Get the free Consequential Loss (fire) of Profit Proposal Form

Get, Create, Make and Sign consequential loss fire of

Editing consequential loss fire of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consequential loss fire of

How to fill out consequential loss fire of

Who needs consequential loss fire of?

Understanding Consequential Loss Fire of Form: A Comprehensive Guide

Understanding consequential loss and its implications

Consequential loss refers to the secondary effects of a loss event, particularly when it comes to fire damage. Unlike direct losses, which involve immediate physical damage to property, consequential losses encompass the broader ramifications, such as operational disruptions, lost profits, and additional expenses incurred during recovery.

For businesses, understanding the distinction between direct and consequential losses is crucial. Direct losses are easily identifiable, such as the cost of repairing or replacing damaged assets. In contrast, consequential losses may not become apparent until later and can significantly affect cash flow and profitability.

Given the unpredictability of fire incidents, having coverage for consequential losses is vital. Fire not only damages physical assets but also leads to interruptions in operations. This can impact customer satisfaction, employee productivity, and long-term business viability.

Fire consequential loss coverage: Key components

Fire consequential loss coverage is a specific type of insurance that protects businesses from the financial impacts of indirect losses due to fire damage. Understanding this coverage is essential for assessing risk and ensuring financial stability.

The coverage typically includes various types of consequential loss that businesses can face, such as loss of revenue, increased operating costs, and even loss of potential new business. For instance, if a fire forces a company to shut down for an extended period, the income lost during this downtime can lead to severe financial strain.

A crucial aspect of fire insurance policies is the indemnity period, which refers to the timeframe during which the business is covered for consequential losses. Determining an appropriate indemnity period can ensure that a business is adequately protected during recovery. Businesses should evaluate their past operational disruptions to establish a suitable length for this period.

Exploring types of coverage for fire consequential loss

When it comes to fire consequential loss insurance, businesses typically have access to both standard and additional coverage options. Understanding these types enables businesses to tailor their insurance based on specific needs.

Standard coverage often provides basic financial protection for businesses facing the aftermath of fire incidents. However, to ensure comprehensive safety, additional coverage options are worth exploring.

Choosing the right fire consequential loss insurance coverage may involve consulting with insurance professionals to determine the paths that best align with individual business objectives and risk profiles.

Calculating consequential loss after fire damage

Assessing and calculating consequential loss following a fire incident is critical for business recovery. The framework for calculating these losses typically involves several steps to ensure all factors are considered.

The first step involves an immediate assessment of direct property damage, followed by estimating potential indirect losses that arise from disruptions in business operations. Key metrics include lost profits, ongoing operational costs, and any increase in expenses due to the fire.

Common methodologies for calculating consequential losses include the excess earnings method and the market value approach. Businesses can leverage various tools, including financial modeling software, to facilitate accurate loss estimates.

Major exclusions in fire consequential loss insurance

Understanding exclusions is vital when purchasing fire consequential loss insurance. This knowledge helps businesses navigate policy limitations that can impact recovery during challenging times.

Common exclusions often include losses due to negligence, pre-existing conditions, or conditions that were not disclosed at the time of signing the policy. It is essential for businesses to read policies diligently and clarify any ambiguous terms with their insurers.

Customizing coverage by adding riders or endorsements can mitigate these common exclusions. Collaborating with an insurance broker can facilitate personalized policies that align with specific business needs.

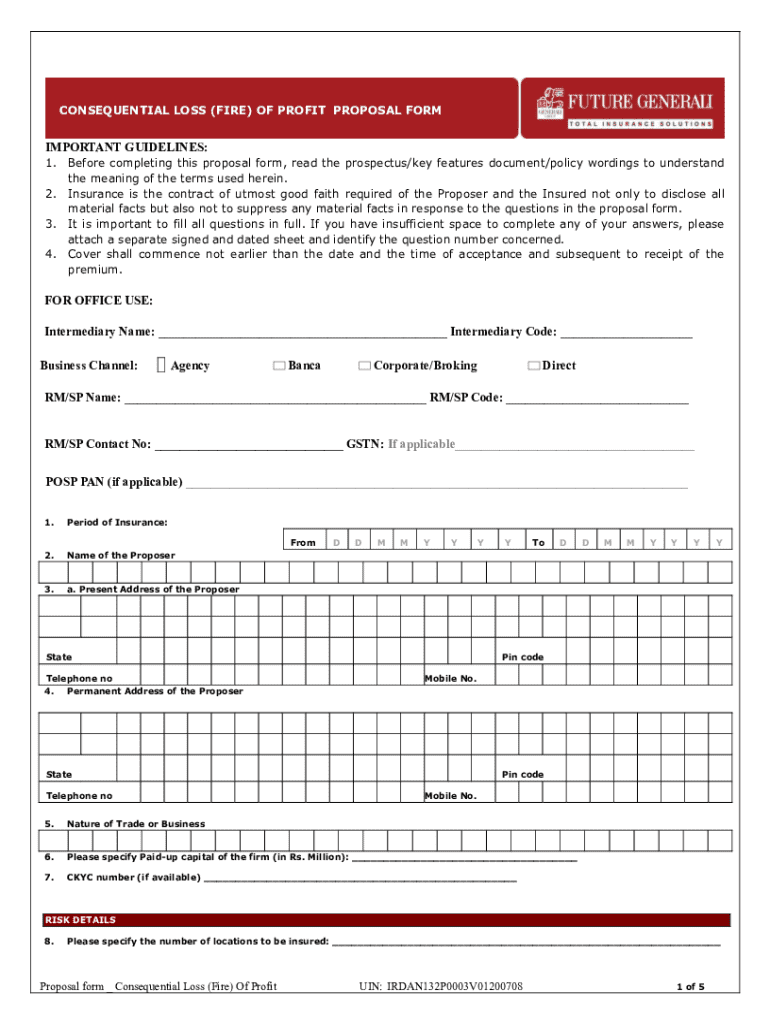

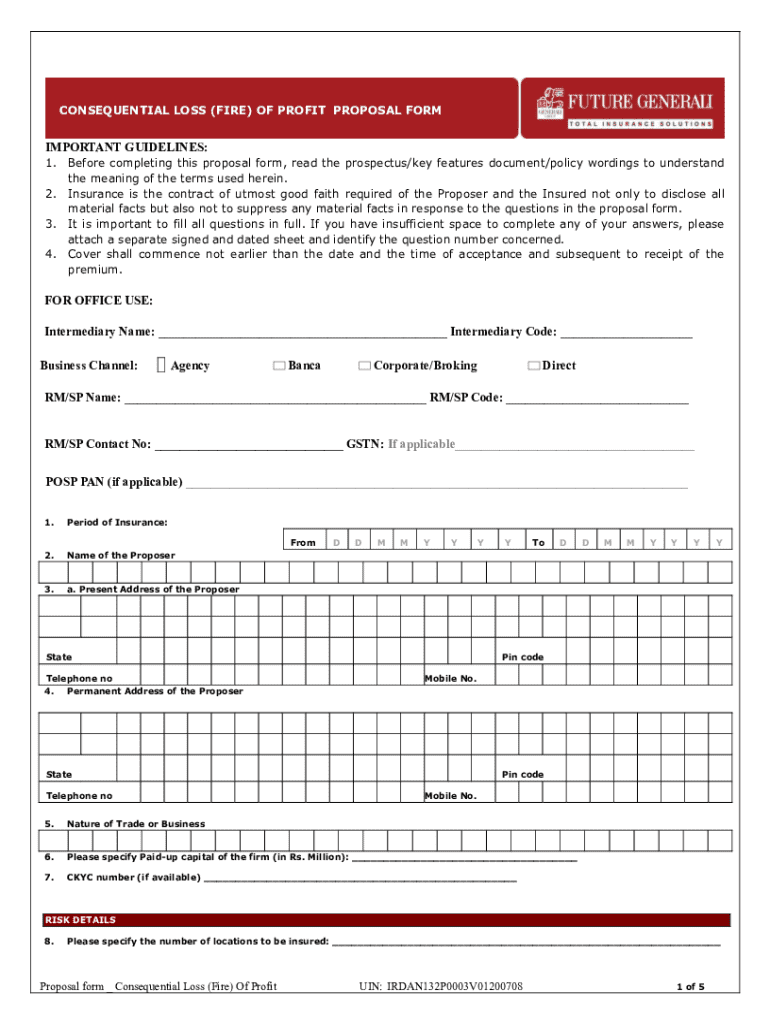

Practical steps for filling out consequential loss fire insurance forms

Filling out consequential loss fire insurance forms requires precise and relevant information to ensure accurate assessment and coverage. Key details typically include property specifications, the extent of damages, and the calculated estimated loss.

To enhance the accuracy of submissions and avoid common errors, following a checklist can be beneficial. For instance, accurately documenting dates, events, and estimates serves as critical information for claims processing.

Utilizing solutions like pdfFiller can simplify the task of completing and submitting these forms, allowing users to edit, sign, and collaborate on documents easily.

Frequently asked questions about fire consequential loss insurance

Many businesses inquire about the benefits of consequential loss fire insurance. Typically, small to medium-sized businesses, as well as those in industries vulnerable to fire risks, find this coverage essential. It enables them to mitigate financial fallout and maintain operations during recovery.

Regularly reviewing your coverage is advisable to adjust for changes in business structure, revenue, or risk exposure. It's also essential to take immediate steps following a fire incident, such as notifying your insurance company, documenting damage, and beginning recovery efforts as soon as possible.

Resources for fire consequential loss form management

Managing fire consequential loss insurance forms is essential for a streamlined recovery process. Technologies that facilitate document management play a crucial role in this aspect.

pdfFiller provides interactive tools for document creation, allowing users to fill out insurance applications accurately. Features such as electronic signatures and cloud storage further streamline the management of essential documents.

Navigating fire insurance with pdfFiller

Choosing a document management solution like pdfFiller provides numerous benefits for those dealing with fire consequential loss insurance. Users are empowered to edit PDFs seamlessly, eSign important documents, collaborate with their teams, and manage files efficiently from a single platform.

Getting started with pdfFiller involves creating an account, where you can upload necessary documents and utilize their wide array of features tailored for insurance professionals.

Important legal and compliance considerations

When acquiring fire consequential loss coverage, understanding legal implications is fundamental. Businesses should be aware of their rights and responsibilities under state insurance laws, which govern coverage scopes and claims processes.

Compliance requirements can vary by location and industry. It is important to stay informed about local regulations regarding fire safety and insurance to avoid any legal pitfalls.

Additional considerations and next steps

Regular evaluation of your fire consequential loss coverage is a best practice. As businesses evolve, so do their risks and insurance needs. Annual reviews allow you to identify gaps or ensure that you are not over-insured.

Consulting with insurance experts can provide insights that refine your insurance strategy. Experts can assist in understanding policy nuances and negotiating better terms that align with business objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in consequential loss fire of?

Can I sign the consequential loss fire of electronically in Chrome?

Can I edit consequential loss fire of on an Android device?

What is consequential loss fire of?

Who is required to file consequential loss fire of?

How to fill out consequential loss fire of?

What is the purpose of consequential loss fire of?

What information must be reported on consequential loss fire of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.