Get the free Credit Card Authorization

Get, Create, Make and Sign credit card authorization

Editing credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization

How to fill out credit card authorization

Who needs credit card authorization?

The Complete Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form serves as an essential document in the transaction process, allowing businesses to secure approval from cardholders for payment. This form not only provides a framework for collecting payment information but also mitigates risks related to fraud and chargebacks. Its importance cannot be overstated, as it ensures that payments are processed with the consent of the cardholder, maintaining legality and trust in the merchant-customer relationship.

There are different types of authorizations, which can either be one-time transactions or recurring payments that necessitate a greater level of compliance and detail. In particular, recurring payments require careful management as they pull funds from the customer’s account automatically at specified intervals, making the credit card authorization form vital for ongoing services like subscriptions. Using these forms effectively reduces fraud incidents by confirming the cardholder's identity and authority to use the card for payments.

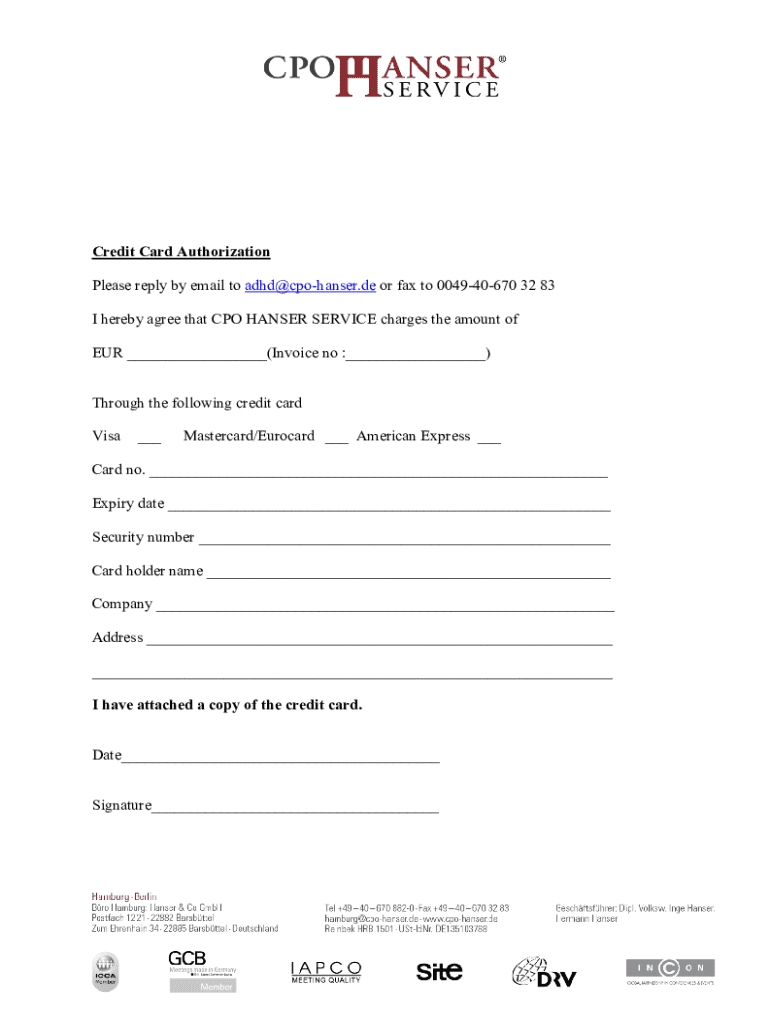

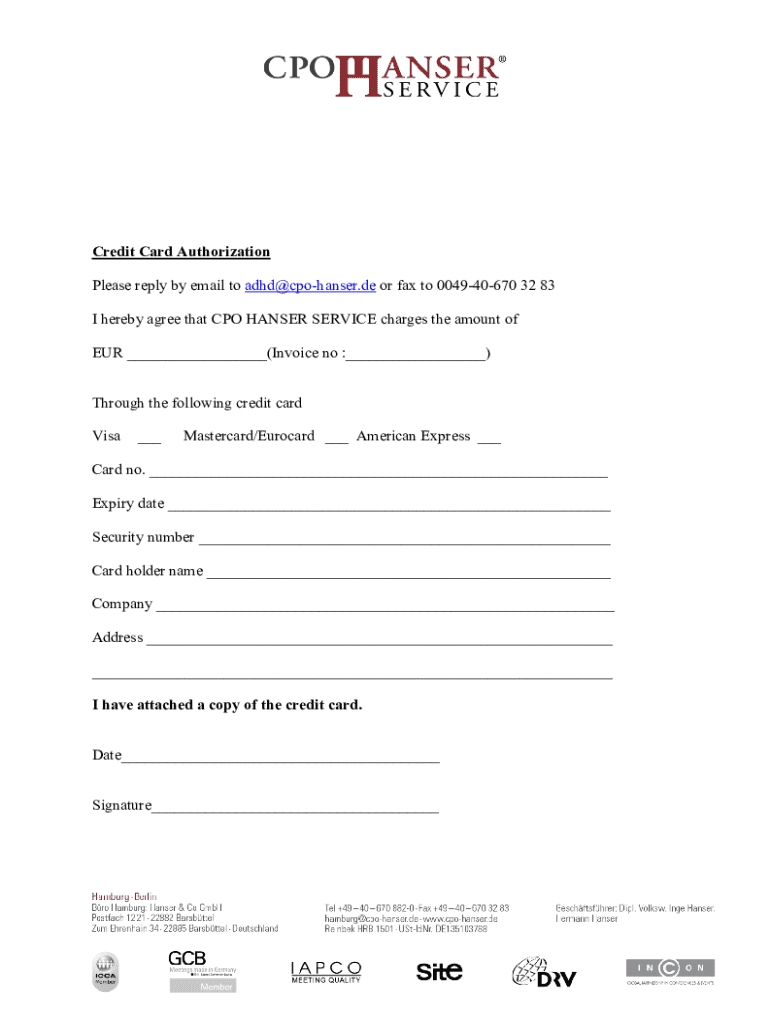

Components of a credit card authorization form

A well-constructed credit card authorization form must include essential fields that capture critical information. The first of these is the cardholder information, which typically includes the name, billing address, and contact details. Providing accurate identification helps to affirm the legitimacy of the transaction. Next is the payment information section, where the credit card number, expiration date, and the amount to be charged are listed to facilitate the payment process effectively.

In addition to these basics, it is advisable to include merchant information, which clarifies who the customer is conducting business with—this could be anything from a brick-and-mortar establishment to an e-commerce platform. For enhanced security, consider incorporating a CVV field, as this three-digit code adds an extra layer of verification. A signature space is also critical, as this serves as evidence of consent from the cardholder, tying them legally to the terms of the transaction. All of this should be backed by clear legal considerations explaining what cardholders are agreeing to, as transparency is paramount in financial dealings.

When to use a credit card authorization form

The application of a credit card authorization form can vary significantly, depending on the context. E-commerce transactions, for instance, thrive on these forms due to the inherent risks of online shopping. By ensuring that you have the cardholder's consent documented, businesses can protect themselves against chargebacks often associated with online payments. Similarly, subscriptions demand the usage of authorization forms as they automatically bill customers on a scheduled basis, which requires a higher level of trust and verification.

Within service-based industries, vendors, contractors, and freelancers should implement authorization forms during their initial client engagement. For instance, a catering company may request an authorization form to secure deposits and ongoing payments. To maximize the effectiveness of these forms, sellers should implement them at the onset of the business relationship and during payment confirmations to reduce potential disputes later on.

Benefits of utilizing credit card authorization forms

Using credit card authorization forms offers multiple benefits that can enhance a business's operational efficiency. One of the significant advantages is their ability to prevent chargeback abuse. When customers authorize a payment via a well-constructed form, disputing a charge becomes more challenging, helping businesses protect their bottom line. In many cases, businesses that adopt proper authorization practices see a notable decrease in chargebacks, directly impacting profitability.

Another essential benefit is the improved cash flow it encourages. By utilizing a credit card authorization form, businesses can expedite the payment process, leading to faster collections and less time spent on the collections process. As an added advantage, it promotes enhanced trust and satisfaction among customers, as they feel more secure knowing their payment details are being managed transparently and responsibly.

How to create and manage a credit card authorization form

Creating a credit card authorization form may seem daunting, but breaking it down into manageable steps makes it straightforward. First, you need to gather all necessary information, including the cardholder’s personal and payment details. Next, complete the authorization fields ensuring clarity and precision, to avoid possible confusion with transactions. Once all information is inputted, review the document thoroughly and finalize it for the customer’s signature.

To make this process easier, consider utilizing tools like pdfFiller, which provides options for easy edits and the incorporation of templates for quick access. Collaborating with your team on creating these documents can enhance the overall efficiency of your document management. Storing signed forms securely in a cloud-based environment ensures compliance and easy retrieval in case of disputes, further enhancing operational control.

FAQs about credit card authorization forms

Legal requirements surrounding the use of credit card authorization forms can vary depending on jurisdiction and the nature of the business. Nevertheless, using these forms is generally considered a best practice for most businesses dealing with payments. If your form lacks a space for CVV, it may be that your business model does not require it, but including it often adds another layer of security.

Retention periods for signed authorization forms can depend on financial or tax regulations applicable in your region. Generally, keeping these documents for at least several years is advisable to safeguard against claims or disputes. When dealing with international payments, a credit card authorization form can still be relevant, but it’s essential to ensure compliance with local laws and practices in each region you operate in.

Related documents and forms

Beyond the credit card authorization form, various related documents play essential roles in business transactions. Recurrent payment authorization forms are crucial for businesses engaging in subscription services, as they provide a framework for ongoing payment authority. Credit card payment agreements can establish the terms of service for transactions involving credit card usage, helping companies define their policies clearly.

Merchant service agreements are also critical, as they describe the contractual relationship between the merchant and the service provider. Having access to these documents not only enhances transaction integrity but also fortifies the legal protections for both parties involved.

Enhance your document management with pdfFiller

pdfFiller stands out as an imperative tool for managing credit card authorization forms efficiently. With features such as online editing and eSigning, businesses can swiftly create and modify their forms, ensuring that they are always compliant with the latest regulations. Templates allow for quicker access and usage of the forms needed for seamless transactions, fostering rapid business operations.

Moreover, the secure cloud-based document management system provided by pdfFiller ensures that all transaction records are safely stored and easily retrievable, adding a layer of convenience and compliance for any business. This platform empowers users to centralize their documentation efforts, streamlining processes that support payment security.

Explore more resources

For business owners, continuous learning about payments and chargeback prevention is essential. Articles focused on how to prevent chargebacks effectively can offer actionable strategies to minimize financial risk. Also, setting up recurring payments is a topic worth exploring, as it provides insights into best practices for routine billing and customer retention strategies.

Best practices in payment processing for small businesses are also crucial areas to explore, offering a deeper understanding of how to operate within a competitive landscape while ensuring compliance and customer satisfaction.

Join our community

As you navigate the world of credit card authorization forms, we encourage you to share your experiences and insights. Engaging with a community of business owners and payment processing experts can provide valuable feedback and tips, helping each of us streamline our documentation processes further. Keep an eye on updates regarding trends in document management and tools that can make this valuable part of your business even more effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card authorization in Chrome?

Can I create an electronic signature for the credit card authorization in Chrome?

Can I edit credit card authorization on an iOS device?

What is credit card authorization?

Who is required to file credit card authorization?

How to fill out credit card authorization?

What is the purpose of credit card authorization?

What information must be reported on credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.