Get the free Cardholder’s Transaction Dispute Declaration Form

Get, Create, Make and Sign cardholders transaction dispute declaration

How to edit cardholders transaction dispute declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cardholders transaction dispute declaration

How to fill out cardholders transaction dispute declaration

Who needs cardholders transaction dispute declaration?

Cardholders Transaction Dispute Declaration Form: A Comprehensive Guide

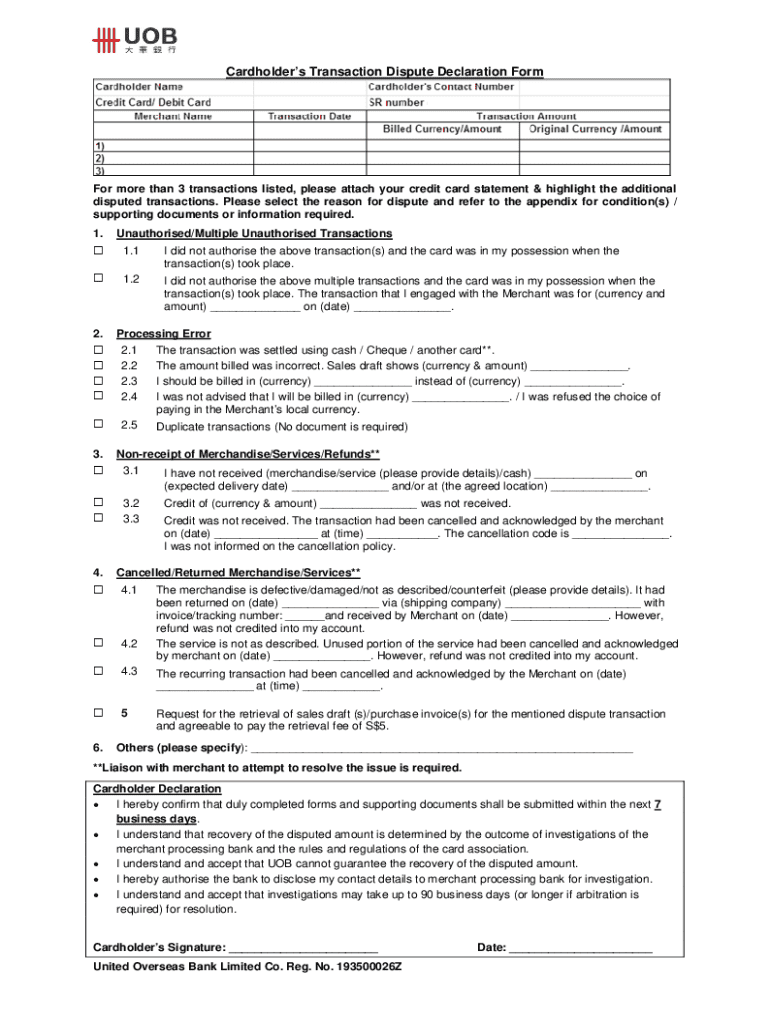

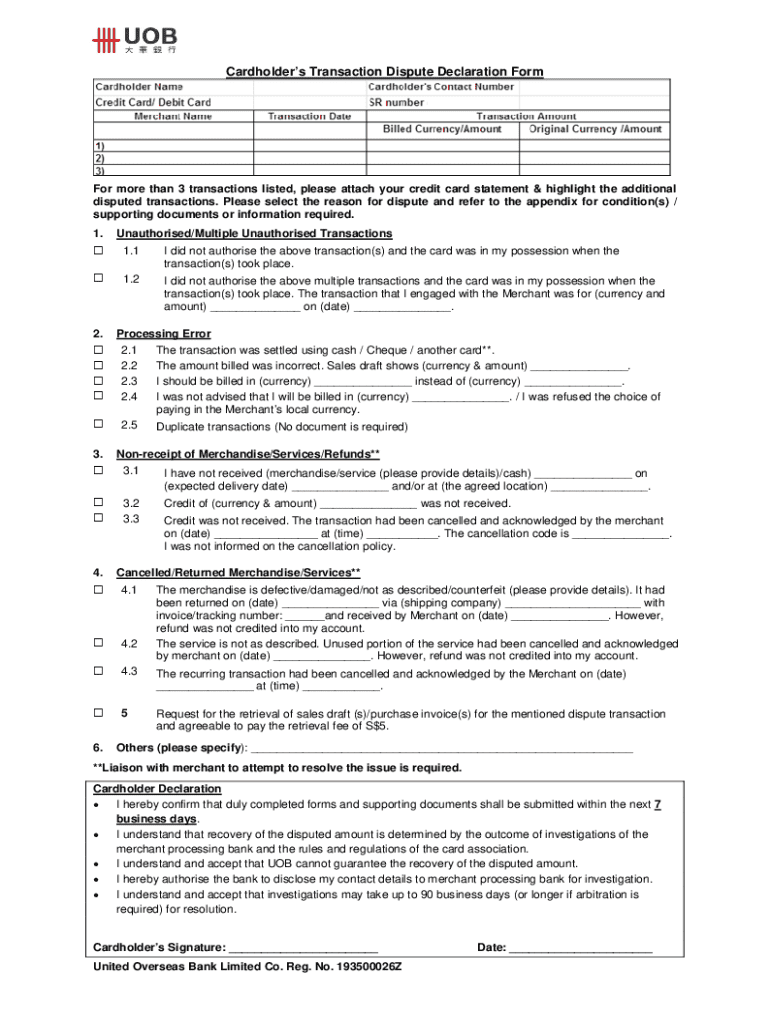

Understanding the cardholders transaction dispute declaration form

The cardholders transaction dispute declaration form serves as a critical tool for consumers facing issues with their transactions. This form allows cardholders to formally declare and initiate a dispute regarding unauthorized or incorrect charges on their bills. It plays a vital role in protecting consumers' rights against fraudulent activities or billing errors from merchants.

Several scenarios can necessitate the use of this form, including cases of fraudulent transactions, billing discrepancies, and issues related to goods and services not delivered as promised. Without a clear and structured approach to disputing these transactions, cardholders might find it challenging to resolve their grievances effectively.

For cardholders, understanding this form is paramount. It empowers them to take action regarding unauthorized charges, thereby safeguarding their financial health and consumer rights. Legal protections like the Fair Credit Billing Act ensure that cardholders have a mechanism for resolving disputes, giving them the confidence to question charges they believe are incorrect.

Preparing to fill out the form

Before diving into the actual filling of the cardholders transaction dispute declaration form, it’s essential to prepare adequately. Gather necessary information such as transaction details including the date, amount, and description of the charge you are disputing. Additionally, have on hand any receipts, bank statements, or correspondence with merchants that support your claim.

Understanding your rights as a consumer is crucial. Federal laws under the Fair Credit Billing Act provide cardholders the right to dispute unauthorized charges and outline the process that credit card companies must follow when resolving disputes. Becoming familiar with these rights can significantly empower consumers when dealing with financial institutions.

Step-by-step guide to completing the form

Completing the cardholders transaction dispute declaration form is straightforward when broken down into manageable sections. The first section typically asks for your personal information, including your name and billing address. Ensure that this information is accurate to avoid delays in processing. The subsequent sections will ask for detailed information regarding the transaction in question.

In the narrative section, clearly describe why you are disputing the transaction. Use straightforward language and include relevant details that will help the card issuer understand your position. It’s also beneficial to refer to any laws or protections that support your claim. Common mistakes include being vague or omitting crucial details, which can lead to delays or rejections of your dispute.

To ensure clarity, consider providing sample entries as guidance. For instance, detail how to state the transaction date as 'March 5, 2023', followed by an explanation such as 'I did not authorize this charge as I was not at the location on this date.'

Editing and customizing your form

pdfFiller offers an array of features that make it easy to edit the cardholders transaction dispute declaration form. Once you upload the document, you can utilize its editing tools to fill in your details accurately. This platform allows you to annotate the form, add signatures electronically, and include any additional information that may be pertinent to your case.

One standout feature of pdfFiller is its interactive tools, which simplify customization. You can access pre-made templates that expedite the process of filling out the form, reducing the chances of error. Additionally, the auto-fill options streamline your work by automatically populating common fields based on your previous entries.

Submitting your dispute

Once you have completed the cardholders transaction dispute declaration form, it's crucial to choose the right method for submission. There are typically several methods available, including digital submission through your bank's website, email, or traditional mailing. Each method has its advantages and requires different considerations.

Track your submission diligently. If mailed, retain the receipt; if emailed or submitted online, follow up with a confirmation number. Response timelines vary based on the financial institution, but typically, cardholders can expect a response within 30 to 60 days. Be prepared for various outcomes, as disputes may result in either the reversal of charges or a denial based on the supporting evidence.

Follow-up procedures

After submitting your dispute, it’s crucial to take proactive steps. If you haven’t received a response within the promised timeline, consider following up with your bank or credit card provider. Be persistent; your rights as a cardholder provide you with the authority to demand clarity on your dispute status.

Should your dispute not yield a satisfactory outcome, prepare for potential escalations. This could involve contacting a consumer advocacy group or legal assistance, depending on the nature of your dispute. Keeping thorough documentation of submitted forms, correspondence, and responses will aid in any further actions you may need to take.

Documentation is an invaluable asset in any dispute process. Retaining copies of all communications, including the cardholders transaction dispute declaration form, will enable you to track the progression of your case effectively and serve as proof of your efforts.

Additional considerations and support

During the dispute process, numerous challenges may arise, from lack of response to outright denial of claims. Addressing issues promptly is key. If your initial attempts at resolving the dispute do not succeed, consider revisiting your documentation to ensure all information is clear. Additionally, seek assistance from consumer rights organizations that can provide guidance on stringent responses.

It may become necessary to consider professional assistance, especially if your dispute involves larger sums or legal complexities. Signs you might need expert help include feeling overwhelmed by the process, lack of clarity in the responses you receive from your financial institution, or if your dispute has significant implications for your financial health.

Utilizing the pdfFiller platform for future disputes

Using pdfFiller for the cardholders transaction dispute declaration form not only helps you manage this dispute but also supports long-term document management. The platform allows for easy storage and retrieval of transaction records and dispute forms, ensuring that all necessary documents are accessible whenever the need arises.

For teams handling multiple disputes, pdfFiller’s collaborative features shine. Shared access to documents via cloud storage enables teams to work together efficiently, avoiding duplication and confusion. This collaborative effort streamlines the dispute management process, allowing teams to resolve issues swiftly and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cardholders transaction dispute declaration online?

Can I sign the cardholders transaction dispute declaration electronically in Chrome?

How can I fill out cardholders transaction dispute declaration on an iOS device?

What is cardholders transaction dispute declaration?

Who is required to file cardholders transaction dispute declaration?

How to fill out cardholders transaction dispute declaration?

What is the purpose of cardholders transaction dispute declaration?

What information must be reported on cardholders transaction dispute declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.