Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding the Credit Card Authorization Form: A Comprehensive Guide

Understanding the credit card authorization form

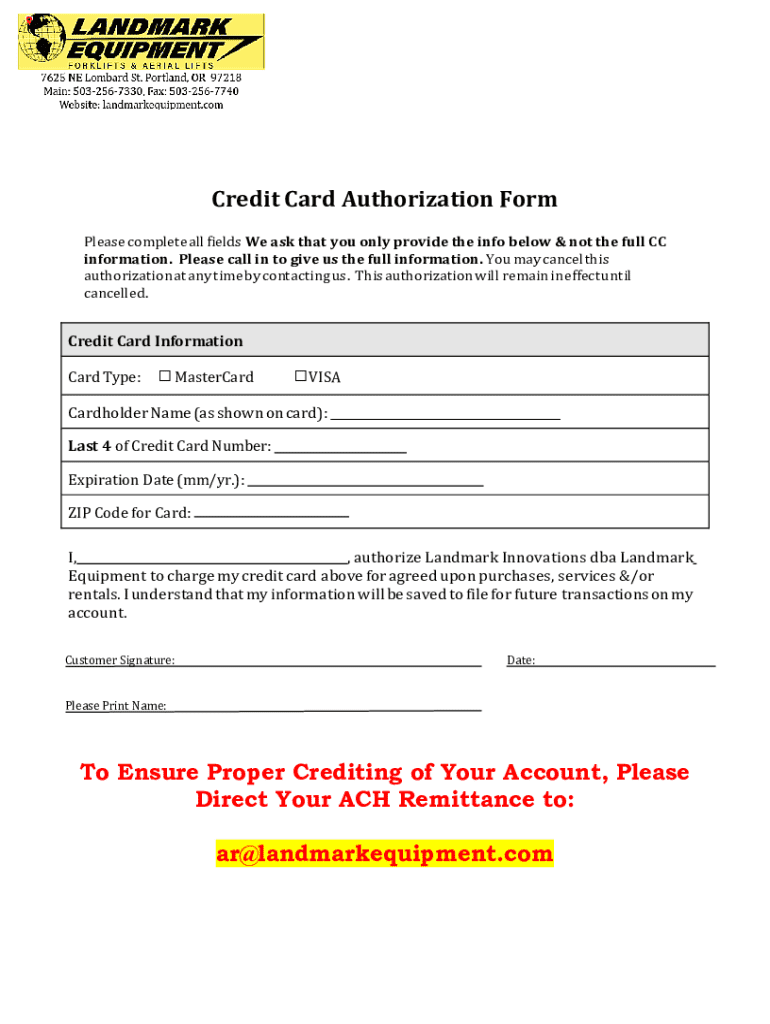

A credit card authorization form is a crucial document that grants a merchant the authority to charge a cardholder's credit card for a specific amount. This form acts as a formal request to process payments, ensuring that transactions are conducted securely. Not only does it serve as a protective measure for businesses, but it also safeguards consumers by providing a clear record of authorization.

The importance of a credit card authorization form lies in its ability to reduce the risk of chargebacks, which can be costly for companies. When a cardholder disputes a transaction, the merchant can refer to the authorization form as proof that consent was given. Additionally, a well-structured form fosters trust between the business and its customers, as it transparently outlines the cardholder’s agreement to the purchase.

When to use a credit card authorization form

Credit card authorization forms are especially valuable in various scenarios. Commonly, they are utilized during online purchases where the product or service is delivered electronically, making it essential to confirm the customer’s intent to buy. Additionally, subscription services often require authorization forms to facilitate recurring payments without constant confirmation from the cardholder.

However, there are situations where a credit card authorization form may not be necessary or appropriate. For instance, in-person purchases typically do not require a form, as the transaction occurs immediately with physical card presence. Additionally, small transactions or casual services may not warrant the complexity of an authorization form.

What is included in a credit card authorization form?

A comprehensive credit card authorization form should have several essential components to ensure clarity and legality. Firstly, it must include cardholder information, such as the name, address, and contact details of the individual authorizing the charge. Equally crucial is the merchant's information, clearly indicating who will be processing the payment.

The transaction amount must be explicitly stated to avoid misunderstandings. Lastly, it's important to define the time frame for authorization—whether it’s a one-time charge or recurring payments. Optional elements like the purpose of the charge and detailed terms and conditions might also enhance the form's effectiveness.

Benefits of using a credit card authorization form

The use of a credit card authorization form offers numerous benefits for both merchants and consumers. One of the key advantages is the reduction of chargeback disputes. With a signed form, merchants have a documented agreement that can defend against claims of unauthorized transactions. This protection is especially critical in industries susceptible to fraud.

Moreover, the form enhances payment security. By collecting the necessary information upfront and establishing a clear authorization process, businesses can reduce the risk of fraudulent activities. Enhanced security not only protects the business but also builds customer confidence in the transaction process, ultimately fostering loyalty and repeat business.

How to create your credit card authorization form

Creating an effective credit card authorization form can be streamlined with a few practical steps. Start by gathering necessary information from the cardholder, ensuring you have comprehensive details that meet legal requirements. Next, choose the right template on pdfFiller that aligns with your business needs and customize it with your company’s branding.

When customizing, keep in mind to include a clear explanation of the payment purpose and any applicable terms and conditions. This level of transparency will enhance the customer's understanding and trust.

Editing and managing your credit card authorization form

Once your credit card authorization form is created, managing it efficiently is essential. Utilizing pdfFiller’s tools allows for easy editing and updates whenever necessary. You can add interactive elements such as signature fields and checkboxes to facilitate a smoother user experience.

Additionally, pdfFiller provides numerous options for saving and sharing the completed forms. This feature is particularly useful for businesses that require collaboration between staff members during the transaction process. Ensure that your team is familiar with these tools to enhance workflow efficiency.

eSigning your credit card authorization form

Incorporating electronic signatures (eSignatures) into your credit card authorization form offers significant benefits, including convenience and increased security. With pdfFiller, you can facilitate eSigning seamlessly, allowing customers to authorize charges digitally without the need for physical paperwork.

It's crucial to be aware of the legal considerations in using eSignatures. Most jurisdictions recognize electronic signatures as legally binding if they comply with relevant electronic transaction laws. By using pdfFiller, you ensure that your forms meet these compliance standards, further protecting your business and providing an added layer of assurance for your customers.

Frequently asked questions (FAQ)

Several queries frequently arise regarding credit card authorization forms. One common question is what happens if a customer wants to cancel their authorization. Typically, customers can revoke authorization, though merchants may have policies in place to handle such requests.

Another frequent inquiry revolves around the legality of credit card authorization forms. As long as they comply with applicable regulations, these forms are generally considered legally binding. Lastly, businesses are advised to maintain authorization records for a period that complies with local laws and industry standards, often around three to seven years.

Explore our credit card authorization form templates

At pdfFiller, we offer a variety of pre-designed credit card authorization form templates, tailored to meet diverse business needs. These templates can save time and effort in the document creation process, allowing users to focus more on their core business activities.

Utilizing pre-designed templates ensures that all essential components are included, reducing the likelihood of errors or omissions. To access these templates, simply visit our website and browse through our collection, where you can easily customize any template to fit your business requirements.

Subscribe for updates and featured templates

Staying informed about new templates and resources can significantly benefit your business. By subscribing to our updates, you will gain access to valuable insights and tools that can enhance your document management processes.

The subscription process is straightforward and user-friendly, allowing you to receive notifications directly to your inbox. This way, you can stay abreast of the latest developments in credit card authorization forms and other related resources.

Thank you for engaging with us

We appreciate your interest in our resources on credit card authorization forms. We encourage you to further explore the tools and features that pdfFiller has to offer, which can support your business in managing documents effectively and securely.

With pdfFiller empowering users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, you can navigate the complexities of payment authorizations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card authorization form online?

How do I fill out the credit card authorization form form on my smartphone?

How do I complete credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.