Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

A comprehensive guide to credit card authorization forms

Understanding the credit card authorization form

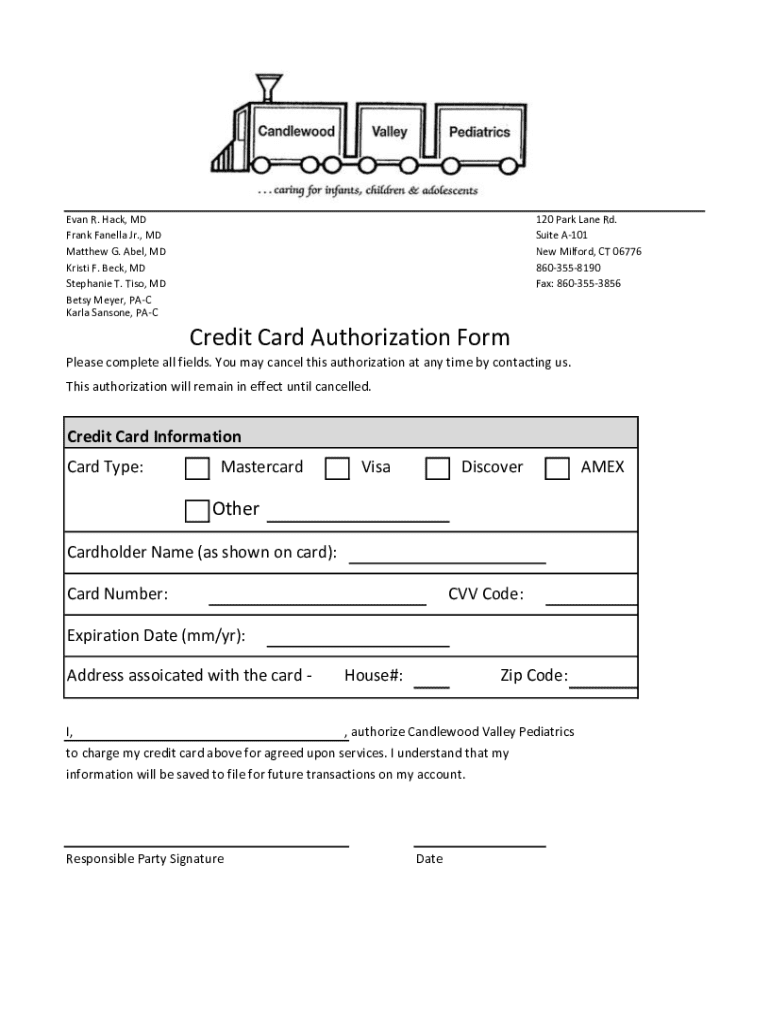

A credit card authorization form is a document used by businesses and service providers to obtain permission from a cardholder to charge their credit card for specified amounts. This form enhances transaction security by clearly outlining the conditions under which a payment is authorized, helping protect businesses against potential fraud and chargebacks.

The primary purpose of a credit card authorization form is to establish a clear agreement between the cardholder and the merchant. This clarity helps to prevent misunderstandings related to payments, ensuring that both parties know what to expect. Furthermore, the form acts as a safeguard for both businesses and consumers by providing a documented consent level for financial transactions.

It's important to differentiate a credit card authorization form from general payment forms. While both serve the purpose of facilitating transactions, authorization forms specifically focus on securing consent for the use of a card, especially for recurring payments and larger transactions.

Importance of using a credit card authorization form

Utilizing a credit card authorization form is critical for preventing chargeback abuse, which can be financially devastating for businesses. Chargebacks occur when a customer disputes a transaction, often leading to the merchant losing both the product/service and the payment. Having an authorization form in place helps to establish that the charge was agreed upon, reducing the likelihood of such disputes.

Another key advantage of using this form lies in ensuring transaction security. It builds a secure channel of communication between the merchant and customer, assuring that sensitive card details are handled with care. The presence of a signed authorization form fosters trust, as customers feel more confident knowing that their consent is documented and secure.

From a legal standpoint, using a credit card authorization form can protect businesses in case of chargebacks or transaction disputes. It provides legal evidence that the customer authorized the transaction, making it an essential aspect of securing payment agreements.

Components of a credit card authorization form

A credit card authorization form should contain several essential details to ensure it serves its purpose effectively. First, it must include the cardholder's information, which typically consists of the name, billing address, and contact information. Next, the payment amount being authorized is crucial, as both parties need to agree on the exact sum involved.

Additionally, merchant information must be clearly presented, including the name and contact details of the business. Optional elements may enhance security, such as requiring the CVV code, specifying expiration dates, and noting the type of credit card being used.

Another essential component is the signature section. This area serves as proof that the cardholder has agreed to the charge, strengthening the validity of the transaction. Best practices suggest ensuring there is enough space for a clear signature, as well as providing instructions for completing the form to avoid confusion.

When to use a credit card authorization form

There are particular scenarios where it becomes vital to utilize a credit card authorization form. For example, businesses that implement recurring payments, such as gyms, subscription services, or even restaurants offering delivery, should definitely use these forms to have a documented agreement for future transactions.

High-value transactions also warrant the use of an authorization form. The seller's perspective is clear: without proper documentation, they expose themselves to potential losses due to disputes or misunderstandings. Companies in sectors such as real estate, e-commerce, and specialized services notably benefit from leveraging credit card authorization forms.

How to create your own credit card authorization form

Creating a credit card authorization form can be straightforward if you choose the right template for your needs. Begin by selecting a template from pdfFiller that suits your business model and objectives. This ensures you're starting with a solid foundation that includes essential components.

Follow these steps for customization: first, edit the text to reflect your business name, payment terms, and specific details pertinent to your operations. Next, ensure relevant sections are clearly structured for easy reading. Consider incorporating interactive elements with pdfFiller's tools, allowing for easier digital filling and submission for your customers.

Lastly, provide guidance on signing the document and introduce eSigning processes seamlessly. This way, you provide not only a form but also an efficient way for customers to authorize payments with their digital signatures.

Best practices for using credit card authorization forms

To maximize the effectiveness and security of your credit card authorization forms, compliance with payment regulations is crucial. Familiarize yourself with the relevant legal standards governing payment processing in your industry and region to ensure you’re meeting all requirements.

Additionally, secure storage of authorized forms is essential. Maintain these documents in a protected environment to prevent unauthorized access to sensitive payment information. Implementing guidelines for data protection and privacy not only safeguards your company but also builds confidence among your customers.

As for the duration for keeping signed forms, businesses generally should retain them as long as necessary to protect against chargebacks or disputes, often a period of 3 to 5 years, depending on local regulations.

Frequently asked questions (FAQ)

You may wonder if there is a legal obligation to use a credit card authorization form. While it may not be explicitly required in every instance, it is considered best practice to protect both your business and your customers. Providing documentation of consent ensures clearer transaction records and mitigates financial risks.

Another question might arise about the omission of the CVV space on some forms. Many businesses choose to skip this requirement for security reasons, as storing CVV information is not compliant with PCI standards. Regarding 'Card on File,' this term refers to permissions given for storing a customer’s card information for future transactions, which should also involve obtaining a credit card authorization form.

Handling a customer dispute regarding unauthorized charges can be challenging. In this scenario, referring back to the signed authorization form is crucial. If the form is present and valid, it demonstrates that the charge was indeed authorized, helping clarify the situation.

Interactive tools and additional resources

Utilizing modern tools such as pdfFiller can greatly enhance your experience with credit card authorization forms. The platform offers access to a variety of templates specifically designed for creating these forms efficiently. Users can benefit from a cloud-based environment that allows document management from anywhere, streamlining the process of filling, signing, and collaborating on crucial documents.

Moreover, pdfFiller provides step-by-step guides for eSigning and collaborating, ensuring you and your customers experience a seamless interaction while handling authorization forms. This not only boosts operational efficiency but also helps in maintaining a professional appearance for your business.

Exploring related topics and resources

Understanding payment processing fees and rates can also play a significant role in how you manage credit card transactions. Familiarizing yourself with these costs can lead you to make more informed decisions about your payment processes.

Additionally, knowing how to accept online payments securely is paramount in this digital age. In conjunction with credit card authorization forms, businesses should consider other authorization forms related to various payment methods, keeping customer data security measures front and center in their operational strategies.

Engagement section

We invite you to share your experiences with credit card authorization forms. Your stories can shed light on best practices and highlight potential pitfalls in your operations, helping others learn from your journey.

For ongoing tips and resources, consider subscribing to our newsletter. Stay informed about developing secure business practices tailored for the needs of individuals and teams seeking robust document management solutions.

Connect with our growing community on social media to explore further insights and discuss approaches to enhance your transaction security and customer confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How do I edit credit card authorization form online?

Can I sign the credit card authorization form electronically in Chrome?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.