Get the free Check Deposit/withdrawal Form

Get, Create, Make and Sign check depositwithdrawal form

How to edit check depositwithdrawal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check depositwithdrawal form

How to fill out check depositwithdrawal form

Who needs check depositwithdrawal form?

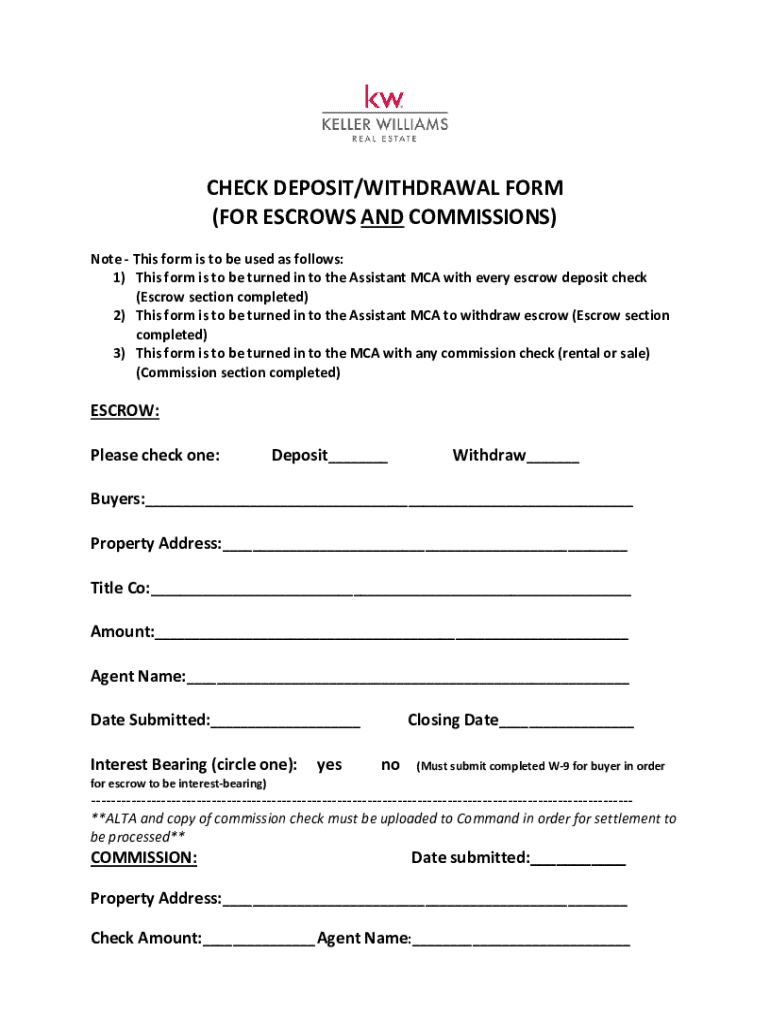

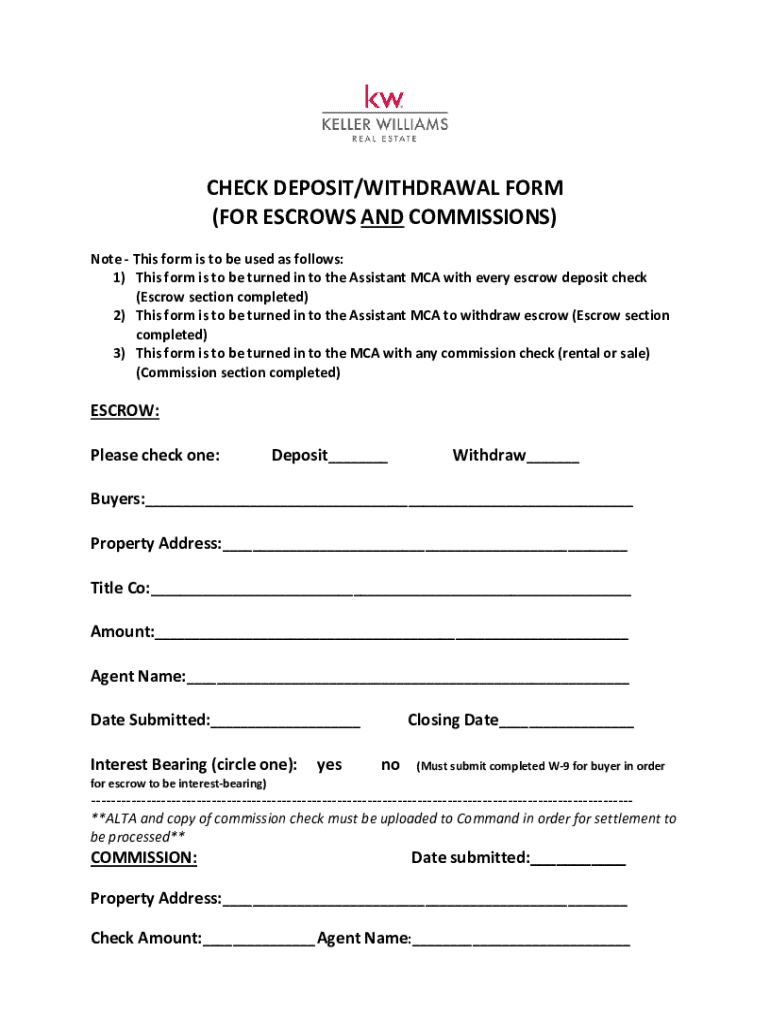

Check deposit/withdrawal form: A comprehensive guide

Overview of the check deposit/withdrawal process

Accurate handling of financial transactions often begins with properly filled forms. The check deposit/withdrawal form is crucial for individuals and businesses alike, as it formally requests the bank to either deposit funds into an account or withdraw them from it. Understanding the nuances of this process can prevent delays and errors, making the importance of meticulous form filling undeniable. By leveraging a digital solution like pdfFiller for these transactions, users can simplify the once tedious process and ensure their forms are completed correctly and securely.

The advantages of using a digital platform extend beyond mere convenience. Users benefit from features such as instant access to form templates, automated field-fill capabilities, and the ability to securely store and manage documents using cloud technology. Embracing digital solutions not only streamlines the workflow but also empowers users to maintain accurate records of their transactions, making future reference more manageable.

Preparing your check deposit/withdrawal form

Ready to get started? Before filling out your check deposit/withdrawal form, gather all necessary documentation. This includes your personal identification, such as a driver's license or government ID, as well as your account information, including your account number and routing number. Familiarizing yourself with your check details, like the amount and payee’s name, will also be beneficial.

pdfFiller offers a variety of form templates to match your needs. Selecting the right template can significantly enhance your experience, whether you are looking for a check deposit form tailored for personal accounts or one designed for business transactions. Accuracy is key when entering information — always double-check your entries to avoid unnecessary setbacks.

Step-by-step guide to filling out the check deposit form

Filling out your check deposit form doesn't need to be a daunting task. Follow these easy steps to ensure clarity and correctness.

The withdrawal process explained

Understanding the withdrawal form is as important as mastering the deposit process. This form serves a distinct purpose—to request funds from your account. Knowing when and why to withdraw can help you manage your cash flow effectively.

One key difference between deposit and withdrawal forms is the nature of the request. A deposit form adds money to your account, while a withdrawal form requests the transfer of funds out. Being familiar with these distinctions can aid in ensuring that you complete the correct form tailored to your needs.

Step-by-step guide to filling out the check withdrawal form

Like the deposit form, filling out a withdrawal form requires attention to detail. Follow this simple guide to ensure a smooth withdrawal process.

Ensuring compliance and security

After filling out your check deposit/withdrawal form, it's crucial to double-check your entries. Small mistakes can lead to processing delays or even account issues. Verifying your information can save time and effort later. Additionally, safeguarding your personal and financial data is paramount; use pdfFiller's built-in encryption and security features to keep your information secure.

With financial institutions prioritizing security, flexibility in managing these forms through a secure platform should ease your concerns. By choosing a reputable service like pdfFiller, you can rest assured that your documents are constantly protected, allowing you to focus on more significant aspects of your finances.

Managing your forms post-submission

After submitting, managing your check deposit/withdrawal form is a critical next step. With pdfFiller's cloud storage, accessing previous forms is quick and easy, ensuring you can review and edit past submissions when necessary.

Additionally, should you need to resend forms or track their status, pdfFiller provides options to do so with ease. This capability makes document management more streamlined, eliminating fears of lost submissions or miscommunication with your bank.

Common mistakes to avoid

When filling out your check deposit/withdrawal form, several pitfalls can impede your transaction. One of the most frequent mistakes includes entering incorrect information. Always ensure your personal details, account numbers, and amounts are accurate.

Another common oversight is not adhering to submission guidelines set forth by your bank. Understanding these requirements can prevent rejections and delays. If you do encounter errors post-submission, promptly communicating with your bank can provide solutions and clear up any issues quickly.

Frequently asked questions (FAQs)

Understanding the potential hiccups in form submission is crucial. What should you do if your form is rejected? Promptly contact your bank for clarification. Can you edit your form after submission? Usually, no, but checking with your financial institution can provide insights into their policies. Lastly, processing times vary; typically, deposits may take one to two business days, while withdrawals could take longer depending on your bank's funds availability policy.

Interactive tools and resources

Utilizing pdfFiller's interactive tools can greatly enhance your user experience. Their user-friendly interface allows for seamless document creation and management. Furthermore, combining templates specific to your needs with collaborative features ensures your forms are filled out accurately and efficiently.

Exploring links to related templates can also provide further assistance with check-related forms. These resources will arm you with ample knowledge and support, making it easier for you to manage your finances effectively.

Enhancing collaboration on forms

If you're working within a team environment, the collaborative capabilities of pdfFiller are invaluable. You can invite team members to review and approve your check deposit/withdrawal forms, ensuring everyone is aligned before submission.

Real-time collaboration features allow for instant feedback and adjustments, promoting a cohesive workflow. This approach not only speeds up the process of filling out forms but enhances communication among team members, reducing the likelihood of errors.

Final thoughts on efficient document management

Opting for a cloud-based solution like pdfFiller revolutionizes how individuals and teams manage their check deposit/withdrawal forms. The access-from-anywhere feature empowers users to complete and submit their forms securely no matter where they are.

The seamless experience provided by pdfFiller for ongoing document needs illustrates the importance of integrating technology into daily financial tasks. By harnessing the power of such tools, users can experience enhanced productivity and better alignment with their financial objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get check depositwithdrawal form?

How do I execute check depositwithdrawal form online?

Can I edit check depositwithdrawal form on an iOS device?

What is check depositwithdrawal form?

Who is required to file check depositwithdrawal form?

How to fill out check depositwithdrawal form?

What is the purpose of check depositwithdrawal form?

What information must be reported on check depositwithdrawal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.