Get the free Credit Account Application Form

Get, Create, Make and Sign credit account application form

How to edit credit account application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit account application form

How to fill out credit account application form

Who needs credit account application form?

Everything You Need to Know About the Credit Account Application Form

Understanding the credit account application form

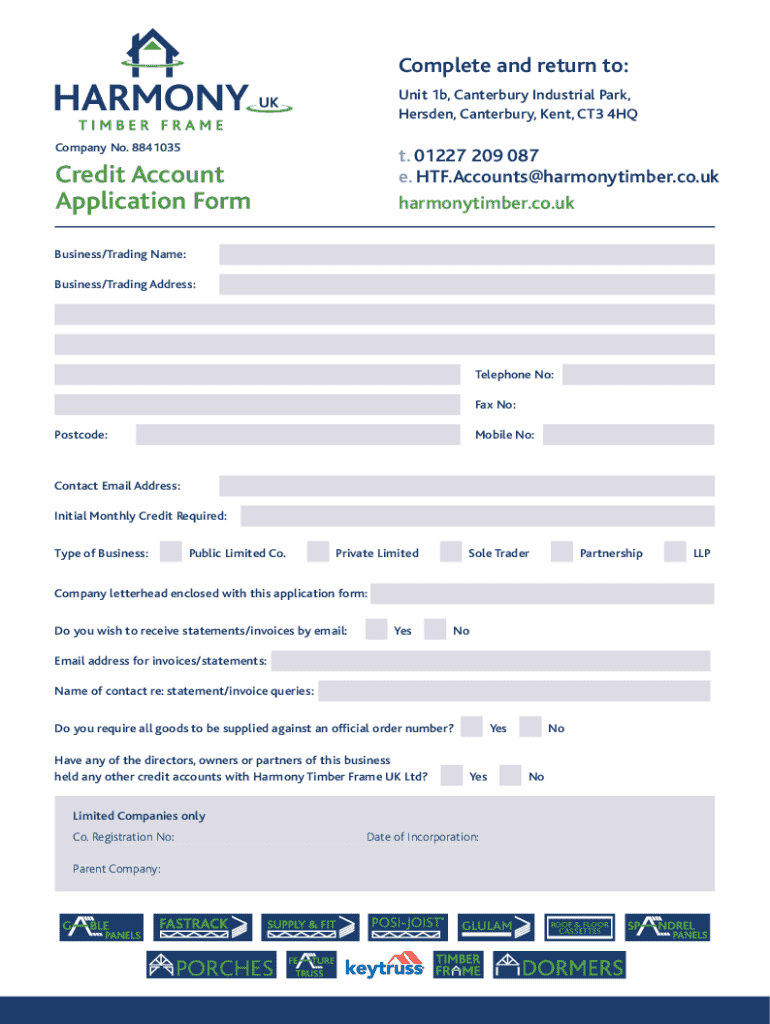

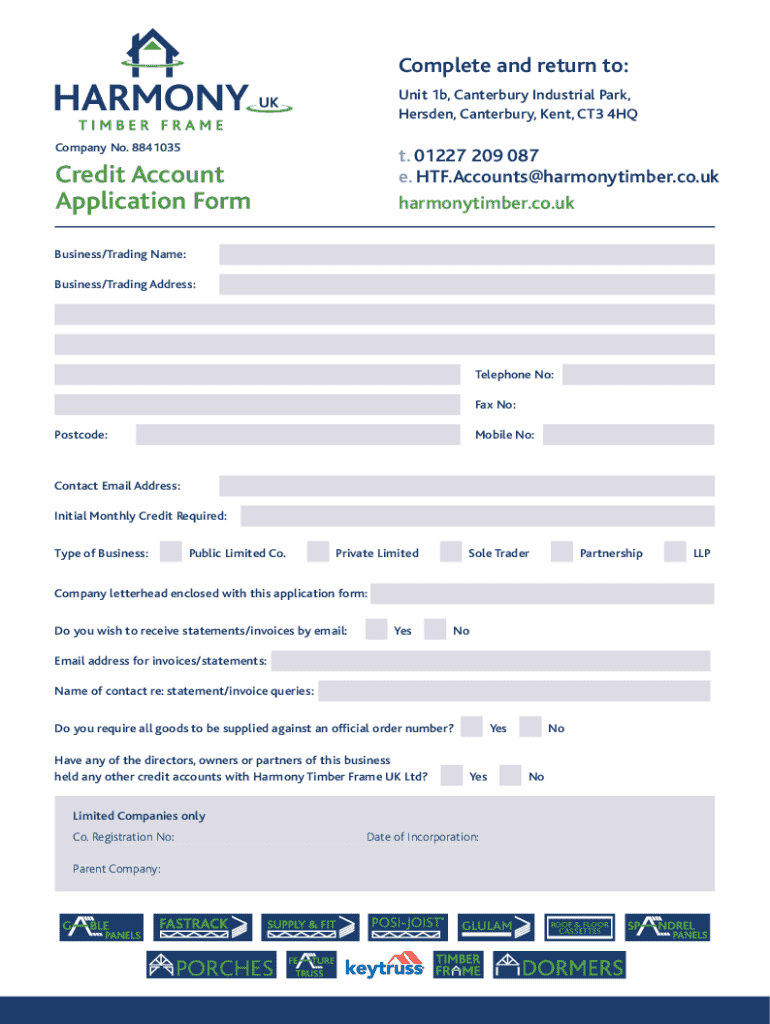

A credit account application form is a standardized document that individuals or businesses complete when seeking to obtain credit, such as a credit card, loan, or line of credit. This form serves as an official request for credit, detailing the applicant's personal and financial information to help lenders assess their creditworthiness. Submitting a completed credit account application form is often the first essential step in the borrowing process.

Understanding this form's purpose is crucial, as it serves not only as a means of communication between the applicant and the lender but also as a vital tool for evaluating risk. Lenders depend heavily on the information provided within the form to decide whether to grant credit and under what terms. Therefore, a thoroughly completed credit account application form can make a significant difference in your borrowing experience.

Key components of a credit account application form

The credit account application form typically comprises several essential sections that gather necessary information from the applicant. It includes various components designed to paint a complete picture of the applicant's financial situation.

Detailed sections of the credit account application form

The application form is divided into sections that explore the applicant's background, preferences, and permissions, ensuring lenders have a holistic view of the applicant.

Filling out the credit account application form

Completing the credit account application form accurately is crucial for improving your chances of approval. Here’s a step-by-step guide to help you fill out the form efficiently.

Editing and customizing your application with pdfFiller

Using pdfFiller, you can enhance your credit account application form by customizing it to fit your needs. pdfFiller offers tools that enable you to edit specific fields and add required data that might not be included in standard versions of the form.

Templates are available on pdfFiller, allowing for consistent formatting across multiple submissions. This can save time and ensure that you present a professional-looking application to potential lenders.

Signing the credit account application form

Once your application form is complete, it's time to sign it. pdfFiller provides eSignature features that allow you to add your signature securely and legally.

Submitting the credit account application form

Submission of the credit account application form can vary based on lender preferences. Understanding best practices for submission can minimize delays in processing.

Tracking and managing your application status

After submission, tracking the status of your credit account application is essential. pdfFiller allows you to access your application to monitor its progress and manage any follow-up.

Expect to hear back from your lender within a specific timeframe, usually within a week. Use this time to prepare for questions or additional documentation that might be requested.

Troubleshooting common issues

Even a well-prepared application can face challenges. Familiarizing yourself with common reasons for application denial can save you time in resolving issues.

Interactive tools and resources on pdfFiller

pdfFiller offers a range of interactive tools and resources to aid in completing and managing your credit account application form effectively. Access to templates and sample forms ensures you have a comprehensive starting point.

Additionally, tools for sharing and collaboration allow you to involve necessary parties, such as financial advisors or accountants, in the application process.

Insights on improving your credit application approval odds

Enhancing your chances of approval starts with understanding lender criteria and expectations. Providing detailed and accurate information related to your financial situation can significantly impact their decision.

Conclusion: Streamlining your credit application process

Utilizing pdfFiller streamlines the credit account application process, allowing you to manage your documents efficiently. This platform not only enhances accessibility and collaboration but also provides the tools needed to ensure your application stands out.

With features like easy editing, eSignatures, and resource access, pdfFiller empowers users to take control of their credit applications, making the entire process a smoother and more manageable experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit account application form in Gmail?

How can I edit credit account application form from Google Drive?

Can I create an electronic signature for the credit account application form in Chrome?

What is credit account application form?

Who is required to file credit account application form?

How to fill out credit account application form?

What is the purpose of credit account application form?

What information must be reported on credit account application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.