Get the free Credit Card Application Form

Get, Create, Make and Sign credit card application form

How to edit credit card application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card application form

How to fill out credit card application form

Who needs credit card application form?

Your Complete Guide to the Credit Card Application Form

Understanding credit card applications

A credit card application form is a crucial document for anyone seeking to obtain a credit card. It not only records personal and financial information but also serves as a formal request to a bank or financial institution for credit. Individuals apply for credit cards for various reasons, including making purchases, building credit histories, or taking advantage of rewards programs. Moreover, applying for credit cards can happen during important life events such as starting a new job, relocating to a new city, or when managing unexpected expenses.

The importance of a credit card application form cannot be overstated. It directly influences your credit score, which plays a significant role in your overall financial health. Each approved application can help build your credit history, while a denied application may lead you to reconsider your financial management strategies. Hence, understanding what credit card companies are looking for in an application is paramount.

Types of credit card applications

There are two primary types of credit card applications: online and paper. Online applications have gained immense popularity due to their speed and convenience. With just a few clicks, you can fill out the application form, upload necessary documents, and submit it, often receiving instant feedback regarding your application status. When filling out an online application, ensure that you have all required information ready, as the process generally includes various sections that must be completed sequentially.

Conversely, paper applications may still be necessary in certain situations, such as for older individuals who may not be as tech-savvy or when applying for specific credit products available exclusively through traditional methods. Key considerations while completing a paper application include ensuring clarity in your handwriting and double-checking for any missing information, as incomplete forms can lead to delays or outright denials.

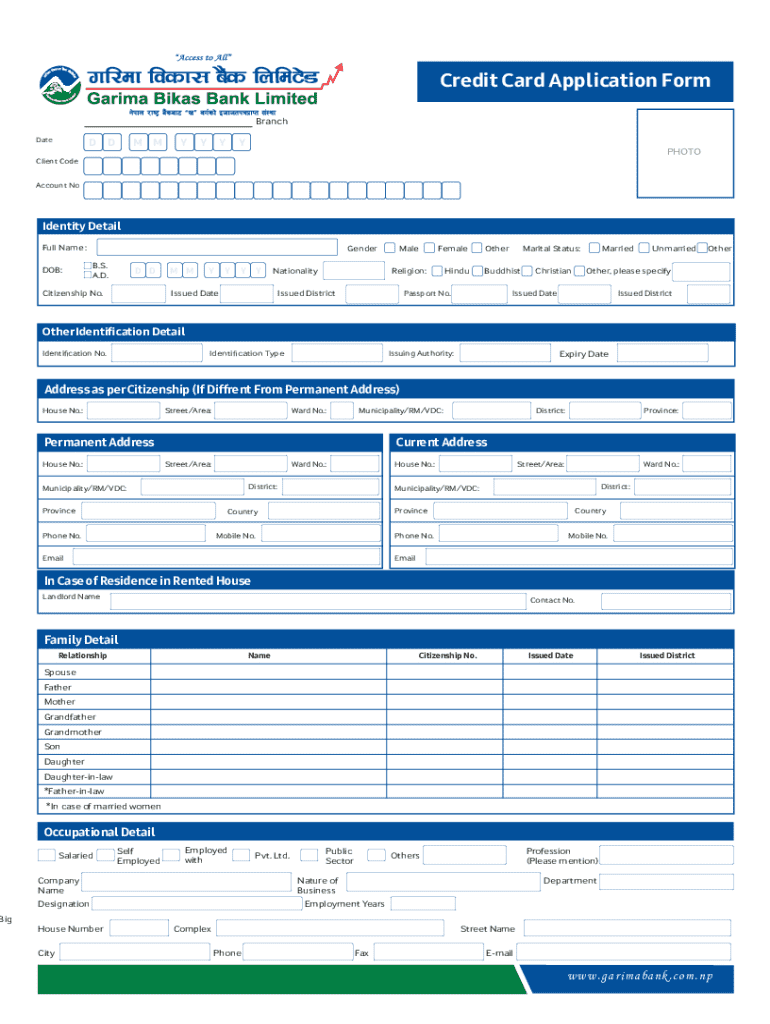

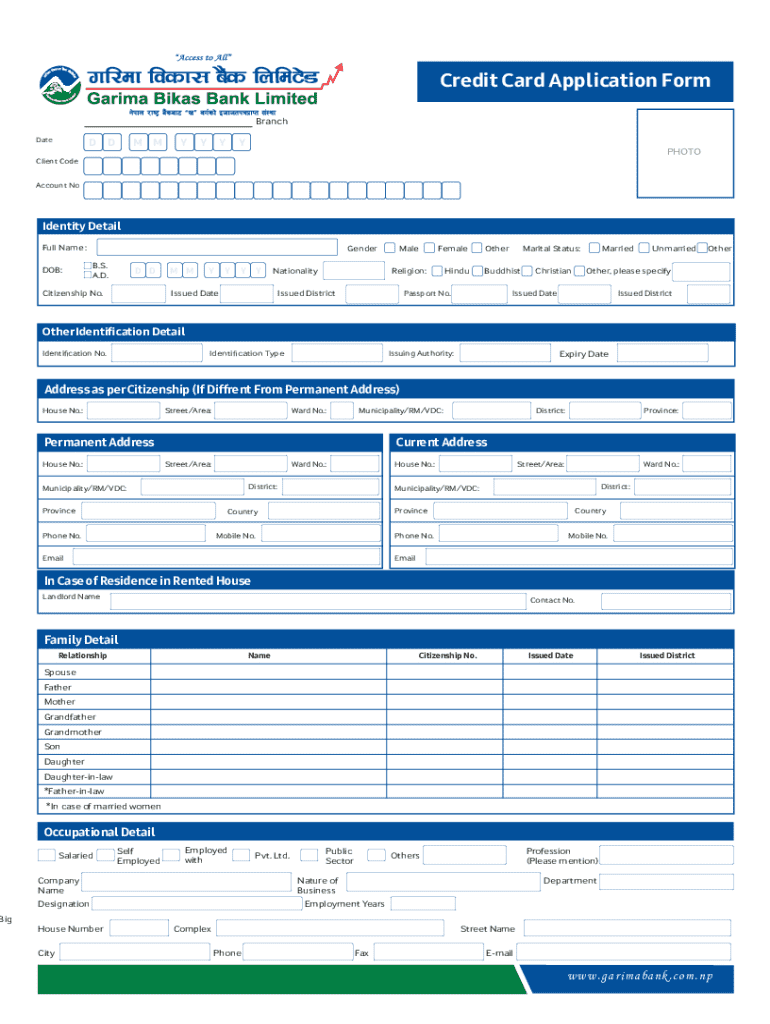

Detailed overview of the credit card application form

When you receive a credit card application form, it typically consists of several critical sections. The personal information section requires you to provide your name, address, phone number, and email address. In the United States, you may also need to include your Social Security Number (SSN) for identity verification and credit check purposes.

The financial information section delves into your employment status and income, which credit card companies evaluate to determine your creditworthiness. This section may ask for an estimate of your monthly income, existing debts, and financial obligations. Understanding the terms and conditions associated with credit cards, such as interest rates, annual fees, and rewards programs, is also essential. Careful examination of the fine print can help you avoid unexpected fees once you begin using your card.

Step-by-step guide to completing a credit card application

Completing a credit card application involves several important steps. First and foremost, gather all necessary documents such as proof of income, photo identification, and any existing credit account details. Having these ready will streamline the application process.

Next, start by filling out your personal information accurately, ensuring your name and address match what is on official documents. Providing financial details follows in the next step, where transparency about your income and any existing debts will build trust with the credit issuer.

Once you have completed the application, it’s vital to review it for errors. Missing information or inaccuracies could lead to processing delays or outright denial. Finally, you can submit your application either online or mail it to the designated address if you're using a paper form.

What happens after submission?

After submitting your credit card application, the processing timeline typically varies from a few minutes to several days, depending on the financial institution. During this time, they will review your information, check your credit report, and make a decision to approve or reject your application.

Possible outcomes include approval or denial. In case of approval, you'll receive your credit card via mail along with instructions for activation. In case of denial, you should receive a letter detailing the reasons for rejection, which may include insufficient credit history or high debt levels. Understanding conditional approvals is also important, as they may lead to a requirement for additional verification, such as submitting further documents or clarifications.

Managing your credit card application and follow-up

Tracking your application status can usually be done online or by contacting customer service. Most financial institutions provide a specific portal or means to follow up on your application. If they require additional information, be prepared to respond promptly to ensure your application is not delayed further.

Once approved, you will need to activate your card. This process often includes calling a designated number or completing steps online. Understanding the issuance process fully ensures you begin utilizing your new credit card effectively, including insights into using its features responsibly.

Common mistakes to avoid

When completing a credit card application form, certain mistakes can be detrimental to your success. One common error is submitting an incomplete application. Even minor omissions can lead to delays in processing or rejection. Therefore, double-checking your application before submission is essential.

Another significant mistake is falsifying information. Providing false data can not only lead to instant denial but can also have long-term repercussions on your credit history. Lastly, ignoring the implications of your credit score is a common oversight. Understanding how your credit score affects your chances of approval is vital for a successful application.

Tips for a successful credit card application

Before you apply for a credit card, evaluating your creditworthiness is essential. Checking your credit score can provide insights into your chances of approval. Additionally, it allows you to address any issues that might prevent you from being approved.

Selecting the right credit card is equally important. Compare different offers based on their features, such as rewards, interest rates, and applicable fees. Finally, familiarize yourself with pre-qualification versus pre-approval processes. Pre-qualification gives you an estimate of your chances without a hard credit inquiry, while pre-approval involves a more thorough check, which provides a clearer picture of your eligibility.

Utilizing PDFfiller for a seamless application process

PDFfiller can significantly enhance your experience when filling out a credit card application form. With interactive tools that allow you to fill out forms efficiently, edit, and eSign within a cloud-based platform, you can streamline the documentation process.

Utilizing PDFfiller’s features to enhance your credit card application can include customizing your form, adding notes where necessary, and securely managing your documents. This tool not only saves time but aids in ensuring accuracy, making your application as polished as possible before submission.

FAQs about credit card applications

Many applicants have common questions and concerns when filling out a credit card application. One frequently asked question is about credit scores: how much do they matter? The answer is significant, as a higher score often leads to better approval odds and more favorable terms.

Another common query pertains to documentation: what specific documents are required during the application process? Generally, proof of income and identification are needed, but this can vary by institution. Clarifying these points and debunking myths about credit card applications can help potential applicants navigate the process more confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card application form in Chrome?

Can I create an electronic signature for the credit card application form in Chrome?

Can I create an electronic signature for signing my credit card application form in Gmail?

What is credit card application form?

Who is required to file credit card application form?

How to fill out credit card application form?

What is the purpose of credit card application form?

What information must be reported on credit card application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.