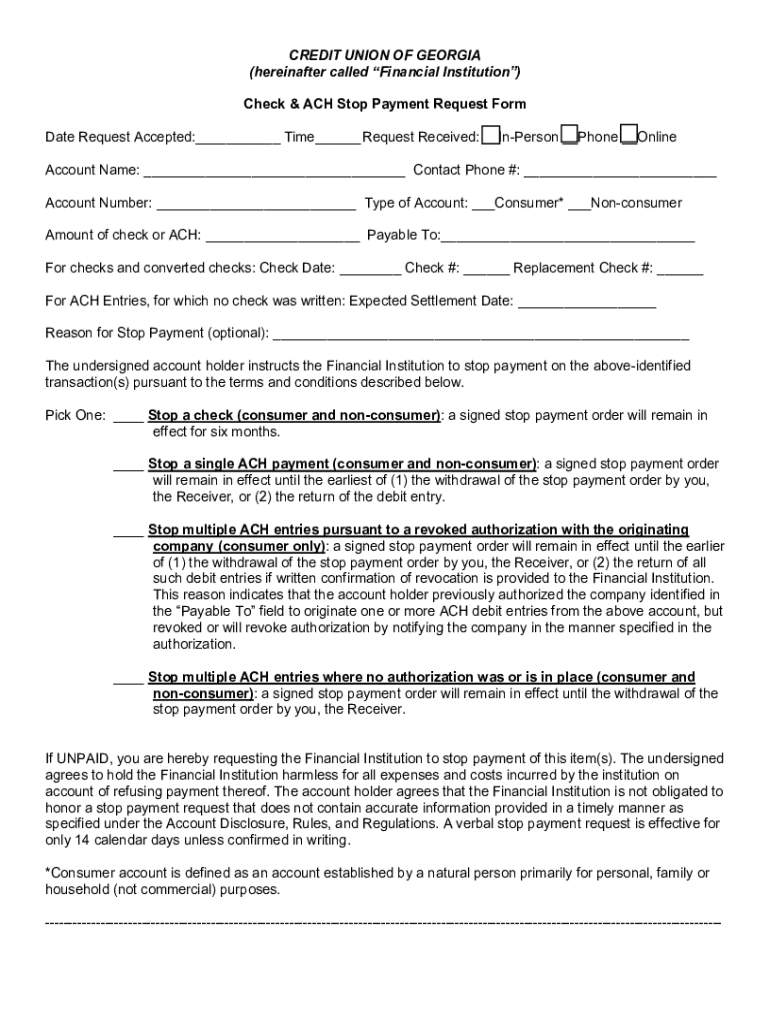

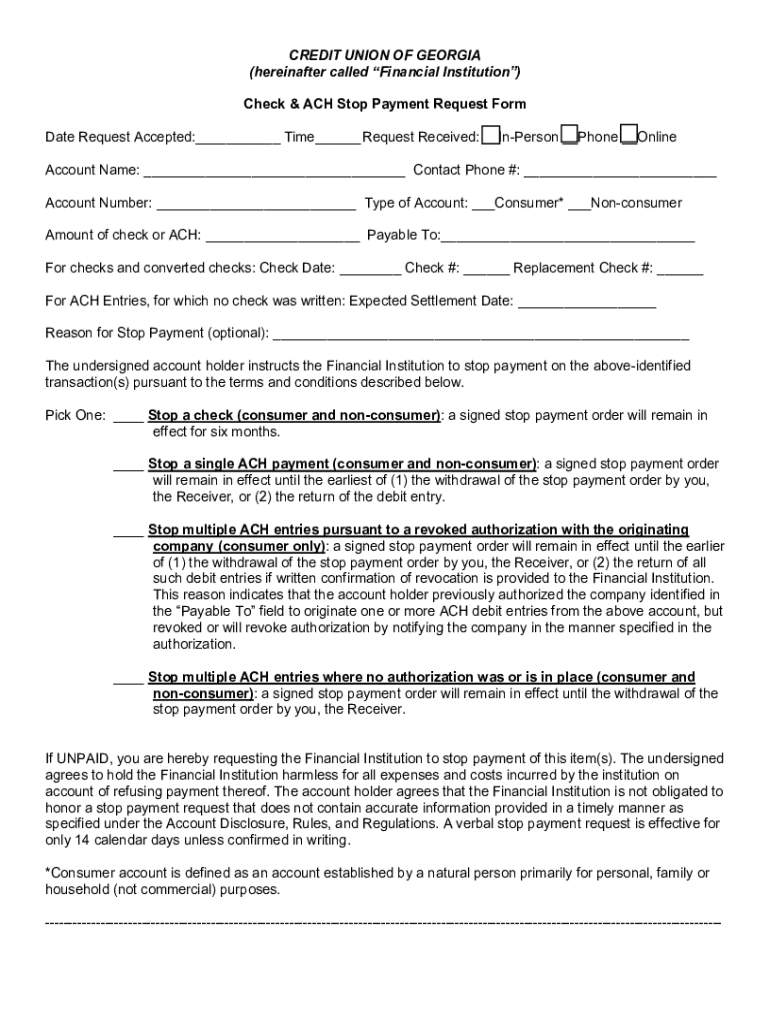

Overview of the ACH stop payment form

The ACH stop payment form is a formal document that individuals submit to their bank to stop an unauthorized or incorrect transaction from being processed. The form typically consists of several critical sections designed to collect information regarding the transaction in question. Each component serves an important purpose to ensure the proper processing of the request.

Detailed instructions for completing the ACH stop payment form

Completing the ACH stop payment form requires accuracy and attention to detail. Start by gathering necessary account details such as your account number and personal identification to prevent any delays or complications. Following that, provide specifics on the transaction; this includes the transaction date, amount, and full details of the payee. Each detail contributes to the consensus of the situation and enhances the likelihood of a successful stop payment request.

Finally, confirm your authorization. This section ensures that you agree to the stop payment request and recognize any potential implications or fees associated with the action. To ensure accuracy in your form submission, double-check all entries, as small mistakes can lead to significant delays.

Submitting your ACH stop payment form

After completing the ACH stop payment form, it must be submitted to your banking institution. There are multiple methods for submission, including using an online banking platform, visiting a bank branch in person, or sending it via postal mail. Each method has its advantages, and choosing the right one could streamline your request.

It’s crucial to consider the timing of your submission. Processing times may vary based on the method chosen and the bank’s internal protocols. Checking with your institution for specific timelines can help set the right expectations.

Fee structures for ACH stop payments

Different banks may have varying fee structures associated with ACH stop payments. Typically, banks charge a fee for handling the request, but this can differ significantly. Factors that influence these fees include the bank's policies, the type of transaction, and whether you are a premium customer or using basic services.

Being informed about your bank's policies and potential fees can help avoid surprises during the transaction process. Checking related policies beforehand can ensure you have a complete understanding and maintain control over your finances.

Following up on your stop payment request

Once the ACH stop payment form is submitted, following up is critical to ensure that your request is processed as intended. You can confirm the stop payment has been honored through your banking app or customer service. It’s advisable to regularly track pending ACH transactions after making your request to detect any inconsistencies immediately.

If your request is not honored, prompt action is necessary. Contact your bank’s customer service department to inquire about the status of your request, providing any reference number you received during submission.

Troubleshooting common issues with ACH stop payment requests

Sometimes, challenges may arise with ACH stop payment requests. Common issues include failed submissions, often due to incomplete information or network errors. If a transaction dispute occurs after requesting a stop payment, it's essential to have documentation handy as evidence of your request.

In unresolved cases, reaching out to your bank support team can provide guidance to mitigate your concerns. Having clear communication and documentation can significantly ease the resolution process.

Best practices for managing ACH transactions

Preventative measures can significantly reduce the need for stop payments on ACH transactions. Regularly monitoring your account activity enables you to spot unauthorized transactions early and take action before they become issues. Setting up transaction alert notifications can be highly beneficial; these alerts keep you informed about significant transactions.

Using pdfFiller’s platform to manage, edit, and securely store financial documents simplifies this entire process. Its user-friendly interface allows for easy navigation of necessary forms and documentation.

Conclusion & next steps

Navigating the process of completing an ACH stop payment form can seem daunting, but understanding the steps involved can simplify the task. From recognizing when to submit a stop payment to knowing how to follow up effectively, each aspect is integral in safeguarding your finances. Leveraging pdfFiller not only aids in efficiently managing this specific request but also enhances your experience with ongoing document management needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the check ach stop payment in Chrome?

How can I fill out check ach stop payment on an iOS device?

How do I fill out check ach stop payment on an Android device?

What is check ach stop payment?

Who is required to file check ach stop payment?

How to fill out check ach stop payment?

What is the purpose of check ach stop payment?

What information must be reported on check ach stop payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.