Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

A comprehensive guide to credit card authorization forms

Understanding credit card authorization forms

A credit card authorization form is a document used by businesses to obtain permission from a cardholder to charge their credit card for a specific amount. This form serves as both a safeguard for merchants and a form of protection for customers, ensuring that transactions are conducted securely and with explicit consent.

The importance of this form in the payment processing cycle cannot be overstated. It not only facilitates easier and faster transactions but also plays a crucial role in reducing instances of fraud. Legally, having a signed credit card authorization form can serve as critical evidence in disputes, particularly against chargebacks.

When businesses handle sensitive payment information, adherence to compliance standards like PCI DSS (Payment Card Industry Data Security Standard) becomes vital. A well-structured credit card authorization form helps businesses meet these legal requirements.

Benefits of using credit card authorization forms

Utilizing a credit card authorization form offers several benefits that can significantly enhance business operations and customer relations. One of the most notable advantages is the prevention of chargeback abuse. Chargebacks can be costly and detrimental to businesses, particularly small ones, and having a signed authorization form can help prove that a customer approved the transaction.

Another key benefit is the enhancement of customer trust and security. When customers provide their card details through a formal authorization process, they feel more secure knowing that their information is only processed after clear consent. This can enhance customer relationships and encourage repeat business.

When to use a credit card authorization form

Credit card authorization forms should be employed in specific situations where there is a need for documented consent for payment processing. For instance, recurring payments, such as those made for subscription services or installment plans, necessitate clear authorization to avoid disputes later on.

Businesses that typically benefit from using these forms include online retailers, subscription-based services, and even traditional brick-and-mortar stores that offer services paid over time. For instance, a local gym may require a credit card authorization form to charge members on a monthly basis. Similarly, restaurants might use them for high-ticket reservations or catering orders.

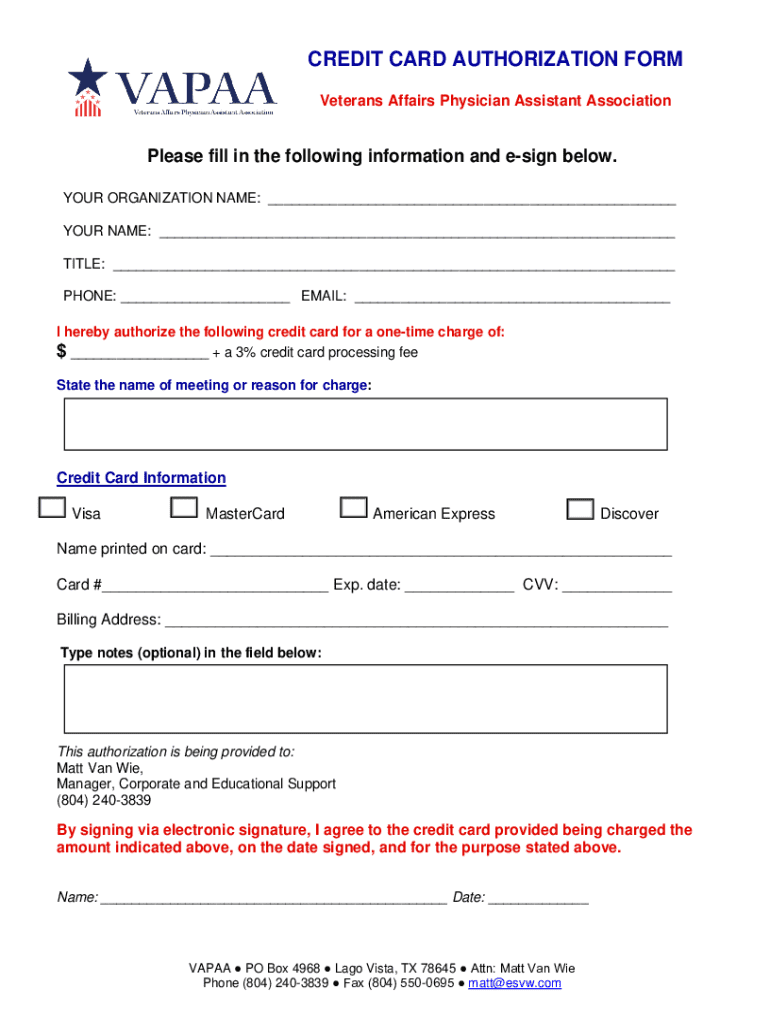

Key components of a credit card authorization form

An effective credit card authorization form must include essential details to validate the transaction. This may encompass cardholder information, including the full name, billing address, contact details, and the last four digits of the credit card number. Additionally, explicitly stating the payment amount is crucial to ensure transparency.

Optional fields to consider can include the CVV number and expiration date, though it's essential to handle this information with care due to privacy concerns. Furthermore, clear terms and conditions are paramount, allowing users to understand their rights and responsibilities fully.

How to properly fill out a credit card authorization form

Filling out a credit card authorization form accurately is vital to ensure its validity. Here's a step-by-step guide:

Double-checking for accuracy before submitting the form can prevent potential issues later on, such as chargeback claims or transaction disputes.

Editing and customizing your credit card authorization form

Using platforms like pdfFiller, creating and modifying your credit card authorization form becomes a seamless process. You can customize various sections of the form to fit your specific business needs, tailoring it for your clientele while adhering to legal requirements.

To ensure that your form meets the expected standards, consider adding your business logo, color scheme, or even changing the layout for better user engagement. Additionally, utilizing available templates on pdfFiller can jumpstart this process, allowing users to focus on what matters most: securing payments.

Storing and managing signed authorization forms

Best practices for storing signed credit card authorization forms involve converting them into secure digital formats. Keeping these forms managed and organized will not only make them easy to access but also ensure compliance with legal retention requirements. Businesses should consider secure cloud storage solutions that comply with local privacy regulations.

pdfFiller supports document management, enabling users to store, search, and retrieve authorization forms efficiently. Implementing a systematic approach towards document management can significantly reduce the risks associated with lost or misplaced forms while maintaining an organized repository.

Common questions related to credit card authorization forms

There are several common inquiries regarding credit card authorization forms. One of the most pressing concerns involves chargeback prevention. Do credit card authorization forms help prevent chargeback abuse? The answer is yes, as having clear proof of authorization minimizes the likelihood of chargebacks occurring.

Another frequent question is: Am I legally obligated to use credit card authorization forms? While it may not be mandatory, it is highly recommended, especially for businesses dealing with recurring payments. Additionally, some may wonder why a specific form doesn't include a space for CVV. This could be due to security practices aimed at minimizing the risk of storing sensitive information.

Download our templates to get started

pdfFiller offers a range of downloadable templates for credit card authorization forms designed to meet diverse business needs. These templates can help you start with a solid foundation while ensuring all necessary details are included.

Accessing and utilizing these templates effectively allows businesses to focus on their core functions without getting bogged down in the intricacies of form creation. Simply select a template that suits your requirements, customize it, and begin securing payments effectively.

Related tools and resources

Besides pdfFiller’s document management capabilities, there are several additional services and products that can enhance your payment processing efficiency. Links to guides on payment processing and security measures can provide valuable insights into best practices you can incorporate into your business.

Considering other document solutions that complement your workflow, such as electronic signature platforms or secure payment gateways, can further streamline your operations.

Staying informed and connected

Staying updated on best practices surrounding credit card authorization forms is crucial. Subscribing to our newsletter ensures you’re among the first to receive updates and best practices related to document management and payment solutions.

Additionally, following our blog will keep you informed about new insights and trends in document management and effectively handling payments, helping your business stay ahead of the curve.

FAQs section

We've compiled a list of the most common inquiries regarding credit card authorization forms, providing clarifications about payment processing and security:

Stay engaged with the latest trends in online payment methods and learn how to adapt your strategies effectively.

Feedback and community

Encouraging user feedback on their experiences with credit card authorization forms can foster a sense of community among users. Engaging in discussions regarding best practices will also contribute to learning and improvement.

Join our community to share insights and experiences, and read testimonials from businesses successfully utilizing pdfFiller for their forms. Collective experiences can lead to refined practices that enrich the overall user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in credit card authorization form without leaving Chrome?

How do I edit credit card authorization form straight from my smartphone?

How can I fill out credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.