Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

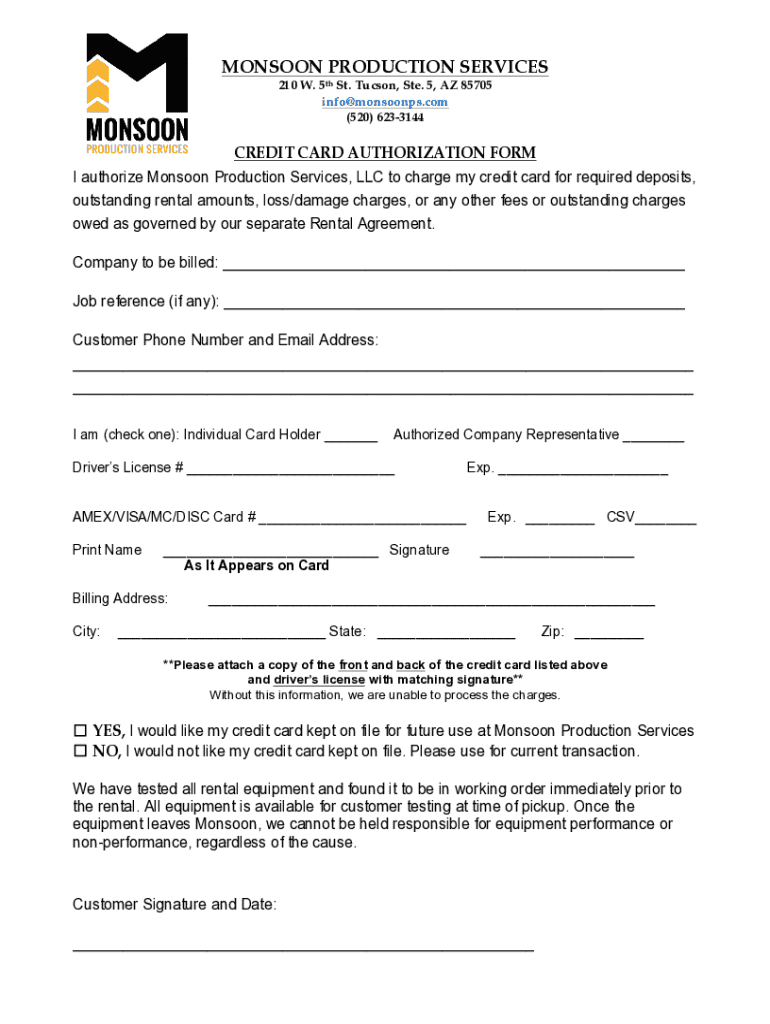

A credit card authorization form is a crucial document that enables merchants to obtain a customer's permission to charge their credit card for goods or services. This form acts as an agreement between the customer and the business, ensuring that the transaction is legitimate and authorized. The importance of credit card authorization forms cannot be overstated, as they play a pivotal role in preventing fraudulent transactions and reducing the risk of chargebacks.

There are various types of transactions that may require an authorization form. These can range from in-person sales at a restaurant or retail store to online purchases and subscription services. Businesses that deal with recurring payments, such as gym memberships or software applications, particularly benefit from having a structured authorization process.

Components of a credit card authorization form

A standard credit card authorization form typically includes several key elements that are vital for processing payments securely. These components ensure that the necessary information is collected efficiently, reducing the chances of errors that could lead to transaction issues.

In addition to these key elements, businesses should consider incorporating security features, such as a space for the CVV code, which is used to further validate the legitimacy of the card. Dynamic fields to capture varying transaction types can enhance the form’s adaptability and usability across different sales scenarios.

Assessing the necessity of a credit card authorization form

As a seller, determining when to use a credit card authorization form is crucial for protecting both your business and customers. Authorization forms are particularly essential for transactions involving larger sums of money or those that are processed remotely, such as online transactions. Their use ensures that the cardholder is fully aware of the transaction and has consented to it, which is especially important in the prevention of fraud.

The benefits of using a credit card authorization form extend beyond just security. They significantly reduce the risk of chargebacks, which can be detrimental to a business’s reputation and financial health. Customers also appreciate transparency, knowing their purchase has been authorized thoughtfully and securely. Some legal obligations may also require businesses to maintain a clear record of authorization, especially in regulated industries.

Best practices for filling out credit card authorization forms

Completing a credit card authorization form accurately is essential for processing transactions smoothly. Here’s a step-by-step guide for businesses to follow when filling out the form:

Common mistakes include not confirming the expiration date or omitting important elements like the CVV code. Additionally, being mindful of data protection regulations is crucial as mishandling sensitive customer information could expose your business to legal risks.

Storage and management of signed authorization forms

After a credit card authorization form has been signed, businesses must maintain secure records to comply with financial regulations. Proper storage practices involve keeping the forms in a safe and secure environment, either physically or digitally, to protect sensitive information from unauthorized access.

The recommended duration for storing signed forms often adheres to financial regulations, which may vary by jurisdiction. Conversely, complying with data privacy laws is critical, and businesses should be aware of how long they retain customer information, ensuring it is safely disposed of when no longer needed.

Anti-fraud measures and chargeback prevention

Credit card authorization forms are significant tools in combating fraud and chargebacks. By ensuring that transactions are properly authorized, businesses can mitigate risks associated with fraudulent chargebacks. They enhance the security of the payment process and protect against unauthorized transactions.

There are several tips to enhance security practices when using authorization forms:

If a chargeback does occur, promptly gather documentation, including the signed authorization form, to dispute the claim effectively. Understanding card on file arrangements can also aid in maintaining ongoing customer relationships while ensuring compliance with security requirements.

Frequently asked questions (FAQ) about credit card authorization forms

Businesses and consumers frequently have questions regarding credit card authorization forms. Here are some of the most common queries:

Download ready-to-use templates

To streamline the process, businesses can benefit from utilizing ready-to-use credit card authorization form templates. Having a standardized form can save time and ensure consistency across transactions. These templates are available in PDF format and can be easily customized to meet specific business needs.

pdfFiller offers an array of customizable templates, allowing businesses to edit and manage their documents seamlessly. This tool enhances workflow efficiency and offers a secure way to handle sensitive payment information.

Related documents and resources

In addition to credit card authorization forms, businesses may benefit from other financial documents and resources. Various templates such as payment schedules, invoice templates, and more can help streamline financial operations.

Using pdfFiller for other financial documents enhances productivity and ensures that all documents are readily accessible and compliant with applicable regulations. This interconnectedness can be extremely beneficial for businesses, especially smaller establishments or startups.

Engage with our community

At pdfFiller, we value community engagement and want to hear your experiences and tips regarding credit card authorization forms. We invite you to subscribe to our newsletter for the latest updates, best practices, and resources tailored to your business needs.

Your feedback helps us refine our offerings, ensuring we provide the most relevant tools and information to assist businesses in managing their documents efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card authorization form?

Can I create an electronic signature for signing my credit card authorization form in Gmail?

How do I fill out the credit card authorization form form on my smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.